Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 26, 2021

By Chris Fenske

All major European and most US equity indices closed higher, while APAC was mixed. US government bonds closed slightly lower and benchmark European bonds closed mixed. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. Natural gas, copper, silver, and gold closed higher, while the US dollar and oil closed lower.

Please note that starting with today's edition, we will be including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Most major US equity indices closed higher, with the S&P 500 +0.2% closing at a new record high; Russell 2000 +1.2%, Nasdaq +0.9%, and DJIA -0.2%.

2. 10yr US govt bonds closed +1bp/1.57% yield and 30yr bonds +1bp/2.25% yield.

3. CDX-NAIG closed flat/51bps and CDX-NAHY -1bp/291bps.

4. DXY US dollar index closed -0.1%/90.81.

5. Gold closed +0.1%/$1,780 per troy oz, silver +0.5%/$26.21 per troy oz, and copper +2.4%/$4.44 per pound.

6. Crude oil closed -0.4%/$61.91 per barrel and natural gas closed +5.3%/$2.87 per mmbtu.

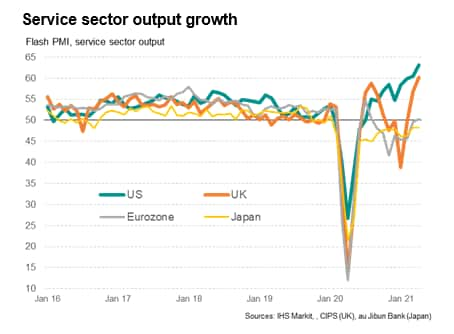

7. The US and UK reported stronger economic growth than Japan and the eurozone in April, according to flash PMI data from IHS Markit, reflecting better vaccine rollouts and easing COVID-19 lockdowns, which buoyed business confidence and boosted service sector growth in particular in the US and UK. The major source of divergence in growth rates between the four economies was the service sector. A survey record expansion was seen in the US, accompanied by the fastest UK growth for over six years. In contrast, the eurozone eked out only a marginal expansion and Japan remained in contraction, though recent months have seen both report the best performances since the pandemic began. (IHS Markit Economist Chris Williamson)

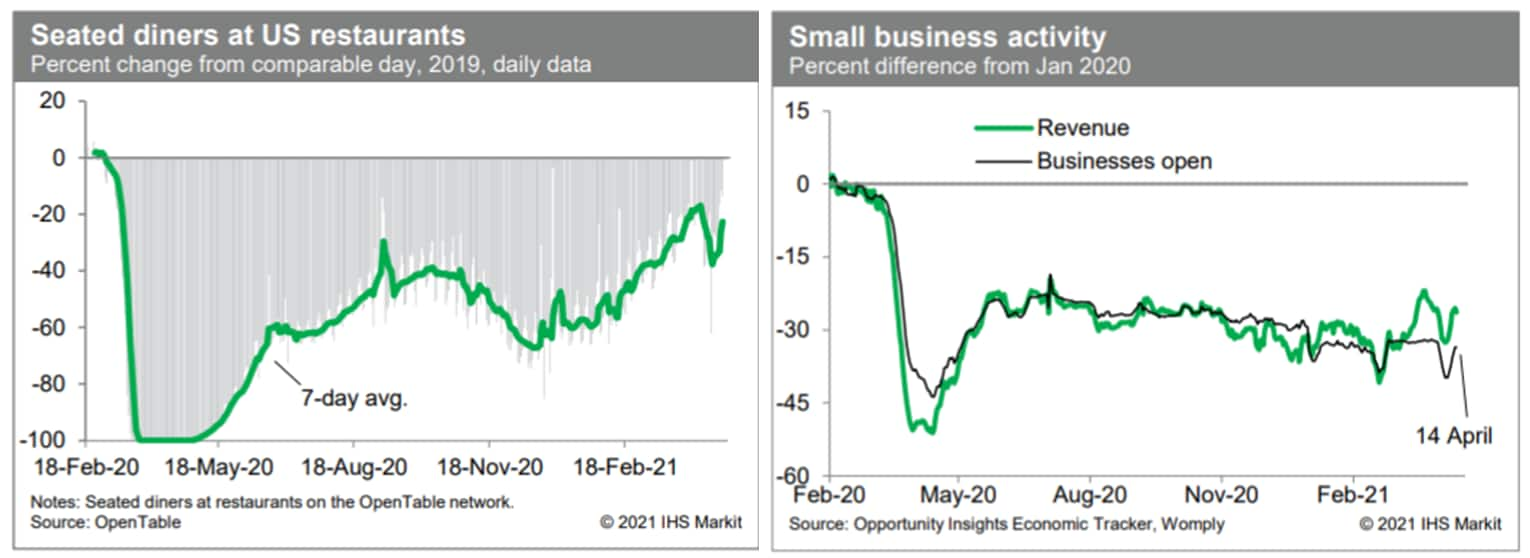

8. The trend in US seated diners on the OpenTable platform is rising again following a setback in the recovery a week or so ago. As of the week ending yesterday, the count of seated diners was down about 23% from the comparable week in 2019. Meanwhile, small business activity (revenues and the number open for business) firmed in mid-April, according to the Opportunity Insights Economic Tracker, but remains well below pre-pandemic levels. Finally, what looked like early signs of recovery in the movie-theater industry have fizzled, as box-office revenues (relative to 2019 levels) have declined for two consecutive weeks, according to Box Office Mojo. (IHS Markit Economists Ben Herzon and Joel Prakken)

9. US manufacturers' orders for durable goods rose 0.5% in March, while shipments rose 2.5% and inventories rose 1.0%. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

a. In response to the details in this report that inform our GDP tracking, we raised our estimate of first-quarter GDP growth by 0.2 percentage point to 6.2% and left our forecast of second-quarter growth unrevised at 8.2%.

b. Both orders and shipments of manufactured durable goods remained well above their pre-pandemic trends, as goods consumption has apparently replaced, at least temporarily, consumption of services forestalled by the pandemic.

c. An area of particular strength has been capital goods. Orders for core capital goods in March were 10.2% above the February 2020 level, while shipments of core capital goods were up 8.9% over the same period.

10. House Democrats in the United States have announced that they have re-introduced H.R.3, the so-called "Elijah C. Cummings Lower Drug Costs Now Act", which aims to allow the federal government to negotiate the cost of prescription drugs. The proposed legislation was re-introduced by Education and Labor Committee Chairman Robert C. Scott, Energy and Commerce Committee Chairman Frank Pallone Jr., and Ways and Means Committee Chairman Richard E. Neal. If approved, H.R.3 would cap Medicare beneficiaries' out-of-pocket spending on prescription drugs at USD2,000 per year; require drug manufacturers to pay a rebate to the federal government if they increase prices faster than inflation; empower the Secretary of Health and Human Services to negotiate better prescription drug prices in Medicare, and make those negotiated prices available to commercial health insurance plans; and introduce international reference pricing (IRP) to cap prices in the US. (IHS Markit Life Sciences' Milena Izmirlieva)

11. Tesla on Monday said revenue in the first quarter jumped around 74% from the same period a year earlier to $10.4 billion. The company generated a $438 million net profit, up from $16 million a year ago. Wall Street on average expected the company to report sales of about $10.5 billion and net income of around $509 million for the January through March period, according to analysts surveyed by FactSet. (WSJ)

12. Containers piled high on giant vessels carrying everything from car tires to smartphones are toppling over at an alarming rate, sending millions of dollars of cargo sinking to the bottom of the ocean as pressure to speed deliveries raises the risk of safety errors. The shipping industry is seeing the biggest spike in lost containers in seven years. More than 3,000 boxes dropped into the sea last year, and more than 1,000 have fallen overboard so far in 2021. The accidents are disrupting supply chains for hundreds of U.S. retailers and manufacturers such as Amazon and Tesla. (Bloomberg)

13. Gentex has reported its financial results for the first quarter of 2021, including record first-quarter net sales of USD483.7 million, an increase of 7% year on year (y/y). (IHS Markit AutoIntelligence's Stephanie Brinley)

a. Gentex's net sales in the first quarter were down 9% from USD529.9 million in the fourth quarter of 2020.

b. The automotive components supplier reports that its results in the first quarter were impacted by the components shortages that caused a decline in worldwide automobile production in the first quarter, a situation is not yet resolved.

c. Gentex said the impact of the shortages decreased its revenue by about USD45 million in the first quarter.

d. Gentex stated that, despite the difficulties, the sales in the first quarter were the second-highest quarterly sales in its history. Gentex's sales of exterior auto-dimming mirrors in international markets also increased, by 15% y/y, in the first quarter.

14. Chile's banking regulator, the Financial Market Commission (Comisión para el Mercado Financiero: CMF), announced on 23 April that it will temporarily withdraw additional provisioning requirements on refinanced corporate loans and in cases where banks grant companies grace periods. The CMF stated that this measure is to "ease the conditions for banks to reprogram the debts of their clients". The measure is only applicable to corporate credit; this will last until 31 July 2021 and is only applicable for clients whose loans are up to 30 days in arrears at the date of refinancing. Grace periods under the ruling are not permitted to exceed six months. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

a. A similar forbearance measure was implemented by the CMF between March and August 2020, with a broader scope of forbearance that applied to all segments of credit.

b. Currently, the figures reflecting the potential deterioration of banks' corporate portfolios are lower than in other credit segments. CMF's "expected deterioration in loans" index stood at 5.4% of total loans in February 2021, when last reported, mostly reflecting the expected difficulties affecting 7% of non-mortgage household credit. The index for corporate credit stood at 5.3% in the same month.

c. The most probable explanation of why the new relief from provisioning is only applicable to corporate credit is that although the expected deterioration index for consumer loans is higher than the overall average, it is within its normal historical range. By contrast, expectations of difficulties with corporate credit have risen steadily over the last year.

Europe/Middle East/Africa

1. Major European equity indices closed higher; Spain +1.0%, Italy +0.5%, UK +0.4%, France +0.3%, and Germany +0.1%.

2. 10yr European govt bonds closed mixed; Spain -1bp, France flat, Germany/UK +1bp, and Italy +2bps.

3. iTraxx-Europe closed flat/51bps and iTraxx-Xover +1bp/250bps.

4. Brent crude closed -1.6%/$65.03 per barrel.

5. As with other agricultural products this year, dairy is feeling the fallout of the UK leaving the EU, with its treatment as a third country by the bloc pushing dairy export volumes down 87%, while value suffers a 67% blow in January-February. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

a. According to customs data, total exported volumes from the UK reached 29,500 tons as opposed to 234,600 tons seen in January-February 2020. Similarly, value dipped to GBP93 million form the GBP278.7 million in 2020.

b. Exports to the EU alone totaled GBP37.3 million, and 14,800 tons in volume.

c. Declines y/y were reported across all dairy export categories. The biggest plunge in UK's exports to the EU were recorded in liquid milk and cream, down almost 100% to 900 tons from the 139,100 tons exported in 2020.d. Cheese was the largest export category in the period, with a total of 6,700 tonnes exported, which is 76% down y/y, followed by whey, with an 83% dip to 2,100 tons.

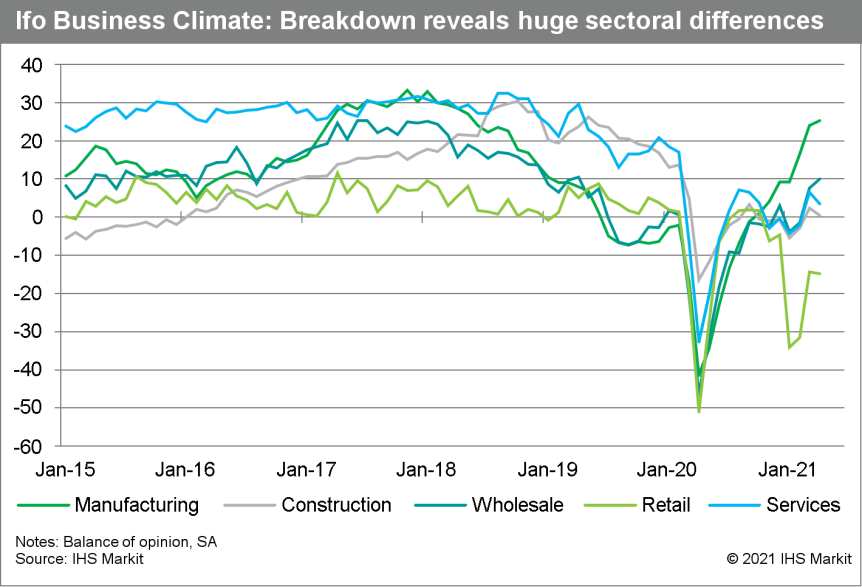

6. In April, the headline Ifo index, which reflects business confidence in industry, services, trade, and construction combined, edged up only slightly from 96.6 to 96.8. This is its highest level since June 2019 and almost even with the long-term average of the series at 97.0. The Ifo Institute highlights that the third wave of the COVID-19 virus pandemic and bottlenecks in intermediate products are impeding Germany's economic recovery. (IHS Markit Economist Timo Klein)

a. Business expectations corrected downwards from 100.3 in March to 99.5 in April, having advanced by a cumulative 9 points during February-March.

b. The assessment of current conditions posted its third consecutive gain, rising from 93.1 to 94.1, a 14-month peak and thus its best level since the pandemic began.

c. Retail expectations suffered the largest setback as the looming return to a stricter lockdown will end "buying-on-appointment" schemes for the time being. The opposite was observed with respect to current conditions in retail, however, as car dealerships reported the largest improvement.

7. Volkswagen (VW) Group is expecting the vehicle production hit from the semiconductor shortage to worsen, reports the Financial Times. The president of the automaker's SEAT brand, Wayne Griffiths, told the newspaper, "We are being told from the suppliers and within the Volkswagen Group that we need to face considerable challenges in the second quarter, probably more challenging than the first quarter." He added that this was the "biggest challenge" facing the automaker currently, and that the SEAT brand's Martorell (Spain) site was currently operating "hand to mouth". The senior executive said, "The name of the game this year will be flexibility." He said that, once the company received the semiconductors, it could decide which models and variants to build, adding, "We have to try to build when we get [microchips] available." (IHS Markit AutoIntelligence's Ian Fletcher)

8. Porsche is planning a German plant to produce battery cells for electric vehicles (EVs), in a bid to speed up its electric mobility drive, reports Reuters, citing Porsche CEO Oliver Blume. "Battery cells are a key technology for Germany's automobile industry which we must also have in our own country," said Blume to a German newspaper. "Porsche wants to play a pioneering role in this," he said, adding that the battery cell factory would be built in the Swabian town of Tübingen. (IHS Markit AutoIntelligence's Jamal Amir)

9. The Central Bank of Egypt (CBE)'s overnight deposit rate currently stands at 8.25% and the lending rate is 9.25%, while the main operation and discount rates are now at 8.75%. Rates have been left on hold since last November, when the MPC unexpectedly made a 50bps cut, following an earlier 50 bps cut in September. The CBE has made a record cut in March 2020 in response to the outbreak of COVID-19, bringing the total cut to 400 bps in 2020. (IHS Markit Economist Yasmine Ghozzi)

a. The CBE remains cautious and is expected to hold off on making further cuts until the second half of the year, particularly as a number of emerging markets (EM)'s central banks increased rates last month.

b. Across 37 EMs, policymakers ended their easing cycles and hiked interest rates in March, a change in stance since February 2019. The change in direction towards more tightening cycles is expected to continue owing to rising inflation, strong rebound in energy prices, and rising US treasury yields, which could put pressure on some EMs to handle, especially those for which external and fiscal imbalances were exacerbated recently with spiraling COVID-19 cases.

Asia-Pacific

1. APAC equity markets closed mixed; India +1.1%, South Korea +1.0%, Japan +0.4%, Australia -0.2%, Hong Kong -0.4%, and Mainland China -1.0%.

2. DeepRoute.ai has received a permit to conduct a passenger trial of its autonomous cars in Shenzhen, China. The company plans to launch the service in the middle of this year, initially in small areas of the city, allowing residents to apply for trial rides. Following this, DeepRoute.ai plans to expand the service to other areas across the city and involve more passengers, reports Gasgoo. DeepRoute.ai offers solutions that focus on Level 4 autonomous operations and has research centers in Shenzhen (China), Beijing (China), and Silicon Valley (United States). Last year, DeepRoute.ai began transporting passengers and freight using its autonomous vehicles (AVs) in Wuhan and Xiamen, China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

3. German auto-parts supplier Continental AG has partnered with Chinese artificial intelligence (AI) firm Horizon Robotics to form a joint venture (JV) dedicated to intelligent driving business, reports Gasgoo. The companies plan to leverage each other's strengths to develop advanced driver assistance systems (ADAS) and autonomous software and hardware systems for global automakers. Continental is to offer its expertise in product quality management, supply-chain technology innovation, and research and development (R&D) and Horizon Robotics is to provide its automotive-grade AI chips of the Journey series and perception algorithm. (IHS Markit Automotive Mobility's Surabhi Rajpal)

4. Jidu Auto, a joint venture (JV) between Baidu and Geely, plans to invest CNY50 billion (USD7.7 billion) over the next five years in developing smart-car technology, reports Reuters. The JV aims to launch its first electric vehicle (EV), which would resemble a "robot", in three years, with sales targeted at young customers. Following this, the company is targeting the release of a new model every 18 months. To achieve this, the JV is considering hiring 2,500 to 3,000 staff over two to three years, including 400 to 500 software engineers. According to the report, the branding for Shanghai- and Beijing-based Jidu Auto is scheduled to be unveiled in the third quarter of 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

5. Honda Mobility Solutions is to conduct trials of an on-demand mobility service using a reservation and vehicle dispatch system in the Japanese city of Utsunomiya. The aim of the trials is to solve city issues such as an increasing need for smooth connections with public transportation and an ageing population who have difficulty in travelling by private car. The service will be available in city's Kawachi and Kiyohara districts and it will use data accumulated by Honda's two-way car navigation system. (IHS Markit Automotive Mobility's Surabhi Rajpal)

6. The Reserve Bank of India (RBI), the country's central bank, announced on 22 April that banks are allowed to pay dividends "from profits for the financial year ended March 31, 2021", provided that they are "not more than fifty percent of the amount determined as per the dividend payout ratio". According to a previous notice (RBI/2004-05/451), the maximum dividend payout ratio has been set at 40%. (IHS Markit Banking Risk's Angus Lam)

a. The Indian authorities announced the dividend suspension in April 2020 as part of a series of early COVID-19-virus-related policies. The relaxation of the suspension is likely to allow state-owned banks, which account for about 60% of total banking-sector assets, to pay dividends to the government and assist its fiscal program.

b. Given the current COVID-19-virus situation in India and the limited capital injection of INR200 billion announced as part of February's budget, with INR145 billion already earmarked for injection into several weak banks, IHS Markit assesses that relaxing dividend payouts further will be highly unlikely to ensure that profits are preserved for capital rebuilding.

7. Maire Tecnimont has been awarded an EPCC contract by India Oil Corporation for the implementation of a new para-xylene (PX) plant and the relevant offsite facilities at the Paradip plant in the State of Odisha, in Eastern India. Once completed, the new PX plant will have a capacity of 800,000 tons per year. The PX produced will be used to feed the adjacent purified terephthalic acid (PTA) unit, thus ensuring availability of world-class feedstock that will provide a significant boost to the country's manufacturing industry. The contract has been awarded on a lump-sum basis and is valued at USD450 million. The project will be carried out by a consortium consisting of Maire Tecnimont subsidiaries Tecnimont and Mumbai-based Tecnimont Private Limited and is expected to be completed in 33 months. (IHS Markit Upstream Costs and Technology's William Cunningham)

8. The Australian economy has rebounded in early 2021 from the impact of the COVID-19 pandemic restrictive measures that hit domestic demand during 2020. With economic growth momentum improving rapidly, the Australian economy is forecast to grow at a pace of 3.2% y/y in 2021, following an estimated GDP contraction of 2.4% y/y in 2020. (IHS Markit Economist Rajiv Biswas)

a. The IHS Markit Flash PMI has since risen steeply at the outset of the second quarter, from a final reading of 57.0 in March to 58.8 in April. Private sector growth in Australia gathered considerable momentum in April, according to the Flash PMI data. The upturn was associated with improved client confidence, buoyant market conditions, strengthening demand, the easing of COVID-19 restrictions and low interest rates. Aggregate new orders increased at a survey-record pace.

b. The IHS Markit Flash Services Business Activity Index rose to 58.6 in April, from a final reading of 55.5 in March, signaling the strongest increase in service sector output in the survey history. The upturn was boosted by the quickest expansion in new business inflows on record.

c. The IHS Markit Flash Manufacturing PMI also showed a sharp increase in 59.6 in April, rising from 56.8 in March to its highest mark in the survey history. Strengthening demand conditions encouraged goods producers to step-up output in April. The pace of expansion was sharp and the fastest in close to four-and-a-half years.

d. Due to the significant second wave of the COVID-19 pandemic that impacted on the state of Victoria, the Victorian economy was substantially affected in the 2020-21 financial year by a protracted second lockdown during from July to October 2020, for a period of 112 days. Following the lifting of the lockdown, household spending by Victorian households rebounded, rising 10.4% quarter-on-quarter in the December quarter of 2020. The state government of Victoria have projected strong growth of around 5% for the 2021-22 financial year, reflecting low base year effects that will boost growth in output.

Posted 26 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.