Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Dec, 2017 | 08:00

Highlights

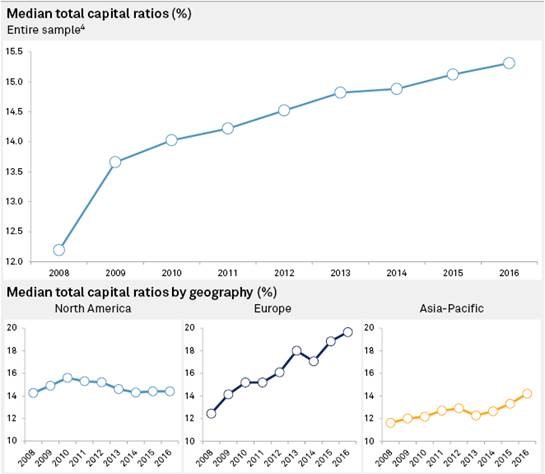

European banks have led global capital ratios higher in the decade since the financial crisis, as regulators raised the bar for minimum capital adequacy.

Compared to the global standard of 8% total capital, the median annual capital ratios of core European banks are significantly higher, data compiled by S&P Global Market Intelligence shows.

European banks have led global capital ratios higher in the decade since the financial crisis, as regulators raised the bar for minimum capital adequacy, and against the backdrop of growing legacy bad debt and a slow economic recovery.

Compared to the global standard of 8% total capital, the median annual capital ratios of core European banks are significantly higher, data compiled by S&P Global Market Intelligence shows. The ranking, which includes ratios of 83 of the world's largest banks, is headed by Dutch and Nordic lenders, which have large mortgage books that require proportionately higher levels of core capital.

Major Chinese banks, whose assets have tripled since 2008, show lower capital ratios than their European or American peers. During the post-crisis period, U.S. capital markets have continued to develop, allowing banks there to shift more assets off their balance sheets, while European banks remain challenged by high piles of bad loans.

The Bank for International Settlements gradually raised the percentage of common equity Tier 1 that capital banks have to hold against risk-weighted assets, after implementing the Basel III standard between 2010 and 2013. The final chapter of Basel III will stiffen capital measures further over the next five to 10 years, with lenders required to hold at least 72.5% of the capital against risky assets recommended by standard risk models.

Learn more about tools within the Market Intelligence platform used to conduct this analysis.