Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Sep, 2016 | 09:00

By Nick Wright

Highlights

The Strategies for Gold Reserves Replacement is a series of reports analyzing the industry's efforts to enhance the supply pipeline. The recently published M&A Activity report is part of the report series.

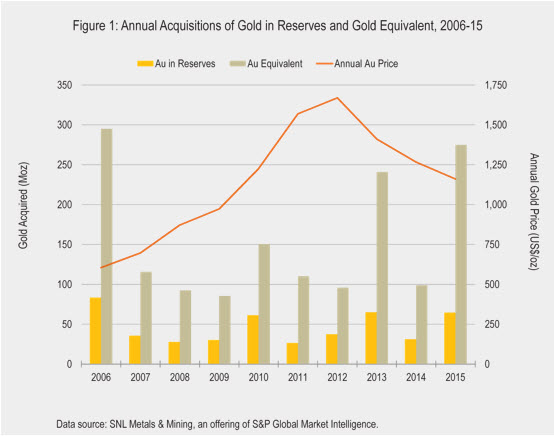

Gold M&A deals are showing a continuation of the trend towards lower valuations of gold assets being acquired. According to the M&A data in the Strategies for Gold Reserves Replacement report, 58.4 Moz of gold reserves acquired in company and project deals in 2015 almost doubled the acquired gold reserves of 31.2 Moz in 2014. However, the total acquisition price of $9.47 billion only rose by half of the acquisition price of $6.14 billion paid in 2014. The price paid per ounce of gold in reserves was therefore reduced by almost 20% to $162/oz in 2015.

The Strategies for Gold Reserves Replacement is a series of reports analyzing the industry's efforts to enhance the supply pipeline. The recently published M&A Activity report is part of the report series.

Highlights of the Gold M&A Activity report are below:

Continue reading about gold M&A activity trends.