Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jan, 2017 | 11:00

Highlights

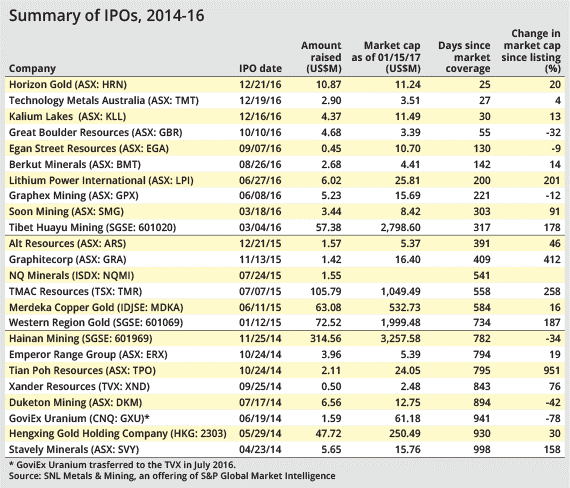

Since 2014, only a handful of new IPOs have launched, but for most of the companies that stepped in, the markets have treated them well.

As S&P Global Market Intelligence's Monthly Industry Monitor has chronicled over the past nine months, financing activity surged in 2016, after collapsing to an all-time low in 2015. With renewed investment in the metals and mining sector, new companies are sure to arrive on the scene, and 2016 delivered, with 10 new companies hitting the markets by year-end. They raised US$98.0 million through their IPOs, and all but one were Australian companies trading on the ASX.

To be sure, 2015 also saw its share of IPOs, and in terms of gross funds raised, the value was far greater than that in 2016. Six companies launched IPOs and raised a total of US$245.9 million, slightly down from the US$382.7 million raised through eight IPOs in 2014. Three of the new 2015 companies are producers or explorers with near-production assets. Hong Kong's Western Region Gold was the first, raising US$72.5 million in its January 2015 IPO. The company was first incorporated in 2002, and is a miner and smelter of gold and other nonferrous metals.

In June, Jakarta-based PT Merdeka Copper Gold Tbk. launched on its home exchange and raised US$63.1 million. The company is building its Tujuh Bukit gold-copper mine using the funds raised in its IPO.

Toronto-based TMAC Resources Inc. raised US$105.8 million for its July 2015 launch on the Toronto Stock Exchange. The company is commissioning its Hope Bay gold mine, which is expected to begin commercial operations later in 2017.

Only two companies launched on the ASX in 2015, Graphitecorp Ltd. in September and Alt Resources Ltd. in December, with the companies raising a combined total of about US$3 million.

While it would appear that companies needed vast resources of cash and guaranteed-value assets to gain a public listing in 2015, the markets in 2016 appeared more open to risk. There was one large IPO in 2016, with China’s base metal miner Tibet Huayu Mining Co. Ltd. raising US$57.4 million for their Shanghai listing back in March; however, the nine other IPOs in 2016 were by smaller companies launching on the ASX and raising an average of US$4.5 million each.

Those Australian explorers are searching for a range of targets, including gold explorers Soon Mining Ltd., focused on West Africa, and Australia-focused Great Boulder Resources Ltd., Berkut Minerals Ltd., and Egan Street Resources Ltd. Technology Metals Australia Ltd. is exploring for vanadium, while Lithium Power International Ltd., and Graphex Mining Ltd. are exploring for lithium and graphite, respectively.

The surge in IPOs coming onto the ASX may be continuing this year. Davenport Resources Ltd., Kalamazoo Resources Ltd. and Freehill Mining Ltd. have hit or are expected to hit the market in January 2017. Huntsman Resources Ltd., Lithium Consolidated Mineral Exploration Ltd., Nelson Resources Ltd., and Raptor Resources Ltd. are planning February IPOs on the ASX, while a rare Toronto listing is also anticipated in February, with Adventus Zinc Corp. launching on the TSX Venture Exchange. In March, Marquee Resources Ltd. and Matador Mining Ltd. will also hit the ASX.

The rate of new IPOs suggests renewed health in the metals and mining sector, but how are companies faring after going public? For Tian Poh Resources Ltd., the China/Mongolia-focused coal explorer that listed on the ASX in October 2014, the IPO has gone quite well, with the company enjoying a near tenfold increase in value in just over two years. On the other hand, GoviEx Uranium Inc., which launched on the Canadian Securities Exchange in June 2014, has shed 78% from its market value, thanks to falling demand for uranium. In July 2016 GoviEx moved to the TSX-V in hope of gaining better access to capital.

Most of 2015's IPOs have had positive results. Graphitecorp's market cap has increased more than fivefold since its November 2015 launch, thanks to strong graphite markets and its resource-defined graphite project in Queensland, Australia. TMAC Resources has more than tripled in value and is now a billion-dollar company.

Among the 2016 launches, the year went well for Tibet Huayu Mining, which has more than doubled in value, while Lithium Power International has tripled in value since its June listing. Not all 2016 IPOs are posting positive years, however. Graphex Mining is down slightly since its June launch, while Great Boulder Resources was down just over 30% after just two months of trading.

Some hiccups from new listings are to be expected, however. The recovery in metals prices is still tepid, with gold essentially traveling full circle in 2016. But with exploration budgets down another 21% in 2016 and discovery rates falling to all-time lows, renewed investment in the industry in the form of IPOs is a welcome sign.