Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Nov, 2017 | 15:30

By Sophia Furber and Syed Fariq Javaid

Highlights

The recent hurricane season has dampened talk of M&A among the biggest Lloyd's of London insurers, but long-term optimism has kept valuations elevated.

Investors can see the growth opportunities

The recent hurricane season has dampened talk of M&A among the biggest Lloyd's of London insurers, but optimism regarding their long-term potential has kept valuations elevated.

High price-to-book ratios for the remaining listed insurers in the Lloyd's marketplace — Hiscox Ltd., Beazley Plc, and Lancashire Holdings Ltd. — have sparked talk of potential consolidation. Following a series of deals in 2015 and the acquisition of Novae Group Plc by AXIS Capital Holdings Ltd. earlier in 2017, analysts suggested Lancashire could be the next to be sold; Beazley has also been the subject of takeover talk.

But losses from Hurricanes Harvey, Irma, and Maria, plus recent earthquakes in Mexico, have clouded the picture. Hiscox has forecast net claims of $150 million from Harvey alone, while Beazley said the disasters were likely to wipe $150 million off its 2017 earnings. Swiss Re AG is predicting total insured losses of some $95 billion for the whole industry.

M&A could be "off the agenda for a while" because of the large hurricane losses and the Mexico earthquakes, Nicholas Johnson, director of insurance research at Numis Securities, said in an interview.

"We've seen a high degree of catastrophe losses," he said. "If it hadn't have been for hurricane season, perhaps we would have seen more consolidation. But I don't think buyers would want to push this now."

High price-to-book

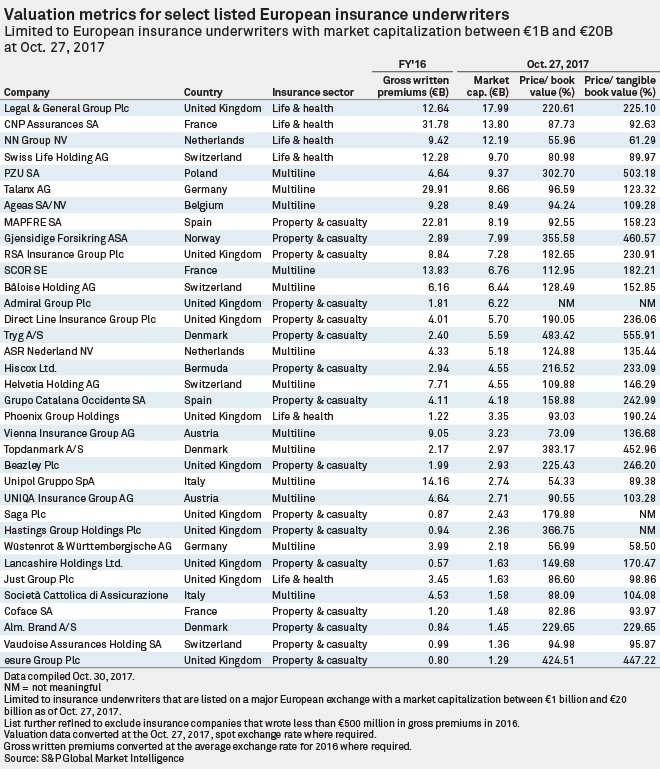

Nevertheless, price-to-book ratios at Hiscox, Beazley, and Lancashire have risen since June, buoyed by the promise of organic growth opportunities and solid returns. Hiscox was trading at a ratio of 216.5% as of October 27, up from a pre-hurricane season 195.3% at June 30; Beazley's ratio rose to 225.4% from 219.2%, and Lancashire's increased to 149.7% from 143.5%. These are among the highest valuations in a group of large European insurers compiled by S&P Global Market Intelligence.

The price-to-book ratio is a measure of a firm's current market price relative to its book value, or net asset value.

Johnson said investors are looking beyond hurricane losses at the long-term potential of Hiscox and Beazley as stand-alone companies.

"They've been successful at driving growth in their businesses — for example by organically growing U.S. operations from a small base," he said.

Hiscox said earlier in October that it planned to increase the capacity of its Lloyd's syndicate by around 45% in anticipation of improved pricing and better market conditions. It is predicting a "widespread market turn" following the recent heavy catastrophe losses, Artemis reported.

Solid dividends, ROE

In general, U.K. and European mid-sized insurers have a good track record over recent years in terms of income and special dividends, and this continues to make their shares look attractive to investors despite expected hurricane losses, Johnson said.

Beazley paid out an interim dividend of 3.7 pence per share for the first half, up 6% from 3.5 pence per share in the same period in 2016, and in line with a strategy of delivering 5% to 10% dividend growth. Hiscox paid an interim dividend of 9.5 pence per share, compared with 8.5 pence per share a year ago.

Joanna Parsons, head of research at Stockdale Securities, said Hiscox, Beazley and Lancashire have all performed well in terms of special dividends and return on equity, and said investors are already looking beyond the short-term hit from hurricane season.

"Investors can see the growth opportunities," she said in an interview. "These companies are branching out into new areas, such as cyber insurance in Beazley's case."

Beazley is now the largest Lloyd's insurer of cyber risks, and has also been an early mover in branching into data breach insurance. It launched a cyber and data breach insurance portal in September.

Although these larger Lloyd's insurers are unlikely to be acquired in the near term, smaller firms that have suffered a severe hit from the recent hurricane season could become M&A targets, according to Andreas van Embden, an analyst at Peel Hunt.

Large insurers' balance sheets may not be in good enough shape for them to make large or costly acquisitions, but distressed buyouts could be a possibility.

"There may be some smaller insurers that are struggling and need to fall on someone else's shoulders. In a way, that's what happened with the sale of Novae," he said in an interview.

Easily assess Lloyd's syndicates’ performance. S&P Global Market Intelligence provides standardized financial data and automated analytical tools, integrated with proprietary and consolidated news – offering a single source solution for comprehensive market intelligence.