Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 Jan, 2021

At any given point in time, there may be broad industry issues or macroeconomic trends, as well as state-specific developments that can positively or negatively impact utilities' financial performance. How regulators and policymakers address these challenges will affect the relative level of risk accruing to ownership in the securities of the utilities operating in a given state-level jurisdiction.

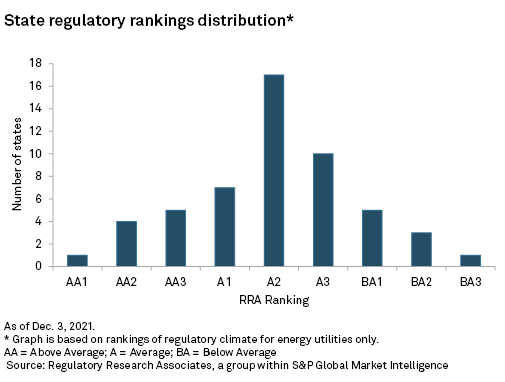

As part of its ongoing research, Regulatory Research Associates, a group within S&P Global Market Intelligence, evaluates the regulatory climate for energy utilities in each of the jurisdictions within the 50 states and the District of Columbia, a total of 53 jurisdictions, on an ongoing basis. Each evaluation is based upon consideration of the numerous factors affecting the regulatory process, including gubernatorial involvement, legislation and court activity, as well as specific commission actions.

An Above Average designation indicates that, in RRA's view, the regulatory climate in the jurisdiction is relatively more constructive than average, representing lower risk for investors that hold or are considering acquiring the securities issued by the utilities operating in that jurisdiction. At the opposite end of the spectrum, a Below Average ranking would indicate a less constructive, or higher-risk, regulatory climate from an investor viewpoint.

RRA attempts to maintain a "normal distribution" of the rankings, with the majority of the states classified in one of the three Average categories.

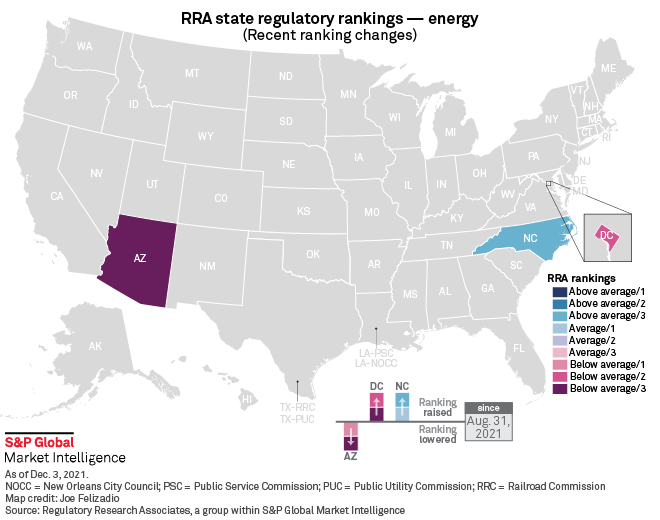

Developments in recent months have led RRA to lower its regulatory ranking of Arizona to its lowest ranking category, indicating a higher degree of regulatory risk for investors relative to other jurisdictions. At the same time, RRA raised the ranking of the District of Columbia and North Carolina, finding that recent developments indicate these jurisdictions are becoming relatively more constructive than they were previously from an investor viewpoint.

Ranking changes map

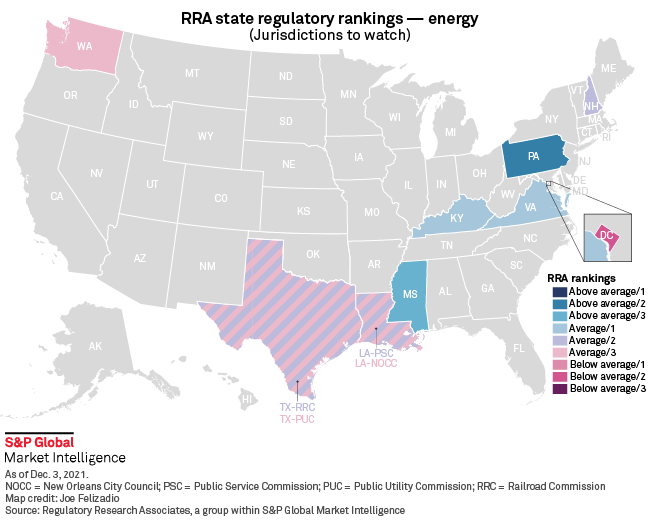

RRA has also identified several state-level jurisdictions that could experience noteworthy changes in the level of regulatory risk for investors in light of ongoing issues and proceedings in those jurisdictions.

While the District of Columbia Public Service Commission recently adopted a multiyear rate plans for the jurisdiction's largest electric utility, certain stakeholders have appealed the commission's rulings, which could ultimately lead to a change in that framework. In addition, there are several pending grid modernization-related proceedings that also bear watching and there has been turnover at the commission in recent months.

New Hampshire is also worth watching because of the high degree of commissioner turnover at the New Hampshire Public Utilities Commission and the relative inexperience of the current complement of commissioners.

With Hurricane Ida making landfall on the Gulf Coast in August 2021, causing wide-ranging service disruptions, RRA is monitoring Louisiana, including the City Council of New Orleans, which regulates Entergy Corp. subsidiary Entergy New Orleans LLC, and Mississippi for regulatory actions in response to forthcoming utility service restoration activities. Similarly, Texas bears continued scrutiny as regulators and policymakers implement changes to the regulatory construct to prevent the market dislocations that arose during the February 2021 winter weather event known as winter storm Uri.

In Pennsylvania, ongoing tension between the Republican-controlled Senate and Gov. Tom Wolf, a Democrat, bears watching. The Senate has opposed the governor's moves to implement energy transition-related initiatives, such as joining the Regional Greenhouse Gas Initiative, without enabling legislation.

With the Nov. 2 general election, Virginia saw a change not only in the governor, but also in the governor's political party, as Republican Glenn Youngkin defeated Democrat Terry McAuliffe. This change could bring about significant changes in the state's approach to the ongoing energy transition.

The state of Washington also bears watching as the Washington Utilities and Transportation Commission continues to investigate alternatives to traditional cost-of-service ratemaking that may include performance measures or goals, targets, performance incentives and penalty mechanisms.

States to watch map

Three issues that RRA has p identified as items to watch for 2022 include the treatment accorded stranded costs related to the energy transition, recovery of costs associated with severe weather events, and the treatment to be accorded costs and lost revenues associated with the COVID-19 pandemic.

The U.S. energy sector is in the middle of an extended period of transformative change, broadly referred to as the energy transition.

Demands from public policymakers, regulators and customers to improve the reliability and resiliency of the grid in the wake of more frequent weather events while, at the same time, moving away from carbon-emitting generation and heating resources to renewable and/or zero-emissions resources is causing certain assets to be retired before the end of their planned service lives, leading to the potential for stranded costs.

While carbon-emitting generation assets are currently the most at risk assets, as the industry framework evolves other asset classes may face similar challenges.

For generation facilities owned by vertically integrated utilities, addressing stranded costs falls to regulators, and it is generally agreed that under the regulatory compact, the utility should be able to recover the assets that have become stranded because of a change in public policy that occurred after the plants were built and in operation.

State regulators and policymakers are using a variety of options to address the stranded cost plant balances. Using accelerated depreciation, creating regulatory assets, offsetting stranded assets with existing regulatory liabilities and securitization are among the strategies being employed.

Another issue arising with increasing frequency across the sector is the treatment to be accorded extraordinary weather- and storm-related costs.

most utilities have provisions in their base rates for "normalized" severe-weather-related costs; these are generally estimates based on historical averages for varying time frames. However, in recent years, the instances where actual storm-related costs have significantly exceeded the baselines reflected in rates have become more numerous.

Certain states have allowed utilities to include in rates an incremental amount to fund a storm reserve that the utilities can then tap for costs that exceed the baseline levels. In other states, the utilities, through either incident-specific accounting orders or routine commission policy, are permitted to defer "extraordinary" storm costs for future recovery. Recovery is generally addressed in rate cases and is usually authorized over a relatively short period: five to seven years. The utilities are usually permitted to earn a return on the unamortized balance.

In cases where the amounts to be recovered are particularly large, the utilities may be permitted to use securitization to finance the deferred balances and even to replenish the storm cost reserve.

With utility disconnection moratoriums implemented in the wake of the COVID-19 pandemic coming to an end for most, if not all, customers in most states, issues related to the recovery of the related costs are beginning to crop up in rate cases.

Thus far, recovery has not been particularly contentious. As expected, commissions are generally allowing recovery of any related deferrals to occur over a few years, with varying treatment with respect to allowing a return on the unamortized balance. However, in some instances, regulators are requiring the companies to continue to defer some, if not all, of their costs related to COVID-19.