Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Nov, 2016 | 12:45

Highlights

This quarter’s 13F analysis shows that hedge funds may have been just as surprised by the election as pollsters and psephologists.

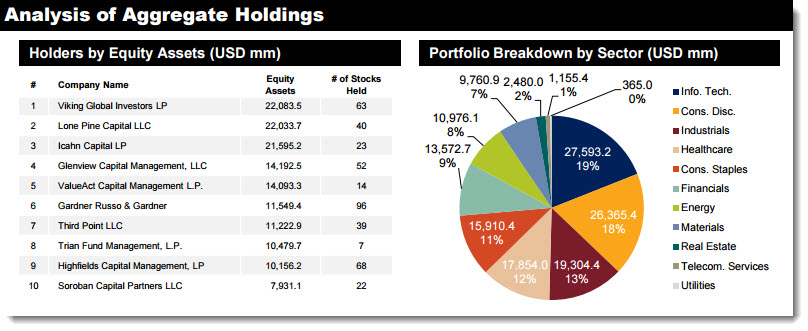

This quarter’s Hedge Fund Tracker shows that the top funds managed approximately $145 billion in equity holdings, down from the $150 billion under management in Q2, and down more than $50 billion from the highs reached in 2015. Eight out of 11 S&P 500 sectors were net sells, while the limited sector buys were down significantly from the usual $1 billion mark. For example, Industrial’s led this quarter’s top sector buy with a meager $407 million, far below anything we saw in 2015.

This quarter also shows that hedge funds may have been just as surprised by the election as pollsters and psephologists. The healthcare industry saw the largest net sell, indicating a possible expectation that former Secretary of State Hillary Clinton’s promised healthcare reforms would adversely affect the sector. Both Glenview Capital and Viking Global pulled out significantly from Allergan, which was this quarter’s top sell at $1.5 billion.

Despite being a net sell at $335 million, Information Technology saw this quarter’s top buy, with Lone Pine making a brand new position in eBay at $998 million. This sector could be adversely affected if the FCC adapts its stance on net neutrality during the Trump Administration. However, if repatriation taxes drop from 35% to 10%, as promised by the President-elect, Tech companies that have significant overseas income could benefit.

Summary of findings in the Q3 2016 Hedge Fund Tracker:

DISCLAIMER

Form 13F Reports are required to be filed within 45 days of the end of a calendar quarter by institutional investment managers with the U.S. Securities and Exchange Commission (SEC). An institutional investment manager is an entity that invests in, buys or sells securities for its own account, or a natural person or entity that exercises investment discretion over the account of any other natural person or entity. Only securities on the 13F list provided quarterly by the SEC (13F Securities) are required to be included in Form 13F Reports. Therefore, Form 13F Reports may not reflect the most current holdings of institutional investment managers because it is required that the 13F Report include only 13F Securities, is filed on a lag, and some funds may not meet the filing thresholds or other requirements. In addition, because the 13F Reports are as of the last date of the quarter, the 13F Report may not describe intra-quarter activity.