Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 01, 2023

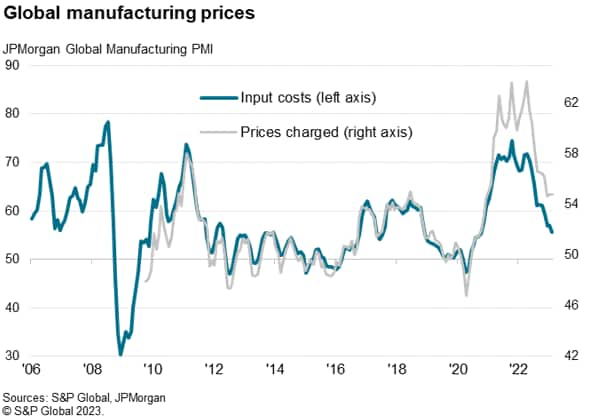

Worldwide manufacturing input costs rose in February at the slowest rate since October 2020, the rate of inflation running sharply lower than the peaks seen in 2021 and 2022 in response to improving supply and weak demand for inputs. Selling price inflation remained elevated, however, buoyed by upward wage pressures, sending a concerning signal for the persistence of stubbornly high consumer price inflation.

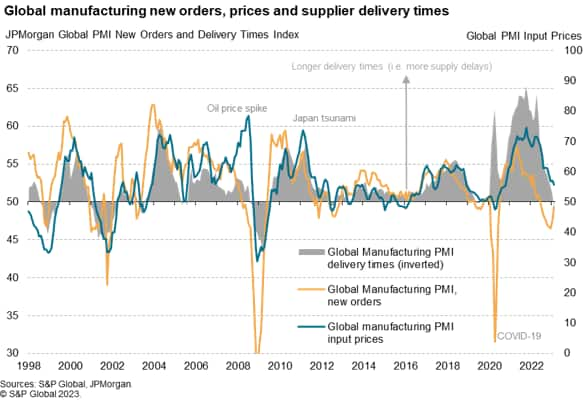

Global manufacturing input costs rose at the slowest rate for 28 months in February, according to the JPMorgan Global Manufacturing PMI, compiled by S&P Global. Lower prices in part reflected improved supply conditions: average supplier delivery times shortened in February, contrasting with the unprecedented lengthening recorded during the pandemic, and at an extent not seen since 2009.

Supplier lead times quickened partly in response to supply chain logistical improvements since the height of the pandemic, such as fewer shipping container shortages, but also reflected a cooling of demand for inputs, which has meant suppliers have become less busy and therefore better-able to meeting demand in a more timely manner. Demand, as measured by new order inflows into manufacturing, fell for an eighth successive month in February, albeit the rate of decline easing for a second straight month.

Thus, with supply improving and demand continuing to fall, the environment is one in which raw material price pressures are falling on average worldwide. Input prices in fact even fell in both Germany and Italy.

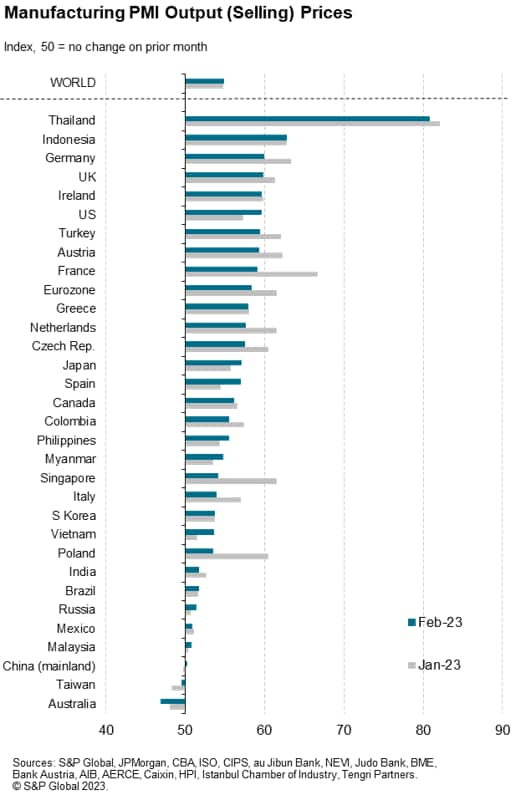

However, while input cost inflation continued to ease in February, it was a different story for average prices charged for goods leaving the factory gate, whereby average selling prices rose globally at an unchanged rate in February. Although the rate of selling price inflation has edged up only marginally so far this year from the two-year low seen at the end of last year, the still-elevated rate of increase relative to input cost inflation remains a concern in relation to the stickiness of global consumer price inflation.

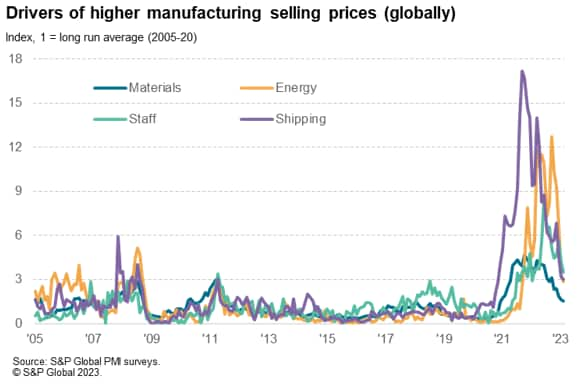

Looking further into what is driving prices higher, raw material prices are exerting the lowest upward pressure relative to their long run average, with staff costs exerting the greatest pressure, followed by shipping costs and energy costs.

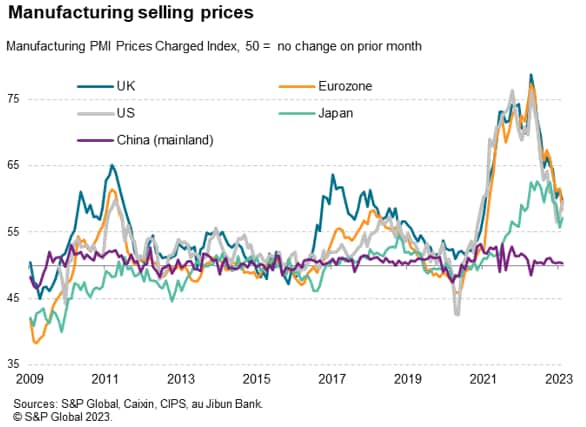

Looking at the major economies, selling price inflation turned notably higher in the US as well as in Japan, Spain, Vietnam and Taiwan. However, rates of inflation continued to cool in the eurozone on average and in the UK, helped lower by falling energy costs.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.