Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 17, 2022

Even though some supply chain tensions have eased recently, the risks are rising again. Some sectors and countries are more vulnerable due to materials and labor shortages and surging prices. The Russia Ukraine war will further exacerbate supply chain problems and will be further driving commodity prices. Sectors with long global value chains, high dependency on energy and metals supply will face highest headwinds, however, disruption of transportation and risks to global trade rebound will likely have broad-based implications for supply chains.

Delivery times and input price growth eased, but material and labor shortages are at the historical highs in the EU in industry, construction and services. According to the European Commission Business Survey more than 50% of industrial companies in the EU are facing such material and equipment shortage that they are limiting their production. Shortages of labor and materials have also risen significantly in construction. Moreover, the RussiaUkraine war will also affect transportation and supply of raw material, such as energy, food and metals, and have a negative impact on production and prices.

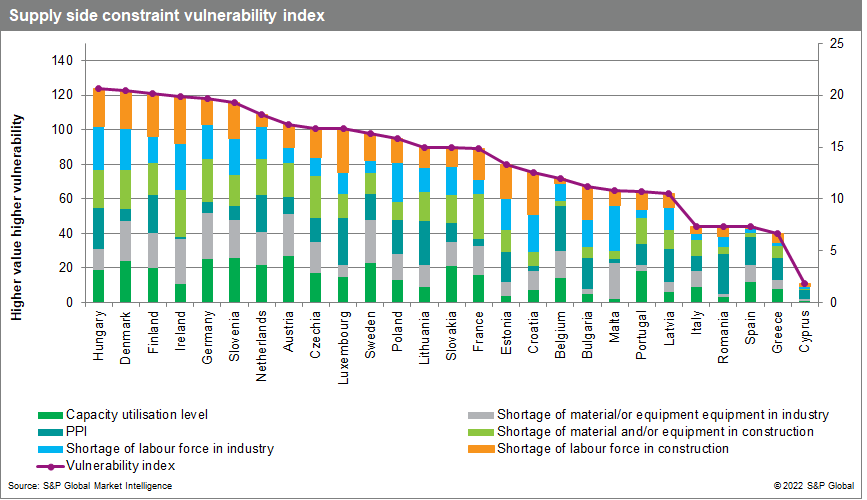

We have developed a supply side constraint vulnerability index that ranks countries in terms of their shortage of material and equipment, overall capacity utilization levels, labor shortages, and the strength of growth in producer prices. According to those metrics Hungary, Denmark, Finland Ireland and Germany are the most vulnerable countries to supply side constraints. Countries in South Europe and Romania are less affected.

Supply side constraint vulnerability index

The most strongly affected industries are manufacturing of motor vehicles, trailers, and semi-trailers; electrical equipment; machinery and equipment; and computer, electronic, and optical products as a majority of companies operating in those sectors are facing high shortages. Germany and France have the highest share of companies in those sectors reporting production-impeding shortages.

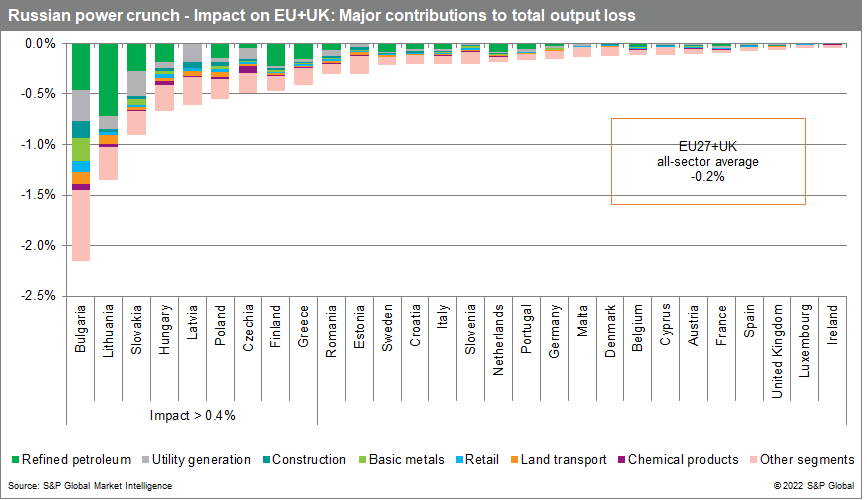

The Russia Ukraine war will further exacerbate supply chain disruptions through effect on the availability of transportation and prices of inputs. The Russian war with Ukraine has already resulted in soaring energy prices, and has affected the prices of metals and agricutural commodities, for which Russia and Ukraine are important players. Europe uses Russia as an input provider, especially in oil refining and power generation, transport services, basic metals and chemical industries.

Judging from input output tables data, industry in Emerging European economies is more dependent on oil and gas imports coming from Russia than other countries in the EU. A 40% shortfall in oil and gas import from Russia would result in highest output losses in Bulgaria, Lithuania and Slovakia. Bulgaria is most vulnerable due to its large basic metals sector as well as utility generation and refined petroleum sectors depending on imports from Russia.

Russian power crunch - Impact on EU+UK: Major contributions to total output loss

Rising prices and possibly lack of those commodities could distort not only energy supply, but also that of metals, which are important for the production in automotive sector, various machinery and equipment - sectors which also have one of the longest GVC's - semi-conductors and construction.

The shock for European businesses will naturally not only be on Russian input availability. Rising energy and other raw material prices, combined with higher labor costs, will put upward pressure on costs at large (through shipping, storage, electricity) and demand. This development is likely to limit the rebound of global trade and further aggravate the disruptions in global value chains.

Finally, transportation costs will be affected by sharp increase in fuel costs. The sanctions will result in delays due to intensified controls and longer routes due to boycott of Russian ports and closure of Russian airspace. The sector will also face labor force shortages as Ukraine and Russia account for 275 thousand of the world's 1.9 million seafarers. This, together with high fuel prices, is adding to rapidly rising costs, rising port congestion and reduced capacity.

Get more of the latest news on the Russia Ukraine war here.

Posted 17 March 2022 by Vaiva Seckute, Principal Economist, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.