All major US and European equity indices closed higher, while most APAC markets were lower. US and benchmark European government bonds closed sharply higher. CDX-NA and European iTraxx closed tighter across IG and high yield. Oil, gold, silver, and copper closed higher, the US dollar was flat, and natural gas was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed higher, with the Nasdaq +0.2% and S&P 500 +0.4% closing at new record highs again; Russell 2000 +1.4% and DJIA +0.6%.

- 10yr US govt bonds closed -13bps/1.45% yield and 30yr bonds -10bps/1.89% yield.

- IHS Markit Securities Finance data indicates that 24.7% of the issue value of the current on-the-run 10yr US government bond were on loan as of the 4 November close, which is near the highest level since the bond was issued in August.

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) rallied 5bps for 9-year and longer paper, with that same part of the curve 9-10bps better week-over-week.

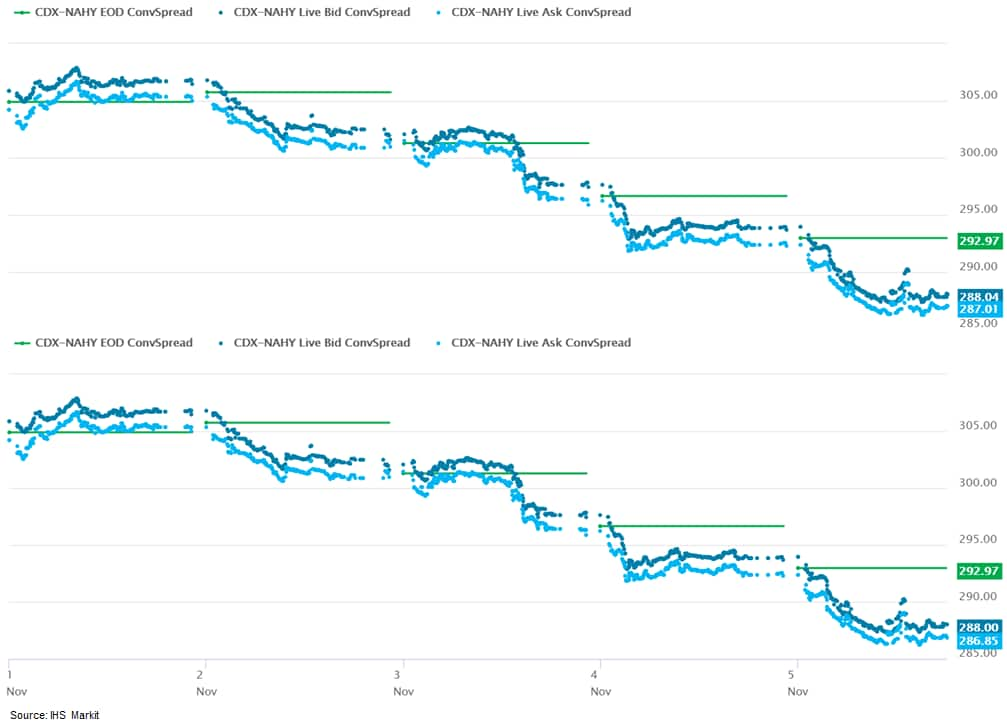

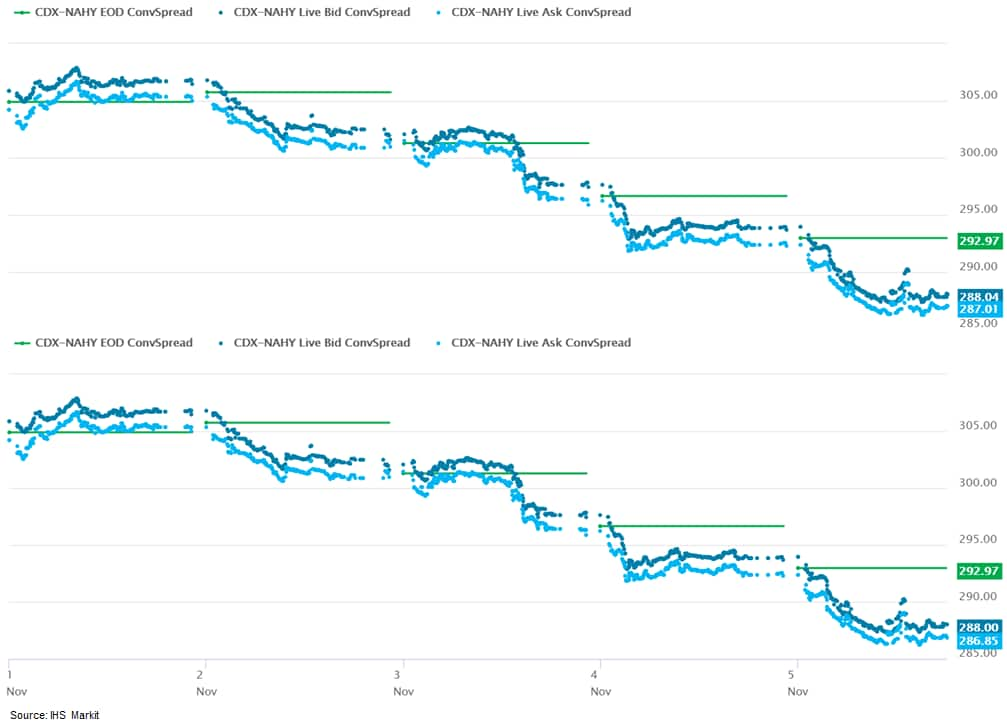

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -5bps/288bps, which is -3bps and -17bps week-over-week, respectively.

- DXY US dollar index closed flat/94.32.

- Gold closed +1.3%/$1,817 per troy oz, silver +1.0%/$24.16 per troy oz, and copper +0.5%/$4.34 per pound.

- Crude oil closed +3.1%/$81.27 per barrel and natural gas closed -3.4%/$5.63 per mmbtu.

- Pfizer Inc. said a preliminary look at study results found that its experimental pill was highly effective at preventing people at high risk of severe COVID-19 from needing hospitalization or dying, the latest encouraging performance for an early virus treatment. The company's drug cut the risk of hospitalization or death in study subjects with mild to moderate Covid-19 by about 89% if they took the pill within three days of diagnosis, Pfizer said Friday. The drug, called Paxlovid, was also found to be generally safe and well-tolerated in the early look at ongoing study results, the company said. (WSJ)

- US nonfarm payroll employment rose 531,000 in October, beating expectations, and the unemployment rate declined 0.2 percentage point to 4.6%. Combined with upward revisions to payroll gains for prior months, these developments reveal a labor market on a solid footing heading into the fourth quarter. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The gain in overall payroll employment was more than accounted for by a 604,000 increase in private payrolls. Notable gains there included leisure and hospitality (164,000), professional and business services (100,000), manufacturing (60,000), and transportation and warehousing (54,000).

- The latter two industries have been boosted by elevated demand for goods, as the composition of consumer spending remains more heavily tilted toward goods (and away from services) than pre-pandemic norms.

- The recovery in payroll employment has come a long way, but the count of jobs still remains 4.2 million below the February 2020 level.

- This is not for a lack of trying on the part of business. As of August, there were considerably more job openings than job seekers (in the labor force and unemployed), and the labor-force participation rate has barely budged since spring. At some point, continued robust job growth will likely require a rising labor-force participation rate.

- Elsewhere in this morning's report, average hourly earnings rose 0.4%, while the average workweek slipped 0.1 hour to 34.7 hours. Combined with the robust gain in private payrolls, these indicators set up private wage and salary income for solid annualized growth of roughly 8% in the fourth quarter.

- Outstanding US nonmortgage consumer credit rose $29.9 billion to $4.37 trillion in September, nearly twice as fast as in July and August but slower than in June. (IHS Markit Economist Mike Montgomery)

- The 12-month change in outstanding consumer credit was 4.9%, above the change in August, but most of that reflects 2020 moves.

- Revolving credit rose $9.8 billion, a far smaller rise than June's $17.9 billion; revolving credit has risen 2.7% over the past 12 months, far below the 10.9% rise in personal consumption expenditures or the 5.4% rise in the CPI.

- The ratio of nonmortgage consumer credit to disposable personal income was 24.4%, but erratic stimulus measures make single-month ratios of little use.

- Consumers used stimulus payments to pay down (or off) debt last year and in January 2021. Revolving debt gains surged in May and June to very high levels, but greater caution seems to have since reemerged on average.

- Although shiny, new Teslas and Ford Mustangs get most of the attention in the shift away from the internal combustion engine (ICE), US auto and power industry members, politicians, and industry analysts said that there's much more to the EV equation. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- Infrastructure, product supply chains, workforce development, consumer education, and affordability all must factor into the mix—and it's up to industry and government to work together to bring the future to reality, they said 3 November during the two-day Auto Innovation Summit by the Alliance for Automotive Innovation, the largest auto trade group in the US.

- The Biden administration gave a positive jolt to the EV industry with the announcement in August of a goal that 40-50% of new light-duty vehicle sales in the US in 2030 will be zero-emission. "It was almost a transformative moment, when the president, the United Auto Workers, leaders of three automakers [Ford, GM, and Stellantis], and enviros all stood together with the same agreed-upon goal," said US Senator Debbie Dingell (Democrat, Michigan). Biden also pledged that the federal government will help to install 500,000 EVs chargers nationwide by 2030.

- Dingell said that the storms and record heat of the last two years have focused attention on climate change like never before. Given that vehicle transportation accounts for about 29% of annual US GHG emissions, "autos are right back at the center of the discussion ... on what could replace the internal combustion engine. There's never been a more critical time to invest in the auto industry and to explore policies to support the industry and its workers."

- A new analysis published by the Florida Department of Citrus (FDOC) projects that the estimated total supply of orange juice on the world market will decrease for the 2021-22 Florida season, by 15.5% over the previous period. This represents a drop from 1.77 billion single-strength equivalent (SSE) gallons to 1.49 billion SSE gallons due to reduced availability in production from leading suppliers, such as Brazil, Mexico, and the US. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Florida production represents 15.7% of world orange juice supply this season.

- Florida's processed orange utilization is estimated at 44.25 million boxes (40.8 kg) in 2021-22, a decrease of 10.6% over last season's utilization of 49.47 million boxes, according to the latest Florida citrus outlook for the 2021-22 season.

- The share of Florida round orange boxes directly utilized for single-strength orange juice (SSOJ), which is used to make not-from-concentrate (NFC) orange juice, is estimated at 39.82 million boxes (or 90.0% of total processed utilization) in the 2021-22 season. This represents a decrease of 3.84 million boxes from last season, according to the outlook authored by Marisa Zansler from the FDOC.

- The quantity of Florida orange boxes utilized in 2021-22 to produce FCOJ is estimated at 4.42 million boxes, a decrease of 1.39 million boxes over last season's utilization of 5.81 million boxes. Certified fresh orange shipments in 2021-22 are estimated at 2.55 million boxes, down 16.2% from the 3.05 million boxes shipped last season.

- The processing forecast is based on the latest USDA production forecast for the 2021-22 Florida round orange crop that predicts a total production of 47 million boxes in the state, a decline of 11% y/y, from last season's crop of 52.8 million boxes.

- According to the USDA forecast, California is expected to produce 43.5 million boxes (36.3 kg) of oranges in 2021-22, a decrease of 20.2% over the previous season. As many as 9.9 million boxes are estimated to be processed into juice based on previous utilization rates.

- General Motors (GM)-backed autonomous vehicle (AV) unit Cruise has launched a fully driverless robotaxi service in San Francisco (California, US). Employees of Cruise and certain members of the public will be initially offered the ride in AVs that operate without a human driver behind the wheel, reports TechCrunch. According to the report, Cruise co-founder, CTO and president Kyle Vogt was the first to ride the driverless AV. Cruise has announced deals to offer rides in Dubai in 2023 and with Honda to test AVs in Japan. (IHS Markit Automotive Mobility Surabhi Rajpal)

- Autonomous truck startup TuSimple, in collaboration with UPS, is mapping new freight lanes in southern states of the United States. TuSimple's autonomous trucks will operate on new routes between Arizona and Florida, reports Reuters. TuSimple said that since 2019 it had logged 160,000 miles transporting freight for UPS's North America Air Freight (NAAF) division. It has achieved 13% fuel savings at speeds between 55 and 68 miles per hour. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry and its trucks run out of facilities in Arizona and Texas (United States), China, Japan, and Europe. TuSimple, in partnership with Navistar, is developing Level 4 autonomous trucks and has received 6,775 reservations for these vehicles, with manufacturing scheduled to start in 2024. (IHS Markit Automotive Mobility Surabhi Rajpal)

- Dominion Energy has awarded DEME Offshore US a USD1.9 billion balance-of-plant (BOP) contract for the Coastal Virginia Offshore Wind (CVOW) project. The BOP contract will be executed in consortium with Prysmian, which will supply the project's cables. DEME's share of the total award is estimated to be worth USD1.1 billion. The company's scope includes the transport and installation of 176 monopile foundations with transition pieces, three offshore substations, scour protection, and the supply and installation of export and inter-array submarine cable systems. DEME will oversee the complete offshore installation works for the foundations, substations, infield cables, as well as part of the export cables. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- DEME Offshore US intends to source the project's installation vessel internally, from DEME Offshore. According to the company, the CVOW agreement is the largest offshore wind installation contract ever awarded for the US market. Upon expected completion in 2026, the project will be the largest wind farm in the North American market.

- DEME has been building up its presence in the U.S. market and established DEME Offshore US LLC in Boston, Massachusetts, in 2019. The CVOW announcement follows two earlier North American contract awards: for Vineyard Wind 1 off the coast of Massachusetts, and for South Fork wind farm off the coast of Long Island, New York. DEME is aiming to complete these two projects in 2023.

- The 2.6 GW CVOW project is located at approximately 27 miles (43 km) off the coast of Virginia Beach, Virginia, USA. It is expected to play a crucial role in helping Virginia meet its goal of becoming carbon neutral by 2045, and is estimated to be capable of supplying energy to as many as 660,000 households, while reducing carbon emissions by over 2 million tons per year.

- Canada's Ivey Purchasing Managers' Index (PMI) fell a sharp 11.1 points to 59.3. Supply chain issues were further highlighted by the report, as suppliers' delivery delays significantly worsened in the month. Similarly, the IHS Markit manufacturing PMI® inched up, but the suppliers' delivery times index fell to a record low. (IHS Markit Economist Chul-Woo Hong)

- While the Canadian Federation of Independent Business (CFIB) Business Barometer rebounded in October, the manufacturing sector's optimism decreased further, likely reflecting supply chain bottlenecks, especially within the auto sector. The intensifying supply chain risks limit overall economic expansion, but real GDP growth is expected to accelerate in the fourth quarter given the modest improvement on balance from business indicators.

- The largest mover was the supplier deliveries index, which plunged 9.0 points to the lowest level since the beginning of the pandemic.

- The employment and inventories indexes further decreased, while the price index jumped for the second consecutive month to a record high 84.6.

- Supply chain issues will continue to weigh on economic growth in the short term.

- Canada's October net employment gain of 31,200 was well below increases in previous months, but it was double IHS Markit analysts' expectations. When combined with the first decline in the labor force in five months, the jobless rate slipped another 0.2 percentage point to 6.7%. (IHS Markit Economist Arlene Kish)

- All the job creation was in the private sector as the number of self-employed workers retreated by 38,200 and there was no change in public sector workers. There was a small pullback in goods-producing industry employment as well as part-time employment.

- The labor force participation rate edged 0.2 percentage point lower to 65.3%. Within the broad age cohort categories, employment among workers 55 years and older was down the most at 18,800.

- Canada was able to hold on to pre-pandemic employment levels in October. Employment policies put some downside risk to the near-term outlook. Yet the gain in hours worked point to decent output gains for the start of the fourth quarter.

- Employment was down in 9 out of 16 industries. The largest losses were in accommodation and food services; business, building, and other support services; and professional, scientific, and technical services. The only notable increase was in trade, advancing 80,500, with the bulk of the gain going to retail trade. Thus, labor shortages seem not to be so bad in this industry.

- Canada's September merchandise trade balance registered a surplus of $1.9 billion. August's surplus was revised from $1.9 billion to $1.5 billion, owing to stronger imports and weaker exports. Nominal exports fell 2.3% month on month (m/m) to $53.0 billion, while imports declined a further 3.0% m/m to $51.1 billion. (IHS Markit Economist Evan Andrade)

- Trade performance was worse in volume terms, as exports were down 3.9% m/m and imports fell a further 4.3% m/m.

- Third-quarter real exports rose 9.6% quarter on quarter at an annualized rate (q/q) and real imports fell 7.0% q/q.

- Although September marked the fourth consecutive merchandise trade surplus, the widening of the surplus was achieved by poor import performance. The reduced automotive trade flows in August, because of the ongoing semiconductor shortage, greatly intensified in September. Motor vehicle and parts exports plummeted 17.9% m/m while imports decreased 13.6% m/m. Excluding these trade flows, nominal exports and imports would have fallen 0.5% m/m and 1.3% m/m, respectively.

- The Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) on 4 November temporarily changed the regulations detailing the minimum net foreign-exchange position ratio. Banks will need to maintain this ratio at the same levels as the lowest between the average daily ratios during October 2021 or the ratio displayed in 4 November. This regulation is intended to last until the end of the month and was instituted to limit demand for dollars in the financial sector. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- So far, banks' holding of dollars is relatively high, making this movement relatively inconsequential if only kept through November. The net foreign-exchange position was instituted to limit the exposure of financial institutions to foreign-exchange fluctuations. Owing to Argentina's historical context, banks have typically remained in a positive position, reducing direct exposures to a depreciation of the local currency.

- However, this action was primarily triggered as a de-facto capital control aimed at stopping the drain of dollars in the country. IHS Markit forecasts that capital controls will continue until at least 2023, increasing the probability of these measures being rolled over or reintroduced after the end of November.

- In turn, this would both reduce the holding of dollarized securities and depress the already declining pace of dollarized credit. These are a significant hedge against the weak monetary situation that the country currently has. Going forward, the relatively low levels of foreign-exchange reserves at the BCRA threaten the reserve requirements for dollar deposits placed at the central bank, tightening the sector's foreign-exchange liquidity.

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain/Italy +1.0%, France +0.8%, UK +0.3%, and Germany +0.2%.

- 10yr European govt bonds closed sharply higher; UK -10bps, Italy -6bps, and Germany/France/Spain -5bps.

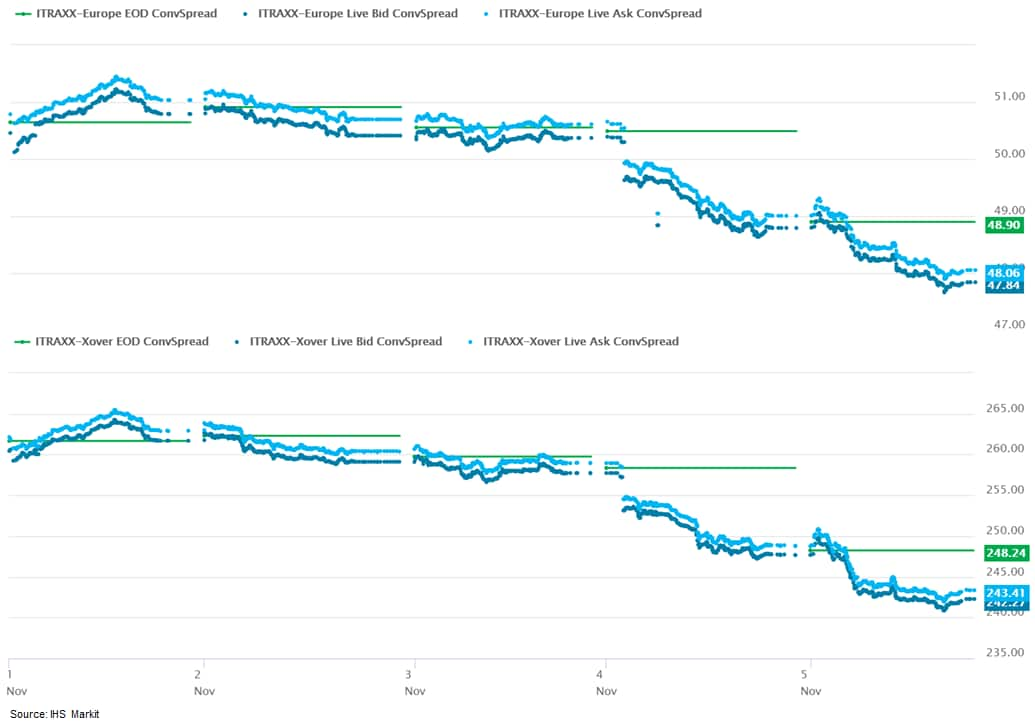

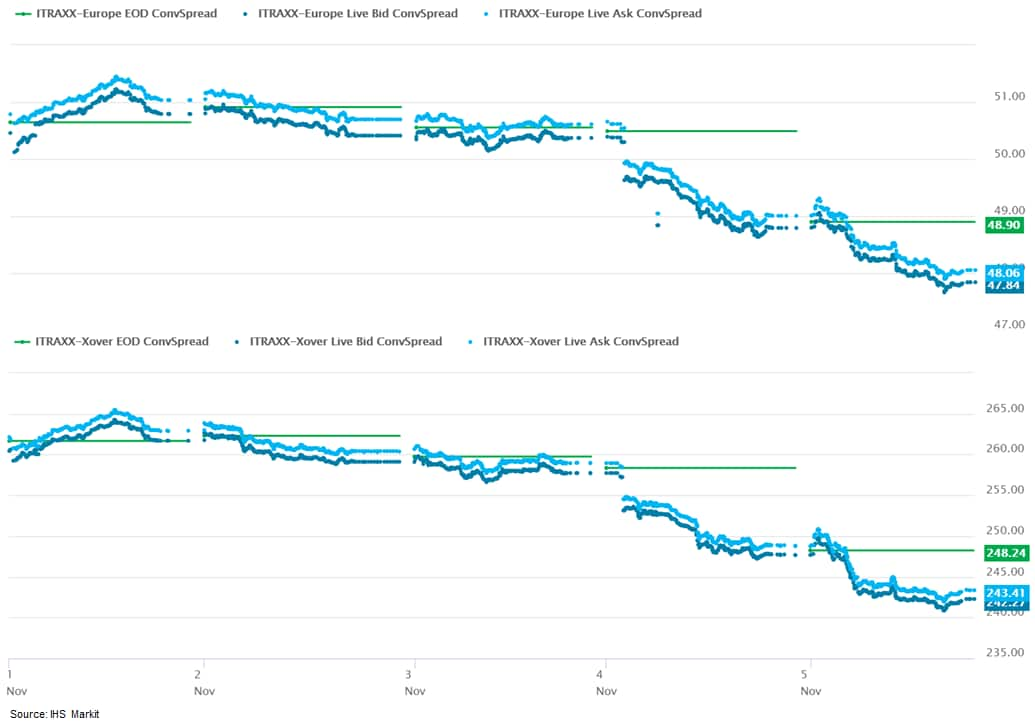

- iTraxx-Europe closed -1bp/48bps and iTraxx-Xover -5bps/243bps, which is -3bps and -19bps week-over-week, respectively.

- Brent crude closed +2.7%/$82.74 per barrel.

- The UK's Monetary Policy Committee (MPC) voted 7-2 to maintain the Bank of England's (BoE) Bank Rate at 0.1% at its meeting that ended on 3 November. The dissenting voices were deputy governor Dave Ramsden and Michael Saunders, who voted to increase the Bank Rate by 15 basis points to 0.25%. They were the first members of the MPC to vote for an interest-rate rise since August 2018. (IHS Markit Economist Raj Badiani)

- The MPC voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- Meanwhile, the MPC voted 6-3 in favor of the BoE continuing with its existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these purchases at GBP875 billion to be achieved by end-2021. The existing program of GBP150 billion of UK government bond purchases started in January 2021 and is close to completion.

- Three members (Catherine L. Mann, Dave Ramsden, and Michael Saunders) voted to reduce the target for the stock of UK government bond purchases from GBP875 billion to GDP855 billion.

- As of 2 November 2021, the total stock of assets held in the Asset Purchase Facility had reached GBP871 billion, including GBP127 billion of the GBP150-billion program of UK government bond purchases announced on 5 November 2020.

- In its November update, the BoE expects its policy rate to rise from the current 0.1% to 0.2% by the end of 2021 and to 1.0% (from 0.3% in the August update) in the final quarter of 2022, based on the market path for interest rates.

- EU lamb prices have pushed back up towards the record-high levels recorded in the spring of this year, as purchasers continue to fret about availability of supplies. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Throughout of lambs at EU abattoirs remains at below-average levels, while imports of sheepmeat from the UK are still constrained by border checks and other paperwork.

- Meanwhile, supplies from New Zealand are still tracking some 17% below the levels of last year, primarily because of very high transport costs and constrained availability of containers.

- This is all adding up into an EU benchmark price which looks poised to break through the EUR700 per 100kg barrier for what would be only the second time.

- In the week ending 31 October, the EU average price for heavy lambs was EUR693.04 per 100kg, up by 1.1% on the previous week.

- Prices have risen especially sharply in Germany - up by 3.9% week-on-week to EUR780.82 per 100lkg - and also in Spain, where the reference price has now risen by 11% over the past five weeks.

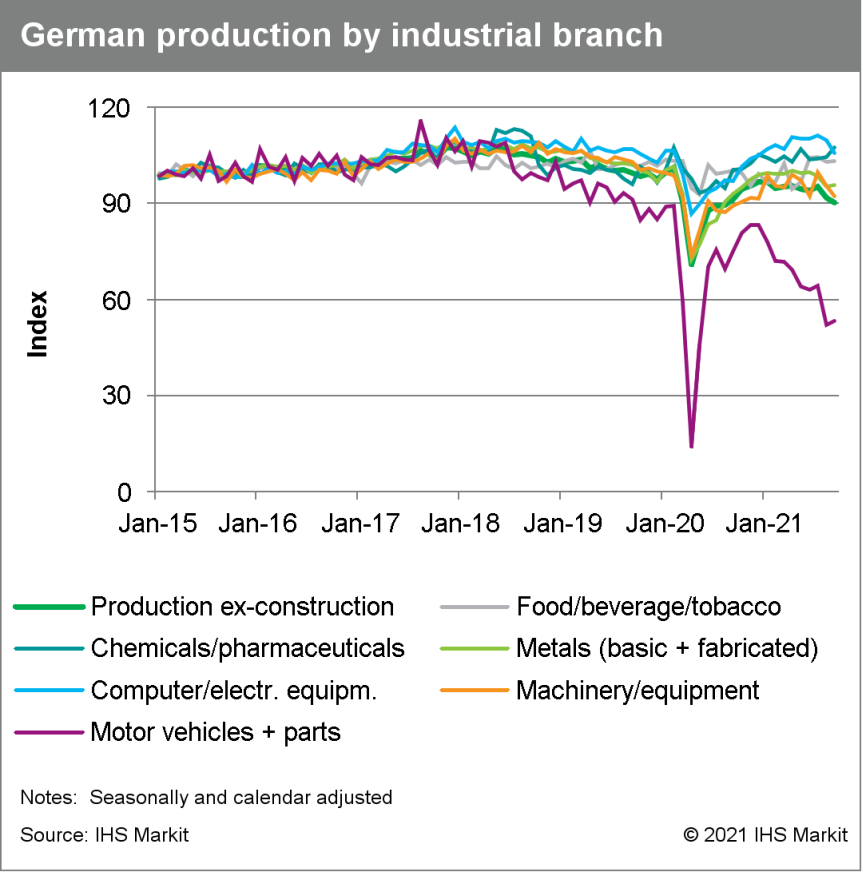

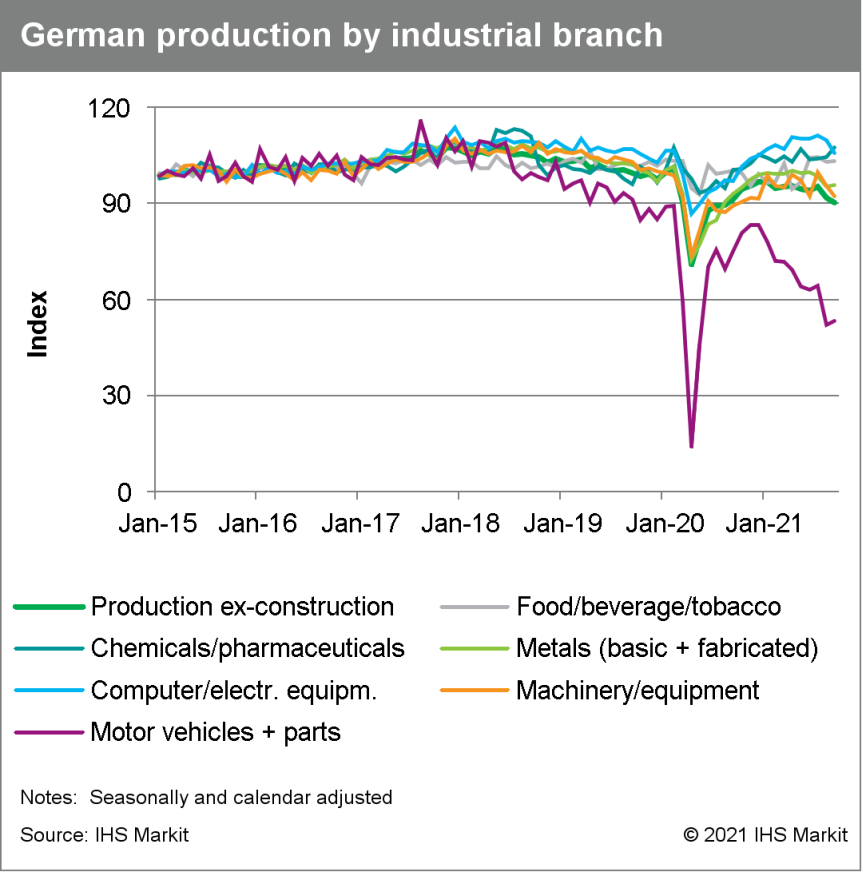

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 1.4% month on month (m/m) in September, extending a 3.7% m/m setback in August. Thus, the latest output level remains almost 11% below its February 2020 pre-pandemic high. (IHS Markit Economist Timo Klein)

- Total production including construction (see table below for a breakdown of recent history) was a little firmer, falling 1.1% m/m in September to a level that was 9.5% below that of February 2020. This owed to construction output increasing by 1.1% m/m in September and generally having held up much better than manufacturing throughout the pandemic. Meanwhile, energy output rebounded during August and September after a major decline in the May-July period.

- The split by type of good (see table below) reveals that the investment goods sector, which had already suffered a major setback in August, extended its decline in September. Intermediate goods production declined for the fourth consecutive month, but not to the same extent as investment goods. In contrast, consumer goods output was broadly flat in September and maintained an upward tendency when compared with levels at the start of 2021. This was enabled by the loosening of coronavirus disease 2019 (COVID-19)-related restrictions since May.

- The September breakdown by industrial branch reveals diverging developments. Motor vehicle production at least stabilized (up 2.1% m/m) following a huge drop in August (-18.9%). Nevertheless, output in this sector remains some 40% below pre-pandemic levels, linked primarily to the shortage of semiconductors that turned into a severe bottleneck once manufacturers ran out of stocks accumulated in early 2021. The other main sector posting higher output in September was chemicals/pharmaceuticals, which increased by 2.9% m/m, its fourth increase in the past five months. In contrast, output in the food/beverages/tobacco and metal sectors was broadly flat in September (both up 0.3% m/m), and production in the machinery and equipment and electronic and electric equipment sectors declined anew by 3.3% and 3.7% m/m, respectively.

- French industrial production declined by 1.3% month on month (m/m) in September, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Production had increased by 1.0% m/m and 0.5% m/m in August and July, respectively. (IHS Markit Economist Diego Iscaro)

- Industrial output rose by 2.8% year on year (y/y) in September. However, it was still 5.2% below its level right before the pandemic in February 2020.

- Transport equipment continued to be a major drag on overall industrial production, falling by 8.4% m/m. The sector has been particularly hit by the shortages of semiconductors and global supply-chain disruptions.

- Within transport equipment, production of motor vehicles fell by 14.6% m/m (following a rise of 11.8% m/m in August and a fall of 30.3% m/m in July). Production of motor vehicles remained around 35% below its level in February 2020.

- The breakdown by main industrial grouping shows falls in all categories in September. Production of capital and consumer durables fell particularly sharply (-3.1% m/m and -2.4% m/m, respectively), while production of non-durables (-0.5% m/m) and intermediate goods declined at a more moderate pace.

- Energy production fell by 0.8% m/m, following rises of 0.9% m/m and 1.2% m/m during the previous two months.

- Swedish freight tech company Einride has expanded its operations in the US market, according to a company statement. To achieve this, the company has signed on technical partners Ericsson and Siemens, as well as its first customers, Bridgestone and GE Appliances. Along with the US launch of its autonomous transport vehicles, Einride is introducing a new range of products, including an intelligent operating system called "Einride Saga" to support the movement of freight. Shippers can use Einride Saga to order and track shipments, oversee routes and visualize fleet data. Einride also said it has hired its first remote truck driver based in the US, who can monitor the autonomous trucks in situations that require human interaction. Robert Falck, founder and CEO of Einride, said, "The U.S. freight market is one of the most competitive and to be an industry leader you need to play in this league. We have the technology and solution to bring the biggest change in the freight industry since the adoption of the diesel truck 100 years ago." Autonomous freight transportation is an attractive option for one of many potential autonomous vehicle business use cases; the expectation is that, eventually, being able to eliminate the cost of a human driver could make transportation services far more affordable for both the merchant and the consumer. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Turkish Industry and Technology Minister Mustafa Varank has announced that Turkey's Automobile Joint Venture Group Inc (Türkiye'nin Otomobili Girişim Grubu: TOGG) and China's Farasis are to begin electric vehicle (EV) battery production soon, reports the Daily Sabah. The minister said, "We have made serious progress regarding the production of batteries, which are the heart of electric vehicles, in Turkey. TOGG and global giant Farasis will start their 20 GW battery investment in Gemlik soon." According to the news source, TOGG and Chinese EV battery-maker Farasis are to manufacture the batteries in Gemlik district in the northwestern province of Bursa. In October 2021, TOGG announced the signing of a letter of intent to partner with Chinese-based lithium-ion battery-producing company Farasis Energy Inc to use the supplier's battery cells in TOGG's product range. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Most major APAC equity indices closed lower except for Australia +0.4%; South Korea -0.5%, Japan -0.6%, Mainland China -1.0%, and Hong Kong -1.4%.

- Geely Auto Group has revealed its vision for the next five years with nine ambitious initiatives under its "Smart Geely 2025 Strategy". The initiatives include full-stack in-house development of autonomous vehicle (AV) technologies, CNY150 billion (USD23.4 billion) of investment in research and development (R&D), and launching over 25 new smart vehicle models in the next five years. The automaker aims to achieve global sales of 3.65 million units, with overseas sales of 600,000 units, by 2025. Geely also aims to reduce its carbon emissions by 25% in the next five years, realize a 100% full-scenario digital value chain, achieve an EBIT margin of over 8%, and assign 350 million shares to the first batch of 10,000 employees, reports Gasgoo. This development coincides with Geely launching global powertrain brand Leishen Power and a new modular intelligent hybrid powertrain platform, Leishen Hi-X. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese autonomous vehicle (AV) startup Momenta has raised USD500 million in a Series C funding round, reports TechCrunch. This brings the company's total Series C financing to more than USD1 billion. Investors involved in this round included SAIC Motor, General Motors, Toyota Motor, Mercedes-Benz, and Bosch, as well as investment institutions such as Temasek and Yunfeng Capital. Momenta uses cameras, GPS, and inertial measurement units (IMUs) to generate HD maps by integrating technologies such as deep-learning-based perception and simultaneous localization and mapping (SLAM). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mainland Chinese wind turbine manufacturer Dongfang Electric has unveiled a 13 MW permanent magnet direct drive offshore wind turbine design. The design is based on its 10 MW direct drive platform and has received a design authentication certificate from China's General Certification and National Energy Key Laboratory for Wind and Solar Simulation. The turbine will have an installed capacity of 12.5 to 13 MW, with hub around 130 meters above sea level. The diameter of the rotor is 211 meters, with a sweep area of 34,967 square meters. The design has been put into production and the first unit will be delivered by the end of 2021, making it the largest diameter offshore wind turbine to be delivered in Asia. Dongfang and China Three Gorges previously developed a 10 MW offshore wind turbine in 2019, China's first double-digit unit, and subsequently installed it at the Fuqing Xinghua Bay Wind Farm, off Fujian province, in July 2020. (IHS Markit Upstream Costs and Technology's Melvin Leong)

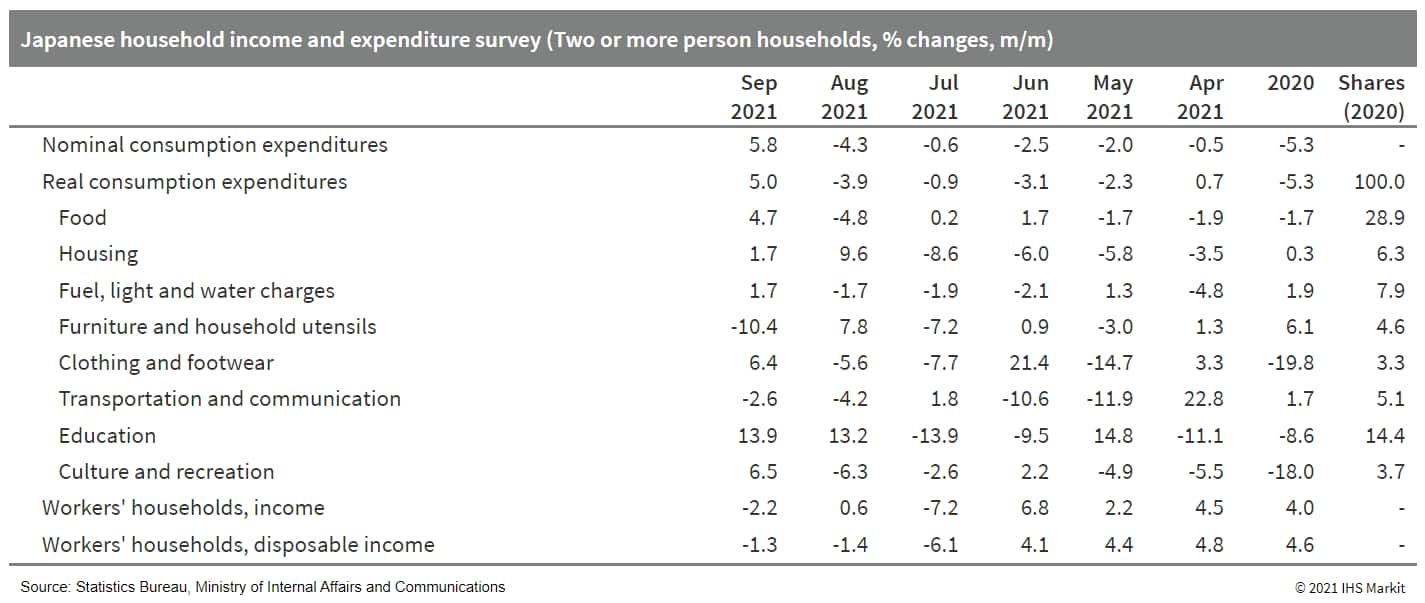

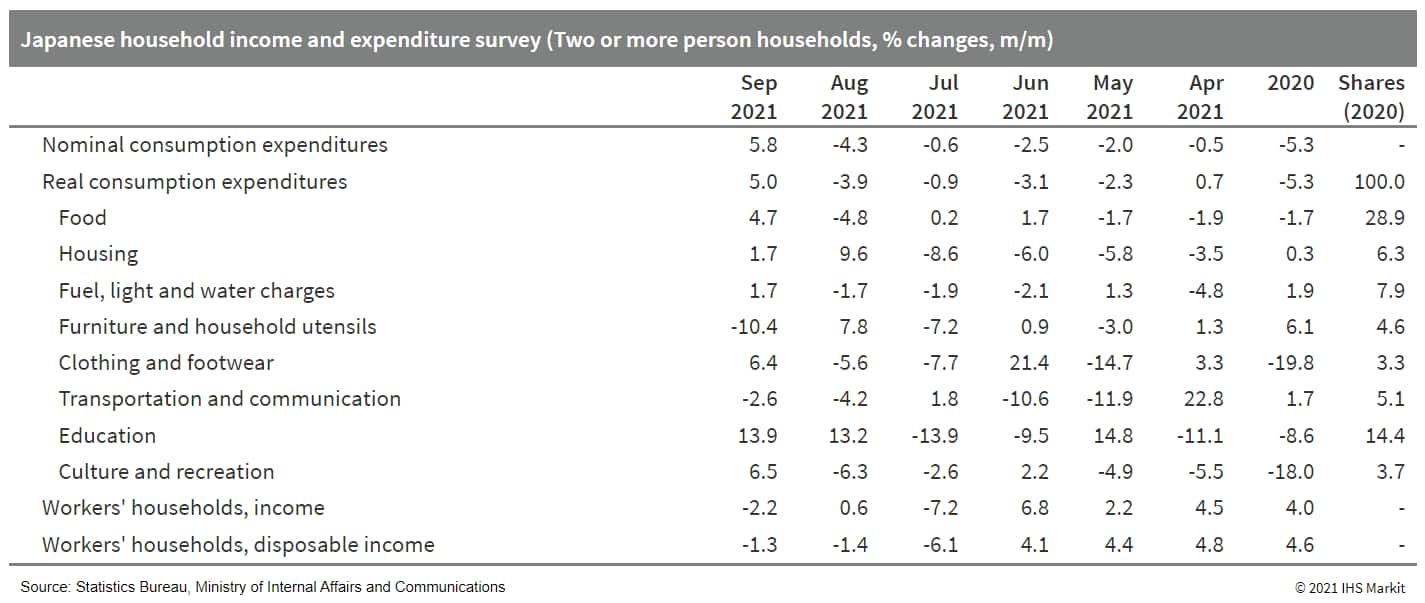

- Japan's real household expenditure rose by 5.8% month on month (m/m) in September following four straight months of decline, but the year-on-year (y/y) figure continued to fall, down 1.9% because of continued negative impacts from containment measures and supply-chain disruption affecting autos and some electrical products. (IHS Markit Economist Harumi Taguchi)

- The m/m rebounds of spending in food, clothing and footwear, as well as culture and recreation, were largely thanks to a decline in coronavirus infections and progress in vaccine rollouts. Continued increases in spending on education and medical care also contributed to the solid m/m increase, which was partially offset by declines in spending on furniture and household utensils and transportation and communication.

- Although the September results were better than IHS Markit expected, the 4.6% quarter-on-quarter (q/q) drop in real expenditure for the third quarter of 2021 suggests that weak private consumption was probably a driver of shrinking real GDP for the third quarter (which will be released on 15 November).

- Vietnamese automaker VinFast has announced that it will make a capital investment of more than USD200 million and establish a headquarters in California (United States) as part of its strategy to expand operations in North America, reports Reuters. It plans to launch two battery electric sport utility vehicles (SUVs) in the US next year, as well as opening 60 showrooms across the country. The automaker has also stated that it will monitor the prospect of establishing a manufacturing facility in the US. Separately, VinFast has signed a memorandum of understanding (MOU) with the French state-controlled power group Électricité de France (EDF) to co-operate to install electric vehicle (EV) charging stations in France, reports the Vietnam News Summary. Under the MOU, VinFast will partner with EDF to provide solutions related to the public EV charging station network and design special incentives for owners of its EVs in France. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 05 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.