Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 21, 2023

By Jingyi Pan

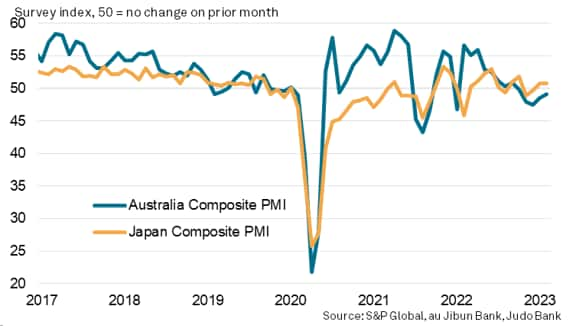

Japan and Australia saw private sector performances varying into February, whereby the flash composite PMI steadied in mild expansion territory in Japan while Australia's private sector output shrank at a shallower rate. However, a common theme cutting across these two APAC economies was the state of lacklustre demand in February.

While the lack of demand continues to bode well for price and supply chain developments midway into the first quarter, it does little to buoy sentiment, especially in Australia where business confidence sank to a near three-year low.

The latest Judo Bank Flash Australia Composite PMI, compiled by S&P Global, posted 49.2 in February, up from 48.5 in January. The reading was a four-month high, albeit remaining in contraction territory for a fifth consecutive month. The uptick in the PMI reading was supported by shallower declines across both the manufacturing and service sectors with services contracting at the slower rate of the two.

Overall, the indication from the Flash Composite PMI remains one of softening economic conditions midway into the first quarter for Australia, but the degree to which the private sector is slowing has eased markedly compared to end-2022.

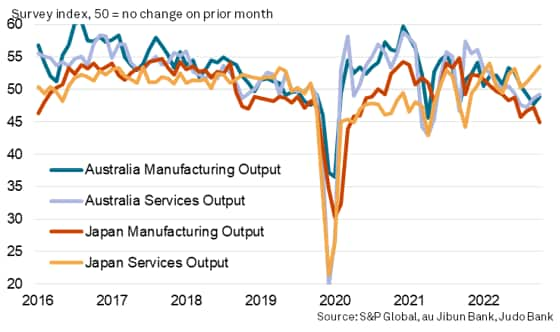

Meanwhile in Japan, the au Jibun Bank Flash Japan Composite PMI, also compiled by S&P Global, remained unchanged at 50.7 in February. However, diving deeper into the sector performance, one would find that the divergence in performance between manufacturing output and services activity further widened in the second month of 2023. Manufacturing output in Japan fell at the sharpest pace since July 2020 while services activity extended the current rebound to grow at the fastest rate in eight months.

While the manufacturing sector remained subjected to broader global macroeconomic influences, notably slower trade flows and destocking, Japan's service sector stayed a beneficiary of easing COVID-19 disruptions, thus continuing to experience a solid expansion in February.

Despite the varying themes across Japan and Australia, economies for which flash PMI data are available, the common theme shared by both economies has been one of falling demand in February. This has been an issue lingering from end-2022, carrying into the start of 2023 for various APAC economies.

New orders in Australia declined in February at the fastest rate since September 2021, underpinned by deteriorations in demand across both manufacturing and services. Over and above the weak macroeconomic conditions affecting demand, higher interest rates were frequently highlighted by survey respondents as reasons for the paring back of demand.

Meanwhile Japan's manufacturing new orders fell at the sharpest pace since July 2020. However, running above the manufacturing new orders index by almost 10 index points was the services new business index, which reflected a solid improvement in demand for services. To a large extent, this was driven by the post COVID-19 pent-up demand (including international demand) as new export orders growth accelerated.

The overall picture as signalled by the composite new orders indices (covering both manufacturing and services) nevertheless remained one of softening demand across the two APAC economies, and provides early hints of persistently subdued demand conditions likely for the rest of the APAC region in February.

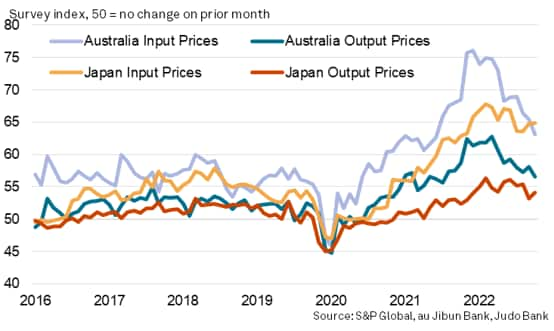

An expected side-effect of the easing demand is softening price pressures, but this was largely restricted to Australia in February. Although still elevated, both input cost and output price inflation declined to the lowest levels since November 2021 in Australia. Concurrently, manufacturing suppliers' delivery times lengthened at the least pronounced rate since at least May 2016 to indicate further signs of improving supply conditions.

Simultanously in Japan, lead times likewise lengthened at a slower rate. However, price pressures remained stubbornly high across the board, providing little reprieve especially for manufacturers shouldering the double whammy of weakening demand and rising costs.

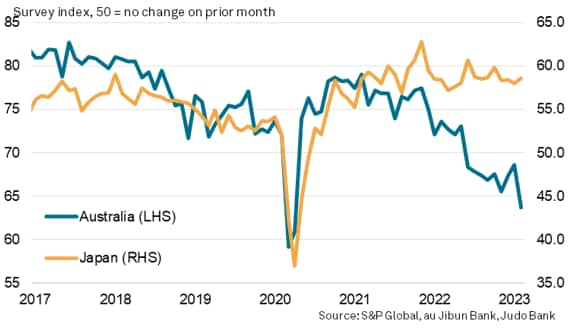

Finally, the only sentiment-based PMI sub-index, the Future Output Index, reflected subdued views with respect to anticipated business activity in the next 12-months across both Japan and Australia. Japan's flash composite PMI Future Output Index matched the 12-month average in February, showing little change in sentiment despite the better service sector performance enjoyed during the month, to hint that this upturn could prove short lived. Meanwhile, business confidence in Australia plunged to the lowest level since April 2020.

In line with the factors weighing on demand, business sentiment was affected by the macroeconomic outlook in both countries, in addition to the interest rate trajectory in Australia. Furthermore, despite the easing of restrictions in mainland China which buoyed sentiment earlier, the latest February data from Japan and Australia have showed limited signs of turnaround, especially from the manufacturing perspective, which does little to shore up better business confidence across these two APAC economies tracked.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location