All major US and most major European equity indices closed higher, while APAC was mixed. US government bonds closed mixed with the curve slightly steeper, while benchmark European bonds closed higher. European iTraxx and CDX-NA closed almost unchanged on the day across IG and high yield. The US dollar, natural gas, Brent, gold, copper, and silver closed higher, while WTI was flat on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000/Nasdaq +0.9%, S&P 500 +0.5%, and DJIA +0.2%.

- 10yr US govt bonds closed flat/1.64% yield 30yr bonds +2bps/2.09% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bp/301bps.

- DXY US dollar index closed +0.2%/93.81.

- Gold closed +0.6%/$1,807 per troy oz, silver +0.6%/$24.59 per troy oz, and copper +0.7%/$4.53 per pound.

- Crude oil closed flat/$83.76 per barrel and natural gas closed +11.7%/$5.90 per mmbtu.

- Tesla Inc. crossed $1 trillion in market value Monday, joining a select group of companies after its stock price more than doubled this past year on surging vehicle sales and rising profits. Investors pushed the electric-vehicle maker over the line after Hertz Global Holdings Inc. ordered 100,000 autos to be delivered to the rental-car company by the end of next year, a bulk purchase that promises to expose more mainstream drivers to Tesla's technology. (WSJ)

- COP26 will be a conference under pressure from an energy crisis, but this development has only crystalized its transformation into an economic planning conference - as much or more than a climate change conference. (IHS Markit EnergyView Climate & Cleantech's Peter Gardett and Conway Irwin)

- Competing models of infrastructure financing are anchoring bifurcated views of energy transition policy planning heading into the conference, with these positions hardened by widespread price spikes in power, commodities, and oil prices since the end of the summer. Central planning models that governments use to support low risk long-term infrastructure capital allocations are competing for global investment funds with higher-return, higher-risk market-based approaches.

- With estimates of needed investment to hit current Paris Agreement net-zero targets running as high as $27 trillion in the latest IEA report, the shape of future economic pathways is up for discussion at COP26, and the decisions made or not made at the conference will have significant long-term financial and economic impacts over almost every actionable investment horizon.

- Advocates of a faster energy transition away from fossil fuel use have generally aligned with the long-term government-led planning approaches, while advocates of a slower transition that focuses on decarbonizing existing infrastructure are more aligned with the market-based approaches. Both are seeking to leverage climate politics to get government financial support for their preferred solutions, but the recent spike in energy prices has lent additional urgency and weight to each view.

- While some of the broader ambitions for the conference remain unsettled only days before it opens on 31 October in Glasgow, several key policy approaches appear to have generated sufficient cross-cutting appeal to varied constituencies that they remain on track as COP26 is readied. Development finance, highly targeted - though often indirect - fuel-specific financial support, and corporate climate change risk reporting are all still intact measures as the conference gathers.

- With COP26 less than a week away, the pledges by nations to reduce their carbon emissions continue to arrive, including some trend-setting announcements. But analysis of global climate commitments by organizations such as the International Energy Agency and UN Environmental Program (UNEP) indicate that they still are far short of what's needed to limit global warming to 1.5 degrees Celsius, as the Paris Agreement mandates. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- More than 70 countries in total have come forward over the past two years with updated and more ambitious nationally determined contributions (NDCs) under the Paris Agreement. These include every G7 nation, all of which have NDCs aligned with net-zero emissions by 2050. In all, 194 nations have submitted a first NDC, and 13 have submitted a second, according to the UN's NDC Registry.

- These came even as memos were leaked to the media on 21 October showing that major energy producing nations such as Australia and Saudi Arabia lobbied to change the language in a key UN science panel report on global warming to reduce the association between fossil fuels and climate change and to promote carbon capture as the equivalent to eliminating fossil fuel use.

- The World Meteorological Organization (WMO) raised the stakes further with a report on 25 October that found that the concentration of CO2 in the atmosphere reached 413.2 parts per million (ppm) in 2020, the highest ever recorded. CO2 concentrations are 149% of the pre-industrial level. The rate of increase last year was 2.5 ppm, or slightly above the average rate from 2011-2020 of 2.4 ppm per year.

- Methane is at 262% and nitrous oxide at 123% of the levels in 1750, according to the WMO, and both increased from 2019 to 2020 by more than the 10-year average.

- "The economic slowdown from COVID-19 did not have any discernible impact on the atmospheric levels of greenhouse gases and their growth rates, although there was a temporary decline in new emissions," it said.

- Buyside interest across new issue municipal deals was noteworthy over the course of last week despite unenthusiastic macro market conditions after $12.8 billion priced, driven by several large scale ESG transactions which supplied green bond focused investors larger par size. Investor appetite for ESG paper was strong last week after the Utah Transit Authority (Aa2/AA/AA) priced $448 million of taxable green revenue refunding bonds with robust buyside participation after bumps of 5-25bps were registered across the scale, with the greatest bump noted in the 2036 maturity, falling +95bps off the 10YR UST. The City of Brockton, MA (A1/AA-/-) also tapped into the primary market to finance $302 million general obligation pension bonds, offering yield focused investors greater opportunity after strong buyside demand suppressed spreads by 8-11bps across the scale with allotted investors realizing a 3%+ yield in the 2035 maturity. This week's calendar is slated to fall under double digit levels to $9 billion, spanning 221 new issue offerings with a large presence from the state of California supplying ($2+ billion) of new issue deals. The Cities of Dallas and Fort Worth, TX (A1/-/A+/AA) will lead this week's negotiated calendar offering $704 million joint revenue refunding bonds with proceeds designated for Dallas Fort Worth International Airport with maturities spanning 11/2022-11/2046 led by Barclays Capital. The California Community Choice Financing Authority (A2/-/-) will also come to market supplying $564 million clean energy project revenue bonds with a corresponding climate bond certified ESG status, selling on Wednesday 10/25 and senior managed by Goldman Sachs. This week's competitive calendar will incorporate 118 new issues for a total of $1.85 billion with the City of Los Angeles, CA (Aa2/AA/AAA/AA+) leading the auction calendar with $212 million general obligation bonds, spanning 9/2022-9/2041 and carrying a self-labeled social ESG status, selling on Wednesday 10/27. (IHS Markit Global Markets Group's Matthew Gerstenfeld)

- On October 22, Puerto Rico's Financial Oversight and Management Board announced that it has approved a proposed $606 million fuel contract between the Puerto Rico Electric Power Authority (PREPA) and Puma Energy Caribe LLC for the Aguirre, Costa Sur, San Juan and Palo Seco power plants. (IHS Markit PointLogic's Barry Cassell)

- The contract price adder negotiated under PREPA's enhanced procurement process represents an approximate 33% price reduction compared to the current minimum adder of $4.28, the Board noted. Puma provides PREPA with a credit cap of $200 million and sixty-day credit term. Four companies had provided proposals.

- "The Oversight Board worked closely with PREPA to ensure a transparent and competitive bidding process that achieved the best possible price for the residents and businesses of Puerto Rico," said the Oversight Board's Executive Director Natalie Jaresko. "The Oversight Board has consistently requested improvement in PREPA's contracting practices, to utilize best practices, ensure transparency, promote competition, and ensure the best possible pricing and terms for the benefit of all consumers. The new contract shows that prudent procurement practices achieve the best results. This contract is a big step forward, providing big savings on the adder fee portion of the fuel supply contracts."

- PREPA, accused of pervasive mismanagement, has been in bankruptcy protection for the past few years.

- The contract with Puma is a one-year agreement for the delivery and supply of no more than 1.6 million barrels of No. 6 fuel oil (bunker fuel) per month at market price with a fixed price adder of $2.88 per barrel and includes a provision allowing PREPA, at its sole discretion, to extend the contract for an additional year under the same terms.

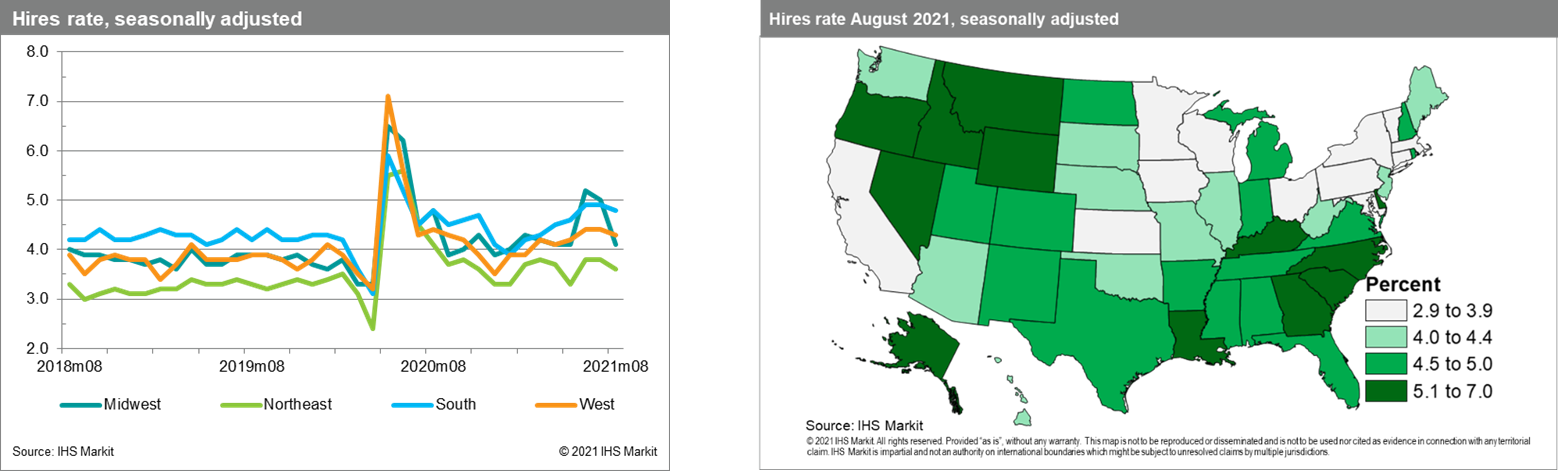

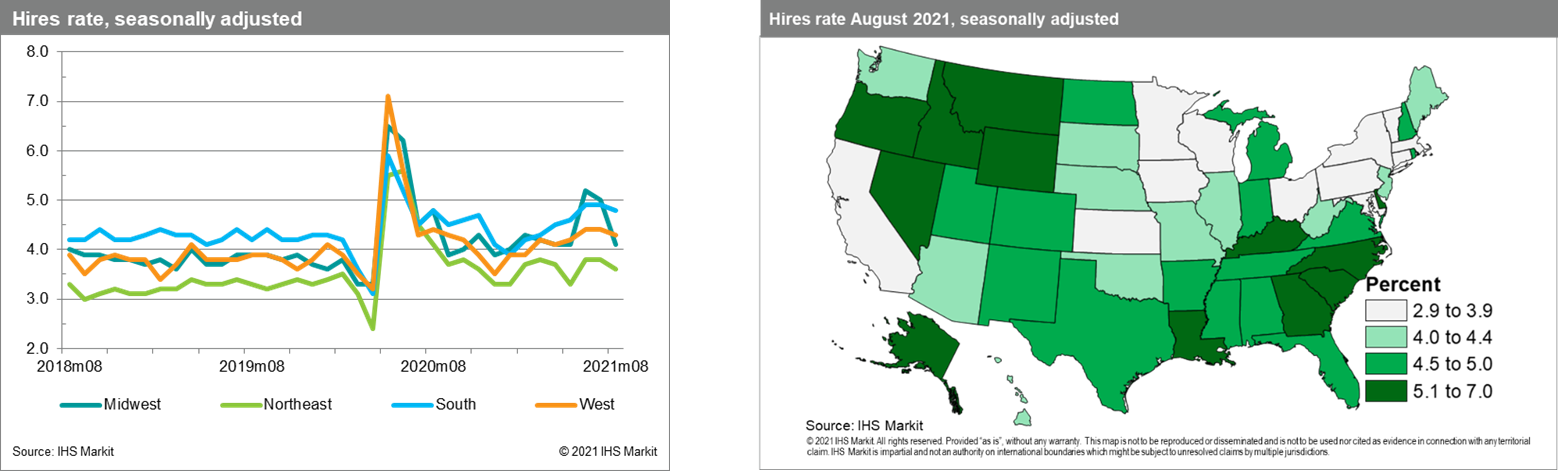

- The first official release of the State Job Openings and Labor Turnover Survey (JOLTS) indicated that conditions remained tight in state labor markets during August. While job openings across all four regions declined in August, every region's job openings rate was still close to the series highs they reached in July, and well above pre-pandemic rates. (IHS Markit Economist Alexander Minelli)

- The job openings rate was highest in the South at 7.0%, down from its series peak of 7.2% the month before, reflecting high demand for workers as Southern firms looked to fill open positions amid expanding confidence in the region's economic recovery. Within the South, Kentucky (8.2%), Georgia (8.0%), and South Carolina (7.8%) were among the top five states with the highest job openings rates, which declined in each by less than the national average of 0.4 percentage point in August. The Northeast and Midwest posted the lowest regional job openings rates, at 6.3% and 6.4%, respectively, although they, too, are also well above historical levels. While the Northeast tends to have a lower rate owing to an older and more educated population that changes jobs less frequently, Massachusetts and New Hampshire tied for the seventh highest job openings rate in August, both at 7.4%.

- In August, the quits rate rose in 14 states and was relatively unchanged in the remaining 37 states, although rates remain above pre-pandemic levels after recovering from series lows during the second quarter of 2020. The quits rate in the Midwest and South increased by 0.3 and 0.2 point, respectively, each to a series high of 3.2%, after significant increases in quits in Illinois, Indiana, Georgia, and Kentucky. Meanwhile, the West and Northeast were unchanged from their July peaks of 2.7% and 2.2%, respectively.

- The quits rate traditionally signals the confidence of workers to find a new, and likely better, job, especially during times of labor market tightness when new hiring incentives and higher wages encourage greater job movement. However, health concerns or the need to take care of family may also have contributed to the higher number of quits in August as that month saw a rise in cases of the Delta variant of COVID-19.

- The hires rate decreased in 18 states, with the largest declines occurring in Illinois, Nevada (both down 2.0 points), and West Virginia (down 1.8 points). While the hires rates in every region are still above their pre-pandemic values, they have declined from the series peaks they saw in mid-2020 after many states relaxed or lifted restrictions on business activity, leading to a surge in hiring.

- Led by New York Attorney General Letitia James, 23 attorneys general petitioned FDA last week to move faster in setting heavy metal standards for baby foods, asking for interim limits no later than April 2022 and guidance that views finished product testing as preventive controls. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- "There are common-sense, science-based actions that can drive down the levels of heavy metals in baby foods, which is why we are calling on the FDA to take these actions as soon as possible," James said in releasing the new petition. "No parent should have to worry about the safety of their children's food. Our children must have the opportunity to live healthy lives, and their parents deserve the peace-of-mind in knowing their babies are safe from the products they consume."

- The petition echoes concerns raised by critics that FDA's April 2021 Closer to Zero plan does not include aggressive enough timelines for heavy metals, particularly after a congressional report put a spotlight on the lack of safety standards and testing by baby food companies.

- The US House subcommittee in February released its first report, finding "dangerously high" levels of lead, mercury, arsenic and cadmium in foods produced by seven of the largest baby food makers in the US: Nurture's Happy Family Organics, Beech-Nut, Hain's Earth's Best Organics, Gerber, Campbell's Plum Organics, Walmart's Parent's Choice and Sprout Organic Foods.

- Publication of the congressional report generated widespread concern among consumers, prompted scores of lawsuits against baby food companies and led FDA to develop its Closer to Zero plan. The plan aims to propose action levels for lead by April 2022, draft levels for arsenic between 2022 and 2024, and draft limits for cadmium and mercury in 2024. Currently, FDA has set only one standard for a heavy metal: inorganic arsenic in infant rice cereal.

- Bristol Myers Squibb (BMS, US) has reportedly approached Aurinia Pharmaceuticals (Canada) with a view to acquiring the Canadian late-stage clinical biotechnology company, according to Bloomberg. However, Bloomberg said that neither of the two companies was prepared to comment on the reported approach, which was attributed to confidential sources. Bloomberg noted that it is also possible that talks between the two companies may stall. Reports of the potential acquisition come shortly after BMS revealed that it was prepared to sell its 11.5% stake in Acceleron (US), despite resistance from a number of other shareholders. Aurinia specialises in autoimmune diseases, and in January received approval from the US FDA for the active lupus nephritis treatment Lupkynis (voclosporin) as its first marketed drug. Aurinia also has two autoimmune disease candidates in pre-clinical development. (IHS Markit Life Sciences' Milena Izmirlieva)

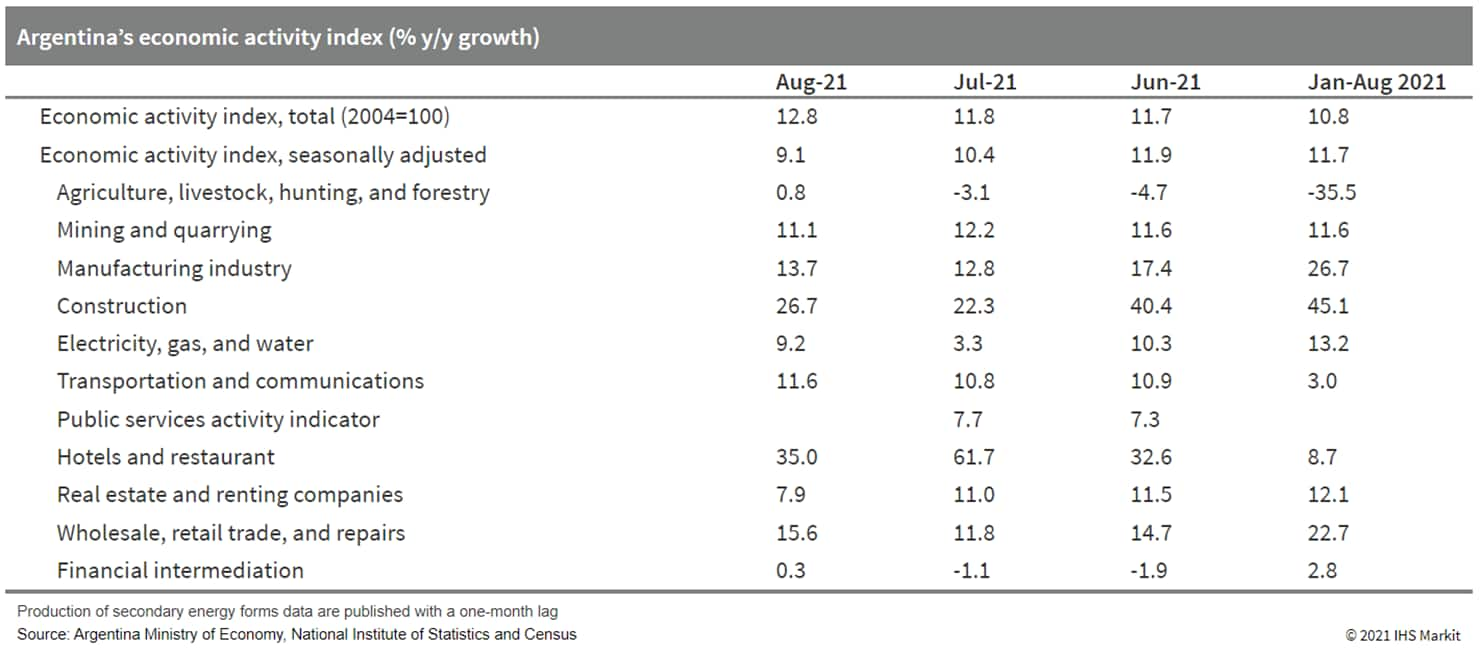

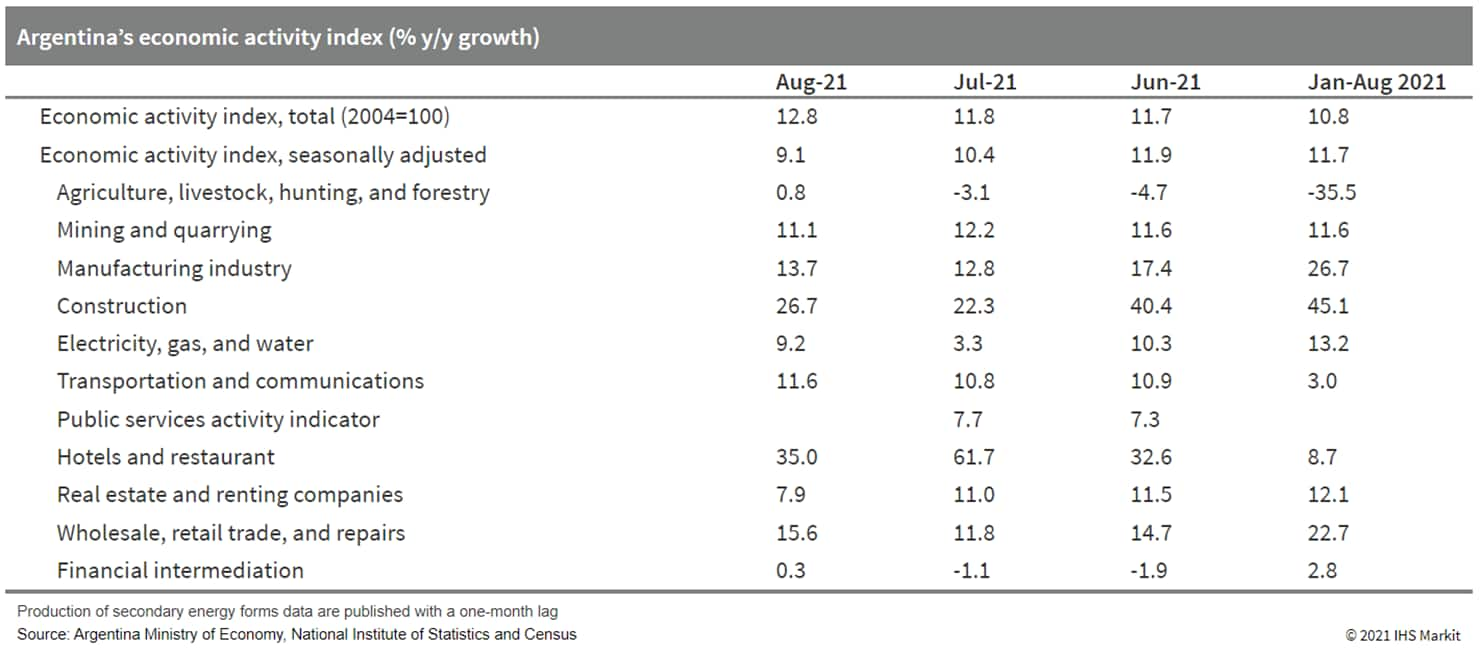

- Argentina's economic activity advanced by 1.1% month on month (m/m) in August in seasonally adjusted terms, posting a third consecutive expansion. The outlook for 2022 remains difficult; the rising inflation rate and the policy uncertainty are driving down growth expectations. (IHS Markit Economist Paula Diosquez-Rice)

- The economic activity index increased by 12.8% year on year (y/y) in August, while the seasonally adjusted data showed a 1.1% m/m increase during the month; the monthly rise in August comes after two consecutive months of expansion. All of the categories in the composite index show an annual rise in August.

- Hospitality and restaurants, construction, manufacturing, and wholesale and retail sales posted the highest annual expansion rates; the hospitality and restaurants sector rose by 35% y/y, although the comparison base was extremely depressed. On the other hand, the primary sector and the financial intermediation services sectors posted the smallest annual expansions in August.

- The Argentine construction costs increased by almost 66% y/y in September 2021; the rise was driven by an 73% y/y increase in the cost of materials, a 60% y/y rise in labor costs, and a 64% y/y rise in general costs. The producer price index rose over 60% y/y in September; the biggest increases were in lumber and non-furniture wood products, oil-refined products, and in non-machinery metal products.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for France -0.3%; Italy +0.9%, Germany +0.4%, UK +0.3%, and Spain +0.2%.

- 10yr European govt bonds closed higher; Italy -5bps, France/Spain -2bps, and Germany/UK -1bp.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover flat/260bps.

- A mix of vaccine hesitancy, reversal of lockdowns, and colder weather is leading to a severe increase in numbers of new COVID-19 cases in countries across Central, Eastern, and South-Eastern Europe, which is pushing healthcare systems in some countries to their limits. On the research and development front, the US FDA issued a Briefing Report in which it asserts that the benefits of Pfizer (US) / BioNTech (Germany)'s COVID-19 vaccine Comirnaty outweigh the risks in the majority of scenarios, meaning that FDA clearance is likely to follow. It appears inevitable that the situation in Central, Eastern, and South-Eastern Europe will deteriorate further; the Latvian authorities have already appealed to the European Union's civil protection agency for technical assistance, including ventilators, and have also warned that they are likely to need to send some COVID-19 patients to other EU countries within a month. With many countries in this region having below 50% of their populations fully vaccinated, the implications of a surge in new cases are considerably more serious than in the case of countries with much higher rates of vaccine uptake. The dangers of vaccine hesitancy and disinformation are being highlighted starkly in this situation. (IHS Markit Life Sciences' Brendan Melck)

- A survey of views on EU plans to set pesticide use-reduction targets found that there is "disagreement about everything" from stakeholder level all the way up to the political level. On 18 October, Dutch consultants Ramboll published the findings of their interviews conducted for the impact assessment of the planned revision of the EU sustainable use of pesticides Directive (2009/128). (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- The Commission is considering ways to amend the Directive so that it can help achieve the pesticide use-reduction targets set in the Farm to Fork strategy, but Attström pointed out that disagreements ranged from individual topics up to EU-level policy. Polarized views result in high expectations versus strong resistance, she said. "Every proposal is met with strong resistance from either side."

- Contested issues include whether pesticides are necessary for controlling pests or increasing food production; whether they are a problem, given that they have been assessed as safe; if there are viable alternatives; and what is the meaning of "viable". Contrasting views are not just apparent at stakeholder level - there were cases where ministries from the same country provided the consultants with "completely different views on what needs to be done".

- There is disagreement over what the current Directive is expected to achieve and different perceptions about whether its objectives have been achieved. Its text refers to reducing "risk", yet there are expectations about reducing "use", Attström observed.

- Several speakers at the conference repeated warnings that farmers could not yet switch away from chemical pesticides as they did not yet have access to adequate alternative crop protection products. Jennifer Lewis of the International Biocontrol Manufacturers Association and David Cary of Pesticide Action Network (PAN) Europe criticized the fact that biopesticides were still assessed under the same legislation as chemical pesticides. The EU agrochemical registration Regulation (1107/2009) has provisions to prioritize biopesticides "but the will has not been followed by the deed", said Cary.

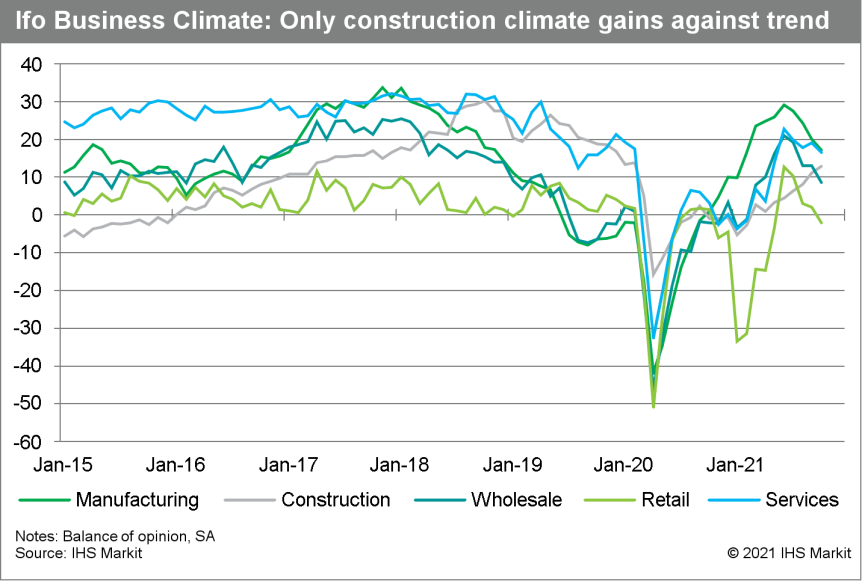

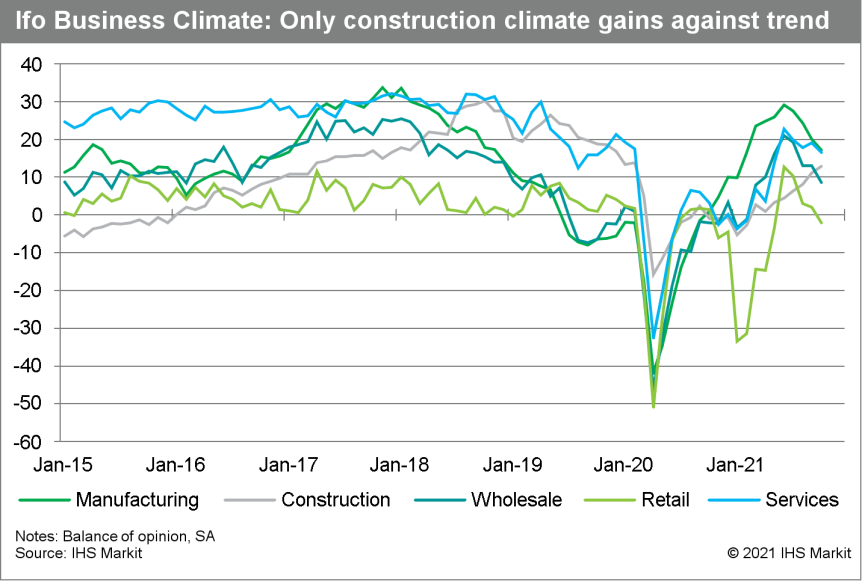

- Germany's business climate has deteriorated for the fourth consecutive month in October, led by expectations. Wholesale and retail trade did worst, whereas dips in the manufacturing and services sectors were less pronounced and construction sentiment maintained its upward trend. Supply-chain bottlenecks have become the key restraining force for the economic recovery. (IHS Markit Economist Timo Klein)

- In October, the headline Ifo index, which reflects business confidence in industry, services, trade, and construction combined, again declined moderately from 98.9 (revised up from 98.8) to 97.7. Even now, this exceeds the pre-pandemic level in February 2020 (96.2) and equally the long-term average of 97.1. As in September, the Ifo Institute highlights procurement problems, calling them "sand in the wheels of the German economy".

- Business expectations dipped for the fourth consecutive month in October, and more strongly so than in the preceding month. The decline from 97.4 to 95.4 takes expectations to their lowest level since February, also now undershooting their long-term average (97.6). The main depressing forces for October expectations were the trade and service sectors, somewhat less so manufacturing. In contrast, the construction-sector outlook has now been improving continually since February (briefly interrupted in April).

- Meanwhile, the assessment of current conditions remained almost stable in October, only slipping from 100.4 to 100.1. This is broadly at par with June's level and still exceeds the pre-pandemic 99.0 in February 2020, let alone the long-term average of 96.6. October's outperformance of this sub-index versus expectations was driven by the fact that current conditions not only in construction but also the services sector were seen more positively than a month ago. This underlines that those sectors least vulnerable to supply-chain problems are faring best at present, and that areas like catering and tourism are not seriously hampered by the remaining pandemic-related restrictions.

- Pulling current conditions and expectations together, October's sectoral breakdown reveals declines in all sectors but construction. Most downward momentum at the data edge stemmed from wholesale and retail trade, as delivery problems have become worse, and retailers fear for their Christmas business despite persistently robust consumer demand. In the manufacturing sector, supply-chain issues have depressed capacity utilisation by 2.1 percentage points to 84.7%.

- German car-rental firm Sixt has announced the addition of low-emission vehicle options to its Sixt Ride business, according to a company statement. Customers booking transfer or limousine services can now choose a hybrid or an electric vehicle (EV) in select European cities. These vehicles are available in Berlin, Dresden, and Munich in Germany as well as cities in France, the UK, Italy, the Netherlands, Spain, Sweden, Switzerland, and Turkey. As part of the launch, passengers booking a ride service in the Green, Business Green, or Business Green XL categories with the voucher code GREEN10 will receive a EUR10.0 (USD11.6) discount on the total fare. The offer is valid until the end of November. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Russian President Vladimir Putin, while speaking at the Valdai Forum conference on 21 October, stated that NATO's presence in the territory of Ukraine, even without Ukraine's formal accession to the military alliance, posed a security threat to Russia. Putin's statement coincided with the visit by US Defense Secretary Austin Lloyd to Ukraine, during which he committed to the US support to Ukraine's territorial integrity and sovereignty, and pledged continued political, technical and material support to improve Ukraine's defense capabilities. Separately, on 18 October Russia announced the closure of its official representative office to NATO in Brussels from 1 November, and demanded the closure of NATO's liaison office in Moscow. While Ukraine continues to have a political and constitutional objective for NATO membership and co-operates with NATO on technical standards and joint exercises, there is currently no Membership Action Plan in place. According to opinion polls, support for Ukrainian membership of NATO increased from 13% in 2012 to 54% in June 2021. (IHS Markit Country Risk's Alex Kokcharov)

- The Georgian current-account balance in the second quarter of 2021 showed a deficit of USD383 million, narrowing by 8.4% y/y and widening by 4.6% quarter on quarter (q/q). The first-half gap of USD750 million marked narrowing of 9.4% y/y. (IHS Markit Economist Venla Sipilä)

- The y/y improvement in the second quarter was thanks to both of the two positive current-account components strengthening. The secondary income-account surplus increased by nearly 60% due to rapid gains in income inflows, and doubling service export inflows outweighed the strong growth of import outflows. This allowed the service surplus to climb to USD168 million, which dwarfed the surplus of USD6 million in the second quarter of last year.

- On the other hand, the goods trade deficit widened by one-third y/y in the second quarter and by 5% y/y in the first half, although export inflows recovered clearly compared with the base quarter, when the coronavirus disease 2019 (COVID-19) virus pandemic started to damage trade. The income deficit deteriorated by nearly two-thirds, on a rapid growth of outflows.

- Net inflows of FDI in the second quarter recovered by an impressive rate of 77% q/q from the first quarter, while falling by a clearly slower annual rate of 2.6%. In the first half, they fell by approximately 11% y/y. Non-debt-creating FDI inflows covered 61% of the second-quarter deficit and 49% of the first-half gap.

Asia-Pacific

- Major APAC equity indices closed mixed; Mainland China +0.8%, South Korea +0.5%, Australia +0.3%, India +0.2%, Hong Kong flat, and Japan -0.7%.

- Discussions between Apple and its Chinese battery suppliers CATL and BYD on the supply of batteries for its planned electric vehicle (EV) model have stalled, according to Reuters. According to the report, Apple wanted the suppliers to set up teams and battery manufacturing plants in the United States, but neither CATL nor BYD agreed. CATL has cited reasons such as political tensions and cost concerns for not setting up a plant in the US. Meanwhile, Apple is also said to be considering Panasonic as a battery supplier for its EVs. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) startup Xpeng Motors has announced updates for its semi-autonomous system at its Tech Day virtual briefing. Xpeng has released Xpilot 3.5, the latest version of its advanced driver assistance system (ADAS). It will be available to owners of Xpeng's P5 car, which was launched this year. The upgrade will be available to customers in the first half of next year. The Xpilot 3.5 system will introduce a feature called City NGP (Navigation Guided Pilot), that allows the car to change lanes, speed up or slow down, or overtake cars and enter and exit motorways. Xpeng also announced details of the next-generation ADAS called Xpilot 4.0, which be built on a comprehensive hardware upgrade and will include features such as vehicle switch-on to assisted parking. Xpilot 4.0 is scheduled for rollout in the first half of 2023. As well as this, Xpeng also unveiled a new vehicle charger that would give the battery a range of 200 km with just five minutes of charging, reports CNBC. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tata Motors is to invest INR150 billion (USD2 billion) over the next four years to launch 10 new electric vehicle (EV) models, reports The Times of India, citing a top official at Tata. Shailesh Chandra, president of Tata's passenger vehicle business unit, said, "With just two green products right now (Nexon and Tigor EVs), we are getting bookings of 3,000-3,500 units per month. However, we are able to supply only around 1,000 units… We are now lining up new investments to the tune of USD2 billion just for electrics and this would be used to add 10 new green vehicles, boost production capacity and charging infrastructure, and create IP (intellectual property)." He added, revealing more details about the upcoming EV portfolio, that, "This will surely include the 'born electric' products, which would be exclusively developed EVs." As of 24 September, Tata had crossed the 10,000-unit mark of EVs sold. (IHS Markit AutoIntelligence's Tarun Thakur)

- South Korean electric bus manufacturer Edison Motors has sought a loan of around KRW700-800 billion (USD593.91-USD678.76 million) from the Korea Development Bank (KDB) to acquire troubled SsangYong, reports The Korea Herald, citing Edison Motors founder and CEO Kang Young-kwon. The state-run lender KDB is the main creditor of SsangYong. "It is not a credit loan. It is a secured loan with SsangYong's assets as collateral, so there is no reason for the KDB to reject it," said Young-kwon, adding that SsangYong is valued at around KRW2 trillion. During a parliamentary audit session, KDB chairman Lee Dong-gull sounded cautious on the bank's financial support, as the latter has not yet fully evaluated Edison Motors' business proposal. "Even if the KDB rejects the loan request, we can take out secured loans from other banks, albeit with higher interest rates, or even from banks outside of Korea," said Young-kwon. SsangYong and its lead manager, the EY Hanyoung accounting firm, have recommended a South Korean consortium led by Edison Motors as the preferred bidder to acquire SsangYong. The Seoul Bankruptcy Court is widely expected to approve the proposal. (IHS Markit AutoIntelligence's Jamal Amir)

- Lotte Chemical Titan (LCT; Kuala Lumpur, Malaysia), an affiliate of Lotte Chemical (Seoul, South Korea), says that "in view of the increase in worldwide COVID-19 vaccinations and opening up of global economies," the conditions are right to start building a previously announced steam cracker and derivatives complex at Cilegon, Indonesia. LCT says that construction work on the Lotte Chemical Indonesia New Ethylene Project (LINE) is expected to commence in 2022 and be completed by 2025. (IHS Markit Chemical Advisory)

- The cost of the project is about $3.9 billion. LCT will own 51% of the planned complex and Lotte Chemical will have 49%.

- Utpal Sheth, executive director/polyolefins at IHS Markit, earlier told CW that the cracker had been due to start up in 2023, but the pandemic and subsequent financial challenges disrupted the plans.

- Lotte Chemical says that the petrochemical complex will consume 3.2 million metric tons/year (MMt/y) of naphtha and liquefied petroleum gas (LPG) as feedstock. The planned cracker at Cilegon will produce 1.0 MMt/y of ethylene and 520,000 metric tons/year of propylene. Lotte Chemical adds that the complex will also manufacture 250,000 metric tons/year of polypropylene (PP) and 140,000 metric tons/year of butadiene.

- Lotte Chemical expects to generate annual sales of $2.06 billion from the LINE project. LCT says that on completion of the project, the facility will provide enhanced operational efficiencies through integration with the company's existing plants in Indonesia. Lotte currently operates a standalone 450,000-metric tons/year high-density polyethylene/linear low-density polyethylene (HDPE/LLDPE) swing plant there, which runs on outsourced ethylene.

Posted 25 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.