Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 26, 2019

By Simon Millington, Head of Product Development, CloudMargin

A version of this blog was originally published by CloudMargin on 30 July 2019.

What's changed?

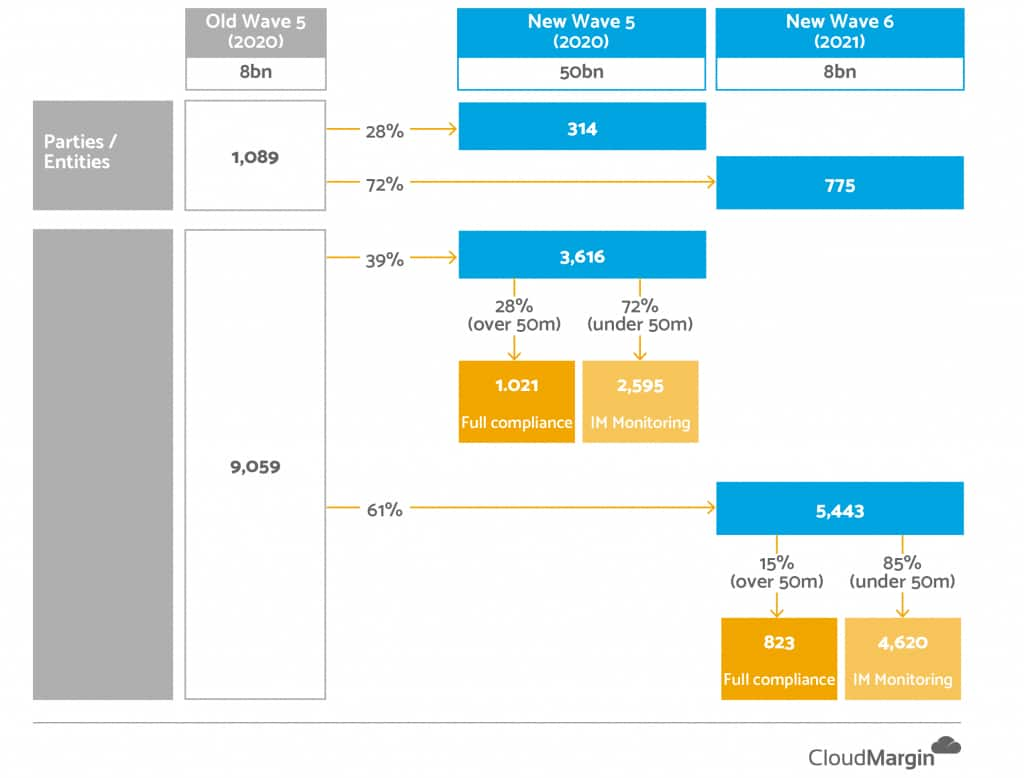

ISDA Scope and Timeline*

What should you do?

For those of you with an AANA of greater than €50bn, there is no change. You need to push on towards compliance by 1 September 2020.

For those of you with an AANA between €50bn - €8bn, you have three options:

As the vast majority of firms are predicted to be in the newly created Phase 6, there will still be a rush to implement. Therefore, option one isn't an option. Whether you've started or not, the extra time will allow you to approach a solution more strategically, potentially saving you money, time and precious human resources.

What's the solution?

Approaching this strategically means you need to focus on what people, process and technology changes need to be put in place to minimize cost, implementation and onboarding time, and time spent maintaining and updating for future regulations or industry shifts. Choosing the right partner can help minimize the impact to your firm.

If you're still searching for answers about how your firm should address the initial margin changes, set up a free Health Check with our partners, IM experts, MarginTonic. If you're not ready to chat, we also have a ton of free IM resources for you to view at your own pace. Check them out here.

Note from IHS Markit: We believe that firms should view collateral as an asset rather than a cost and should strive for an accurate bird's eye view of what the regulations mean for them. This strategic view will allow them to explore how collateral can be monetized as an asset, with best practices in place to address challenges across the margin and collateral eco-system. IHS Markit has solutions to support our clients at each phase of their requirements, including threshold monitoring, management of collateral workflow, performance of initial margin calculations and back-testing. We will continue to maintain close engagement with regulators to ensure our solutions remain fully in line with regulatory expectations. Please contact us to learn more.

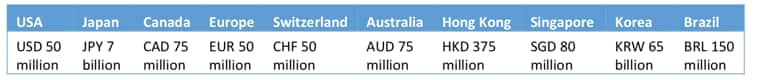

* notional values (€) referenced in this post can be translated into these other values in other jurisdictions (source: ISDA):

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.