Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jul, 2016 | 15:00

Highlights

Nonperforming assets remain high in Spain and could seriously threaten bank capital when stressed.

Among the largest Spanish lenders, capital has generally strengthened in recent years, and nonperforming loans declined significantly.

Spain's banks are benefiting from an economic recovery, but the glare of imminent EU-wide stress test results could expose capital and asset quality problems.

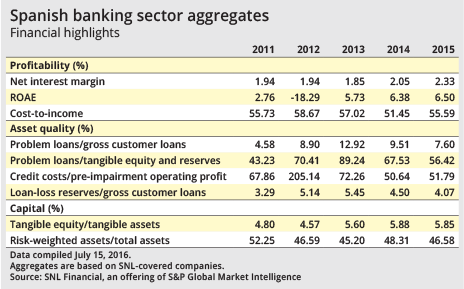

Figures from S&P Global Market Intelligence show that, among the largest Spanish lenders, capital has generally strengthened in recent years, and nonperforming loans declined significantly. The Spanish banking system reached a common equity Tier 1 ratio of 12.5% in 2015, up from 11.6% in 2014. Problem loans as a percentage of gross customer loans declined to 7.6% in 2015, down from a peak of 12.9% in 2013, and there is a clear trend of total NPLs falling at most large banks since 2013.

The general economic situation is good and appears sustainable for 2017, according to Bankia Bolsa bank analyst Javier Bernat, with GDP growing above 2%, implying employment growth.

"The outlook is much better than the last two or three years; property prices are rising by 2% and 3% year over year," he said in an interview. Commerzbank is predicting GDP growth of 2.9% in 2016 and 2.5% in 2017.

But profitability and returns are under pressure from muted loan demand, low interest rates and increasing competition. Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA posted net interest margins of 2.48% and 2.39%, respectively, for the first quarter, but the purely domestic Spanish banks are achieving less impressive figures of between 1% and 2%. CaixaBank SA, Bankia SA and Banco Popular Español SA reported figures of 1.36%, 1.21% and 1.58%. Bernat said he expected this to persist, and the net interest margin in Spain to decline, resulting in returns of between 7% and 9% for the international banks and about 5% for the domestic banks.

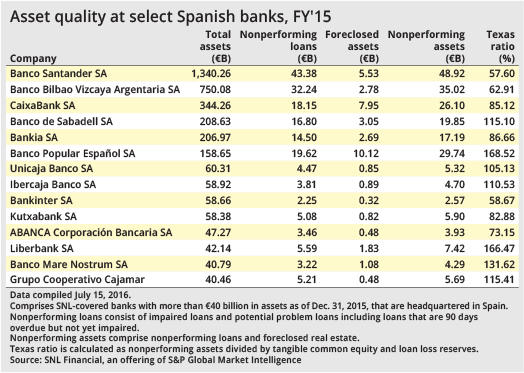

Further, the resilience of asset quality and capital in a downturn will be challenged by the European Banking Authority's stress test, the results of which are due to be released on July 29. The picture for foreclosed real estate is murky; the total has ticked up at Santander, BBVA, CaixaBank and Popular since 2013. And Texas ratios remain high — at several major lenders including Banco de Sabadell SA, which, along with those banks mentioned above, will also be stress-tested, NPLs still represented more than 100% of common equity plus reserves in 2015.

The stress test's adverse macroeconomic scenario implies a deviation of EU GDP from its baseline level by 3.1% in 2016, 6.3% in 2017 and 7.1% in 2018, as well as "a shock in residential and commercial real estate prices."

Asset quality already forced a €2.5 billion capital raise at Popular in May. It was the third in less than four years and represented around half of its market capitalization, as Citi analysts observed in a May 26 note. At the end of 2015, Popular had €19.6 billion in nonperforming loans and €10.1 billion in foreclosed real estate, equating to some €29.7 billion in nonperforming assets and resulting in a 169% Texas ratio. The new equity is intended to cut NPAs to below €20 billion in 2018.

This story first appeared on the SNL Financial platform, an offering of S&P Global Market Intelligence. You can continue reading here. The SNL Financial platform provides comprehensive news coverage, analytical tools, and data on over 50,000 banks across the globe.