Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 6 Jul, 2022

By Nathan Sovall

Introduction

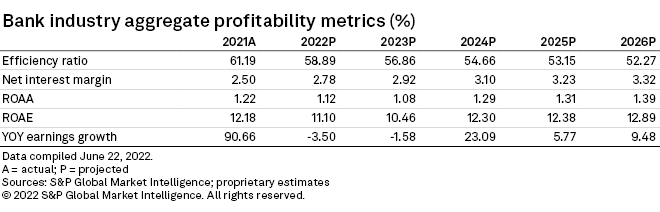

More aggressive tightening of monetary policy by the Federal Reserve improves the earnings outlook for U.S. banks in the near term.

U.S. banks still face difficult year-over-year comparisons as institutions will no longer receive a massive tailwind from reserve releases and strength in mortgage banking income. But earnings are now expected to only decline modestly as the Fed's efforts to tame inflation through rapid increases in interest rates will support considerable net interest margin expansion. Higher rates and inflation could cause some strain for borrowers, however, and should result in increased credit costs in 2023.

Higher rates provide a shot in the arm to bank margins

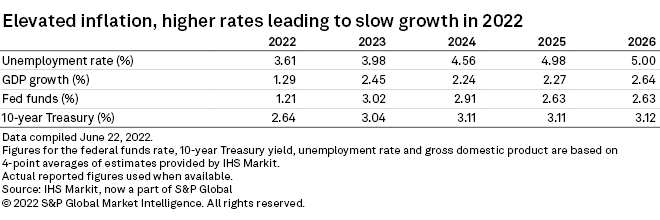

The Fed has raised short-term rates by 150 basis points through mid-June and is expected to continue tightening monetary policy by raising rates by at least 100 more basis points and the shrinkage of its balance sheet during the remainder of 2022. Those actions will bolster bank margins and allow the key profitability metric to expand by 28 basis points in 2022 to 2.78%.

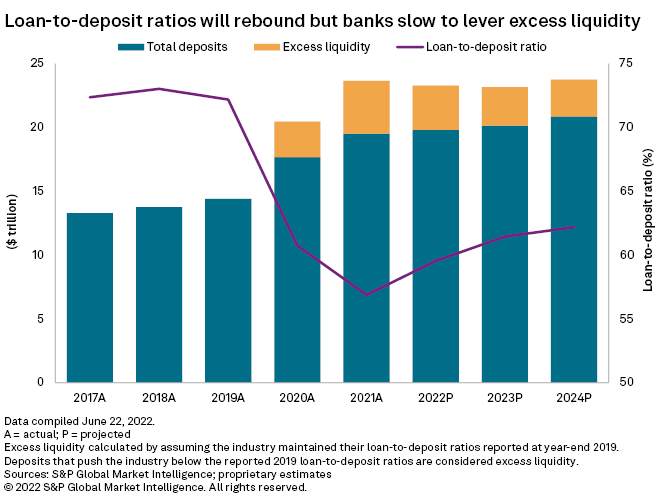

The Fed's balance sheet reduction and utilization of some of the nearly $2.6 trillion in excess savings that consumers have accumulated through the pandemic is expected to lead to slower deposit growth, allowing loan-to-deposit ratios to recover from depressed levels.

Deposits are projected to grow 1.50% from year-ago levels in 2022 and climb 1.75% in 2023, falling well short of the 6.25% and 5.00% projected loan growth in the respective periods.

That growth would reverse the trend witnessed throughout much of the pandemic, when explosive deposit growth overshadowed loan growth, leaving banks sodden with excess liquidity and lackluster margins.

Through stronger loan growth, banks will be able to deploy some of the estimated $4.21 trillion in excess liquidity at the end of the first quarter of 2022. We expect excess liquidity will decline notably in 2022 and 2023 but remain close to $3 trillion.

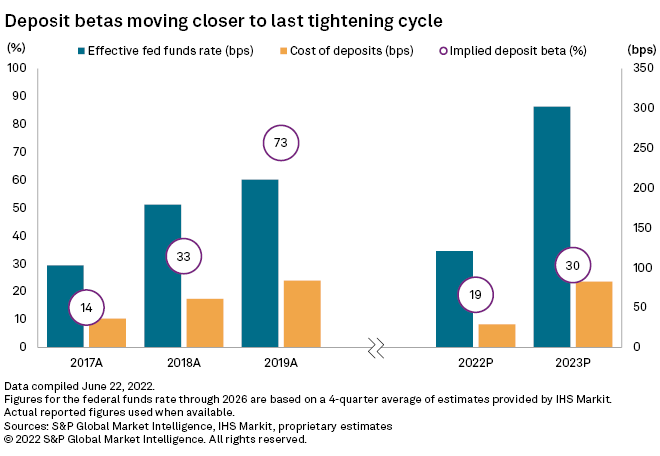

Excess liquidity serves as a headwind to banks margins, but it should also allow deposit rates to lag rate hikes by the Fed, even as the central bank tightens monetary policy at a far quicker pace than witnessed during the last tightening cycle.

Given the sharp increase in the fed funds rate, we now expect deposit betas, or the percentage of changes in the federal funds rate that banks pass through to depositors, will be higher than previously expected. However, deposit betas are expected to remain relatively close to the levels seen during the last rate hike cycle given that institutions continue to operate with historically low loan-to-deposit ratios. Even after substantial increases in short-and-long term rates, most institutions, and in particular the nation's largest banks that own large portions of the industry, have not increased the rates they offer on many deposit products that much either.

We expect the banking industry to record a deposit beta of 18.9% in 2022 and 29.5% in 2023, leading to a cumulative beta of 26.2% by the end of 2023. That experience would be roughly in line with the last tightening cycle. Between the fourth quarter of 2015 and the fourth quarter of 2018, the industry recorded a cumulative beta of 25.4%.

As deposit costs rise, earning-asset yields will reprice higher, leading to notable net interest margin expansion for the banking industry. Earning-asset yields are poised to rise after facing pressure during the pandemic, buoyed by a surge in short-term and long-term interest rates.

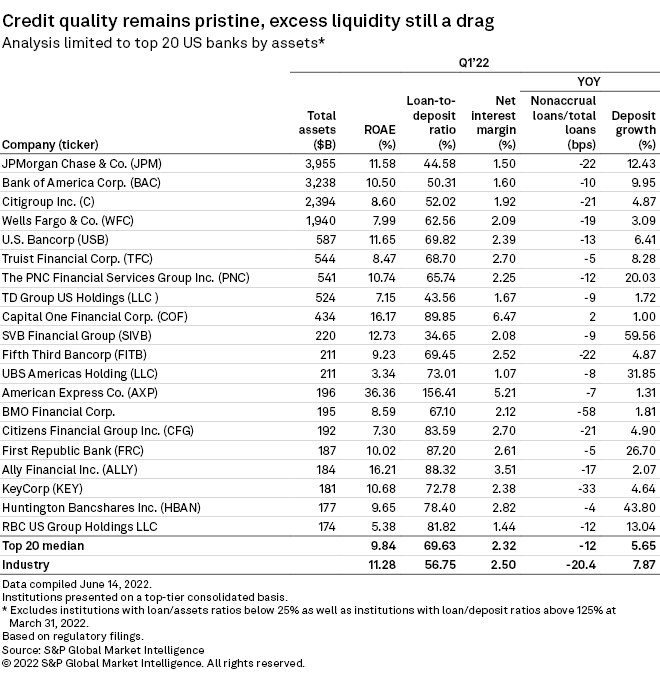

Higher rates support margin expansion but spark heightened credit concerns

Higher rates should help boost loan yields, but historically low loan-to-deposit ratios among the nation's largest banks should lead to strong competition for new loans. S&P Global Market Intelligence expects the industry's loan yield to increase to 4.47% in 2022 from 4.30% in 2021. Market Intelligence then sees the yield on loans rising to 5.01% in 2023 and 5.32% in 2024.

Banks would certainly welcome margin expansion, particularly with noninterest income poised to decline in 2022. Higher interest rates have caused home loan originations to plunge, resulting in pressure on mortgage banking income. Regulatory pressure and emerging competition from neobanks should also contribute to weaker noninterest income as many large institutions have eliminated overdraft fees.

Banks will also no longer receive the massive tailwind to earnings that institutions recorded in 2021, when reserves declined by nearly $60 billion. Reserves are expected to hold fairly steady in 2022, even in the face of growing concerns that elevated inflation and the Fed's efforts to get price increases under control could lead to significant credit deterioration and possibly push the U.S. economy into a recession.

While higher operating and borrowing costs for companies and consumers and slower economic growth will cause credit costs to rise from historically low levels, bankers see few signs of deterioration in their loan portfolios to date and consumer balance sheets remain strong, bolstered by savings accumulated during the pandemic. The lack of meaningful loan growth in recent years and banks efforts to scrub their portfolios during the height should also offer institutions some protection and keep loan losses at manageable levels. Should a recession materialize, loan losses could prove higher than projected, but bank balance sheets remain in shape to weather a downturn.

Scope and methodology

Market Intelligence analyzed nearly 10,000 banking subsidiaries, covering the core U.S. banking industry from 2004 through the first quarter of 2022. The analysis includes all commercial and savings banks and savings and loan associations, including historical institutions, as long as they were still considered current at the end of a given year. It excludes several hundred institutions that hold bank charters but do not principally engage in banking activities, among them industrial banks, nondepository trusts and cooperative banks.

The analysis divided the industry into five asset groups to see which institutions have changed the most, using historically significant regulatory thresholds. The examination looked at banks with assets of $250 billion or more, $50 billion to $250 billion, $10 billion to $50 billion, $1 billion to $10 billion, and $1 billion and below.

The analysis looked back more than a decade to help inform projected results for the banking industry by examining long-term performance over periods outside the peak of the asset bubble from 2006 to 2007. Market Intelligence has created a model that projects the balance sheet and income statement of the entire industry and allows for different growth assumptions from one year to the next.

The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

IHS Markit is now part of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.