Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 17 Aug, 2021

By Paul Manalo and Kevin Murphy

Highlights

Exploration budgets generally move with metals prices, often with a one-year lag. The pandemic-induced price falls of the March quarter 2020 have been followed by strong metals price rebounds, with gold and copper hitting record highs at various points since then.

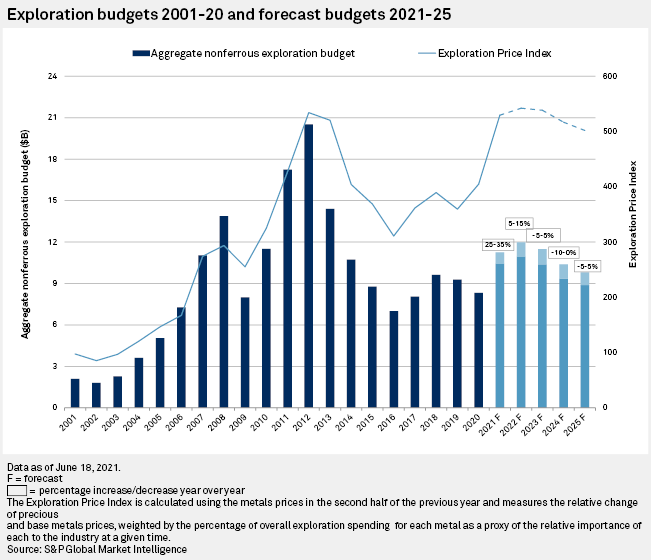

With metal prices continuing their strong performance through the first half of 2021, we expect exploration budgets to increase 25% to 35% over 2020, surpassing our original forecast announced at the Prospectors & Developers Association of Canada convention in March. Looking to 2022, we expect another budget increase, although not as large, despite a projected moderate softening of most metals' prices. From 2023 to 2025, we expect budgets to pull back slightly as the COVID-19 pandemic economic recovery subsides and global economic growth returns to a more moderate pace.

These estimates are based on the relationship between exploration budgets and metal prices, leveraging the global financial crisis as a model for how markets could change in the coming years.

Exploration budgets generally move with metals prices, often with a one-year lag. The pandemic-induced price falls of the March quarter 2020 have been followed by strong metals price rebounds, with gold and copper hitting record highs at various points since then. The improving commodity prices were insufficient or too late, however, to offset other pandemic-related challenges to the exploration sector, resulting in lower budgets for the year.

Our Exploration Price Index rose 31% year over year in 2020, leading us to project an estimated 25%-35% increase in exploration budgets in 2021. A similar budget increase was driven by a metal price rally in 2010, when the price index rose 27% year over year and exploration budgets jumped 44%. This was followed by strong budget increases in the next two years, by 50% in 2011 and 19% in 2012, supported by a continuing rally in commodity prices fueled by rising demand from emerging markets, led by China.

Prior to the pandemic-induced budget decrease in 2020, budgets grew by double-digits in 2017 and 2018 after bottoming in 2016. In 2019, exploration stagnated, and budgets declined by 3.5% as metals prices reversed their 2018 gains when the U.S.-China trade war threatened global growth and commodities demand.

In 2022, we expect metal prices to remain at relative historical highs, although below their 2021 average prices. This will translate into a more modest exploration budget increase of 5% to 15% for the year as programs planned during the 2021 boom continue. From 2023 to 2025, we expect budgets to decline modestly as metal prices pull back and then stabilize. This follows the general trend we saw from 2010 to 2015 after the global financial crisis and China's infrastructure boom, although price decreases and the resulting budget decreases should be more modest this time around.

Even though prices for some commodities, such as gold and copper, have exceeded their previous highs of 2011, we are not seeing exploration budgets revisit their highs from almost a decade ago, as mining companies have taken a more prudent and conservative approach since 2012 to growing their asset portfolios. The lower exploration budgets in recent years due to this risk-averse attitude may threaten future supply pipelines as medium-term demand for certain commodities expands. We nevertheless expect that growing demand for battery metals such as copper, nickel and cobalt may insulate them from our expected pullback in global budgets beginning 2023. This would reflect commodity-specific demand growth as the global energy transition, electrification of the transport sector and a general shift toward sustainability all gain momentum.

Already a client?

BLOG

Blog