Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Jun, 2023

By Sarah Cottle

Today is Tuesday, June 20, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put the spotlight on rising US debt levels. American households held an all-time high of $17 trillion in debt at the end of March, a 19% increase over a year earlier. This record amount and growing delinquency rates for credit cards, auto loans and mortgages are exposing fresh cracks in the US economy. Household spending has remained at fairly robust levels, but the soaring cost of servicing debt is pinching household budgets and eating into wage growth. In the corporate sector, rising capital expenditures are exerting pressure on the credit quality of regulated utilities, according to S&P Global Ratings analyst Gabe Grosberg. Debt among nonfinancial corporations has risen to around $20 trillion, nearly double what it was a decade ago. Credit quality has dropped, with some $3.6 trillion of debt rated just one notch above "junk" status. For speculative-grade companies, a surge of debt maturities in the coming years poses a growing threat to their solvency.

Ukrainian banks reported higher profits for the first three months of 2023 than for all of 2022 on the back of lower loan loss provisions and gains from investments in government debt instruments. With demand for loans subdued due to the war, banks have generated an increasing proportion of their income from securities transactions, including investments into government bonds and the central bank's deposit certificates.

More than 18% of special purpose acquisition companies (SPACs) that held an initial public offering in 2022 were backed by private equity, up 7 percentage points from 2021 and 14 percentage points from 2020, according to an S&P Global Market Intelligence analysis that tracked SPACs with at least 5% ownership by a private equity or venture capital firm.

The Big Number

Trending

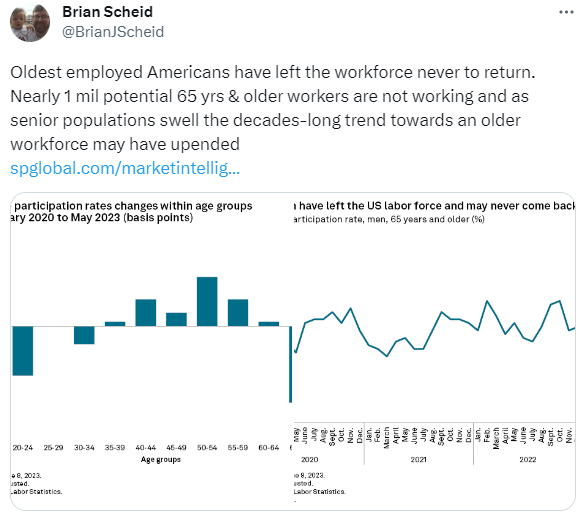

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Roma Arora

Theme