Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2023

By Ian Hughes

The industrial and enterprise worlds have developed a taste for metaverse-style applications. Many organizations are already engaged in, or are planning investments for, evolving how we interact with one another, machinery and data. The lesser-known industrial side of the metaverse industry is leading the way.

In S&P Global Market Intelligence's latest report, we look at planned adoption, budgets and organizational approaches for metaverse technologies, as well as the evolution toward a more connected metaverse between industrial and enterprise business-to-business/business-to-consumer (B2C).

➤ Industrial enterprise metaverse represents engineering and simulation elements closer to the physical world — factory digital twins and shop-floor applications.

➤ Enterprise B2B addresses engagement through remote working, organizational culture and productivity.

➤ Enterprise B2C highlights what companies are doing to engage with their customer bases, including product experiences, services and events.

S&P Global defines the metaverse as the next iteration of the internet: a single, shared, immersive and persistent 3D virtual space where humans and machines interact with one another and with data, enhancing the physical world as much as replacing it.

However, there are many stepping stones along the way. The metaverse will not arrive in a big bang, but in parts, through processes and applications enhanced with more spatial and real-time data and through evolved user experiences. In the meantime, metaverse-style applications and technologies are already in use or are likely to be implemented soon.

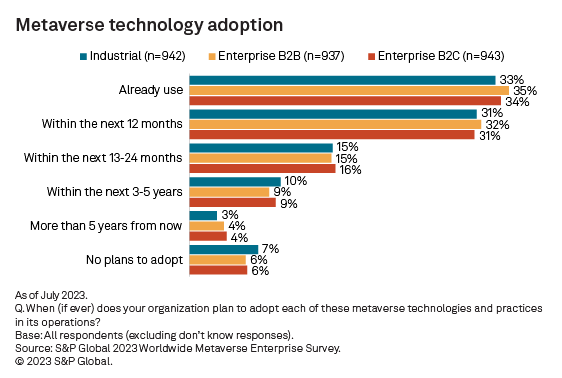

In the S&P Global 2023 Worldwide Metaverse Enterprise Survey of industrial and enterprise respondents, we see that a majority of companies are engaging with metaverse technologies now or plan to in the next 12 months. The responses are remarkably consistent between industrial (64%), enterprise B2B (67%) and enterprise B2C (64%); no single segment shows significantly more current or near-future adoption than another.

This excerpt presents a glimpse into the first in a series of reports that takes a deep look at survey results covering a wide range of metaverse-related subjects, including use cases, implementation approaches and attitudes regarding social and cultural aspects.

In addition to metaverse technology adoption, this report dives into overall budget expectations for 2024, the manufacturing segment's "stand out" position in budgeting, which organizational units are taking responsibility for metaverse applications by segment, as well as key findings, implications and an index of companies involved.

The S&P Global 2023 Worldwide Metaverse Enterprise Survey was conducted among 1,003 respondents worldwide from May 18 through June 14, 2023, resulting in a margin of error for topline statistics of +/- 3 percentage points at the 95% confidence level. It sits alongside the S&P Global 2023 Worldwide Consumer Metaverse Survey — which polled 4,000 adults in 42 countries around the world during the spring and early summer of 2023 — to provide an incredibly complete picture of the current landscape. 451 Research is part of S&P Global Market Intelligence. For additional information on various reports included as part of 451's TBI Internet of Things service using our new Metaverse theme, or to set up inquiry sessions with our analysts, please contact451ClientServices@spglobal.com. This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.