Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Feb 18, 2021

Research Signals - February 2021

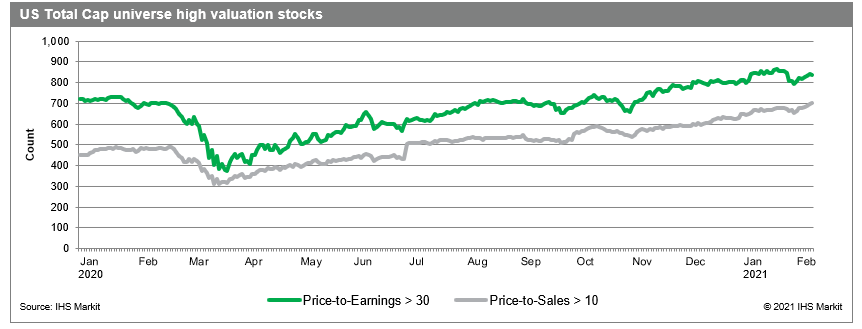

2021 started out as a relatively uneventful month of positive momentum in high risk shares, carried over from the end of last year, on optimistic vaccination and economic outlook. However, pressure built up in the final week of January in a battle between day traders and hedge funds, resulting in frenzied trading in GameStop and other heavily shorted stocks, with major indexes erasing their initial gains for the month. Yet, retail investors' uprise could not derail the bull market and stocks continued to make new highs in the early days of February. As the bull market rages on, we take a few snapshots of factor exposures to highlight current market attributes.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.