Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 14, 2021

By Joseph Hayes

Robust vaccination uptakes, as well as supportive fiscal and monetary policy have facilitated a strong "post-pandemic" recovery in economic activity across developed markets (DMs) so far this year. While these three factors have not been as prevalent in emerging markets (EMs), booming demand conditions in the world's more advanced economies have benefited EMs, particularly exporters.

However, global economic growth has been slowing quite drastically in the second half of 2021 as the post-lockdown boom petered out and supply-issues intensified. Now, easing growth, rising inflation, expectations of tighter monetary policy in developed economies and a stronger US dollar are all compounding to weigh on EMs. As a result, investors are losing confidence in the EM growth story and many EM central banks are beginning to tighten, which could place further strain on EM growth prospects heading into 2022.

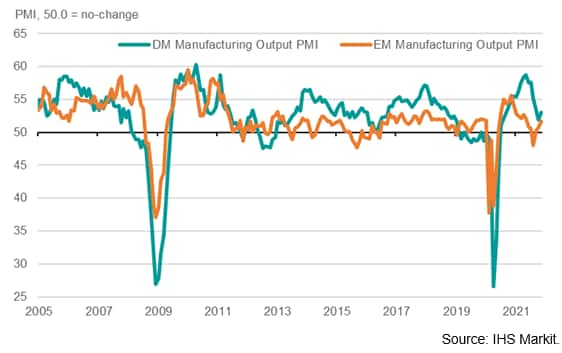

Recoveries across developed and emerging markets have been far from synchronous, according to PMI™ survey data from IHS Markit (see chart 1). Developed world growth greatly exceeded that of EMs throughout all of 2021, primarily due to the difference in the handling of the pandemic as DMs kept stringent virus-combatting measures in place for longer, delaying the timing of the rebound. Regardless, the subsequent slowdown in growth in DMs since the middle of 2021 has clearly weighed on EM economies, although encouragingly the November PMI survey data did show EM manufacturing output rising at the strongest pace in five months.

Chart 1: EM v DM manufacturing output growth

A positive side effect of rising global economic activity for EMs tends to be improved export growth and rising commodity prices. The logic follows that rising commodity demand and prices boosts EM exports both in volume and value terms, and therefore benefits EM growth. Not only this, but ultra-loose monetary policy in the global economic powerhouses has also allowed EM central banks to keep interest rates, and debt servicing costs, low, fostering good growth conditions. However, headwinds to economic output remain at large and the support that the factors listed above lend to EM growth are starting to dissipate.

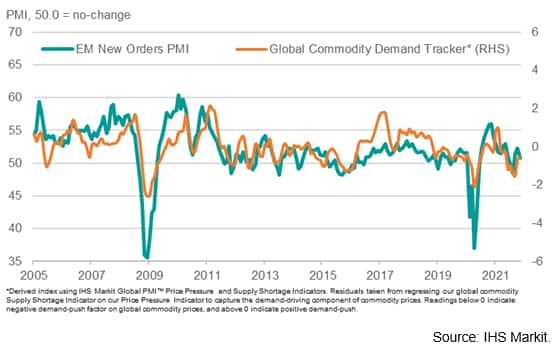

Chart 2: EM manufacturing demand vs. global commodity demand proxy

Most notably, although commodity prices have, until recently, had a strong year, we've seen evidence of weakening demand pressures in commodities for some time. Using IHS Markit Global PMI™ Price Pressure and Supply Shortage Indicators (for more information on these indices, please see below), we've controlled for the effect that supply has on prices to proxy commodities demand. This is important analysis for EMs, particularly in the current environment given that commodity prices are mainly rising due to intense supply shortages. The results can be seen in chart 2, which shows an historically strong relationship between our global commodity demand tracker and the PMI New Orders Index for EMs. Weakening demand pressures in commodities has coincided with an easing of new order growth at EM manufacturers.

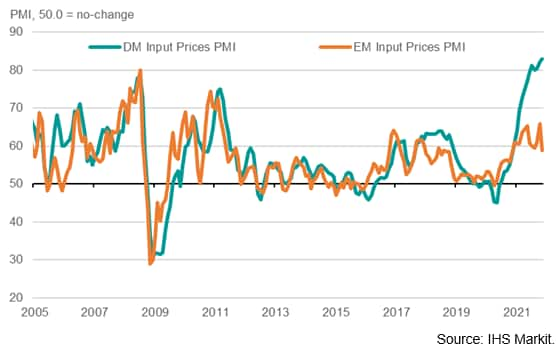

The next problem - inflation - is more acute at DMs, but EMs may ultimately pay the greater price. While price pressures at DMs have touched multi-decade highs this year due to the surge in demand for materials, shortages of inputs at suppliers, transport bottlenecks and poor global shipping container availability, input cost inflation at EMs has remained relatively contained (see chart 3).

Chart 3: DM v EM Manufacturing input price inflation

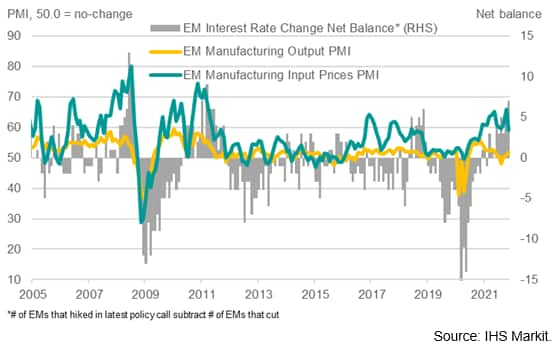

That said, the EM Input Prices PMI has been well above its historical average this year which, alongside expectations of tightening by the Federal Reserve and other DM central banks, has caused EM monetary policy to also tighten. Given how damaging inflation can be to an EM economy, interest rates often have to be more pro-active than reactive to protect the domestic currency and the central bank's credibility. Unfortunately, credibility protection comes at the cost of economic growth, and we've already seen many EMs raise rates this year despite growth underwhelming (see chart 4).

Chart 4: EM central banks tighten policy as growth languishes

Lastly, amid fading risk appetite and growing expectations of higher interest rates in the US, the US dollar has strengthened, and JP Morgan's Index of EM currencies has dropped by almost 10% this year alone. As EM currencies weakens, domestic financing costs rise, and EM central banks are forced into action either by intervening in the FX market or by increasing interest rates.

Chart 5: EM equities slip into decline as commodity demand deteriorates

A less favourable external economic environment, combined with tighter EM monetary policy, has made EM assets less desirable from an international investors perspective. The trend in total US dollar returns from EM equities has subsequently deteriorated, in line with the signal from our global commodity demand tracker.

Summary

In summary, monetary policy across EMs has tightened in response to rising inflation and expectations of higher interest rates across the developed world. With the global manufacturing sector struggling amid intense supply-chain dislocations, steep cost pressures and slowing demand, weak global growth is likely to persist. The combination of these factors undoubtedly skews the outlook for EMs in 2022 further to the downside.

Demand conditions facing EMs will be a crucial barometer of economic health to monitor in the coming months, especially if supply issues persist or intensify and put more upward pressure on commodity prices. As rising commodity prices are usually seen as a positive signal for EM growth prospects, focusing on the demand component here will enable us to determine how accommodative global economic conditions are for EM growth. We will be keeping a close eye on The EM Manufacturing New Orders PMI and our global commodity demand tracker over the coming months to monitor how the EM economic environment is evolving.

*IHS Markit Global PMI™ Price Pressure and Supply Shortage Indicators are derived from IHS Markit's monthly Purchasing Managers' Index™ (PMI) business surveys. These surveys are highly regarded worldwide for providing accurate and timely data on economic trends.

SSIs are calculated from the number of purchasing managers that report a specific item to have been in short supply during the survey month. An adjustment is made each month to allow for any month-to-month variation in the total number of survey respondents. Indices are presented as a multiple of the long-run average since 2005.

PPIs are calculated from the number of purchasing managers that report a specific item to have been up in price during the survey month (less the number reporting an item down in price). An adjustment is made each month to allow for any month-to-month variation in the total number of survey respondents. Indices are presented as a multiple of the long-run average since 2005. For more information on how you can get these data series, please contact economics@ihsmarkit.com.

Joe Hayes, Senior Economist, IHS Markit

Tel: +44 1344 328 099

joseph.hayes@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.