Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

WHITEPAPER — Mar 01, 2024

Following recent market volatility and regulatory changes, insurers must continuously develop and enhance their tools to manage derivatives. Continuous updating is crucial to maintain an optimal balance between capital and cost on their balance sheets.

Since 2016, when Solvency II entered into force in the European Union, the requirements have become increasingly important and stricter, impacting investment, risk and capital management functions. These new standards required insurers to fully embrace solvency-related metrics in all business processes, from data sourcing (i.e., asset valuations need to reference market data that is accurate, complete and appropriate data) to outsourcing (i.e., solutions provided by vendors need to comply with the general principles for the prudential regulation of insurers to ensure independence, accuracy and expertise).

Solvency II had a far-reaching impact. Largely inspired by the European regulation, several Asia Pacific markets transitioned to new solvency frameworks, including those in Australia, mainland China and Singapore. Other markets, including those in Hong Kong, Japan, Korea, Taiwan, Malaysia, New Zealand and Thailand, are still in the process of defining or improving their solvency requirements, with expected launch dates in the coming months[1]. In the United Kingdom, the insurance market is wondering how much the PRA and HMT[2] will diverge from the Solvency II regulations adopted before Brexit.

The rapid change of insurer regulatory solvency frameworks across the world has not been the only source of disruption in recent years. High volatility in the financial markets following the COVID-19 pandemic and the recent uncertainty around the macroeconomic environment greatly impacted own funds requirements and created new opportunities in the market thanks to the volatility spillover. Particularly in 2022, capital markets experienced changes that had not been seen for decades, with sharply rising interest rates and elevated levels of inflation resulting in a mixed set of impacts on derivatives in company balance sheets and capital requirements. These events had to be jointly handled on top of the complex LIBOR transition.

During the COVID-19 outbreak, market turbulence led to sudden liquidity needs. These needs were often triggered by using derivatives for hedging, capital optimization, asset and liability management (ALM) and strategic asset allocation (SAA), a widespread practice in the insurance market. Derivatives need to be appropriately valued and stressed, so access to high quality data is key.

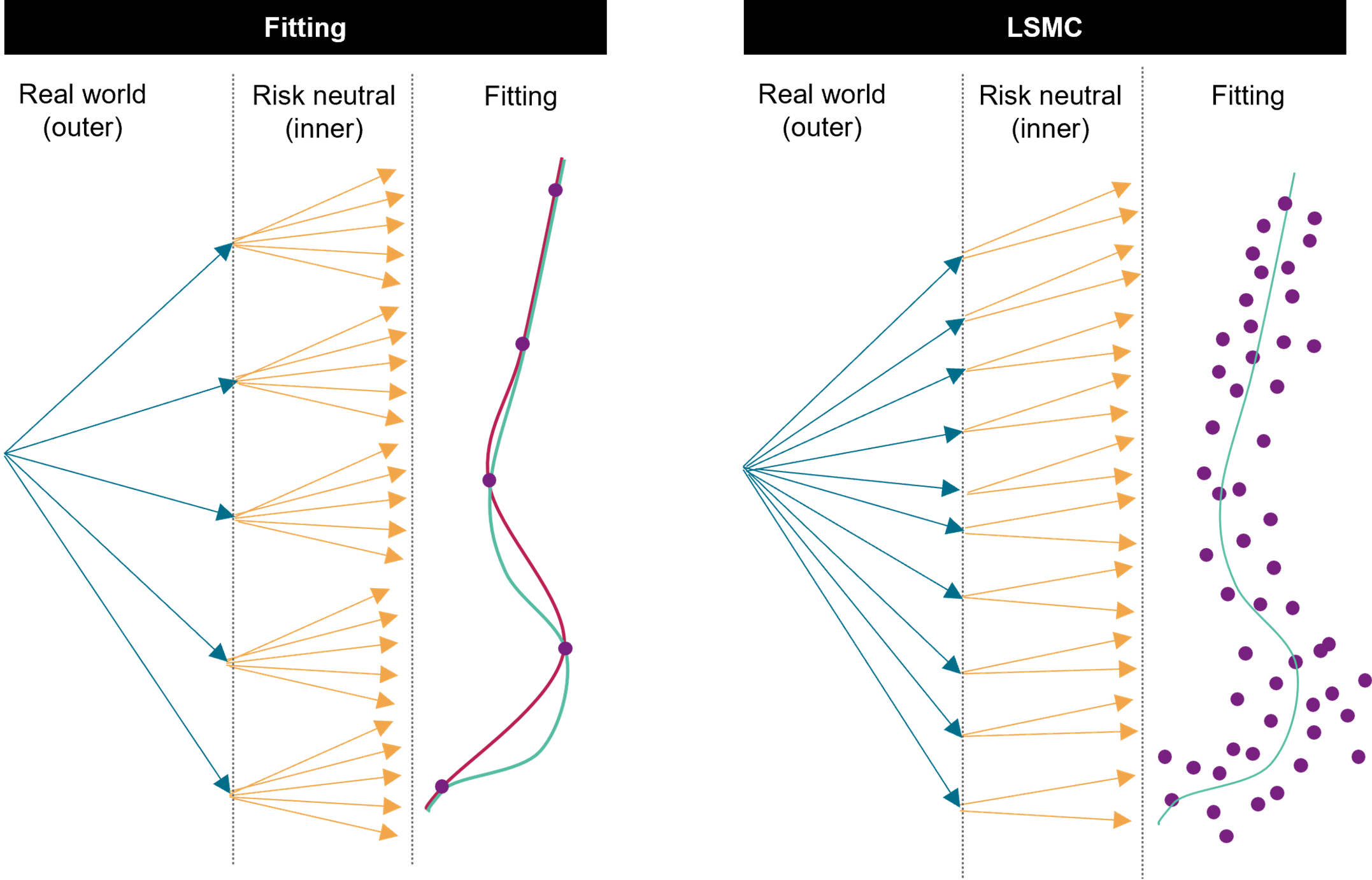

Graphical comparison of results based on fitting and Least Square Monte Carlo (LSMC) methods

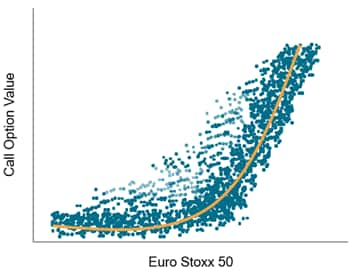

Relationship between the value of a European call option to the movement in the underlying Euro Stoxx 50 under multi risk factor scenarios

In this whitepaper, we discuss derivatives usage in the Solvency II context and share case studies for managing the relevant industry challenges.

Download full whitepaper

[1] In Asia, insurance regulations are reviewing existing risk-based capital (RBC) being effective in 2024 for Hong Kong, in 2025 for Japan, and in 2026 for Taiwan.

[2] After Brexit, HM Treasury (HMT) and the Prudential Regulation Authority (PRA) are currently adapting the Solvency II framework to the UK insurance market, tailoring the regime to the UK while maintaining robust standards for capital requirements.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.