Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Apr, 2018

Energy

By Lisa Fontanella and Sara Bellizzi

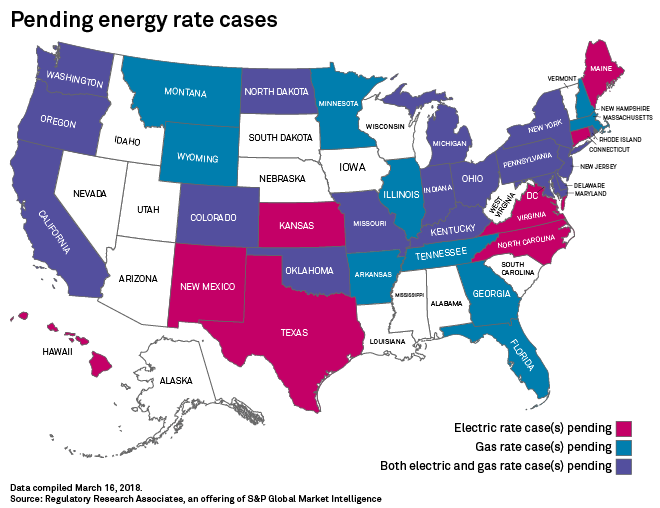

The pace of regulatory activity remains active nationwide, with 77 electric and gas rate cases pending in 36 states as of March 16. In addition, most state regulatory commissions and the Federal Energy Regulatory Commission have opened proceedings to address the revenue requirement impacts of the federal tax act enacted in December 2017. Taking effect January 1, the act, among other things, lowers the corporate income tax rate to 21% from 35%.

In these 77 pending cases, the utilities are seeking rate increases aggregating to about $5.5 billion, net, excluding the later-year steps of multiyear rate requests

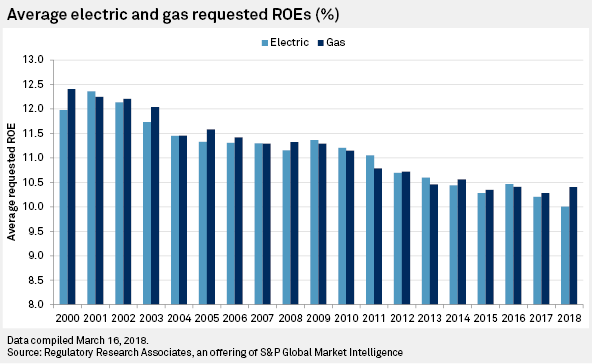

Of the 77 pending rate cases, about 18 of them were formally initiated this year. In those cases, the average requested ROE is 10% for electric and 10.4% for gas utilities versus 12% for electric and 12.4% for gas companies in 2000.

In addition to rate case proceedings, state commission reviews of merger proposals are underway in a few states from proposed transactions announced in 2017 and 2018.

Tax reform-related proceedings are ongoing at the state and federal level. A large number of companies are addressing the issue with their respective commissions on a stand-alone basis or as part of commission-initiated generic proceedings. Others have proposed to address the tax reform issues more holistically in the context of pending rate proceedings and have filed revised revenue requirements that reflect the changes that stem from the TCJA. Still others have filed new base rate cases or indicated that they plan to do so in the future to address the issue.

Several grid safety and modernization proceedings are pending nationwide. In California, the California Public Utilities Commission’s investigation into whether Pacific Gas and Electric Co., or PG&E, and its parent PG&E Corp.’s organizational culture and governance prioritize safety and adequately direct resources and accountability measures to achieve safety goals and standards continues. Among the possible remedies to be considered is a reduction in the company’s authorized ROE. An investigation is also pending before the California PUC to determine whether the costs related to Aliso Canyon Natural Gas Storage Facility should be excluded from the rates of Southern California Gas Co. following a highly publicized safety-related incident.

The District of Columbia Public Service Commission has opened an investigation to “identify technologies and policies that can modernize our energy delivery system for increased sustainability and will make our system more reliable, efficient, cost-effective, and interactive.”

In neighboring Maryland, the Public Service Commission has opened a proceeding to conduct a “targeted review” of Maryland’s electric distribution system to “ensure that [the system] is customer-centered, affordable, reliable, and environmentally sustainable.” Working groups are to complete deliberations on these issues by June 2018.

The Public Utilities Commission of Ohio has initiated a proceeding to investigate the merits of certain technological and regulatory initiatives that could “serve to enhance the consumer electricity experience.” The PUC has established a three-phase investigation; the first phase began in April 2017, with presentations to the commission that offer “a glimpse of the future.”

An investigation into the “NextGrid Utility of the Future,” a collaborative that will primarily focus on identifying future technological advancements and improved utility regulatory models was recently initiated by the Illinois Commerce Commission. An independent third party will lead the investigation, and reports will be presented to the commission in 2018.

A grid modernization investigation is underway in Rhode Island, referred to as the Power Sector Transformation Initiative. Meanwhile, as part of a pending rate case, National Grid plc subsidiary Narragansett Electric Co. is proposing a Power Sector Transformation plan to support the Initiative. Narragansett Electric’s Power Sector Transformation plan is comprised of four main components: investments in advanced metering, grid modernization, electric vehicle infrastructure, and energy storage and solar demonstration projects.

Similar proceedings are pending in Massachusetts, Connecticut, and Minnesota. In New York, a policy framework on ratemaking and utility business models was adopted in May 2016 as part of the Reforming the Energy Vision proceeding. The utilities submitted Distributed System Implementation Plans that address distribution system planning, operations, and administration, and identify changes that can be made to effectuate state energy goals and objectives.

Generic proceedings are underway in several states to review aspects of the ratemaking framework. In New Mexico, a proceeding is pending to increase the “transparency” of “rate cases by reducing the number of issues litigated in rate cases and provide a “more level playing field among intervenors and [New Mexico Public Regulation Commission] staff on the one hand, and the utilities on the other.”

In Oklahoma, a task force was established to undertake a “performance assessment” of the Oklahoma Corporation Commission, including the time it takes to process cases.

The Michigan Public Service Commission has commenced a study to address performance-based regulation, whereby a utility’s authorized rate of return would be dependent on achieving certain targeted policy outcomes. The PSC is to provide a report to the legislature and governor in April 2018.

In Minnesota, the commission initiated an investigation into performance metrics and potentially, incentives for Xcel Energy subsidiary Northern States Power-Minnesota’s electric utility operations.

In Nevada, a Committee on Energy Choice has been established by Gov. Brian Sandoval, a Republican, due to the passage on November 8, 2016, of a ballot measure that would amend the state’s constitution to allow for a competitive retail electric market for all customers. In addition, the Nevada Public Utilities Commission initiated a proceeding to examine issues associated with the state’s Energy Choice Initiative and the possible restructuring of Nevada’s energy industry.

In Oregon, legislation was enacted in August 2017 that requires the Oregon Public Utility Commission to establish a public process for investigating how developing industry trends, technologies, and policy drivers impact the existing regulatory system and incentives currently used by the commission.

In Pennsylvania, the PUC has opened a proceeding to address alternative forms of regulation of varying kinds. As part of a grid modernization investigation in Rhode Island, referred to as the Power Sector Transformation Initiative, various state agencies have proposed shifting the traditional utility business model in the state to a more performance based model that would align incentives with customer demand and public policy objectives. Other recommendations include utilization of multiyear rate plans, or MRPs, containing budget and revenue caps “to incent cost savings.”

In South Carolina during July of 2017, SCANA Corp. subsidiary South Carolina Electric & Gas, or SCE&G, announced that it will cease construction of V.C. Summer nuclear units 2 and 3, each 1,117-MW plants. On August 1, 2017, SCE&G formally filed with the PSC to abandon V.C. Summer units 2 and 3 and related ratemaking treatment of the related costs. The General Assembly and the governor’s office are conducting reviews. SCE&G subsequently tendered a proposal designed to resolve the ratemaking and capacity issues associated with the Summer abandonment. The South Carolina Office of Regulatory Staff and Governor Henry McMaster have called for SCE&G to cease collecting $445 million that is currently in rates, and legislation has been introduced to that effect. Passage of this legislation would severely impact SCANA’s financial health and possibly could engender a bankruptcy filing.

Pending before the FERC is a June 5, 2017 complaint related to the ROE authorized for certain transmission owners in the Southwest Power Pool. This is the latest in an ongoing string of complaints against FERC approved ROEs for transmission owners that are part of the California Independent System Operator, MidContinent System Operator and the PJM Interconnection.

A proceeding is also ongoing to broadly examine issues associated with the resiliency of the bulk power system, the goals of which “are to develop a common understanding among the Commission, industry and others of what resilience of the bulk power system means and requires; to understand how each regional transmission organization [RTO] and independent system operator [ISO] assesses resilience in its geographic footprint; and to use this information to evaluate whether additional Commission action regarding resilience is appropriate.”

Several proceedings have been initiated before the FERC to address changes in federal tax rates for companies it regulates, as a result of the TCJA, including electric transmission utilities and natural gas and oil pipelines. For the electric sector, FERC said that “because most of the FERC-regulated electric transmission companies have transmission rates that automatically adjust with changes in the tax rates, the adjustments for much of the industry are already taking place.” However, the commission simultaneously issued “show cause” orders directing 48 companies to propose revisions to their transmission tariffs.

For the natural gas pipeline sector, FERC issued a notice of proposed rulemaking, or NOPR, “that would allow FERC to determine which pipelines under the Natural Gas Act may be collecting unjust and unreasonable rates in light of the corporate tax reduction and changes to the Commission’s income tax allowance policies.” In addition, the NOPR requires pipelines “to file a one-time report, called FERC Form No. 501-G, on the rate effect of the new tax law and changes to the Commission’s income tax allowance policies.”