Almost every major US, APAC, and European equity index closed lower on the day. US government bonds closed lower, while benchmark European bonds were mixed. European iTraxx closed lower across IG and high yield, while CDX-NAIG was flat and CDX-NAHY was slightly wider. The US dollar and gold closed higher, while silver, copper, natural gas, and oil closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq flat; S&P 500 -0.3%, DJIA -0.5%, and Russell 2000 -0.8%.

- 10yr US govt bonds closed +4bps/1.68% yield and 30yr bonds +1bp/2.37% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY +3bps/300bps.

- DXY US dollar index closed +0.5%/90.19.

- Gold closed +0.7%/$1,882 per troy oz, silver -1.1%/$28.03 per troy oz, and copper -3.2%/$4.58 per pound.

- Crude oil closed -3.3%/$63.35 per barrel and natural gas closed -1.6%/$2.96 per mmbtu.

- Eat Just gets $170 million investment for cultured meat. The funds for the Eat Just's Good Meat division, now officially a subsidiary, will help accelerate research and development and build capacity in Singapore and the US in preparation for a domestic launch. "There are a lot of benefits to being part of the whole, but Good Meat does need dedicated capital and dedicated resources if it's going to succeed in the way we want," Eat Just Chief Executive Officer Josh Tetrick said in an interview with Bloomberg. Tetrick and the company's chief technology officer, Peter Licari, will retain leadership positions in both businesses and some employees will work in both as well. The company, which currently sells its plant-based egg products in US supermarkets, also raised $200 million in a funding round in March. At the time, the company was valued at more than $1 billion, and that amount has not changed with the new funding, the company said. Last year, Eat Just became the first company to sell cultivated meat to the public when it started offering cell-grown chicken in a restaurant in Singapore; another Singapore restaurant will soon join it. Just Eat has also started selling through Foodpanda, a food and grocery delivery platform in Asia. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Kia gave its EV6 electric vehicle (EV) a New York introduction yesterday (18 May), while also announcing that Kia Motors America is being renamed Kia America as part of its global brand strategy. The US version of the EV6 shares most of the technology and powertrain announced for the global version, including two battery options and the capability to flex between 800-volt and 400-volt operation to enable super-fast charging. In the United States, Kia notes that the EV6's wheelbase (2,900 millimeters, or 114 inches) is as long as that of the Kia Telluride three-row utility vehicle. The US model also comes with the driver assist and augmented reality features included in the global car. The US Environmental Protection Agency (EPA) estimated driving range for the model is 300 miles. (IHS Markit AutoIntelligence's Stephanie Brinley)

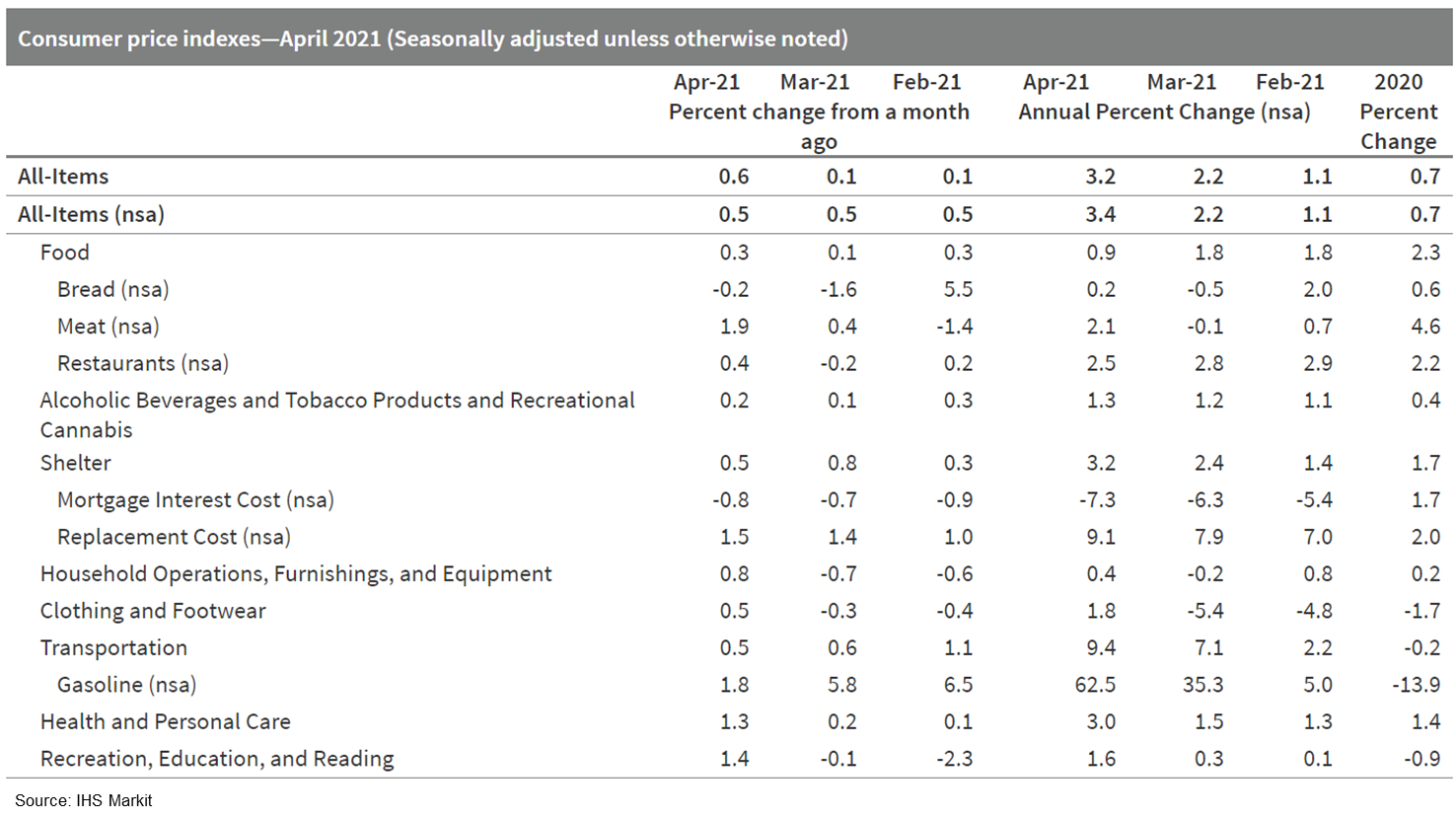

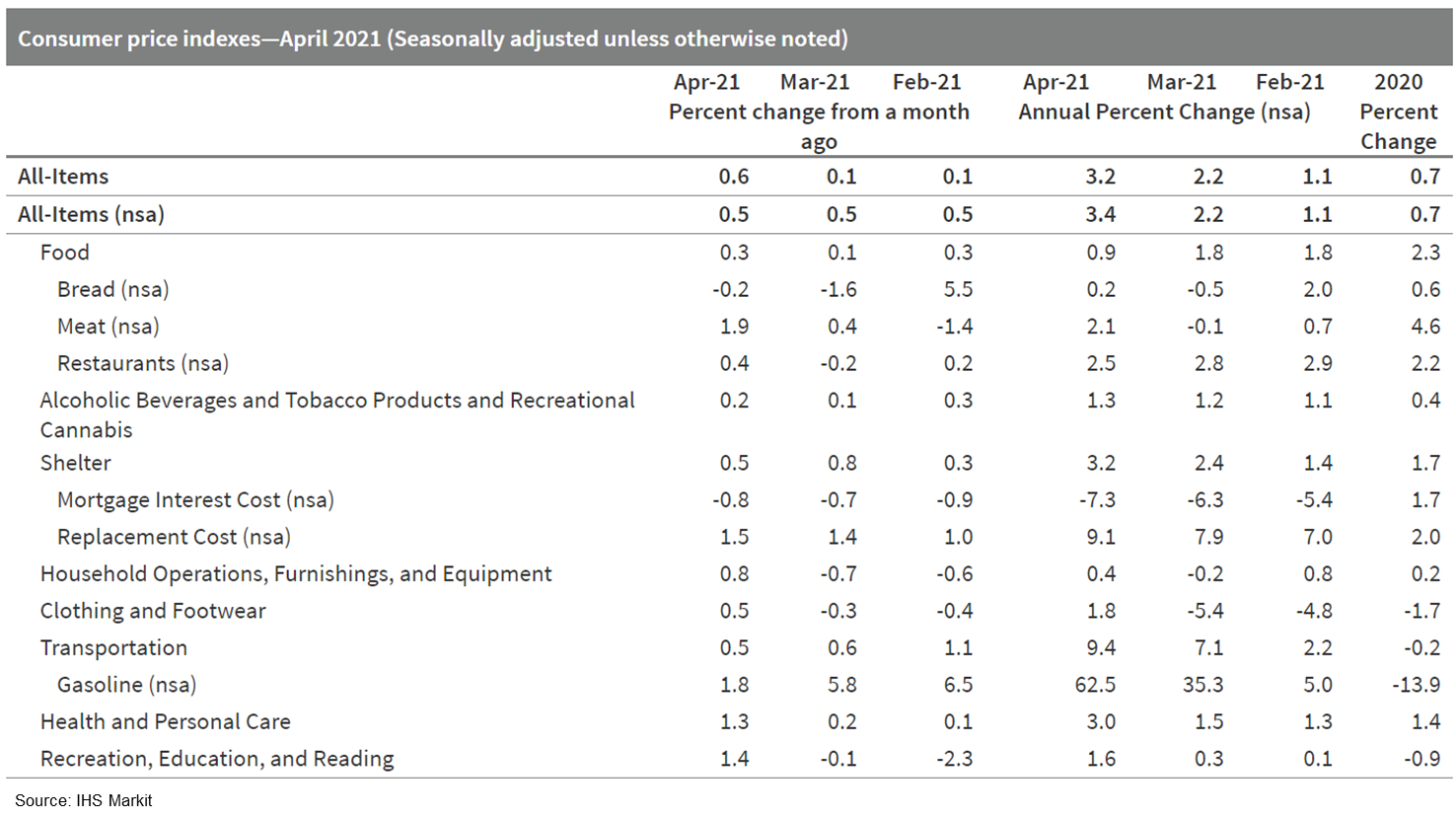

- Canada's consumer prices inflation quickened from the previous month to a 0.6% month on month (m/m) rise on a seasonally adjusted basis (SA) but held steady at 0.5% m/m on a non-seasonally adjusted basis (NSA) for a third straight month. (IHS Markit Economist Arlene Kish)

- Annual inflation moved markedly higher to 3.2% year on year (y/y) SA (up 1 percentage point) and 3.4% y/y NSA (up 1.2 percentage points).

- The average of the core inflation rates ticked 0.2 percentage point higher to 2.1% y/y.

- The inflation upsurge is mostly due to low base-year comparisons and is concentrated in goods inflation. Core services inflation, excluding shelter services, remains mild at 1.2% y/y, yet this pace doubled from the previous month. As in-person services businesses slowly reopen across the country, boosting demand, look for services inflation to heat up.

- Inflation's strong upward momentum is expected and will be temporary thanks mostly to energy price impacts. As such, inflation in 2021 will more than triple the 2020 rate. Inflation will become more subdued and head towards the 2% target range through 2022.

Europe/Middle East/Africa

- European equity markets closed lower, with none of the major indices being higher at any point of the day; UK/Spain -1.2%, France -1.4%, Italy -1.6%, and Germany -1.8%.

- 10yr European govt bonds closed mixed; UK -2bps, Germany -1bp, France/Spain flat, and Italy +3bps.

- iTraxx-Europe closed +1bp/53bps and iTraxx-Xover +5bps/261bps.

- Brent crude closed -3.0%/$66.66 per barrel.

- The UK medium and heavy commercial vehicle (MHCV) market grew by 9.5% year on year (y/y) during the first quarter of 2021. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), demand for vehicles with a gross vehicle weight (GVW) of 6 tons during this period increased from 9,193 units to 10,064 units. Of this total, tractor types led the way in terms of both volume and growth, increasing by 26.6% y/y to 4,456 units. Registrations of tippers also increased, by 10.4% y/y to 1,057 units. However, sales of vehicles with box van bodies dropped 9.7% y/y to 1,084 units and those of vehicles with curtain-sided bodies contracted by 17.6% y/y to 646 units. Sales of vehicles with refuse disposal bodies also dipped modestly, by 1.0% y/y to 575 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- GE Renewable Energy has confirmed the order for 87 Haliade-X 14MW offshore wind turbines for the 1.2GW Dogger Bank C, the final phase of the Dogger Bank offshore wind farm. The company also inked a five-year service and warranty contract, slated to commence in 2026, after commissioning of the project. The contracts are pending financial close, which will take place in late 2021. Installation of the turbines is targeted for 2025. GE has now secured the supply for the entire 3.6GW Dogger Bank project, located between 130km and 190km from the north east coast of England. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The latest batch of eurozone "hard" activity data for March are on the weak side of expectations. Eurozone industrial production rose by a marginal 0.1% month on month (m/m), well below the market consensus expectation (of 0.7% m/m). Manufacturing output was flat. (IHS Markit Economist Ken Wattret)

- Broken down by type of good, March's production data offer mixed signals. Output of consumer durables (-1.2%) and capital goods (-1.0%) contracted on a m/m basis, whereas production of non-durable consumer goods (1.9%) and intermediate goods both rose sharply (0.6%).

- In the first quarter of 2021 overall, industrial production rose for the third straight quarter, but the increase of 0.8% quarter on quarter (q/q) was the weakest by some distance (see first chart below).

- Despite March's lackluster data, the level of eurozone industrial production is just 1.5% below February 2020's pre-pandemic level, with a range of leading indicators, including IHS Markit's PMIs, pointing to strong momentum in the period ahead.

- Eurozone trade figures for March also disappointed. Exports (in value terms) declined by 0.3% m/m, the second fall in the latest three months, with February's m/m rise also revised markedly downwards.

- Exports rose for the third successive quarter in the first quarter, but again, the 1.3% q/q increase was well below the prior two quarters' increases.

- A new study has found that new plant breeding techniques (NBTs) could halve the potential production and market supply losses from the Farm to Fork (F2F) and Biodiversity strategies. On 17 May, HFFA Research GmbH, an independent scientific consultancy, published research which concluded that the use of NBTs in the EU could partially offset a loss of yields from the implementation of the targets from the F2F and Biodiversity strategies - such as reducing pesticide use and risk by 50% and reserving 10% of land for non-productive purposes. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- The International Capital Market Association's (ICMA) Repo Council is conducting a consultation over the potential future role of a "green repo" market. It is considering three main forms of potentially eligible transaction: repo transactions collateralized with assets that are for green or sustainable purposes, like green bonds and loans; transactions where liquidity will be used to fund green and sustainable projects; and repos between counterparties themselves deemed to be dedicated to green and sustainable purposes. (IHS Markit Economist Brian Lawson)

- The first element - provision of a repo market in green bonds - would seek to reduce the scarcity of such assets: a Climate Bond Initiative report covering the first two quarters of 2020 noted that euro-denominated green bonds denominated in euros were on average 5.2 times subscribed, versus 3.1 times coverage for conventional bonds, indicating greater excess demand for environmental, social, and corporate governance (ESG) instruments.

- Use of repos for green projects would force proceeds to be channeled to environmental use, thus "directly boosting the sustainable finance ecosystem".

- Hungary's economic rebound remained on track in the first quarter despite increased COVID-19 restrictions, while accelerating price pressures amid considerable pent-up demand has resulted in the central bank abandoning its hawkish stance with rate hikes possible as early as June. (IHS Markit Economist Dragana Ignjatovic)

- Hungary's Central Statistical Office (KSH) has published a 'flash' GDP estimate for the first quarter. The estimate shows that Hungarian economic activity grew by 1.9% quarter on quarter (q/q) while falling by 2.3% year on year (y/y).

- Although economic activity has fallen for four consecutive quarters in annual terms, in quarterly terms Hungary has maintained growth since the third quarter of 2020. The return to quarterly growth is likely to have been driven by industry and external demand, both of which were largely exempted from the renewed restrictions imposed by the government to tackle rising infection levels.

- In the final KSH release, consumer price inflation accelerated sharply in April, rising by 5.1% y/y and 0.8% month on month (m/m). This is the third consecutive month of accelerating price pressures and the highest y/y reading since November 2012. The sharp acceleration reflected a 13.9% y/y jump in motor vehicle fuel (amid the rise in global energy prices) and a 12.2% y/y rise in alcohol and tobacco prices (amid the rise in excise duties). Consumer price growth averaged 3.7% in the first four months of 2021 compared with 2020.

- Intel Corporation's subsidiary Mobileye and German supplier ZF will jointly develop Advanced Driver Assistance Systems (ADAS) for future Toyota Motor vehicles, according to a company statement. As part of their partnership, Mobileye will provide its camera-based system-on-a-chip, EyeQ4, which ZF will integrate with its Gen21 mid-range radar technology. The solution will power a range of automated safety functions, including automatic emergency braking, adaptive cruise control, and lane keeping, on highways and some secondary roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nigeria's headline inflation rate averaged 18.1% year on year (y/y) in April, from 18.2% y/y in March and 12.3% y/y in the same month last year. Headline inflation accelerated to an average of 17.3% y/y in the first quarter of 2021, from an average of 12.2% in the same period of last year. (IHS Markit Economist Thea Fourie)

- Food inflation continues to be a key drive of higher prices in the Nigerian economy. Nigeria's National Bureau of Statistics (NBS) reported a marginal slowdown in overall food inflation to 22.7% y/y in April from 22.9% in March. The monthly increase in food inflation tapered down to 0.9% month on month (m/m) in April from 1.1% m/m in March.

- "Core" inflation, excluding food and energy costs, remained broadly unchanged at 13.3% y/y in April from 13.2% y/y in the previous month. Health costs (up 15.9% y/y), transport costs (up 14.9% y/y), and miscellaneous goods and services (up 13.1% y/y) recorded the highest annual gains during April.

- The Democratic Republic of Congo (DRC) Finance Minister Nicolas Kazadi met with the IMF's representatives on 3 May 2021 to pick up discussions on a three-year support program for which talks began back in 2019, but which were frozen during last year's onset of the COVID-19 pandemic. (IHS Markit Economist Alisa Strobel)

- The IMF's staff team concluded its Article IV mission to the DRC on 5 June 2019, the first since 2015, stating that it is necessary for the DRC to streamline tax expenditures and consolidate various mining revenue, in addition to pursuing efforts to increase international reserves.

- Since the resumption of co-operation with the IMF in 2019, the DRC received a Rapid Credit Facility Fund of USD368 million in December 2019 and another USD363 million in April 2020. In addition, the DRC has also been eligible for USD20 million in debt relief granted by the IMF in April 2020.

- IHS Markit expects that the DRC's capacity to repay its current obligations to the IMF remains adequate. According to the IMF, the total amount of outstanding credit from the Fund at the end of 2020, once the RCF is disbursed, amount to 50.9% of quota.

Asia-Pacific

- Major APAC equity indices closed lower; Mainland China -0.5%, India -0.6%, Japan -1.3%, and Australia -1.9%.

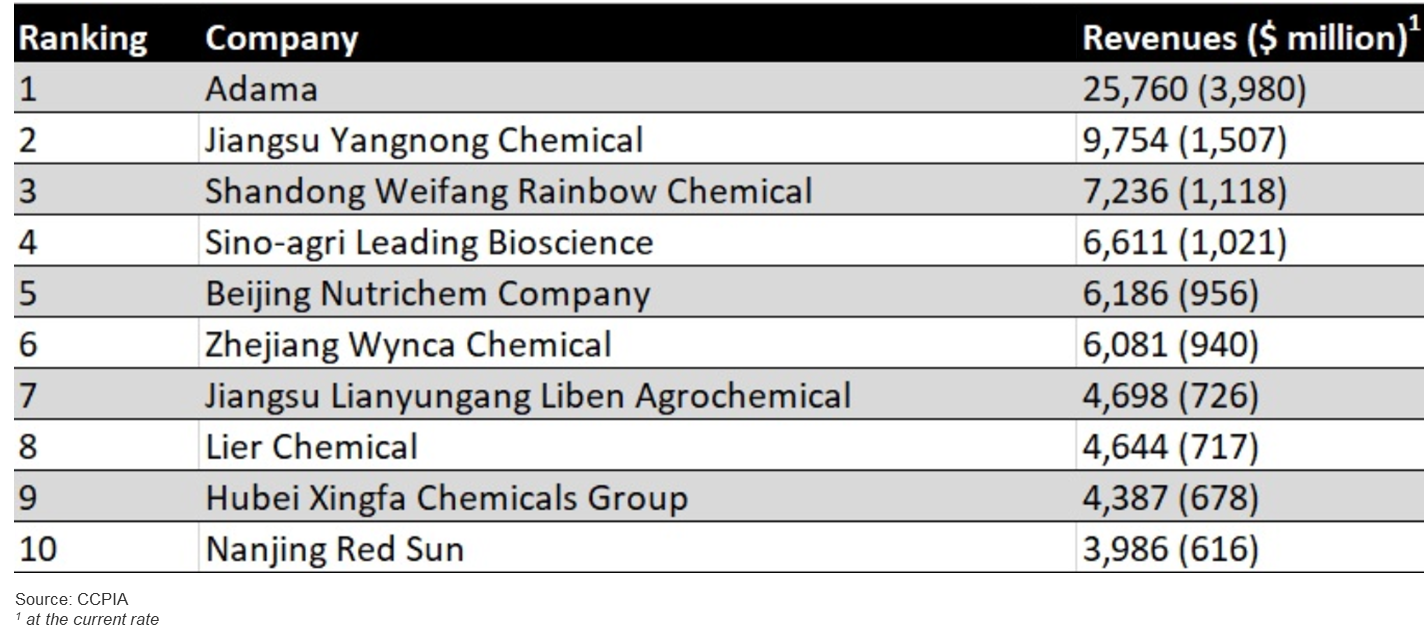

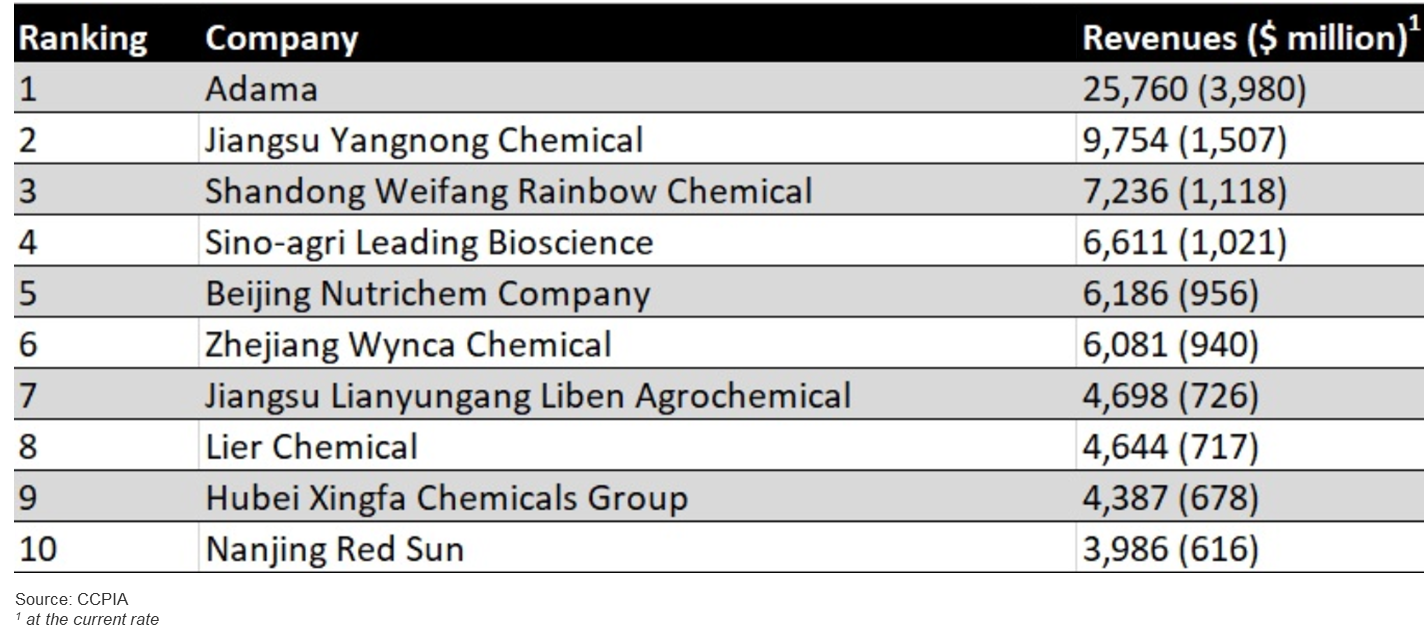

- Combined sales of China's top 100 agrochemical companies rose by 14% in 2020 to settle at Yuan 208,533 million ($32,2018 million at the current rate), reports the China Crop Protection Industry Association (CCPIA). The ranking of the country's leading crop protection businesses was based on agrochemical sales during the year. The cut-off for entry into the list was Yuan 451 million ($70 million). (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- Syngenta Group agrochemical business Adama occupied the top spot with sales of Yuan 25,760 million ($3,980 million), while Jiangsu Yangnong Chemical emerged a distant second with revenues of Yuan 9,754 million ($1,507 million). Shandong Weifang Rainbow Chemical took the third spot with revenues of Yuan 7,236 million ($1,118 million). The top three businesses on the list retained their positions, with all of them reporting improved sales.

- For the top ten companies, combined revenues during the year were recorded at Yuan 79,343 million ($12,258 million), up by 13% over 2019. Nanjing Red Sun was the tenth company and made it to the list with sales of Yuan 3,986 million ($616 million). The number of businesses logging revenues over Yuan 1,000 million ($154.5 million) went up to 64 from 59 a year earlier.

- Lifan Technology, formerly known as Lifan Industry (Group), has started production of its first fully electric multipurpose vehicle (MPV), the 80 V, with battery swap technology at its plant in Chongqing, according to Gasgoo. The company expects to introduce two more models with swappable battery packs this year. Chongqing-based Lifan Industry (Group) began its restructuring process in August 2020. The struggling automaker has long been faced with a risk of bankruptcy owing to low demand for its products and a poor financial performance. To help Lifan continue its operations, the Chongqing government-backed Liangjiang investment fund and Geely have joined forces to invest in the company. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Geely Technology Group and Farasis Energy will set up a joint venture (JV) focused on battery-related businesses, according to Gasgoo. The JV will involve a registered capital of CNY1 billion (USD155.5 million), with Geely holding 65%. The scope of the JV includes research and development (R&D), as well as manufacturing and sales of energy storage and management systems such as lithium-ion (Li-ion) battery, battery module management system, and electric vehicle (EV) charging system. The JV will also work towards research, development, production, and sales of battery components such as cathode and anode materials, electrolyte, and membrane separators. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Posted 19 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.