Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 03, 2023

Business is booming in Hong Kong SAR, with output growing at the fastest rate for over a decade. S&P Global's latest Purchasing Managers' Index (PMI) survey showed business confidence soaring far higher than anything seen previously in the survey's history, buoyed by surging demand amid the reopening of the Chinese mainland economy. Output growth has accelerated sharply in response to the improving demand environments and business outlooks, setting the economy on a firm footing for recovery in 2023

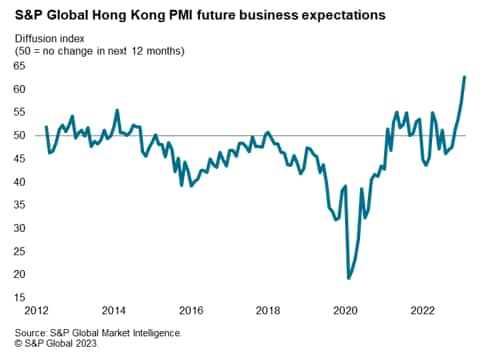

The PMI survey's future output expectations index surged almost six-points to jump to its highest since comparable data were available in 2012, rising for a sixth successive month to indicate a remarkable turnaround in business confidence. Whereas companies had been expecting output to fall over the coming year on average late last year, the mood has turned positive to a degree never before witnessed, corresponding with a change in policy from the Chinese authorities which has allowed COVID-19 restrictions to be relaxed on the mainland.

But it is not just confidence that has been boosted. New orders placed at Hong Kong SAR businesses rose for a second month running after four months of decline late last year, the rate of growth accelerating sharply to the highest since January 2011.

This demand improvement in demand was in turn driven by a wave of new business received from the Chinese mainland, which rose at a rate not seen since the post global financial crisis growth boom of early-2010.

Business activity has risen accordingly alongside the revival of demand and the boost to confidence received from mainland China's relaxation of COVID-19 restrictions. The survey's output index jumped form 52.7 in January to 57.6, its highest since January 2011.

The latest PMI data therefore provide a clear signal that the economy is recovering rapidly at the start of 2023 after the damaging impact of the Omicron COVID-19 wave late last year and the impact of health restrictions on the Chinese mainland.

Since the PMI was first compiled for Hong Kong SAR in 1998, it has exhibited a correlation of 83% in the two decades leading up to the pandemic, with the PMI leading changes in GDP growth by two months, while also being published several months ahead of the GDP data. The latest rise in the headline PMI is broadly commensurate with GDP growth accelerating to an annual rate in excess of 6%.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.