Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Jul, 2023

By Sean DeCoff

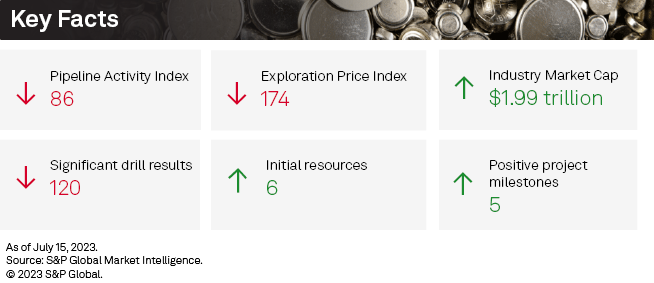

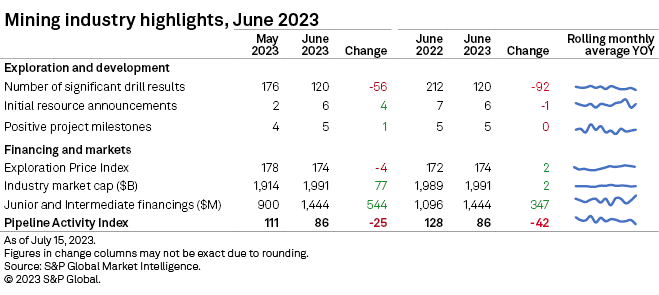

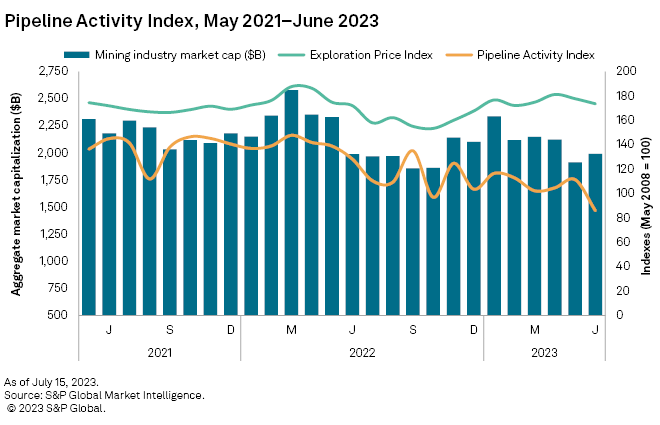

S&P Global Market Intelligence's Pipeline Activity Index (PAI) collapsed in June, dropping 23% to 86 from 111 in May. This was the lowest reading in three years. While the gold PAI slipped from 134 to 125 in June, the base/other metals PAI drove the monthly decrease, dropping 39% to only 58.

Of the metrics used in our PAI, positive milestones, initial resource announcements and completed financings increased month over month while the number of significant drill results decreased.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

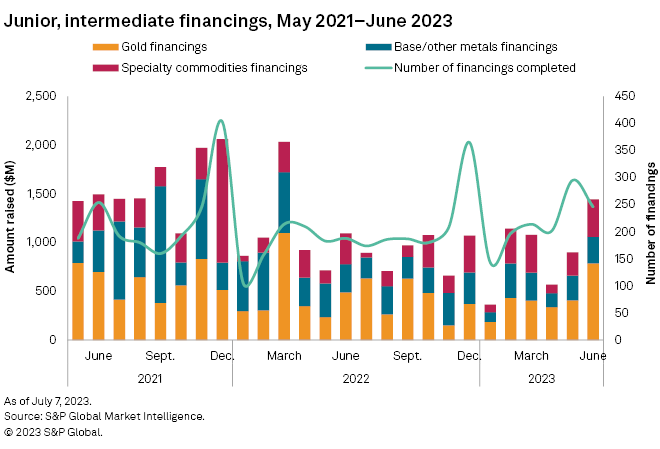

Financings jump 60% to 15-month high

Funds raised by junior and intermediate mining companies jumped 60% to $1.44 billion in June — the highest monthly totals since March 2022 — fueled by high-value transactions for gold, lithium and diamonds. Significant financings drove the increase, accounting for 94% of the funds raised. Despite the increase, the number of transactions declined 17% to 246. June had six transactions valued at more than $50 million, compared with two in May.

Gold financings nearly doubled to $789 million — the highest in 15 months — buoyed by two transactions valuing at least $250 million each. The number of gold transactions fell to 124, down 20%, while the number of significant financings fell to 29 from 51.

The largest gold financing and the largest financing overall was a A$400 million private placement follow-on offering, including overallotment, by Australian Securities Exchange-listed Genesis Minerals Ltd. Proceeds of the offering will be used to develop the reserves of its Lakewood Tailings project and expand the historic Gwalia mine, both gold assets in Western Australia. Genesis recently paid for the Leonora assets that include the Gwalia mine from St. Barbara Ltd. and aims to restart production at the historic mine in the September quarter and deliver its first ore in the last quarter of 2023.

Funds raised for the base/other metals group increased 7% to $271 million, buoyed by increased copper financings but held back by lower funds raised for nickel and silver. The number of financings fell to 80 from 96 in May, while the number of significant financings fell to 25 from 29.

The largest base/other metals financing and the fifth-largest financing overall was a C$130 million private placement by Toronto Stock Exchange-listed Filo Corp. Proceeds of the capital raising will be used to finance the exploration and development of the Filo del Sol copper project in Argentina, with a mineral resources and reserves estimate of 644.2 million metric tons, grading 0.32% copper, 0.32 g/t gold and 10.2 g/t silver.

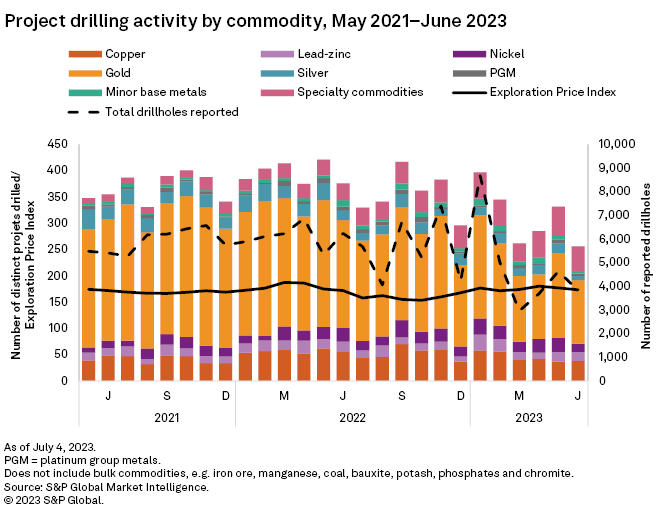

Drilled projects plummet to lowest in 2.5 years

Drilling metrics declined across the board in June, breaking the recovery trend for two consecutive months since the most recent drop in March. The total projects drilled plummeted to 256, 23% lower month over month and the lowest since November 2020. The total number of distinct drillholes reported declined 18% to 3,821, down 39% year over year but still above the year-to-date lowest total in March. Drilled projects year to date totaled 1,099, 12% lower than the 1,254 total in the first half of 2022. Distinct drillholes year to date were down 21% versus 2022.

After recovering in May, gold projects drilling fell below the 35-month low of 123 projects in April to 121 in June, a two-year low. Much of this decline came from the 52% decrease in minesite and 29% decrease in late-stage gold assets reporting drilling. The early-stage total for precious metals held strong, with a marginal decline to 53 from 56 in May. Silver projects drilled more than halved to eight projects, a level not seen since March 2020. Most of the decline in silver resulted from less reporting from advanced assets. Base metals declined to 76 — the lowest year to date — mostly from nickel's 16-month low of 16 projects. Copper was the only commodity that increased in June, albeit marginally to 38 from 37 in May. Specialty metals declined 13% to a year-to-date low of 47 due to less reporting from lithium and uranium projects.

Australia and Canada remained the top two countries despite posting the largest month-over-month decreases. Reported drilled projects in Australia dipped to 89, near the 27-month low of 85 in March. Although specialty metals drilling in the country increased month over month, with more graphite and niobium projects reported, the increase was offset by a decline due to less reported drilling on advanced gold projects and late-stage nickel projects. Canada had an 11-month low of 64 projects, weighed down by declines in advanced gold assets and early- and late-stage specialty metals projects of lithium and uranium. The US remained a distant third despite having the largest increase among all countries to 28 projects, supported by increases in base and specialty metals.

June's top two results involved lithium. The top result came from TSX-listed Avalon Advanced Materials Inc. 's late-stage Separation Rapids lithium project in Ontario with an intersection of 564.9 meters grading 1.51% lithium. In 2022, Avalon almost quadrupled its exploration budget for lithium in late-stage assets to an estimated $0.7 million. In mid-June, Avalon entered into a binding term sheet agreement with Sibelco to establish a joint venture on a few of Avalon's lithium projects, including Separation Rapids, to further fund and advance the project.

ASX-listed Magnetic Resources NL reported the most drillholes in June, with 258 holes completed in its late-stage Leonora-Laverton gold project in Western Australia. Deeper drilling is planned for the project to further extend its resources. In 2022, Magnetic Resources increased its gold exploration budget to $4.5 million from $4 million in 2021.

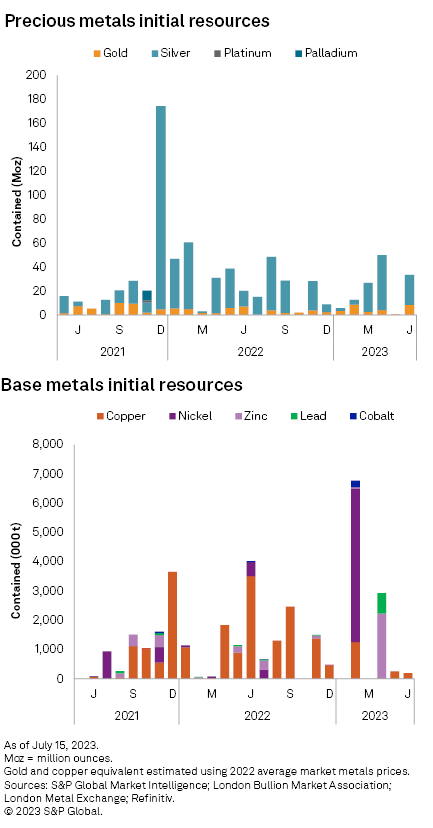

Initial resource announcements rebound

Initial resource announcements improved in the month, increasing to six from only two in May. Five of the announcements were for gold primary projects and one was for copper.

The largest announcement came from Challenger Gold Ltd. , which reported its initial mineral resource estimate for their gold project El Guayabo in Ecuador. The inferred estimates a total of 270 MMt, grading 0.38 g/t Au, 2.6 g/t Ag and 0.07% Cu. Combined, the project is estimated to contain 4.5 million ounces of gold equivalent.

The second largest announcement came from Reunion Gold Corp. , with the initial mineral resource estimate at the Kairuni zone on its Oko West project in Guyana. Indicated resource totaled 41.8 MMt, grading 1.84 g/t Au, with the inferred resource totaling 27.1 MMt, grading 2.02 g/t Au. The combined indicated and inferred resource totals 4.2 Moz gold.

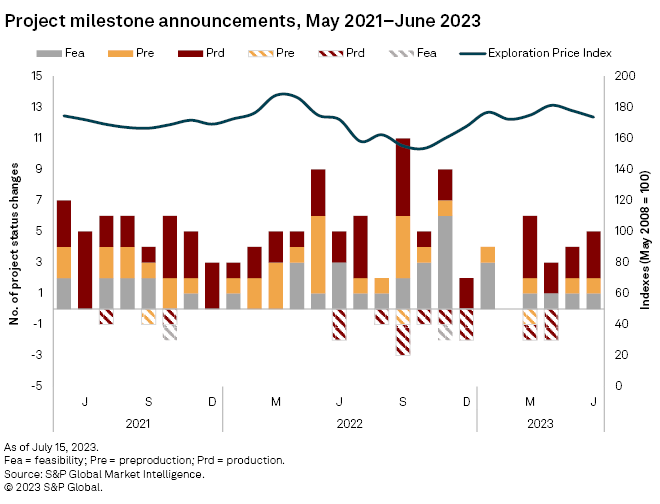

Project milestones increase

Positive project milestones increased month over month to five in June, all for gold primary projects. Three mines reported production milestones, while one project began construction and another completed a feasibility study. There were no negative announcements.

The most notable positive milestone came from West African Resources Ltd. , which announced that construction was underway at the Kiaka gold project in Burkina Faso. The company expected to complete the build at Kiaka and pour first gold in the second half of 2025.

Notably, three companies achieving the first gold pours in June were Hummingbird Resources PLC at the Kouroussa gold mine in Guinea, Australia United Mining Ltd. at Forsayth in Australia and Argonaut Gold Inc. at Magino in Canada.

Exploration price index down slightly

Market Intelligence's Exploration Price Index dropped from 178 in May to 174 in June. Of the eight metals included in the index, only copper and molybdenum posted a month-over-month gain. Gold, silver, platinum, palladium, nickel, zinc and cobalt all weakened but cobalt and platinum prices had the largest declines.

The Exploration Price Index measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Equities buck trend

Despite weakening prices and slowing activity, mining equities registered a slight increase in June. Market Intelligence's aggregate market cap of 2,533 listed mining companies rose 4% to $1.99 trillion from $1.91 trillion in May.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.