Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 21, 2021

By Jingyi Pan

| au Jibun Bank Japan PMI | Month | Flash PMI | Prior |

| Flash Composite Output Index | May | 48.1 | 51.0 |

| Flash Services Business Activity Index | May | 45.7 | 49.5 |

| Flash Manufacturing Output Index | May | 53.1 | 54.3 |

| Sources: IHS Markit, au Jibun Bank | |||

au Jibun Bank Flash Japan Composite PMI: What's the latest?

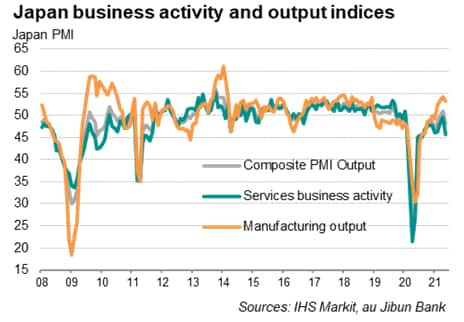

The au Jibun Bank Flash Japan Composite PMI, compiled by IHS Markit and published ahead of the final PMI results, indicated Japan's private sector reverted into contraction in May. This comes after just one month of expansion in April, which was in turn preceded by 14 consecutive months of recession. The service sector slipped further into contraction while manufacturing sustained a fourth straight month of expansion, albeit at a slower rate.

This perhaps comes as no surprise given the reimposition of a state of emergency across various prefectures since April that had now been extended to end-May. Covid containment measures rose to the tightest since June last year, according to IHS Markit calculations. Further expansion of the state of emergency is also being considered, with cases remaining elevated in the country, which would likely continue having a relatively large impact on services.

COVID-19 conditions dampen output and demand into Q2

With slightly over two months until the Tokyo Olympics, Japan's latest surge in COVID-19 cases coupled with the state of emergency certainly had disappointing effects on both output and new business orders in May. Both gauges within the au Jibun Bank Japan Composite PMI have taken a turn for the worse. Notably, output fell at the sharpest rate since January, with services feeling the brunt of the renewed movement restrictions.

On the demand side, the decline in new orders was the fastest since February, although one may find it heartening to learn that international new business inflows continued for a fourth straight month. Domestic COVID-19 conditions therefore appear to be the key dampener of new orders, meaning the possibility of pent-up demand should not be ruled out in the event that the vaccine rollout picking up pace and assisting in the acceleration of the recovery for the Japanese economy. That said, for the time being, any risk of extension of the state of emergency may hit the PMI figures.

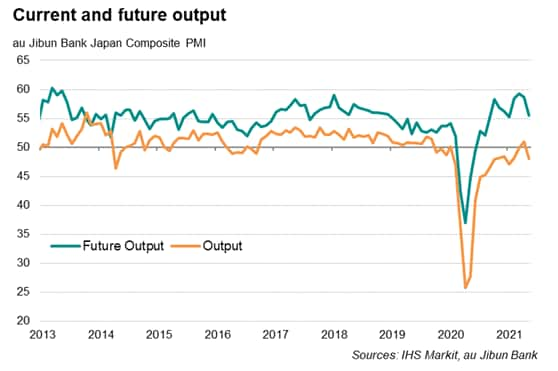

Japan firms maintain positive outlook despite COVID-19 disruption

As it stands, Japanese firms remain largely optimistic even though sentiment has been somewhat tempered by the latest COVID-19 restrictions. Firms continue to expect output to improve in the coming 12-months across both the manufacturing and service sectors, supported by the improvement in external conditions, including amongst Japan's top trading partners. At the same time, there appear to be hopes that the sluggish vaccine rollout situation could improve and help to accelerate the domestic recovery.

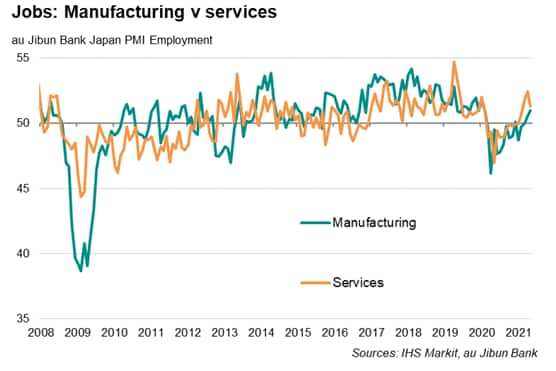

Employment indications also reflected this optimism among firms with the May survey seeing both manufacturing and service sectors continuing to add to payroll numbers during the month. Business owners have likely looked past the shorter-term impact of the COVID-19 resurgence. All said, however, the Japanese economy's recovery remains volatile, and it will be worth watching for whether the new covid wave may have peaked to find a steadier improvement in economic conditions, particularly for the service sector.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location