Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Jan, 2024

By Paul Manalo

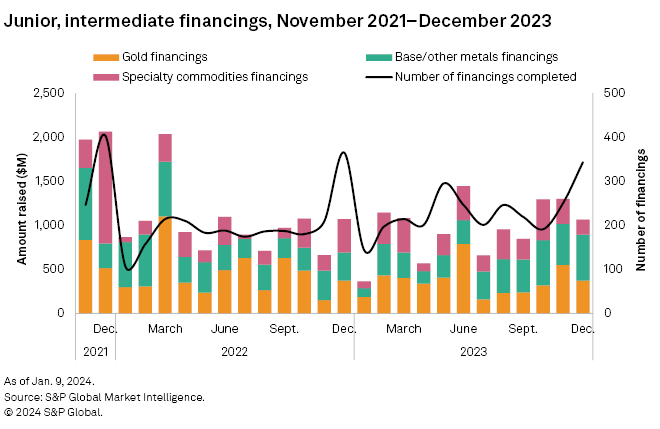

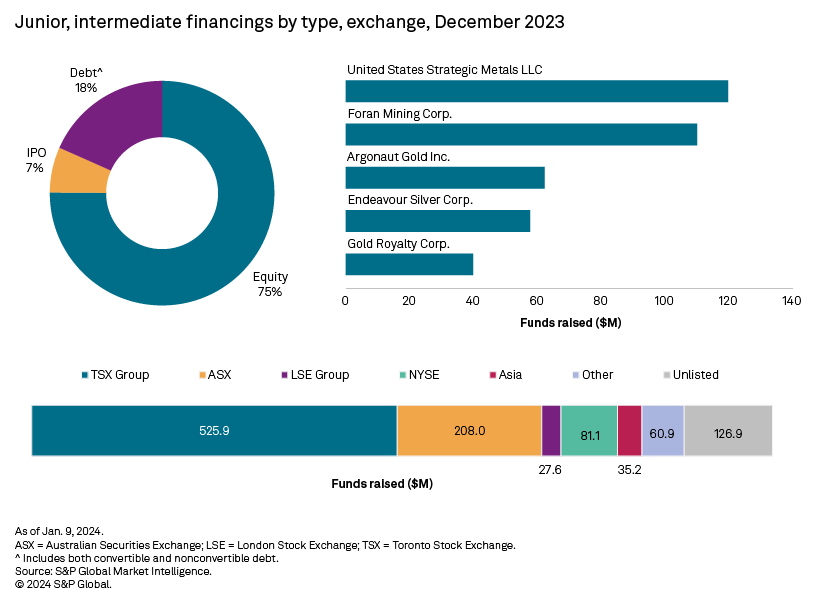

Funds raised by junior and intermediate mining companies fell in December, down 18% to $1.07 billion, dragged down by lower gold and specialty commodities financings, despite higher funds raised for base/other metals. The number of transactions was up 37% to 343 — the highest since December 2022 — bringing the year-to-date total to 2,747, up 16% year over year. The number of significant financings in December was almost flat, down by one to 79. Transactions valued at more than $30 million fell to seven from nine in November.

The December 2023 financings data is available in the accompanying databook.

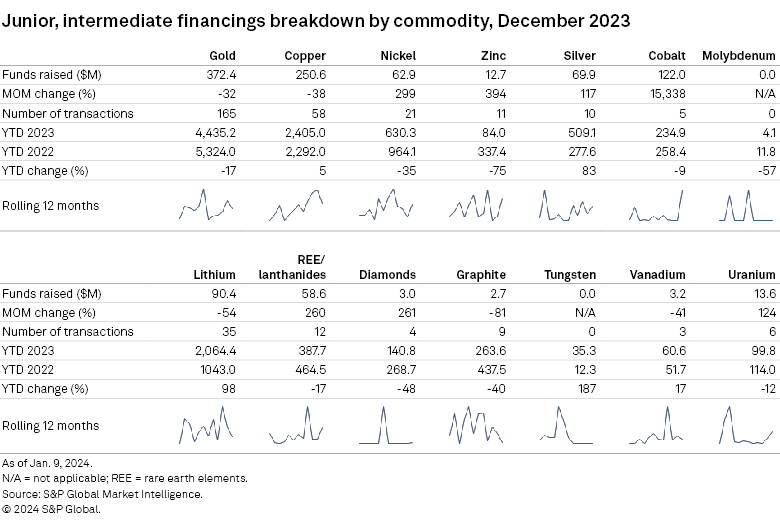

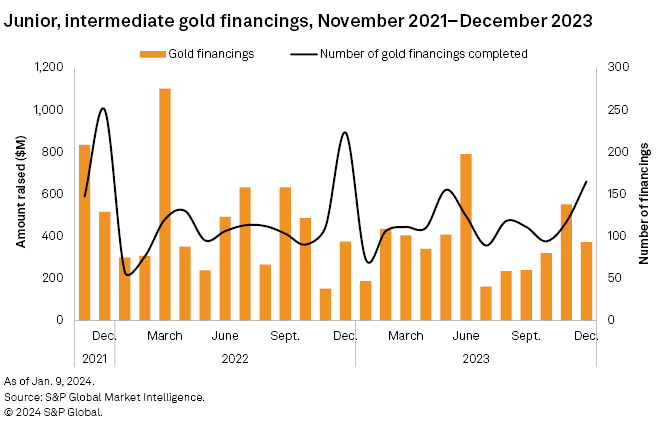

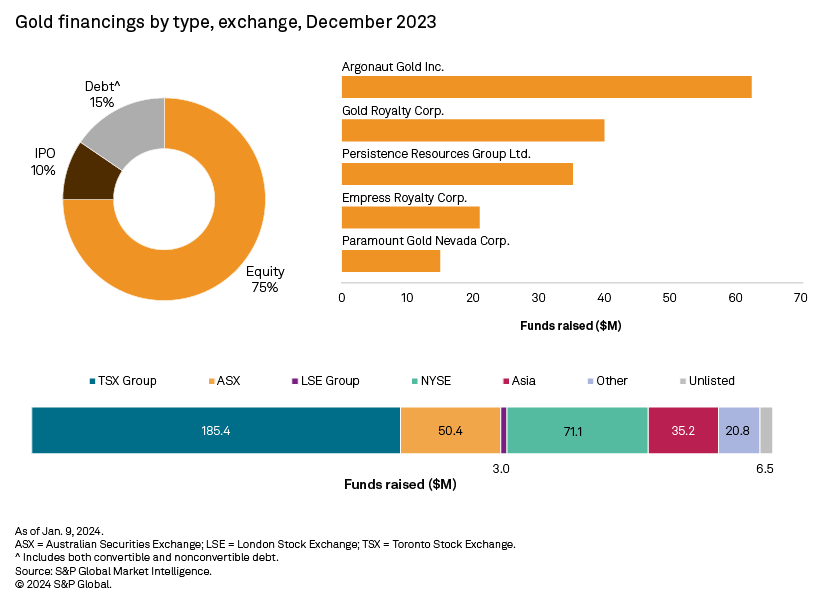

Gold financings decline

Gold financings fell 32% to $372 million after jumping to a five-month high of $550 million in November. While the number of gold transactions was up significantly to 165 from 117 in November, most of them were lower-valued transactions and failed to boost the month's totals. There were three transactions valued at more than $30 million, down from five in November.

The largest gold financing and the third-largest overall was the C$85 million follow-on public offering of Nevada-based and Toronto Stock Exchange-listed Argonaut Gold Inc. The proceeds will be used to fund the development and optimization activities of its precious metals mines in Nevada and Ontario.

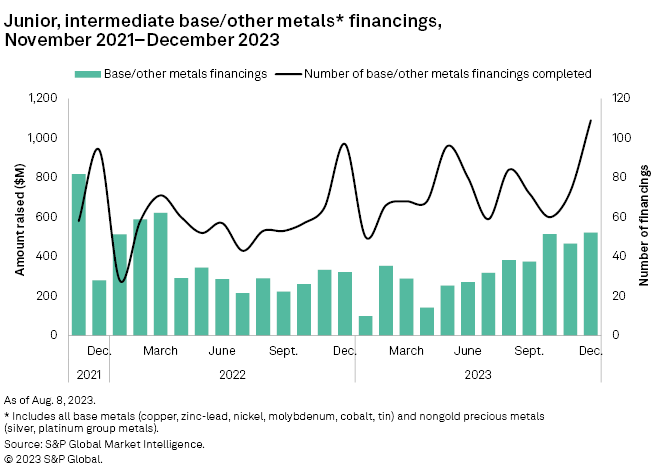

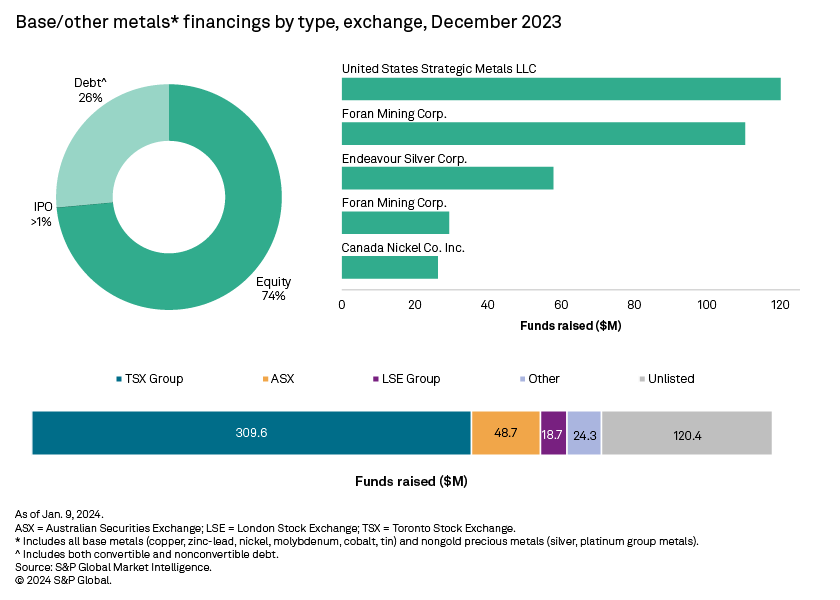

Large copper, cobalt transactions push base/other group to 21-month high

The base/other metals group jumped 12% to $522 million, dominated by large transactions for cobalt and copper — the highest funds raised by the commodity group since March 2022. The number of transactions jumped to a record high of 109 from 73 in November. There were three transactions valued at more than $30 million, the same as in November and October.

The largest base/other metals financing and also the largest overall was the $120 million debt offering of Missouri-based United States Strategic Metals LLC, previously known as Missouri Cobalt LLC. The company is currently developing the Madison cobalt-copper-nickel project that entered a 100% offtake agreement with Glencore PLC in 2022. The loan was earmarked for the finalization of phase one of commercial processing and expansion of mine development of the Madison project.

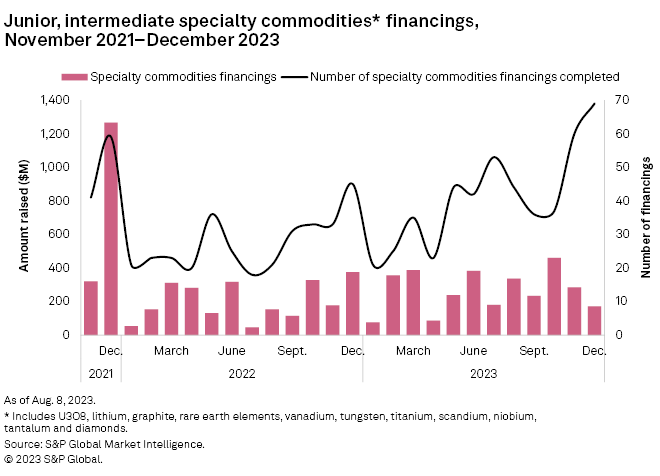

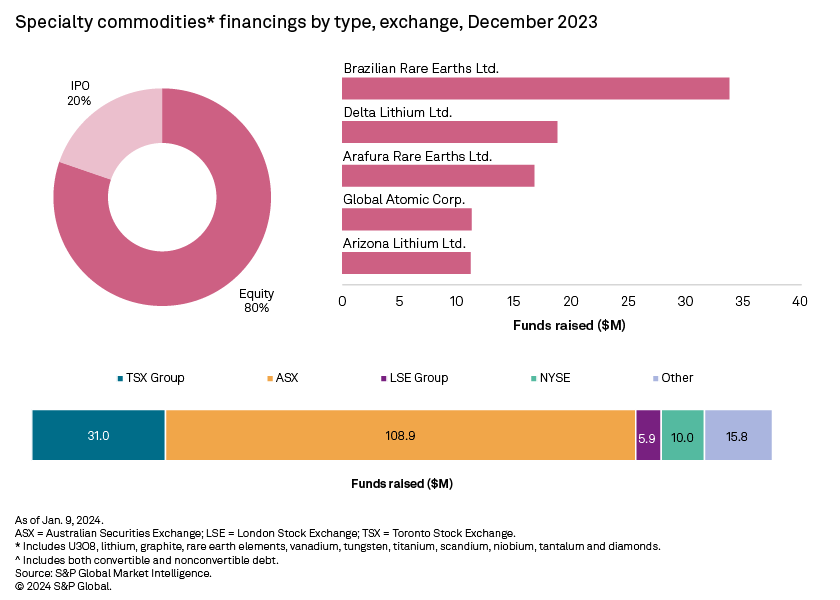

Lower lithium financings drag specialty group

Funds raised for specialty commodities fell for the second straight month, down 40% to $171 million. Lithium financings were halved in December, which dragged the entire group, despite higher funds being raised for rare earth elements. Despite the dip, the number of specialty transactions was up 15% to 69 — the second highest in our record. There was one transaction valued at more than $30 million, the same as in November.

The largest specialty metals financing and the seventh-largest overall was the A$50 million IPO of Sydney-based Brazilian Rare Earths Ltd. in the Australian Securities Exchange. As its name suggests, the company is exploring rare earth elements along with other critical minerals in the state of Bahia in Brazil, and the proceeds are earmarked for acquisitions and exploration. The stock price jumped 9% on the first day and 27% in the first week.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.