Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jan, 2017 | 11:15

By Dr. Chris Hinde and Tom Manzella

Highlights

Various global events played an important role in shaping how equities and commodities performed in 2016. As uncertainty waned and investor sentiment improved in the latter part of the year, gold-related funds took a hit.

As a simplification, 2016 can be characterized as a year of two halves. International concern about deflation and recession peaked with the Brexit vote in the U.K. on June 23. The resultant European emphasis on reflation through fiscal policy, and the subsequent growth-friendly election in the U.S. of Donald Trump as its next president meant the second half of the year saw investment in favor of assets that benefited from growth and inflation.

Equities suffered in the first half of the year, but recovered strongly over the final six months at the expense of bonds. Defensive stocks did better in the first six months, but it was then the turn of cyclical stocks that benefited as the investment mood changed. The improved sentiment was such that the year ended with the Vix index, which tracks the value of options that hedge against volatility at a 30-month low.

The mid-year shift in sentiment was particularly noticeable in the mining sector, with attention turning from precious metals to industrial metals and minerals. In the six months to the end of June, gold had risen almost 25% to US$1,321/oz, but the precious metal subsequently retreated to about US$1,135/oz, an increase over the whole year of just 7%. Indeed, the precious metal fell 3.3% in December.

Often considered as a hedge against uncertainty, investor interest in gold has suffered as optimism has returned to international markets. The rebound in sentiment has been led by the U.S., where better economic data has led to a stronger dollar and rising interest rates. These changes have not only made it less attractive to hold bullion, but they have also reduced interest in using exchange-traded funds for gold investments.

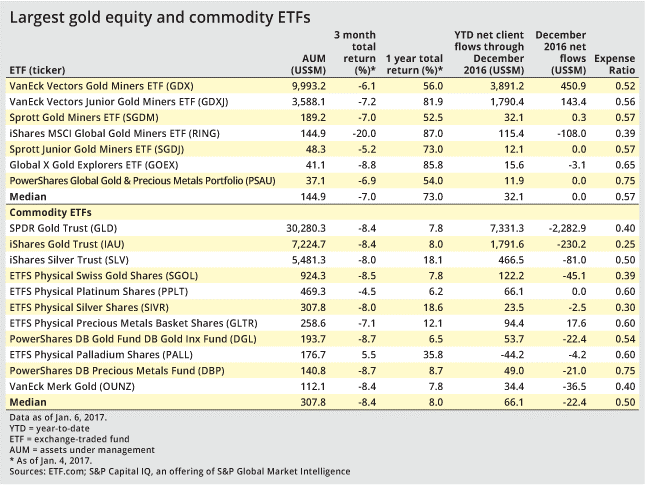

The commodity ETF, SPDR Gold Trust tracks the gold spot price and is the largest fund of its kind to invest in physical gold. Managed by SSgA Funds Management Inc. and the World Gold Council, SPDR Gold Trust ended 2016 with more assets under management, or AuM, than any other gold equity or commodity ETF. SPDR Gold Trust's year-end AuM total of US$30.28 billion included US$7.33 billion in new money. However, the fund saw US$2.28 billion in net outflows during December.

IShares Gold Trust, a close competitor to SPDR, suffered a net outflow of US$230.2 million in December. As a result, the fund's 2016 net inflows reached only US$1.79 billion but iShares AuM of US$7.22 billion ranked it second among commodity ETFs.

The ETF Securities-managed Physical Swiss Gold Shares fund followed the trend of its peers with net outflows in December of US$45.1 million. Physical Swiss Gold Shares had a net inflow of US$122.2 million during 2016, and its total assets ended the year at US$924.3 million.

Meanwhile, the smaller VanEck Merk Gold Trust finished 2016 with total assets of US$112.1 million, aided by US$34.4 million in net inflows during the year and despite US$36.5 million in net outflows during December. As of January 4, the fund's one-year total return of 7.8% was in line with its peers. SPDR, iShares and Physical Swiss Gold Shares returned 7.8%, 8% and 7.8% respectively.

Commodity-focused ETF funds produced reasonable returns against most other asset classes in 2016, despite posting nearly unanimous negative figures during the last three months of the year. Gold equity ETFs, however, which invest directly in mining stocks, posted much better performances, with a median 73% return during 2016. Moreover, they did not see the same kind of December net outflows that commodity ETFs did.

VanEck Vectors Gold Miners is the largest ETF to invest directly in gold mining companies, with assets of US$9.99 billion at the end of 2016. Among the fund's top ten holdings are Barrick Gold Corp. (10.9% of net assets), Newmont Mining Corp. (10.5%) and Goldcorp Inc. (6.8%) as of January 9. The market values of all three miners rose significantly in 2016 but fell during the final quarter by 10%, 13% and 18%, respectively. As for VanEck Vectors itself, the fund returned 56% over the past year, as of January 4, while it lost 6% of its value during the past three months.

VanEck's counterpart fund for junior miners, GDXJ, holds US$3.59 billion in assets and pulled in US$1.79 billion during 2016. The 0.56% expense ratio is slightly higher than VanEck Vectors's 0.52% and is inherently higher risk given its holdings in smaller companies. These assets include a stake of almost 6.1% in IAMGOLD Corp., 5.5% in Alamos Gold Inc. and nearly 4.0% in Pretium Resources Inc., as of January 9.