US and APAC equity indices closed mixed, while all major European markets were lower. US government bonds closed mixed and the curve was steeper on the day, while most benchmark European government bonds closed unchanged. CDX-NA closed modestly wider across IG and high yield, iTraxx-Xover also wider, and iTraxx-Europe was flat on the day. The US dollar, gold, silver, and natural gas closed higher, while oil and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the DJIA +0.3% and S&P 500 +0.3% closing at new record highs; Nasdaq -0.2% and Russell 2000 -0.9%.

- 10yr US govt bonds closed -1bp/1.28% yield and 30yr bonds +1bp/1.94% yield.

- CDX-NAIG closed +1bp/49bps and CDX-NAHY +3bps/287bps.

- DXY US dollar index closed +0.1%/92.63.

- Gold closed +0.7%/$1,790 per troy oz, silver +0.1%/$23.79 per troy oz, and copper -1.5%/$4.33 per pound.

- Crude oil closed -1.7%/$67.29 per barrel and natural gas closed +2.2%/$3.95 per mmbtu.

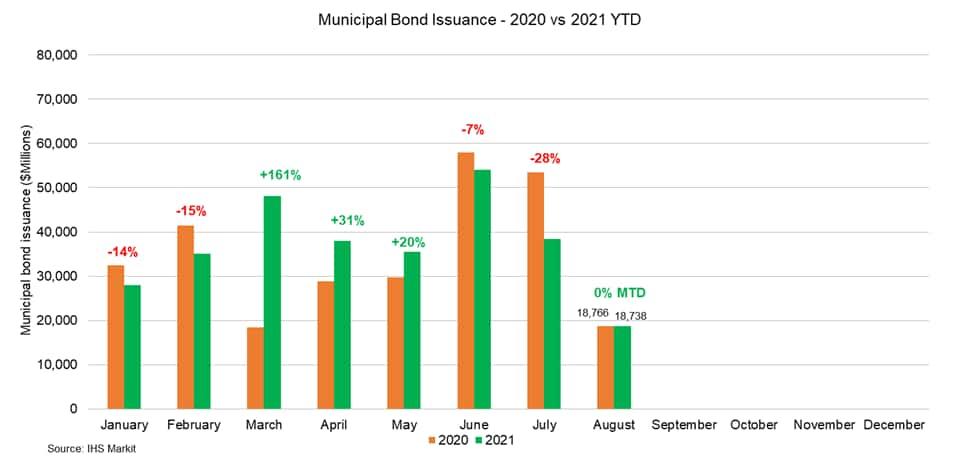

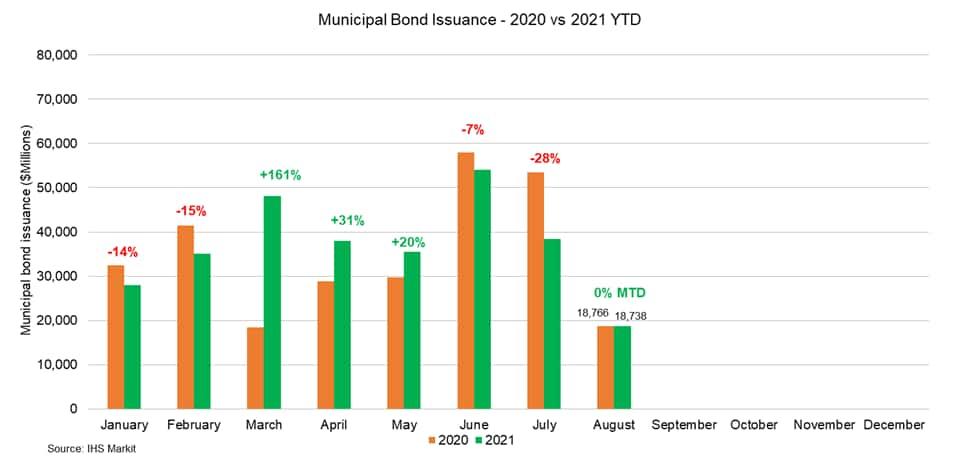

- Municipal bond new issue activity over the course of the month has been steady after last week's calendar supplied $9.2 billion of paper as demand continues to overpower supply throughout the seasonal redemption cycle, a major driving force behind the negative net supply environment. As large institutional accounts seek to deploy cash across various credits, the $832 million Allegheny County Airport Authority (A2/-A/-/A+) senior managed by Citi, experienced healthy order flow last week after bumps of 9bps were registered in the front end of the scale. The Arizona Industrial Development Authority also faced robust buyer demand for a $239 million education facility revenue bonds issue after bumps were registered across every maturity, reaching a peak of 20bps in the 30yr duration. Accounts continue to actively search the primary space for greater yield given the continual credit spread compression across high grade credits, with a portion of demand shifting to sub-investment grade paper lending greater returns. This week's calendar is positioned to offer $11.3 billion of new issue bonds, spanning across 253 deals and outpacing the 2021 weekly average of $9.2 billion as larger issuers step up to the plate and price muni paper. The New York Liberty Development Corporation (-/A/A-) will lead this week's negotiated calendar, selling $1.2 billion of revenue refunding bonds spanning 11/2027-11/2051, carrying a green bond designation from Sustainalytics. The City of New York (Aa2/AA/AA-/AA+) will also tap into the primary space with Citi as senior manager to sell $1 billion of general obligation bonds across two series, selling on Wednesday. This week's competitive calendar will consist of 136 issues for a total of $2.1 billion led by The City of New Orleans (A2/A+/A), auctioning $285 million of public improvement bonds selling on Wednesday. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- Cash and short-term investments on corporate balance sheets globally are at an all-time high of $6.84 trillion, according to data from S&P Global, extrapolated from second-quarter earnings reports. That is 45% higher than the average in the five years preceding the pandemic and a 2.6% increase from the previous quarter. (WSJ)

- The number of people dying with COVID-19 in U.S. hospitals is hitting previous highs in some hot-spot states with low-to-average vaccination rates, upending hopes the virus has become less lethal. In Florida, an average of about 203 people a day are dying in the hospital with confirmed or suspected COVID, matching the state's November peak, according to U.S. Department of Health and Human Services data. That's a daily average of about 9 per million residents, the data show. Louisiana, Arkansas and Missouri have also seen deaths among patients with Covid soar in the past two weeks. (Bloomberg)

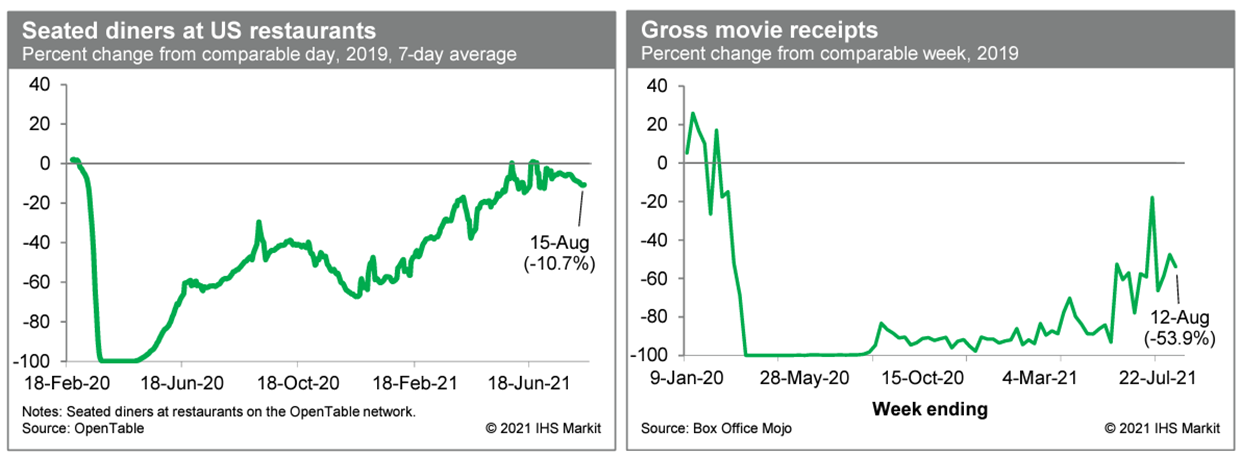

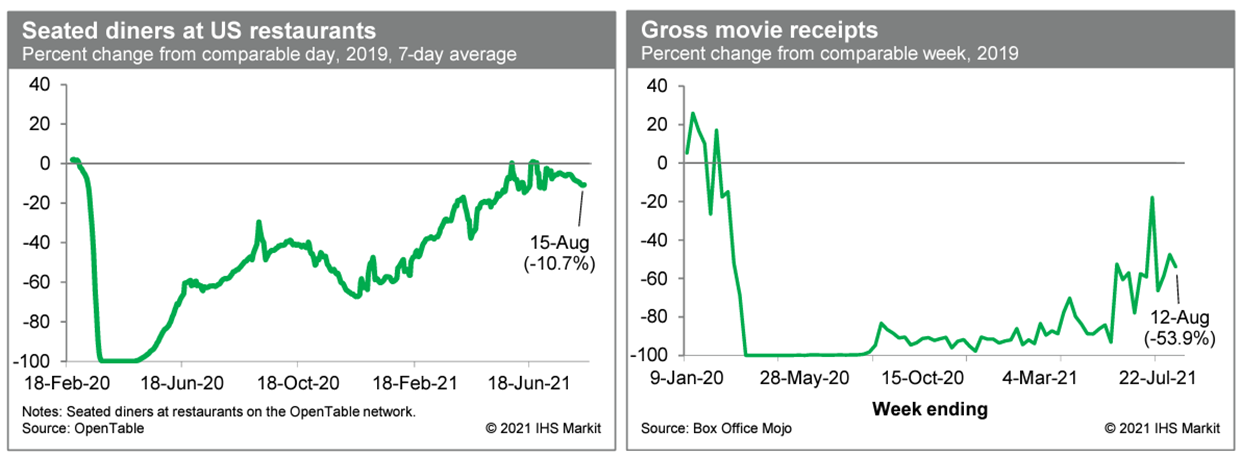

- Averaged over the last week, the count of seated diners on the OpenTable platform was about 10.7% below the comparable period in 2019. This comparison has been softening over the last couple of weeks and suggests that people may be shying away from dining out in the face of the rapidly spreading Delta variant of the COVID-19 virus. Meanwhile, box-office revenues last week were about 54% below the comparable week in 2019, similar to most readings in recent weeks. Movie-theater activity remains weak but is not showing signs of backtracking in the face of Delta. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Given recent progress around increasing government spending on infrastructure, IHS Markit's Perception Analytics team spoke with investors and analysts to understand how potential legislation on infrastructure spending has impacted their investment theses to better understand how the investment community is evaluating the impact. Additionally, the market was probed on how affected companies should be framing conversations with investors about the impact such legislation would have on their business and investment case. Highlights in the report (click here to open the full report) include:

- Several investors and analysts assert that a potential infrastructure bill in the US has positively impacted their willingness to invest in related sectors and note the importance of companies cautiously framing how they stand to benefit.

- "Some of these companies are driven by macro infrastructure spending, so they stand to benefit. It is important for companies to explain how their business is driven by macro impacts such as this to make sure expectations are appropriately understood."

- Some participants assert that the potential passing of an infrastructure spending bill has already been priced in by the market, so there is less upside optionality.

- "It has been part of our assumption that some type of spending bill would get passed; therefore, it is included in our outlook for the industrials group over the next several years."

- Furthermore, many participants remain unsure of the impact that the passing of an infrastructure bill will have and believe it is too early to begin speculating on what stocks stand to benefit.

- "These things probably take longer to play out. We would not invest in something because we think there is a big infrastructure bill."

- Global demand for frozen food packaging is projected to increase by 50% in eight years with plastic packaging benefitting the most, according to consultancy Reports and Data. The packaging market is expected to reach USD60.58 billion in 2028 from USD39.78 billion in 2020 as ready-meal and convenience food demand is rising. The European market should report the largest revenue share, while the Asian-Pacific should grow to the faster annual rate. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- "An increasing global population, a rise in disposable income, and improving living standards of consumers in developing countries are also contributing significantly to the rising demand", the report reads.

- Manufacturers are investing in the development of more efficient packaging and the plastics segment is expected to register the largest growth as the material does not alter food taste and can be easily integrated in the processing line.

- In September 2020, SABIC, which is a global leader in diversified chemicals, announced the launch of a new packaging solution, which is a combination of new Polyethylene (PE) grade with innovative film production technology.

- Major frozen food brands are aiming to meet sustainability goals with the increasing use of recycled post-consumer content in their packaging, which is boosting the production of recyclable frozen food packaging solutions.

- In February 2021, ProAmpac announced the launch of ProActive Recyclable R-2000F for premium frozen food products. The polyethylene-based laminated structure is designed to provide excellent performance in cold temperature conditions.

- US-based autonomous vehicle (AV) LiDAR developer Innovusion has raised USD66 million in a Series B Plus funding round led by Guotai Junan International Private Equity Fund (GTJAI). New investor Shunwei Capital and existing investors Nio Capital, F-Prime Capital, Eight Roads Ventures, and Temasek also participated in the round. The company plans to use the infused capital to increase the production capabilities of its automotive-grade LiDARs, expanding their global footprint, and broadening its research-and-development (R&D) efforts. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indorama Ventures (Bangkok, Thailand) has agreed to acquire surfactants producer Oxiteno from Ultra Group (São Paulo, Brazil) for $1.3 billion, with a deferred payment of $150 million in 2024. The transaction is subject to customary conditions to closing, including approval from the relevant regulatory authorities. It is expected to close in the first quarter of 2022 and will be earnings-accretive immediately, Indorama says. (IHS Markit Chemical Advisory)

- Indorama says the financing is secured through deferred payments, using existing extra cash, and short-term loans against working capital, with the balance as long-term debt. Indorama expects to realize synergies of $100 million by 2025 through portfolio adjustments, asset optimization, and operational excellence.

- Indorama says the acquisition will give it a "unique portfolio" of high-value surfactants and significantly extend the company's newly created integrated oxides and derivatives (IOD) business. IOD's downstream portfolio comprises surfactants, propylene oxide, propylene glycol, and purified ethylene oxide (EO).

- The deal will enable Indorama to assume a market position in technologies catering to niche, IP-rich, and value-added applications in home and personal care, agricultural chemicals, coatings, and oil and gas markets, the company says. "The surfactants market has seen consistent growth over the last decade, driven by trends in population growth, urbanization, and increasing hygiene awareness amid the COVID-19 pandemic," the company says.

- Oxiteno is a leading integrated surfactants producer, catering to end-use markets in Latin America. The company's surfactant products are mainly based on EO. Oxiteno has production at Camacari, Maua, and Triunfo, Brazil; Coatzacoalcos, Guadalajara, and San Juan del Rio, Mexico; Montevideo, Uruguay; Santa Rita, Venezuela; and Pasadena, Texas. It also operates business offices in China, Belgium, Argentina, and Colombia.

- The Central Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP) at its August meeting raised its key policy interest rate from 0.25% to 0.5%, the first change since April 2020. (IHS Markit Economist Jeremy Smith)

- The consumer price index (CPI) increased by 1.0% month on month (m/m) in July, pushing the annual increase to 3.8% year on year (y/y), falling further outside the 1-3% target range.

- The BCRP continues to stress the transitory nature of the ongoing price shocks, noting that this year's consumer price increases are largely explained by the rising international price of key food inputs such as staple grains and oils, the rebound in energy markets after last year's collapse, and the depreciation of the Peruvian sol against the US dollar, which make imports more expensive. Excluding food and energy from the CPI, July's inflation reading was 2.1% y/y, near the mid-point of the target range.

- Although the Peruvian monetary authority projects inflation to return to the target range within the next year, it is nonetheless unwilling to permit inflation expectations to continue rising. Twelve-month inflation expectations have increased by 1.1 percentage points this year and are outside the target range for the first time since April 2017.

- In addition, commodity price shocks in Peru are not so readily dismissible as in large, developed economies; the food and beverages category alone accounts for as much as 37.8% of the Peruvian consumption basket, and crude oil-price fluctuations can exert an outsized influence.

Europe/Middle East/Africa

- All major European equity indices closed lower; Germany -0.3%, Italy/Spain/France -0.8%, and UK -0.9%.

- Most 10yr European govt bonds closed close to unchanged except for Italy +1bp; Germany/France/Spain/UK flat.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover +2bps/234bps.

- Brent crude closed -1.5%/$69.51 per barrel.

- Tesla CEO Elon Musk has said that he is targeting the start of car manufacturing at the electric vehicle (EV) company's first European facility in October, although this timeline is subject to ongoing regulatory approval issues. According to a Reuters report, Musk made the comments when visiting the factory site in Gruenheide, Germany, in the company of Armin Laschet, leader of the Christian Democratic Union (CDU) party and conservative candidate to succeed Angela Merkel as chancellor. However, the local authority's environment agency in Brandenburg has yet to give full approval for the site's construction, which could delay the start of production (SoP) until next year. (IHS Markit AutoIntelligence's Tim Urquhart)

- Faurecia has been accepted as the preferred bidder by the Hueck family for the majority stake the family block holds in German automotive lighting specialist Hella, according to a company statement A preliminary deal has been agreed between the two parties for Faurecia to launch a public tender cash offer for all Hella shares at a price of EUR60 per share (USD70.72), although the total offer per share will be EUR60.96 in order to include a dividend of EUR0.96, which is expected to be agreed at Hella's annual general meeting (AGM) on 30 September. This will be paid by Hella to all its shareholders before the deal is closed. The acquisition of the Hueck family's pool of shares will be made through a mix of EUR3.4 billion of cash and up to 13,571,428 newly issued Faurecia shares. This will give the Hueck family 9% of the share capital of Faurecia when the deal is finalized after an 18-month lock up period. A member of the Hueck family will be offered a seat on the Faurecia board. The deal, which values Hella at EUR6.7 billion, has been unanimously approved by Faurecia's Board of Directors and received the support of Hella's management. By signing off on this deal, Faurecia's management and the Hueck family are looking to create the world's seventh biggest Tier 1 automotive supplier group, which will have the right combination of scale, and technologies to maintain its relevance and drive growth as the industry faces a period of unprecedented change. Hella is already advanced with its offerings of battery electric vehicle (BEVs) powertrain components, including sensors and actuators, while Faurecia is a leader in hydrogen fuel cell systems and hybrid systems. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's unemployment rate stood at 8.0% during the second quarter. This is slightly down from 8.1% during the first quarter of the year. (IHS Markit Economist Diego Iscaro)

- The unemployment rate, as measured by the ILO methodology, has fluctuated sharply since the start of the pandemic, as fiscal measures to support households' incomes led many potential jobseekers not to actively look for employment, lowering the labor participation rate.

- A lower participation rate has a depressing effect on the labor force (which is defined as the working-age population times the participation rate), lowering the unemployment rate. However, the second quarter's figures paint an encouraging picture.

- The participation rate continued to improve as the economy gradually reopened since May. It reached 72.7% during the second quarter, slightly above the 2019 average of 72.6%.

- Moreover, the employment rate (i.e., the ratio of the employed to the working-age population) improved further from 66.6% to 66.9%, reaching its highest level since at least 2003.

- Alternative measures of unemployment provide a slightly different picture. For example, the number of unemployed people as measured by the number of jobseekers registered at Pôle Emploi (the government's job agency) remains 6% above its pre-pandemic level.

- France's hemp industry is set to produce CBD after the Cassation Court has overturned a rule which banned the sale of CBD in June 2021, despite EU legalization. The Cassation Court has released a draft decree, that was notified to the European Commission in July 2021, to authorize "the cultivation, import, export and industrial and commercial use of hemp" is "extended to all parts of the plant", if its THC content is less than 0.2%. The text bans the sale of hemp flowers and leaves (even if they are THC-free), which can be smoked, justifying this ban by "reasons of public order and health". The planted acreage reached 17,900 hectares in 2020 and is expected to peak at 25,000-30,000 hectares in 2030, according to USDA. (IHS Markit Food and Agricultural Policy's Jose Gutierrez)

- According to the latest monthly production value index (PVI) published by Statistics Sweden (SCB), Swedish calendar-adjusted private-sector output in June increased by 10.5% year on year (y/y). Hardly budging from April's convincing gain of 11.0% y/y, this brought the second-quarter growth rate to 10.7% y/y. (IHS Markit Economist Venla Sipilä)

- A substantial push from the motor vehicle industry lifted industrial-sector production growth to 16.7% y/y in June. Conversely, mining and quarrying activity contracted y/y.

- The construction sector expanded by 2.0% y/y in June, thus returning to growth following an increase of around the same rate in February. Even against a weak base, this sector contracted by 1.7% y/y in the first half of 2021.

- Services supply on the whole increased by an accelerated rate of 20.1% y/y in June and by 15.5% y/y in January-June. Among private service fields, the information and communications industry contributed the most (2.0 percentage points) to private-sector production, growing by 17.6% y/y.

- Related figures from the SCB show that growth of Sweden's calendar-adjusted household consumption in June settled at 7.3% y/y, resulting in accelerated growth of 8.0% y/y for the second quarter. Transport and retail sales and service of motor vehicles showed the largest positive contribution to growth, while none of the key sectors acted as a drag.

- Furthermore, preliminary calendar-adjusted data for industrial orders signal growth of 24.4% y/y in June. External orders increased by 36.1% y/y, while domestic orders increased by 10.8% y/y. Seasonal data still suggest falling domestic orders m/m in June.

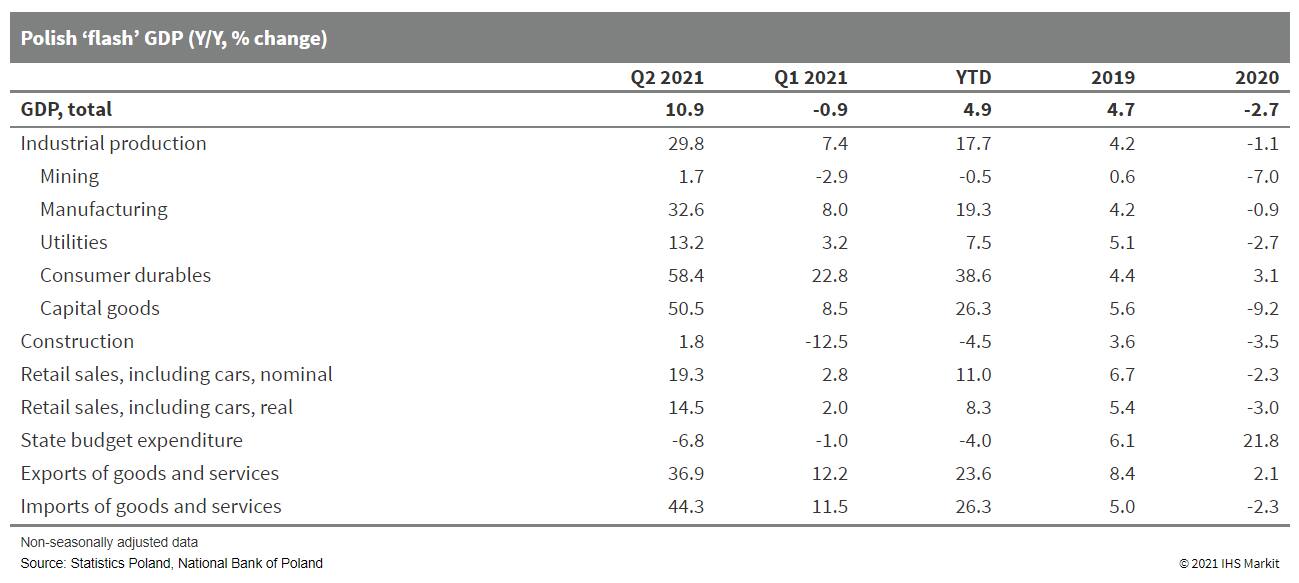

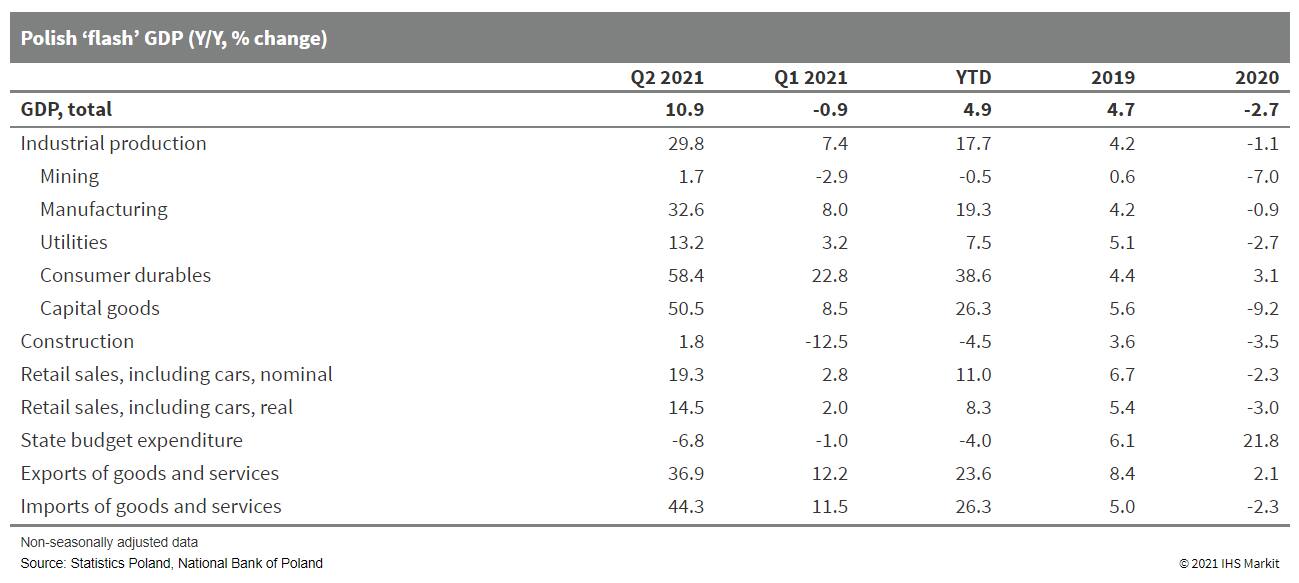

- In Poland, the positive GDP second-quarter growth figures were clouded by rising inflation, which reached a 10-year high of 5.0% year on year (y/y) in July, putting pressure on the central bank. (IHS Markit Economist Sharon Fisher)

- The 'flash' estimate indicated that Poland's seasonally adjusted GDP jumped by 1.9% quarter on quarter (q/q) and 10.7% y/y in the second quarter. Unadjusted GDP soared by 10.9% y/y, a record high.

- Although the breakdown of GDP will not be available until 31 August, monthly data indicate that household consumption was the main driver of growth. In contrast, net exports appear to have had a negative impact, as balance-of-payments data signal that imports of goods and services rose much faster than exports.

- Second-quarter GDP was boosted not only by the low base from 2020, but also by the strong rebound in activity following the lifting of coronavirus disease 2019 (COVID-19) restrictions. Household consumption benefited from pent-up demand and continued strength of the labor market.

- Up by 0.4% month on month (m/m), July inflation was driven by the rising prices of transport (up by 3.1% m/m), recreation and culture (up by 1.3%), household furnishings and equipment (up by 1.2%), and restaurants and hotels (up by 0.9%). Clothing and food recorded negative m/m price growth, helping to diminish overall inflation.

Asia-Pacific

- Major APAC equity markets closed mixed; India +0.3%, Mainland China flat, Australia -0.6%, Hong Kong -0.8%, and Japan -1.6%.

- China's factory output and retail sales growth slowed sharply and missed expectations in July, as new COVID-19 outbreaks and floods disrupted business operations, adding to signs the economic recovery is losing momentum. China's economy has rebounded to its pre-pandemic growth levels, but the expansion is losing steam as businesses grapple with higher costs and supply bottlenecks. (Reuters)

- Industrial output +6.4% y/y vs June's +8.3%, Reuters poll +7.8%

- Retail sales +8.5% y/y vs June's +12.1%, Reuters poll +11.5%

- Fixed asset investment +10.3% in Jan-July, Reuters poll +11.3%

- Mainland China's average new home prices increased by 0.30% month on month (m/m) in July, down 0.11 percentage point from June, according to the survey conducted by the National Bureau of Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- The decline in July month-on-month new home price inflation was broad-based across city tiers, with tier-1 cities leading the disinflation. Notably, month-on-month new home price inflation in Guangzhou declined for the second month in a row, reaching 0.2% m/m in July, down 0.8 percentage point from the prior month. The capital city Beijing reported new home price inflation of 0.8% m/m in July, the highest rate among mainland China's four tier-1 cities despite falling 0.1 percentage point from June.

- Up to 51 out of the 70 surveyed cities registered month-on-month new home price gains in July, down by 4 cities from June. On the flip side, 16 cities reported month-on-month new home price declines, up from 12 cities in June and highest level so far this year.

- Average year-on-year (y/y) new home price inflation further edged down by 0.2 percentage point to 4.1% y/y in July. The change was also broad-based, with the decrease in tier-3 cities the main driver behind the overall disinflation. By end-July, the decline in year-on-year new home price inflation of tier-3 cities had persisted for four consecutive months.

- China's seaborne crude oil imports in August are set to reach a five-month high of nearly 10.2 MMb/d, up from 8.8 MMb/d in July, due to delays in cargo discharge from July-arrival vessels pushing volumes into August. Data from IHS Markit Commodities at Sea shows China's seaborne imports in the first 10 days of August trending at a record high of 11.4 MMb/d, with a significant volume of crude from Saudi Arabia - nearly 3.3 MMb/d so far - being discharged. The lag in discharge activity last month was due to congestion after Typhoon In-Fa made landfall in Zhoushan, Zhejiang province on 25 July, disrupting operations in nearby ports for several days. As a result, vessel congestion off China rose briefly, with the average number of anchored dirty vessels rising to 33 in the last week of July, from 21 in the previous week, according to data from Commodities at Sea's Tankers at Sea. (IHS Markit Maritime and Trade's Fotios Katsoulas)

- Xiaomi is looking to set up its auto business headquarters in Beijing where it will set up its first factory, reports Gasgoo citing local media outlet Auto Business Review. Over the last few months, the company has been reported to be in talks with Beijing, Shanghai, Wuhan, Hefei, and Xi'an over where to locate its auto project. The latest development follows the company's plans to hire 20 engineers for autonomous technology in Haidian District of Beijing. The company is yet to confirm its plans. (IHS Markit AutoIntelligence's Isha Sharma)

- Taiwan's Foxconn has confirmed at a shareholders' meeting that it will establish new manufacturing facilities for electric vehicles (EVs) in Thailand and the United States, reports Nikkei Asia. The company aims to reach mass production in 2023. In addition to the US and Thailand, the company is also looking into the possibility of establishing factories in Europe as part of its global EV footprint strategy, according to Foxconn chairman Young Liu. (IHS Markit AutoIntelligence's Jamal Amir)

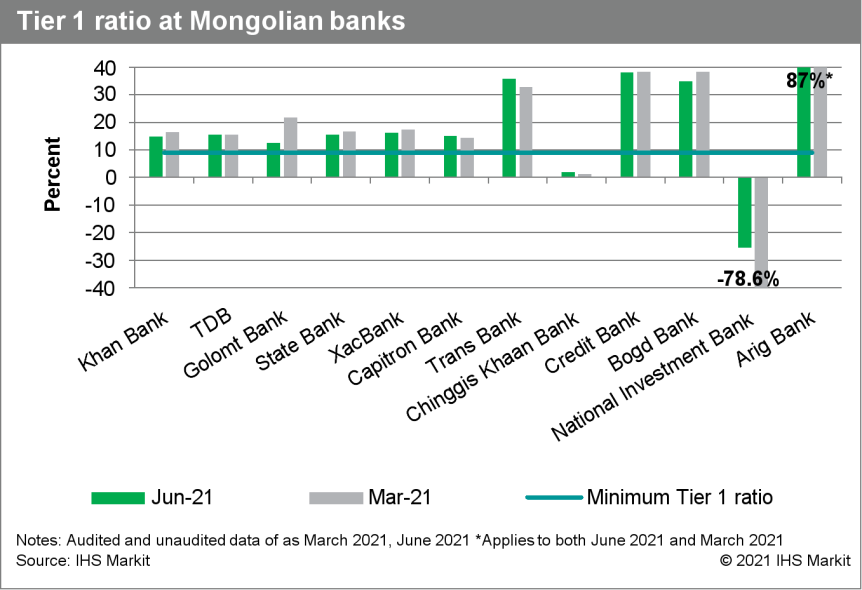

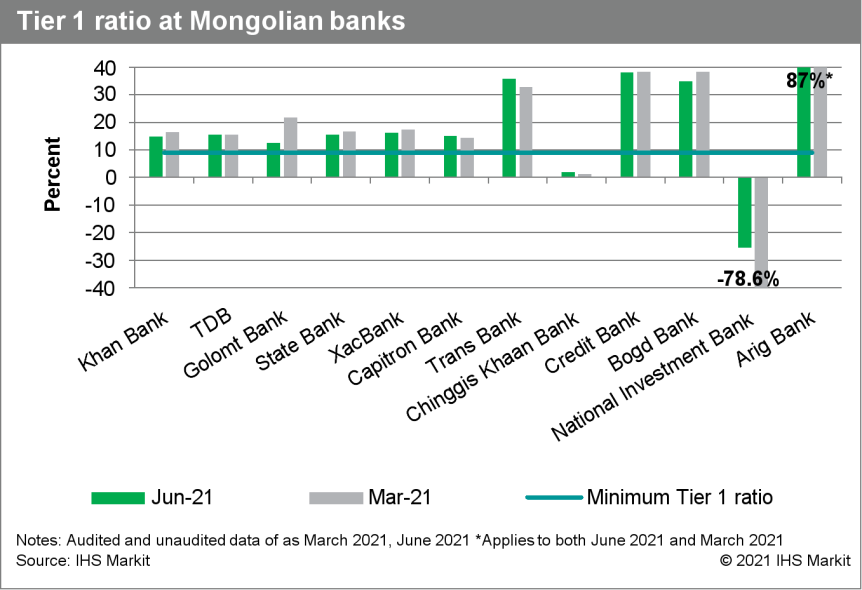

- Data for Mongolia's second quarter of 2021 highlight strong credit growth, outpaced by an increase in deposit growth, of 10.2% year on year (y/y) and 31.9% y/y, respectively. Deposit growth strengthened during another wave of COVID-19 infections in April-May and early June, triggering a fresh round of containment measures. (IHS Markit Banking Risk's Natasha McSwiggan)

- Credit growth strengthened in the second quarter of 2021, reaching 10.2% y/y, recovering from the sharp contraction in 2020. During 2020, the local-currency required reserve ratio (RRR) was reduced from 8.5% in March 2020 to 6% currently. The lower RRR has likely supported ongoing local-currency credit expansion; foreign-currency loans account for just 7.4% of total loans, as of the second quarter of 2021.

- Banking-sector support measures have continued to contain a rise in impairment. The BOM's recently released 2020 annual report indicates significant mortgage loan moratorium usage. According to the document, borrowers with mortgage loans amounting to MNT2 trillion (USD761 million) had deferred their monthly mortgage payments, equivalent to over 40% of total mortgage loans and 13% of total loans.

- Deposit growth increased in the second quarter, likely aided by weaker consumer confidence. Mongolia's banking-sector deposit base expanded by more than 30% y/y in June. This boost came at a time when the country was experiencing another wave of COVID-19 cases, where the spike in infections weakened consumer confidence and demand and encouraged depositors to place funds in banks.

- The sector's capital adequacy ratio has weakened. The ratio fell to 15.4% in 2020, when last reported, down from 16.6% in 2019, likely as a result of a larger allocation of loans that receive a higher weighting in the risk-weighted assets. Although the sector's ratio stands well above regulatory minimums, the banking sector's true capital adequacy and overall stability will remain harder to assess because of the ongoing forbearance measures.

- Japan's real GDP rebounds in Q2 but containment measures could continue to weigh on a recovery. (IHS Markit Economist Harumi Taguchi)

- Japan's real GDP rose in the second quarter of 2021, moving up 0.3% quarter on quarter (q/q, or 1.3% q/q annualized) after a 0.9% q/q (or 3.7% q/q annualized) drop in the previous quarter. Despite the state of emergency in several prefectures including Tokyo during the quarter, the major reasons behind improvement were rebounds in private consumption and private capital expenditure (capex) offsetting a decline in net exports. However, continued sluggishness due to persistent negative impact from the COVID-19 virus pandemic weighed on Japan's recovery so that JPY538.7 trillion (USD4.9 trillion) is still below the pre-pandemic level.

- Private consumption rose by 0.8% q/q following a 1.0% q/q drop, largely driven by 1.6% q/q rise in spending on services. Spending on durable and semi-durable goods also rebounded modestly from the previous quarter. Although containment measures included shortening restaurant hours and closing large commercial facilities, the increase in private consumption suggests that containment measures have been less effective in reducing foot traffic.

- Capex also turned to increase with a 1.7% q/q drop following a 1.3% q/q drop in the previous quarter. Although details of investment are not available yet, the improvement in machinery orders suggests stronger demand in machinery in line with rising capacity utilization, thanks to a continued increase in exports. Residential investment continued to increase, up by 2.1% in line with improved new housing statistics.

- Exports of goods and services rose by 2.9% q/q for four consecutive quarters of increase, reflecting the resumption of economic activity in Japan's trading partners. However, semiconductor shortages weighed on goods exports while border controls continued to limit services exports. Moreover, imports of goods and services rose, outpacing exports with a 3.3% q/q rise, which led to two consecutive quarters of negative contribution to q/q changes of real GDP.

- Partners Mainstream Renewable Power and Aker Offshore Wind will acquire 50% stake in Progression Energy's 800 MW floating wind farm in Japan. The parties will enter into exclusive negotiations with the intention to establish a special purpose vehicle, under which the project will be jointly developed. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- South Korea has awarded its first floating offshore wind license to developers MacQuarie's Green Energy Group (GIG) and TotalEnergies. The planned project is for a 1.5 GW floating offshore wind farm in the region of Ulsan. The electricity business license (EBL) was awarded by the Ministry of Trade, Industry, and Energy through its Electricity Regulatory Commission, and for the first phase of the project of 504 MW. The next step for the development will be to commence environmental impact assessments. The developers are targeting construction of 2024 and have committed to using a local supply chain where possible. IT is likely that the local Korean shipbuilding yards will be involved. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- A South Korean consortium, led by the Korea Maritime & Ocean University (KOMOU) and classification society Korean Register (KR), is planning to develop a floating offshore plant to produce hydrogen using wind power. The consortium aims to produce a 1 MW pilot plant by 2022 before demonstrating a gigawatt-class plant by 2030. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Mercedes-Benz India Limited (MBIL) is planning the launch of a direct customer-to-customer selling platform called Marketplace, reports The Telegraph. According to the source, MBIL's used car business comprises 20% of its sales, and the automaker aims to increase this by 30%. Commenting on the launch, MBIL CEO Martin Schwenk said, "There are two ways in which used cars sell in the market. About 20 percent of the customers trade in with the dealer while 80 per cent shop around. The used car business is largely unstructured. With the Marketplace we are trying to do it in a structured way. The Marketplace will enable direct sales between customer to customer, better transparency, support from dealers, greater inventory." He added, "The market is relatively stable and we are witnessing an increase in demand for used cars." (IHS Markit AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.