Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Apr, 2017 | 10:00

Highlights

Now is an interesting time for a large Chinese marketplace lender to go public, considering the recent underperformance of its U.S. peers and questions about its own fundamentals.

Now is an interesting time for a large Chinese marketplace lender to go public, considering the recent underperformance of its U.S. peers and questions about its own fundamentals.

Shanghai-based China Rapid Finance Ltd is expected to price its U.S. IPO this week, targeting the sale of 10 million American depositary shares at $9.50 to $11.50 apiece in a deal underwritten by Morgan Stanley, Credit Suisse, and Jefferies.

The company reported a net loss of $33.4 million on $55.9 million in net revenues for fiscal year 2016. This loss widened slightly from $30.0 million on $56.1 million in net revenues in fiscal 2015.

While losses are common for many growth-stage companies, it appears that the company's aggressive campaign to court new customers has led to lower margins on loans and high acquisition costs.

A unique edge

China Rapid Finance operates a mobile marketplace lending platform in China focused on what it calls EMMAs, or Emerging Middle-Class Mobile Active consumers. The platform targets prime and near-prime borrowers with creditworthiness roughly equivalent to a FICO range of 660 to 720.

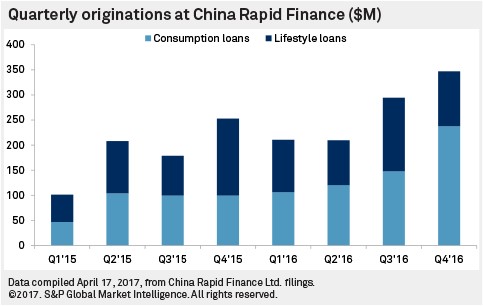

The company offers two types of loans. Consumption loans have terms of two weeks to three months, and range from 500 yuan (approximately $73 as of April 17) to 6,000 yuan ($871). Lifestyle loans have terms of three months to three years, and principal amounts ranging from 6,000 yuan to 100,000 yuan ($14,519).

The company was founded in 2001 and spent nearly a decade developing credit scoring models for large banks before offering its own loans in 2010. This helped create China Rapid Finance’s proprietary lending technology that relies on alternative data for lending decisions. This is a unique edge in China, which historically has lacked a robust credit reporting structure.

Double-digit origination growth

Loan originations are the lifeblood of a marketplace lender. Platforms in the space produce revenue through transaction fees charged to borrowers and servicing fees charged to investors. Originations for China Rapid Finance grew 43.4% to $1.06 billion in 2016. The company had 1.4 million borrowers as of year-end 2016, 67% of whom were repeat borrowers on the platform.

Total short-term consumption loans grew 75.2% year-over-year in 2016, shifting the product mix from about a 50/50 split to nearly 60% short-term. This is in line with the company’s continued push to onboard short-term borrowers in order to offer them longer-term, higher margin loans in the future, a strategy it has termed "low and grow."

Incentives weigh on revenues

Like many digital lenders, China Rapid Finance bears high acquisition costs in order to attract new borrowers. These costs include direct incentives offered to new customers and sales and marketing expenses.

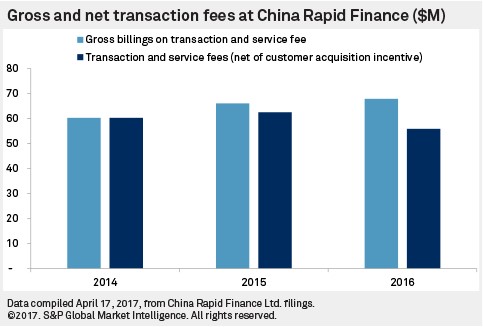

Transaction and service fee revenue, net of customer acquisition incentives, fell 10.6% year-over-year to $55.9 million in 2016. Overall net revenue declined only 0.5% thanks to a decrease in loan loss provisions and other expenses, as well as an increase in other revenue.

By comparing gross billings of $67.9 million to $55.9 million in net transaction fees, it appears that the company spent $10.9 million on customer acquisition in 2016. This was the highest point of any year that the company disclosed, and it means that China Rapid Finance recognized approximately 82 cents of every gross dollar as revenue, compared to roughly 95 cents on the dollar in 2015, and dollar for dollar in 2014. Customer acquisition costs are primarily related to the sourcing of consumption loans and are an integral part of the company’s low and grow strategy.

Sales and marketing expense declined 12.4% year-over-year in 2016 to $30.0 million. This followed a 25.0% jump in 2015 as more sales teams were added to help drive growth. Sales and marketing expenses declined in 2016 thanks in part to optimization of the sales force. Keeping sales and marketing expenses low while increasing loan originations is key to achieving profitability as a digital lender, and the inability to do so has been an issue in the U.S.

Margin struggles

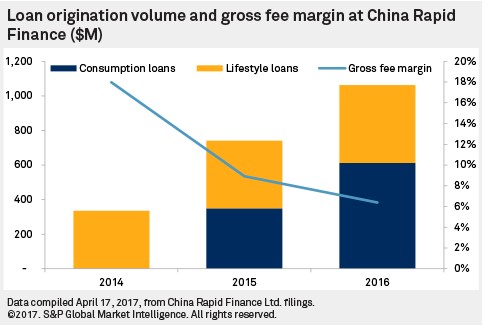

Even before deducting customer incentives from revenues, it appears that the margins on new loans have declined over time at China Rapid Finance. This is likely due to a shift in product mix from longer term lifestyle loans to shorter term consumption loans.

In 2014, when the company originated $334.0 million of lifestyle loans and $1.5 million of consumption loans, the ratio of gross billings on transaction and service fees to loan origination volume (gross fee margin) was 18.0%. In 2016, when consumption and lifestyle loan originations amounted to $611.5 million and $450.5 million, respectively, the gross fee margin was 6.4%.

Lifestyle loans produced gross fee margins of 18.1% in 2014, falling to 12.9% in 2016. Consumption loans produced gross fee margins of 1.6% in 2015 and 2016, the only two full fiscal years in which they were offered.

The company needs to convert shorter term borrowers into longer term borrowers, as laid out in the low and grow strategy. If this effort is not successful, or if these borrowers do not take enough loans in the future to cover the original customer acquisition costs, these issues will continue to drag on earnings.

A wary market for digital lending IPOs

Other digital lenders have made their public debuts with mixed results. On Deck Capital Inc. and LendingClub Corp., two of the largest U.S-based digital lenders, went public in late 2014. As of market close April 17, 2017, On Deck Capital's stock had fallen 78.3% since its opening day, while LendingClub's stock had fallen 63.6%. Elevate Credit Inc., a digital lender focused on short-term loans, has seen its stock rise 24.3% since going public on April 6, 2017, although its shares priced at $6.50 apiece, well below the expected low end of $12.00.

While investors can use the U.S. market as a gauge for potential performance, China is certainly a distinct market, with a population of nearly 1.4 billion and a rising middle class.

If investors buy into China Rapid Finance's low and grow strategy, this offering could be a chance to get in on the growing need for credit from the Chinese middle class. But if the execution is in doubt, the margin pressures facing the company might make the transaction one to watch from the sidelines from now.

As of April 17, US$1 was equivalent to 6.89 Chinese yuan.