Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Aug, 2016 | 16:00

Low-cost, well-diversified exchange-traded funds are increasingly being used by institutional investors, and insurance companies are no exception.

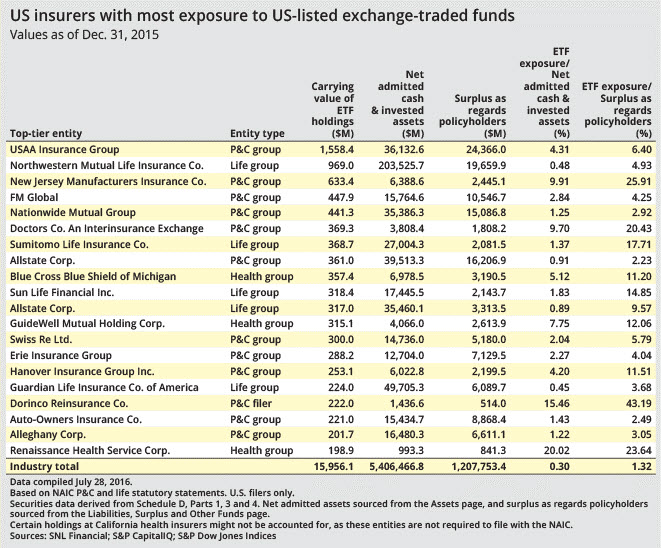

U.S. insurance companies owned $15.96 billion of ETFs in their general accounts at the end of 2015, up from $14.13 billion in 2014 and $12.97 billion in 2013, according to NAIC data gathered by S&P Global Market Intelligence. About 1.3% of policyholders' surplus is in these types of products.

While a rallying stock market likely helped boost carrying values last year, ETF usage has become more prevalent among insurers and is likely to increase given the number of low-cost, passive products that can support both broad and narrow investment strategies.

A recent analysis conducted by S&P Dow Jones Indices shows that ETF assets held by insurance companies more than doubled in the 10 years ended 2015. That growth is expected to continue. The report's authors forecast that, at current growth rates, ETF holdings by insurance companies would double again in five years. S&P Dow Jones Indices operates independently from S&P Global Market Intelligence.

Although life insurance companies have the most general account assets, property and casualty insurance companies have been the more frequent adopters of ETFs.

With a $1.56 billion carrying value in ETF assets, equal to 6.4% of its surplus, USAA Insurance Group was the insurance industry's leader in ETF holdings. Vanguard Group Inc.'s Short-Term Bond Index (BSV), BlackRock Inc.'s iShares Core MSCI EAFE Index (IEFA) and SSgA Funds Management Inc.'s SPDR S&P 500 (SPY) were the P&C insurer's largest positions. Assets were spread across 33 total positions, including smaller stakes in single-factor smart beta ETFs such as iShares Edge MSCI USA Quality Factor (QUAL) and iShares Edge MSCI Momentum (MTUM).

In contrast, Northwestern Mutual Life Insurance Co.'s $969 million in ETF assets, equal to 4.93% of its surplus, was in just three funds. SPY was the largest, but Northwestern also held iShares Core S&P 500 (IVV) and iShares MSCI EAFE Index (EFA).

New Jersey Manufacturers Insurance Co., a more moderately sized P&C company, had the third-most assets in ETFs at $633.4 million — equaling 25.91% of its surplus. Its largest holding was iShares S&P 500 (IVV), but it also held a number of sector-focused ETFs, such as Financial Select Sector SPDR (XLF). XLF holds S&P 500 financial constituents, including Berkshire Hathaway Inc., JPMorgan Chase & Co. and Wells Fargo & Co.

Other high adopters of ETFs, with more than 25% of their surplus as regards policyholders exposed to ETFs, included Dorinco Reinsurance Co. and Renaissance Health Service Corp.

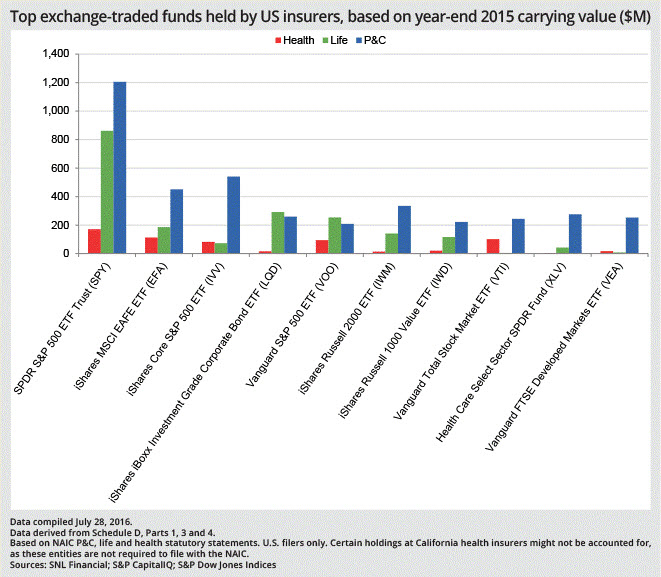

The 10 most commonly held products comprised over 40% of the industry's total investments in ETFs, though the usage of these ETFs was different upon review of P&C, life and health insurance.

P&C companies held more exposure to equity ETFs than life and health insurers. For example, 68.2% of the roughly $490 million held by insurers in iShares Russell 2000 (IWM), which invests in small-cap stocks, was held by property and casualty firms like Allstate Corp. and Doctors Co. An Interinsurance Exchange.

Another example is Vanguard FTSE Developed Markets (VEA), which invests in European and Japanese equities. P&C insurers like Hanover Insurance Group Inc. and USAA held 90.8% of the insurance industry's roughly $280 million worth of investments in the ETF.

Equity ETFs were also the most common among life insurers, but, at the same time, they held a larger proportion of their overall ETFs in fixed-income vehicles than P&C insurers did. Of the most popular ETFs, the iShares iBoxx Investment Grade Corporate Bond (LQD) was held more widely by the life industry, with over half of the $568.4 million coming from life companies, including Guggenheim Capital LLC and Lincoln National Corp.

In 2015, investors collectively put $242.2 billion of new money into U.S.-listed ETFs, according to etf.com. As of June 2016 the industry had $2.236 trillion in assets.