Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 9 Aug, 2021

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

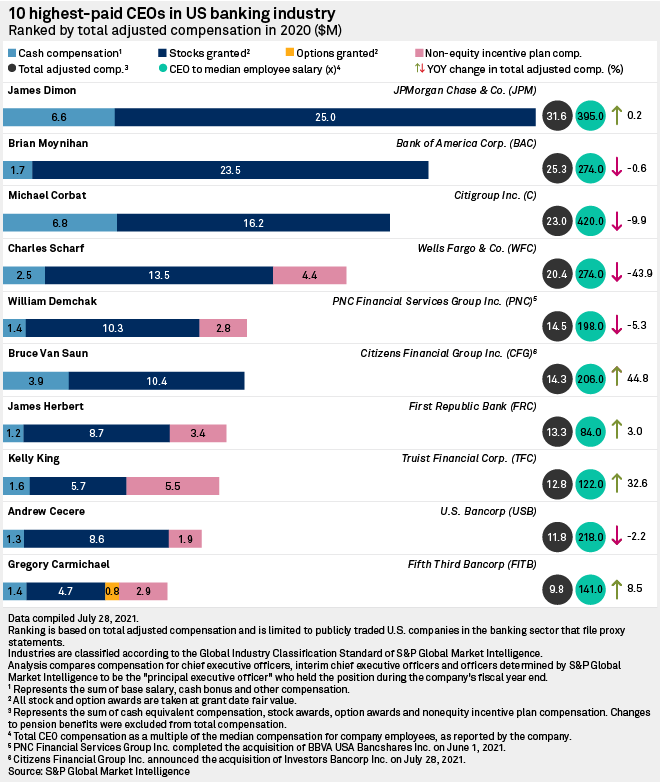

In this edition, we take a closer look at the remuneration increases of CEOs at some of the highest profile U.S. companies in various industries in 2020. Jamie Dimon, who has been at the helm of JPMorgan since 2005, saw his compensation rise 0.2% on a yearly basis. Nine of the 10 highest-paid U.S. asset manager CEOs received a boost in total compensation last year, while several chief executives of big names in fossil fuel production, refining and transportation saw their pay increase despite the record-low crude prices and COVID-19 pandemic demand deficit.

Healthcare mergers and acquisition activity surged in the second quarter, boosted by life sciences and health technology companies. Aggregate deal value grew more than four-fold to $81.3 billion year over year, with Thermo Fisher Scientific's $21 billion purchase of PPD the largest M&A announcement of the quarter. Expected growth in the healthcare industry could fuel acquisition activity in 2021 and beyond, according to analysts.

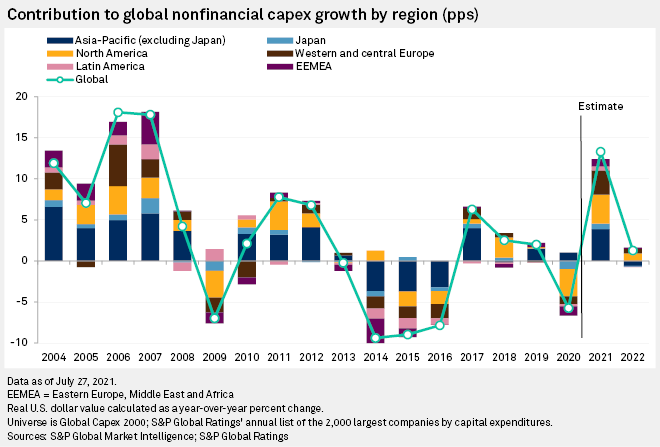

Global corporate capital expenditure is poised to grow 13.3% this year, the biggest annual rise since 2007, as a post-pandemic economic recovery and record levels of borrowing arm companies with $7.9 trillion of cash to spend, according to a forecast by S&P Global Ratings. Excluding the hard-hit energy and materials sectors, capex will jump 15% to a record $2.8 trillion, with the information technology and utilities sectors leading the growth.

Many fossil fuel CEOs saw pay increase in 2020 amid severe industry downturn

Continental Resources occupied the top spot in a list of the 10 top-earning CEOs in the oil, gas and coal industries, with William Berry raking in $29.2 million even as the company's stock price plummeted over 50% during the period.

—Read the full article from S&P Global Market Intelligence

Blackstone's Schwarzman leads way in pay among US financial services CEOs

A majority of the top-paid U.S. asset management CEOs and investment bank CEOs received a pay increase in 2020.

—Read the full article from S&P Global Market Intelligence

LendingTree's Lebda top-paid US fintech, payments CEO in 2020

Ten U.S. fintech and payments CEOs received more than $20.0 million in total compensation in 2020.

—Read the full article from S&P Global Market Intelligence

JPMorgan's Jamie Dimon highest-paid US bank CEO in 2020

Jamie Dimon moved back into the top position after the 2019 leader — Wells Fargo’s Charles Scharf — saw a nearly 44% drop in total compensation in 2020.

—Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

US companies unwind cash buffers as economy recovers, default risk eases

Corporate America borrowed heavily and scaled back spending as COVID-19 wreaked havoc on the global economy, but with revenues ballooning, the need for companies to retain high levels of cash has reduced.

—Read the full article from S&P Global Market Intelligence

Business loan demand bounces back, US banks are ready

A Federal Reserve survey of senior loan officers showed more loan officers than not reporting stronger loan demand among large- and middle-market firms for the first time in more than a year.

—Read the full article from S&P Global Market Intelligence

Energy loan portfolios decline for most large US lenders in the space

Higher oil prices helped improve the credit outlook for energy loans, but most U.S. banks with over $1 billion in lending exposure to the sector continued to report declines in their portfolios.

—Read the full article from S&P Global Market Intelligence

Insurance

California's insurer of last resort faces fire-coverage challenges after ruling

Superior Court Judge Mary Strobel ruled that the California Fair Access to Insurance Requirements Plans, or FAIR Plans, can provide liability coverage that resembles typical comprehensive homeowners insurance, or HO-3, policies, but questions around coverage in the wildfire-plagued state remain.

—Read the full article from S&P Global Market Intelligence

Florida regulator acts again amid signs of rising stress among property insurers

Homeowner insurer Gulfstream followed American Capital Assurance into state-directed liquidation in late July. Meanwhile a growing number of property insurance companies show signs of distress based on tests used by insurance regulators.

—Read the full article from S&P Global Market Intelligence

Credit and Markets

Hong Kong IPO market gets boost as mainland China, US tighten grip on listings

The pending cybersecurity rule, together with Beijing's recent investigation into DiDi Global days after its US$4.4 billion U.S. IPO, have led some mainland Chinese companies to abandon their IPO plans in the U.S. and switch to Hong Kong.

—Read the full article from S&P Global Market Intelligence

With no signs of easing, supply bottleneck pushes inflation toward overheating

A global supply bottleneck that has driven up shipping rates and slowed deliveries to a crawl could last well beyond earlier expectations.

—Read the full article from S&P Global Market Intelligence

Global corporate capex poised for biggest surge since 2007, S&P forecasts

Global corporate capital expenditure will grow as the ongoing economic recovery and policy support for the shift to net-zero carbon emissions encourage investment, according to S&P Global Ratings.

—Read the full article from S&P Global Market Intelligence

Energy and Utilities

Target Zero: Southern must complete Vogtle nukes, offset gas to cut emissions

Southern expects to achieve net-zero emissions by or before 2050 and has reduced greenhouse gas emissions by 52% from 2007 benchmark levels.

—Read the full article from S&P Global Market Intelligence

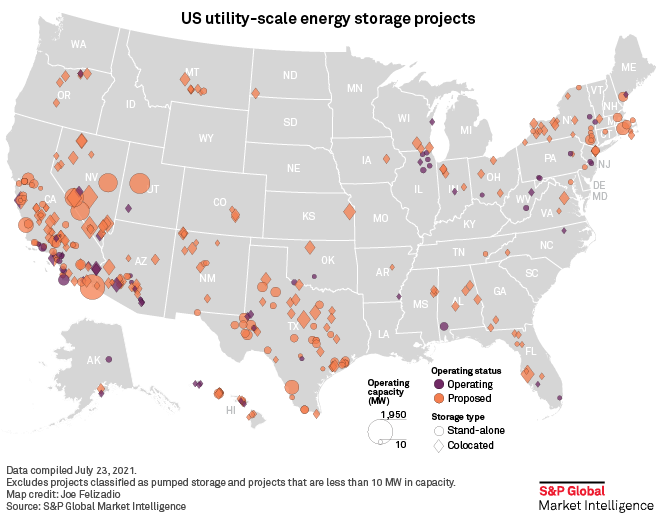

US energy storage ascent hits new heights despite battery crunch

Developers of large-scale energy storage projects supplied 463 MW in the second quarter, a thirteenfold jump from a year ago. Much bigger volumes could arise in coming quarters, depending on availability of lithium-ion battery cells.

—Read the full article from S&P Global Market Intelligence

Healthcare

Healthcare M&A activity rebounds in Q2'21 as pharma companies scan for deals

The number of healthcare deals announced overall grew from the same quarter a year ago, with the number of transactions almost doubling and aggregate value growing more than four-fold to $81.27 billion.

—Read the full article from S&P Global Market Intelligence

Real Estate

Challenging macro environment brings long-standing mortgage REIT to a crossroads

A "crowding out of private capital" pressured returns in the targeted asset class of one of the oldest public mortgage REITs, setting the stage for its agreement to sell to another entity that will pursue an entirely different investment strategy.

—Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

DouYu, Huya merger block to prompt users to move to rival livestreaming players

The two game livestreaming platforms are likely to face more competition from Bilibili and Kuaishou following their blocked merger, experts said.

—Read the full article from S&P Global Market Intelligence

Leveraged Finance

US leveraged loan default rate dips to 0.58%, a 9-year low

The rate crashed below 1% after six straight default-free months. The historical average default rate is 2.9%.

—Read the full article from S&P Global Market Intelligence

Metals and Mining

Philippines eyes $5.9B Tampakan copper mine development in 2022

The Mines and Geosciences Bureau said the Tampakan copper mine, which holds half of the country's total copper reserves and resources at 15.2 million tonnes, is included in the priority projects targeted to proceed to development by 2022.

—Read the full article from S&P Global Market Intelligence

The Week in M&A

Houlihan Lokey targeting global expansion in company's largest-ever deal

Read full article

Sanofi accelerates mRNA vaccine strategy with $3.2B Translate Bio acquisition

Read full article

Mineral Resources to unlock stranded iron ore asset with A$400M Red Hill deal

Read full article

UniCredit's deal for Monte dei Paschi's 'good' assets hangs in the balance

Read full article

Sumitomo Mitsui set to take breather from M&A as capital pressure, risk build up

Read full article

The Big Number

Trending

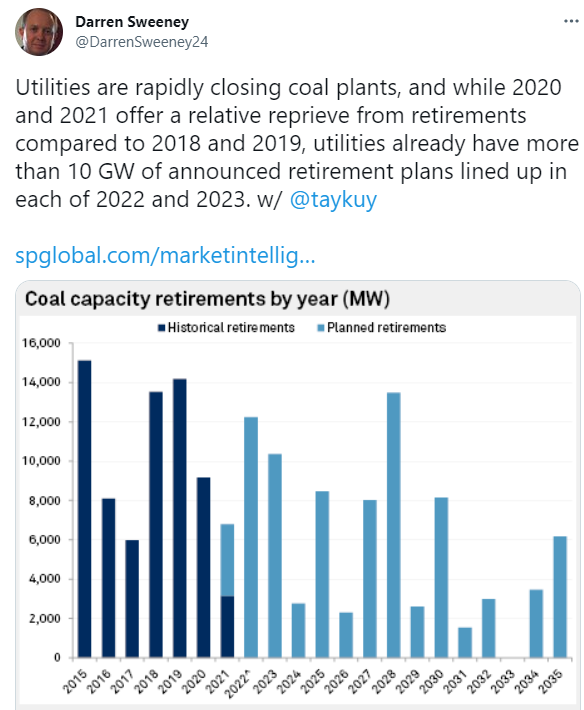

—Read more on the S&P Global Market Intelligence and follow @DarrenSweeney24 on Twitter

M&A in Focus: What's next for SPACs?

Watch now

Politics & Policy: Global Trade, Supply Chain Disruptions & Risk

Watch now

The Changing Fintech Landscape: A Snapshot of M&A Themes and Trends

Watch now

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.