Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 01, 2021

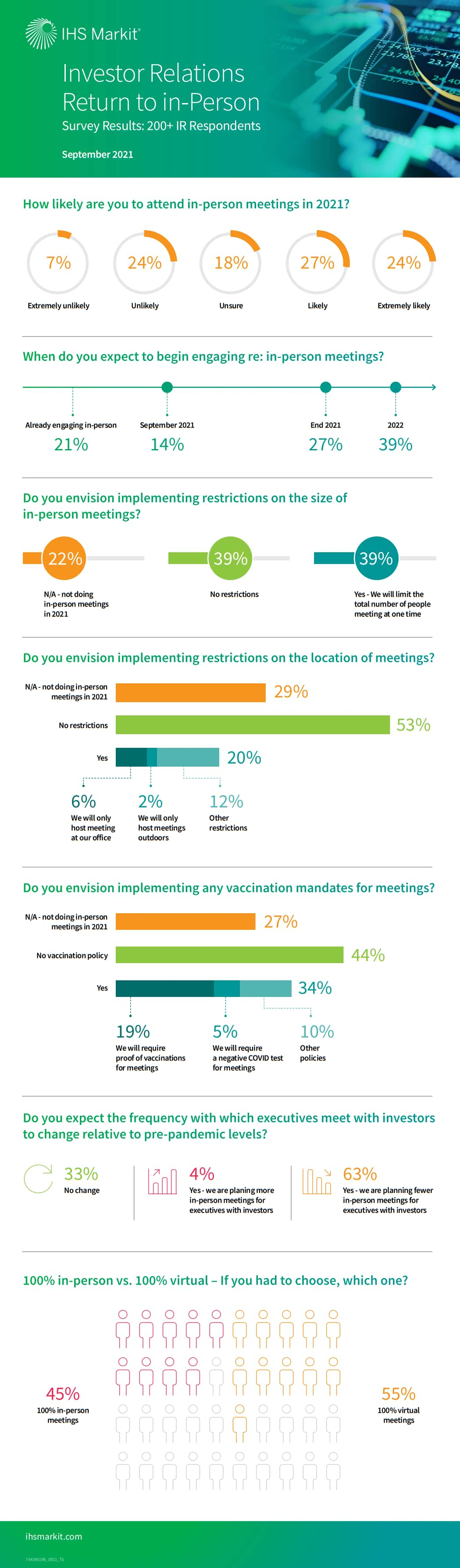

Since the pandemic essentially shut down all in-person business meetings in March 2020, IR teams have been operating in a mostly virtual environment. There have been many innovations in the way that teams have communicated with investors and prospects over this time period, and there are now questions of when we will return to "normal" in-person activities.

This topic is one our clients ask about all the time, so we surveyed IR teams across various industries and market caps to understand how teams are currently thinking about returning to in-person meetings; COVID-19 testing, vaccination mandates and other considerations; and ultimately whether executives and IR teams prefer to return to pre-pandemic practices or to balance virtual and in-person meetings in a different way going forward.

The results are in from 200+ North American IR professionals. Many teams are planning to return to in-person meetings before the end of this year, and most are planning a return to in-person in 2022. At the same time, many teams see significant value in the flexibility of virtual meetings, so it appears that the majority of companies will continue to leverage virtual engagement significantly long after the pandemic subsides.

Visit our Investor Relatlons Solutions page for more information about our Global Markets Intelligence and Advisory services.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.