Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Aug, 2023

By Russell Ernst and Monica Hlinka

Regardless of whether someone is new to the utility sector or is an experienced industry participant, they are likely seeking answers to some common questions.

Regulatory Research Associates' "Frequently Asked Questions" Topical Special Report addresses some of the common areas of confusion among those with a vested interest in the utility industry. Two examples are included below. Other recent RRA reports highlighted the major steps in the rate case process and the mechanics of calculating rate base.

Q: Why is there often a difference between a utility's authorized return on equity (ROE) and its earned ROE?

A utility's ability to earn its authorized ROE is impacted by certain factors that are under the control of company management and others that are not. In its analysis of rate case decisions, RRA considers the likelihood that the company will have a reasonable opportunity to earn the authorized return. Utility regulation is based on a compact between the utility and the regulatory authority that grants the company a monopoly to serve all customers within a designated geographic area, requires the company to provide quality service at "reasonable rates," and accords the company an opportunity to earn a "fair" return for shareholders. Regardless of the ROE approved for the utility in a rate case, the commission may adopt adjustments to the company-proposed revenue, expense and rate base levels, and these adjustments could affect the utility's ability to earn the authorized ROE in the first year of new rates.

"Regulatory lag" occurs when a utility's commission-approved revenue requirement does not reflect its true cost of providing service and can compromise the company's ability to earn its authorized ROE. All else being equal, a commission's use of a historical test year in a rate case can contribute to regulatory lag by ignoring several months, or even a year or two, of expense increases and capital investment made by the utility. To mitigate the effects of regulatory lag, some commissions recognize "known and measurable" adjustments beyond the end of the test year when determining the utility's revenue requirement, although these adjustments may not extend far enough to provide the company with a reasonable opportunity to earn its authorized ROE. Several commissions permit the use of forecast or future test periods, with these test years approximating the first full year of new rates. In addition, some commissions allow for interim rate increases to be implemented during a case, such that the rate hike approved at the conclusion of the proceeding has, effectively, already been in place for several months.

Regulatory lag can also be mitigated by adjustment clauses, which are designed to allow companies to change their rates to recover their costs on a current basis with no negative effect on the bottom line and without the expense and delay that accompanies a rate case filing. That effectively shifts the risk associated with recovery of the cost in question from shareholders to customers. Accounting deferrals also help to reduce regulatory lag.

Q: Who are the parties that are typically involved in utility regulatory proceedings?

A: Regardless of whether they are involved in rate cases, plant preapproval proceedings, service quality review dockets or other matters, intervenors ensure that the utility commissions hear from a broad group of stakeholders. While some may have interests aligned with utilities, an intervenor's participation in a proceeding will often expose areas of concern related to customer service and affordability.

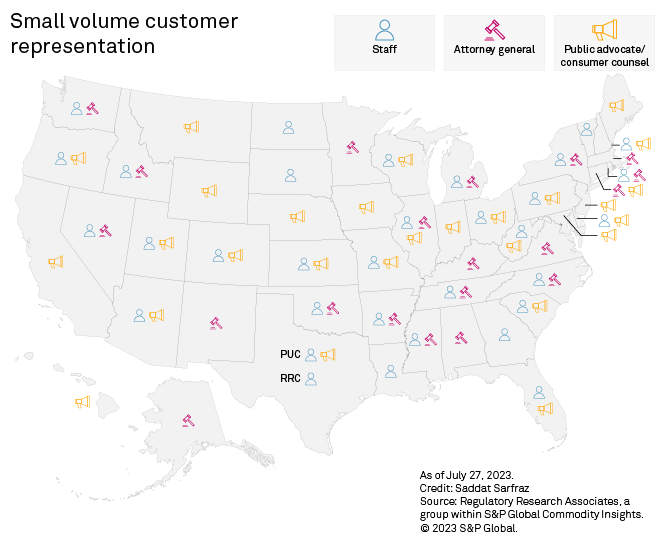

Typically, a state attorney general and/or another state agency, such as a consumer advocate's office, represents the public interest, primarily residential customers. In more than half of all jurisdictions, the commission's staff is tasked with recommending positions on issues that balance the need for utilities to earn a reasonable rate of return with the obligation for customers to pay reasonable rates. Consumer advocates have been actively involved in utility matters for several decades and their roles have evolved somewhat over time. These groups often have statutory intervention authority and do not need formal commission approval to weigh in on utility issues.

Intervening entities can also include an individual large commercial or industrial customer, or a specific group of constituents — such as the American Association of Retired Persons — which advocate on behalf of and support affordable rates generally. Groups seeking to advance an environmental agenda also frequently intervene in utility cases. For example, the Sierra Club, the National Resources Defense Council and entities focused on the expanding use of renewable energy technologies participate in a variety of proceedings each year across the US. Utility worker unions also participate in some proceedings.

Utilities often get involved in rate cases that pertain to their in-state utility peers, especially if there is a matter up for consideration for which the intervenor might share a common interest. In addition, in jurisdictions that have restructured their electric markets, entities representing alternate suppliers — such as the Retail Energy Supply Association — frequently weigh in on utility matters.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.