Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 11, 2023

By Jingyi Pan

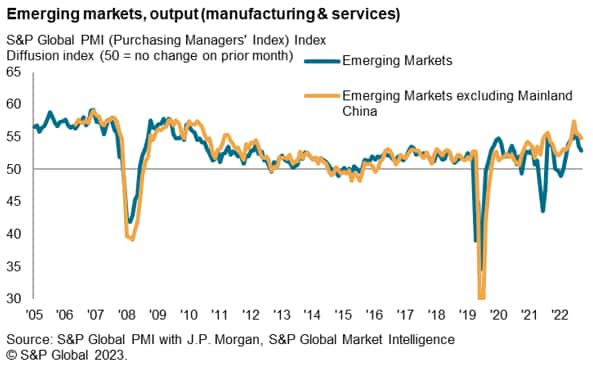

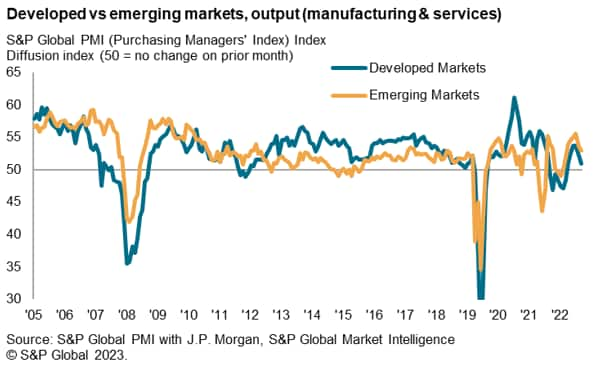

The slowdown in growth that had been more prominent in developed markets is now hitting emerging markets going into the second half of 2023. July's PMI data showed emerging markets expanding at the slowest pace in six months, supported chiefly by service sector growth as manufacturing output near-stalled. Rising borrowing costs, weakening trade conditions and inflation have weighed on global economic growth so far this year.

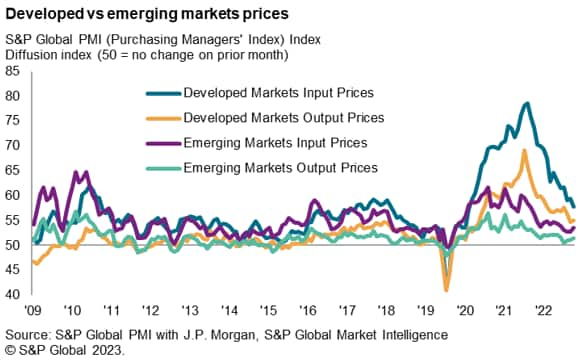

Meanwhile average input costs rose faster across emerging markets in July, leading to higher output price inflation. That said, both inflation gauges remained subdued by historical standards and will be worth watching as concerns heighten over signs of disinflation in various countries.

Overall, emerging markets continue to exhibit resilience in growth compared to their developed counterparts. Nevertheless, according to the PMI Future Expectations Indices, confidence has fallen in both regions over July.

The latest PMI data revealed that growth momentum across both developed and emerging markets has pared at the start of the second half of 2023. That said, while developed markets expanded at only a mild rate, and one that was the slowest in the ongoing six-month sequence, emerging markets continued to grow at an above-average pace in July.

Excluding mainland China, emerging markets output was found to be even more resilient, sustaining an above-average growth pace for a ninth straight month. To a large extent, expectations have centred on a revival in mainland China growth following the easing of pandemic restrictions at the end of 2022. While economic activity continued to expand through the first seven months of 2023 thus far in mainland China, it appears that growth momentum has notably waned.

A key cause of the ongoing slowdown in emerging market growth momentum has been a slump in export performance. A sharper decline in goods trade coupled with a slowing exchange of services resulted in the global trade downturn accelerating in July. Emerging markets likewise saw new export orders fall at the fastest pace so far this year.

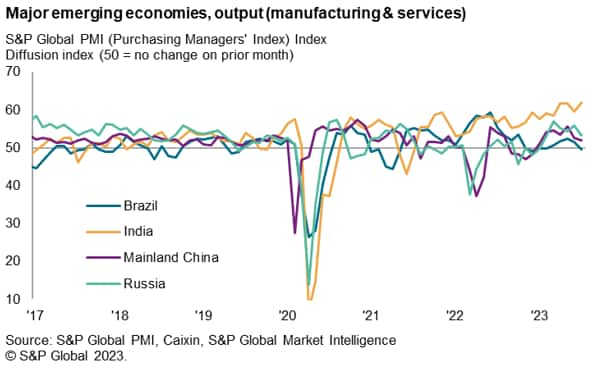

Observing the major emerging economies' performance in July, the clear outperformer was India where private sector output hit a 13-year high as indicated by the S&P Global India Composite PMI which posted 61.9 in July. This was supported by a faster upturn in services activity, although manufacturing output growth also remained strong by historical standards.

Comparatively, mainland China, Russia and Brazil all saw conditions deteriorate alongside the global economy, with Brazil sliding back into contraction after four straight months of growth. Demand weakness across both manufacturing and service sectors underpinned the latest change for Brazil, accompanied by a sharp fall in future expectations among private sector firms.

Meanwhile mainland China's weak start to the third quarter was attributed to a renewed downturn in the goods producing sector, though services activity also grew at a weaker pace compared to earlier in the year.

Price pressures across emerging markets remained historically subdued in July on the back of easing growth momentum. Despite input cost and output price inflation both ticking higher from June, they stayed below their respective averages. In contrast, developed markets, while keeping to a broad easing inflation trend, again recorded input cost and output price inflation above their long-run averages, which suggested that inflation pressures stayed elevated going into the second half of 2023.

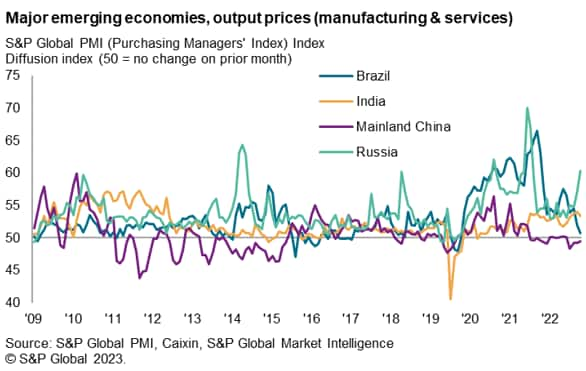

Muted inflation in emerging markets was linked to softer price increases across most of the major emerging economies. Russia was an exception, seeing markedly faster increases in input costs and output charges in July due to the depreciation of the Russian ruble against the US dollar, resulting in significantly higher import price inflation. However, India and Brazil saw selling price inflation fall, while firms in mainland China reported price deflation for a fourth consecutive month. The latest official CPI reading in China has trended in line with PMI indications, falling 0.3% year-on-year (y/y) in July, while producer prices have tracked that of the Caixin manufacturing input price gauge.

While the latest rise in emerging market price inflation may help to alleviate some concerns of disinflation becoming more widespread, the slowdown in economic growth does not bode well for developments on the price front. Furthermore, the Emerging Market PMI Future Output Index declined in July to an eight-month low, signalling falling optimism with regards to output in the coming 12 months among private sector firms in the region.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location