Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Dec, 2017 | 08:00

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

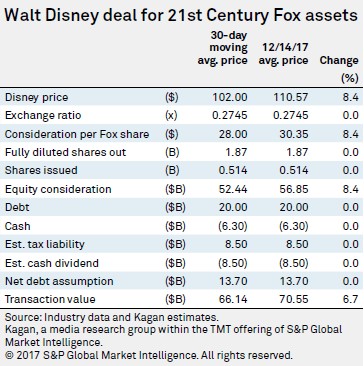

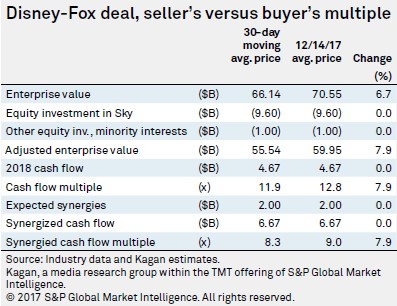

The increase in shares of Walt Disney Corp. has caused the deal price for the coveted 21st Century Fox assets to rise from $66.1 billion to $70.6 bil., and the multiple to go up almost a full turn from 11.9x to 12.8x cash flow.

It's rare that a stock rises significantly on news or rumors of a major acquisition, but media investors appeared to love the Dec. 14 news that Walt Disney Co. plans to buy some of the most coveted assets in the content world, including movie and TV studios, 22 regional sports networks, STAR India Pvt. Ltd., and a 39% stake in Sky plc from 21st Century Fox Inc. Prior to the close of the transaction, it is anticipated that 21st Century Fox will seek to complete its planned acquisition of the 61% of Sky it doesn't already own.

Shares in Walt Disney rose 2.9% Dec. 14 on news of the deal to close at $110.57, an 8.4% increase over the 30-day average used in the deal announcement, which put the deal at $52.44 billion in equity for a total of $66.14 billion including assumed debt.

If the Dec. 14 closing price were used rather than the 30-day average, the equity value of the deal would be worth $4.41 billion more, raising the deal price to $70.55 billion including debt.

With cash flow remaining the same, this raises the seller's multiple from 11.9x to 12.8x and the buyer's multiple from 8.3x to 9.0x. Of course, there is no telling what the actual average 30-day price will be, as this transaction is likely to make a long journey through the Department of Justice's review process.

In addition, there is some risk that the exchange ratio could change due to a final analysis on what the tax bill will be for Fox on this huge asset sale. Disney is footing the tax bill, but being reimbursed by a special dividend from Fox in a complex deal that will save taxes for Fox.

However, there is no question that both companies are being favored by investors after a long, volatile period where media stocks were being crushed and then would bounce back on various bits of news surrounding cord cutting, cord shaving, and the failure of the industry to adopt the new Nielsen Total Audience Measurement metric, which counts online viewing.

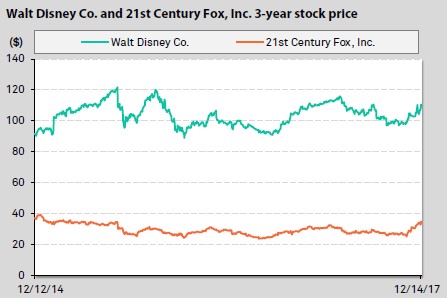

Both stocks are up quite a bit from the trading day before CNBC's David Faber first reported on rumors of a Disney-Fox deal. Shares in Fox are up 39.7% since Nov. 3, when they traded at $24.97 per share, and shares in Disney are up 13.0% from their closing price of $97.85 per share on the same date. Over the long run, things haven't been so rosy. Although Disney shares are up around 20% over the past three years, it has been a roller coaster ride, with the stock reaching as high as $122.08 intraday on Aug. 14, 2015, and dipping as low as $86.25 intraday on Feb. 10, 2016.

Shares in Fox are actually down slightly amidst quite a few up and down periods, including an intraday low of $22.66 on Feb. 9, 2016.

Kagan, a media research group within S&P Global Market Intelligence, thinks the year ahead will show plenty of volatility in both stocks on news regarding what the DOJ is focused on at any particular time. There is no question that this is a favorable transaction for both companies. The question is when, or if, it will close.