All major US equity indices closed lower, while APAC and European markets were mixed. US government and most benchmark European bonds closed higher. European iTraxx closed slightly wider across IG and high yield, while CDX-NA was close to unchanged on the day. Gold, silver, natural gas, and Brent closed higher, WTI was flat, and the US dollar and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower; Nasdaq -0.5%, S&P 500 -0.6%, DJIA -0.8%, and Russell 2000 -1.4%.

- 10yr US govt bonds closed -4bps/1.29% yield and 30yr bonds -5bps/1.86% yield.

- CDX-NAIG closed flat/47bps and CDX-NAHY +1bp/276bps.

- DXY US dollar index closed -0.1%/92.62.

- Gold closed +0.7%/$1,807 per troy oz, silver +0.4%/$23.89 per troy oz, and copper -1.1%/$4.32 per pound.

- Crude oil closed flat/$70.46 per barrel and natural gas closed +0.6%/$5.26 per mmbtu.

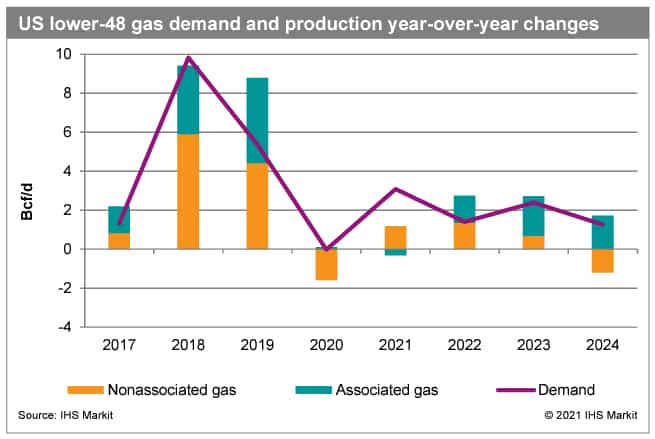

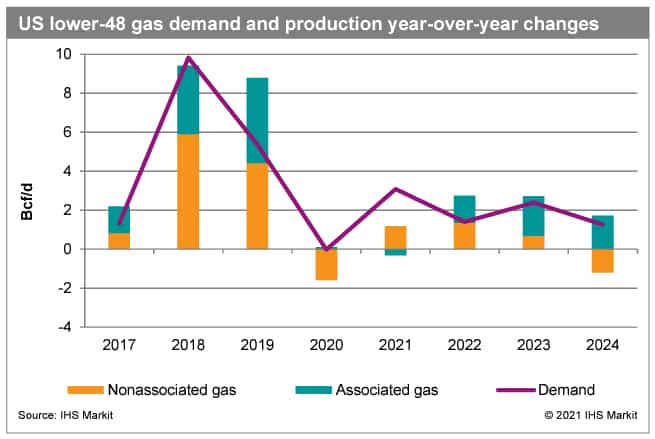

- The current period of stagnant US natural gas production will not last. Following a steep decline in 2020 owing to low commodity prices and COVID-19-induced global oil and gas demand destruction, gas production is on its way to recovery with Haynesville and associated gas production leading the way, with growth unfolding in two stages after the current period of tepid growth. (IHS Markit Energy Advisory's Raoul LeBlanc and Global Gas' Sara El-Hakim)

- The US lower-48 natural gas market is currently undersupplied as demand has recovered much faster than supply. We expect Henry Hub gas prices to average approximately $4.00/MMBtu through next spring—the highest sustained level since 2014. The collapse in oil and gas drilling activity and operators abiding by capital discipline have slowed down the rebound of natural gas production growth in 2020-21 as the market resets.

- In 2022, as operators regain their footing, production growth is forecast to accelerate with the Haynesville play as the primary source of this growth, followed by associated gas production. Henry Hub gas prices are expected to soften to around $3.50/MMBtu on an annual average as production growth catches up with demand.

- In 2023-24, as demand growth moderates and associated gas production continues to grow in our outlook, no room is left for non-associated gas production growth and Henry Hub gas prices soften further to under $3.00/MMBtu.

- The US consumer price index (CPI) rose 0.3% in August following a 0.5% increase in July. The core CPI, which excludes the direct effects of moves in food and energy prices, rose 0.1% in August after a 0.3% increase in July. The CPIs for food and energy rose 0.4% and 2.0%, respectively. Twelve-month changes in the overall and core CPIs eased to 5.3% and 4.0%, respectively. (IHS Markit Economists Ken Matheny and Juan Turcios)

- The recent surge in used car prices cooled off during July-August. After jumping 45.2% over the 12 months to June 2021, used car prices rose only 0.2% in July and declined 1.5% in August. Shortages of computer chips have hampered production of new vehicles, shifting demand into used vehicles. While prices for used cars are likely to remain elevated, the latest figures suggest that large additional increases are unlikely.

- Several other prices fell in August, including some that experienced sharp increases during the pandemic. In addition to the 1.5% decline in the CPI for used vehicles, prices also declined for airline fares (down 9.1%), car and truck rental (down 8.5%), lodging away from home (down 2.9%), motor vehicle insurance (down 2.8%), and prescription drugs (down 0.4%). The surge in COVID-19 cases attributed to the rapid spread of the Delta variant appears to have contributed to price declines in travel-related categories.

- Owners' equivalent rent of residences rose 0.3% in August, matching recent increases. Rent of primary residence also rose 0.3% in August, up from 0.2% increases in each of the prior six months.

- Relative to February 2020, the core CPI has risen at an annualized rate of 3.1%, underscoring that a portion of the rise in 12-month inflation is due to "base effects"—comparisons to depressed price levels earlier in the pandemic. We expect 12-month inflation readings will continue to moderate as base effects recede and supply-chain issues are addressed.

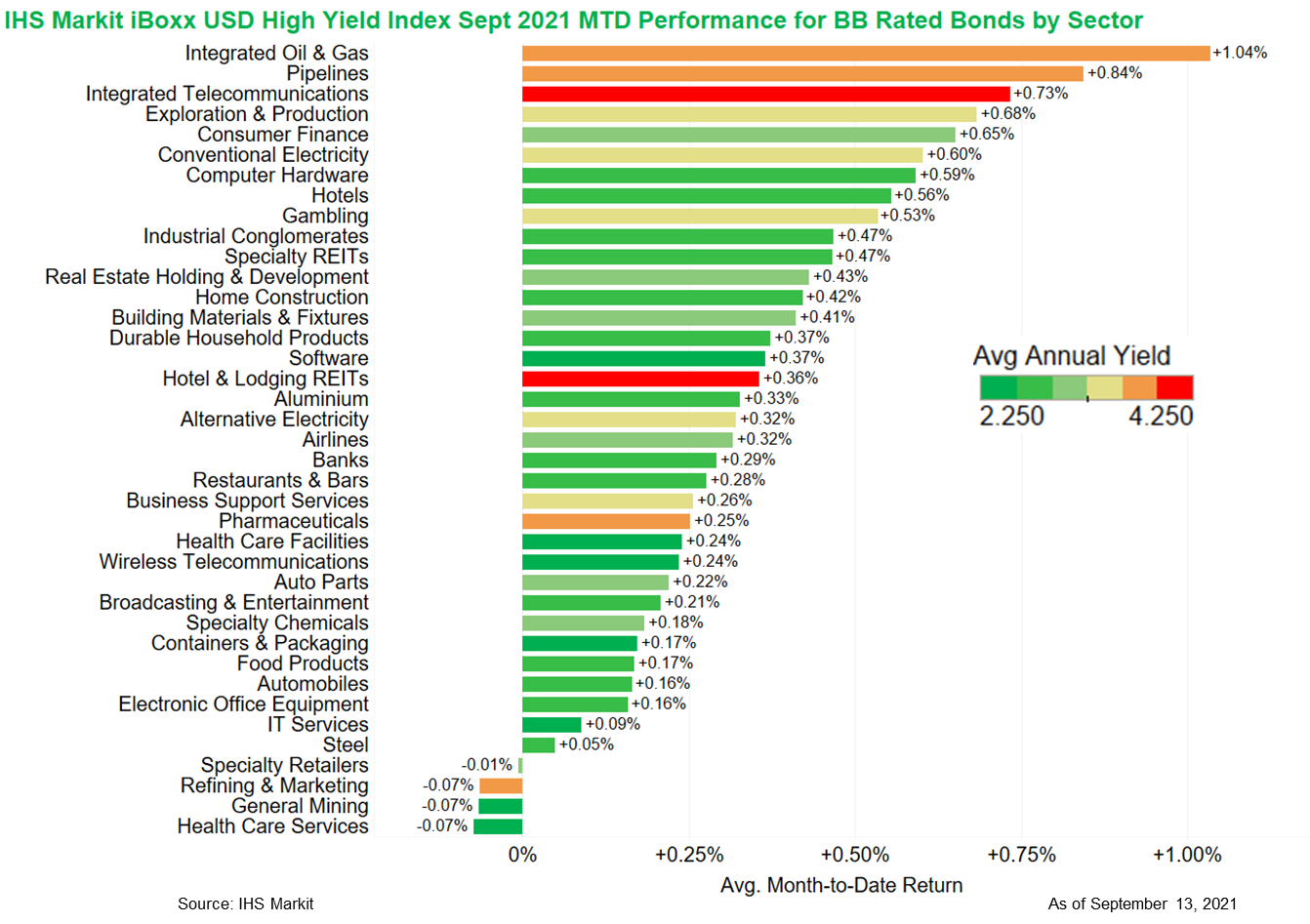

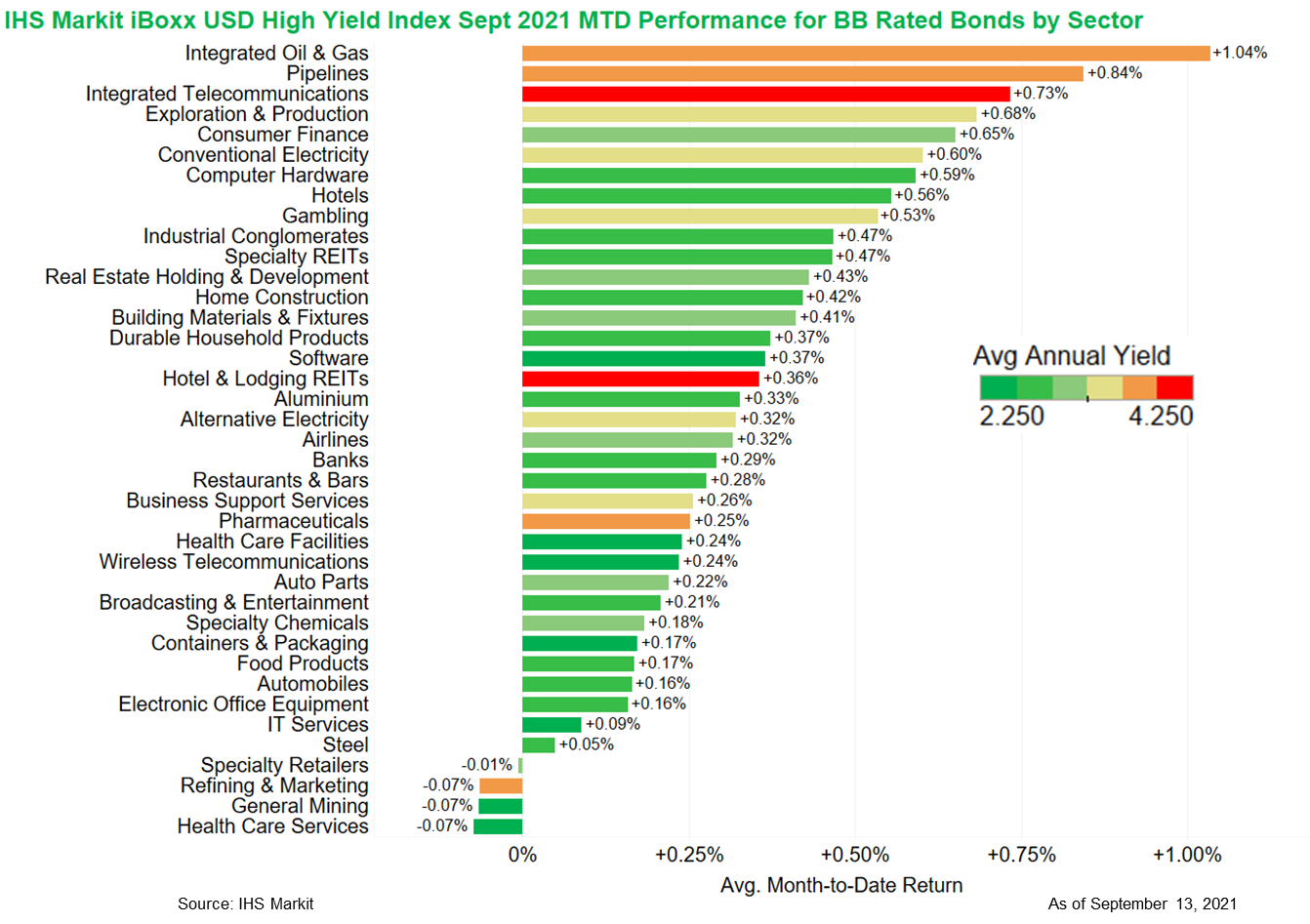

- The below chart shows the September 2021 month-to-day performance (as of yesterday's close) of the IHS Markit iBoxx USD High Yield Index for BB Rated Bonds by sector, with the color of the bars indicating the average yield by sector. The chart indicates that the energy subsectors are three of the top five best performing sectors this month and it's worth noting that energy has been the top performing US high yield sector most of the months since April 2020.

- General Motors's (GM)'s venture capital arm has reportedly invested in radar startup Oculii, according to a Reuters report. The report cites Oculii co-founder Steven Hong as saying that millions of dollars are being invested, although he declined to provide further financial details. Hong reportedly said that GM will now be able to use Oculii's low-cost software to boost resolution of radars and scale up partially automated and autonomous vehicles. Hong was quoted as saying that the investment is a "fantastic signal they're serious about the technology and bullish about radar in general". He also said that he agrees with Tesla's artificial intelligence director Andrej Karpathy about drawbacks of traditional radar. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aurora has unveiled the autonomous Volvo VNL truck integrated with its Aurora Driver's sensor suite, according to a company statement. This prototype marks an important step forward as Aurora and Volvo begin manufacturing commercial L4 Class 8 trucks at scale for Volvo's North American customers. Aurora will integrate its feature-complete hardware kit and verify Aurora-powered Volvo VNL trucks over the next few months using its virtual testing suite. Aurora and Volvo Autonomous Solutions partnered in April with an aim to deploy Level 4 Class 8 trucks for hub-to-hub service in North America. Aurora earlier partnered with Paccar to provide autonomous solutions for the commercial trucking industry. It also announced in 2021 a partnership for ride-hailing vehicles with Toyota and Denso. Volvo Group created a standalone business unit related to autonomous transport solutions in January 2020. The Volvo Autonomous Solutions unit intends to accelerate the development, commercialization, and sale of autonomous solutions for on-road and off-road segments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Veoneer has announced that it has received an updated non-binding proposal from Qualcomm in which it committed to its previously announced bid. Veoneer said it "is evaluating all of the terms of Qualcomm's proposal in consultation with its financial and legal advisors and will, if appropriate, engage in negotiations with Qualcomm and/or Magna [International] to ascertain the best possible outcome for its stockholders." However, it added that "no assurances that Veoneer's discussions with Qualcomm will result in a transaction that the Veoneer board of directors determines is superior to Veoneer's pending transaction with Magna". Veoneer announced last week that it is still backing a deal proposed by Magna, with which it currently has a merger agreement. However, it said at the time that it is still in discussions with Qualcomm, which put forward a higher bid of USD37 per share cash bid against the USD31.25 per share cash bid agreed with Magna. (IHS Markit AutoIntelligence's Ian Fletcher)

- Fugro has announced that it was selected by the Colombian Maritime Authority (Direccion General Maritima - DIMAR) to perform a joint environmental and exploration seep study in the Caribbean Sea. The scope of work encloses the acquisition, analysis and interpretation of seabed sediment samples and heat flow measurements to help assess the region's resource potential. A similar study was made with DIMAR in 2019. New to the 2021 work scope will be the examination of a set of decommissioned well sites. According to the contractor, "This work will help DIMAR understand the environmental conditions at these locations to determine whether any mitigating steps may be required now or during future decommissioning activities." Fugro says that the project commenced in late August and is expected to conclude in November. (IHS Markit Upstream Costs and Technology's Lopamudra De)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Italy +0.4%, Germany +0.1%, France/Spain -0.4%, and UK -0.5%.

- Most 10yr European govt bonds closed higher; Italy -4bps, Spain -2bps, France/Germany -1bp, and UK flat.

- iTraxx-Europe closed -1bp/44bps and iTraxx-Xover -2bps/226bps.

- Brent crude closed +0.1%/$73.60 per barrel.

- The global automotive semiconductor crisis is continuing to have a severe ongoing impact on supply chains and therefore the ability of carmakers to keep production lines open and meet customer demand. However, one positive side effect of the low supply of vehicles is a corresponding rise in vehicle sale transaction prices. Heavy discounting on list pricing has been a prominent feature of the global vehicle market for decades now, arguably most pronounced in North America, and Europe has also become a heavy discounting environment in recent years. The semiconductor issue has changed this as tight supply has firmed up pricing to the extent that in some segments and model lines, discounting has all but been eradicated. There has also been a corresponding effect on the pricing of nearly new vehicles, especially those that are offered in OEM-backed dealer approved-used schemes. This is a result of consumers looking for the next best alternative when the specific vehicle they are looking for is not available in an acceptable timeframe, or in some cases in which the dealer cannot even offer a specific timeframe due to the disruption caused by the semiconductor shortage. After decades of pushing volume and trying to win share at the expense of pricing, it seems the semiconductor crisis has led to a kind of epiphany for the OEMs. While there is no doubt that the likes of Daimler's Mercedes-Benz passenger car brand and BMW had already made a conscious strategic decision prior to the crisis to focus on maintaining pricing, the highly positive financial figures the carmakers have (mostly) posted in the first half and second quarter of 2021 has led them to realize that limited supply has, perhaps counterintuitively, boosted profits in many cases. (IHS Markit AutoIntelligence's Tim Urquhart)

- The UK labor market continued to recover during July and August, with both employment and unemployment conditions improving notably. In addition, rising vacancies and the latest survey evidence signal that many firms are facing recruitment problems, which is leading to elevated wage growth. (IHS Markit Economist Raj Badiani)

- The number of payrolled employees showed another strong monthly increase, up by 241,000 month on month (m/m) to 29.1 million in August. In addition, it now stands above 1,000 above its pre-coronavirus disease 2019 (COVID-19) virus pandemic levels (February). However, the number of payrolled employees in the London, Scotland, and South East regions is below its pre-COVID-19 levels.

- Three of the sectors benefiting from the end of COVID-19 restrictions reported a further rise in payrolled employees between July and August, namely accommodation and food service activities by 36,000 m/m, arts and entertainment by 11,000 m/m, and wholesale and retail by 7,000 m/m.

- In annual terms, the number of employed people in the three months to July was 202,000, or 0.6%, lower compared with a year earlier.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure decreased by 86,000 quarter on quarter (q/q) in the three months to July, standing at 1.55 million.

- Average annual weekly earnings (total pay including bonuses) growth slowed to a still elevated 7.1% year on year (y/y) in the three months to July. Regular pay (which excludes bonus payments) growth eased to 6.8% y/y in the three months to July after accelerating over the past 12 months.

- Total pay in real terms rose by 6.0% y/y in the three months to July, which was the 11th successive gain.

- Slovenia's current-account surplus narrowed through July, but remained substantial. Although strong merchandise import growth will continue to erode the current-account surplus, expected stronger service export earnings and further EU assistance inflows will ensure the surplus remains large throughout the remainder of 2021 and into 2022. (IHS Markit Economist Andrew Birch)

- In January-July 2021, Slovenia posted a current-account surplus of EUR1.5 billion, down somewhat from the EUR1.9-billion surplus noted in the same period of 2020. Although cumulatively it remains smaller than a year earlier, the surplus in July alone once again pushed up year on year (y/y).

- Through the first seven months of 2021, the merchandise-trade surplus narrowed by over EUR500 million y/y. The recovery of import demand was vigorous, outpacing what was also a robust increase of merchandise exports. High global commodity prices have fueled the rise of import growth.

- On the other hand, both the current transfers and services balances have improved versus year-earlier levels, offsetting the worsening of the merchandise-trade surplus. An uptick of EU inflows of support for social benefits drove up gross transfer inflows, curtailing that deficit. Meanwhile, easing of lockdown measures benefited service exports, particularly in the construction and transport sectors.

- Gazprom advises that construction of the Nord Stream II gas pipeline is now fully complete. The pipeline has been installed across the Baltic Sea from Russia to Germany and will have an annual capacity of 55 billion cubic meters. Offshore pipelay commenced in September 2018, with the project originally scheduled for completion in 2019. However, contractor Allseas suspended pipelay operations in December 2019, citing anticipation of the US government's National Defense Authorization Act (NDAA) coming into force as the cause. Construction of the pipeline recommenced earlier this year. (IHS Markit Upstream Costs and Technology's Lopamudra De)

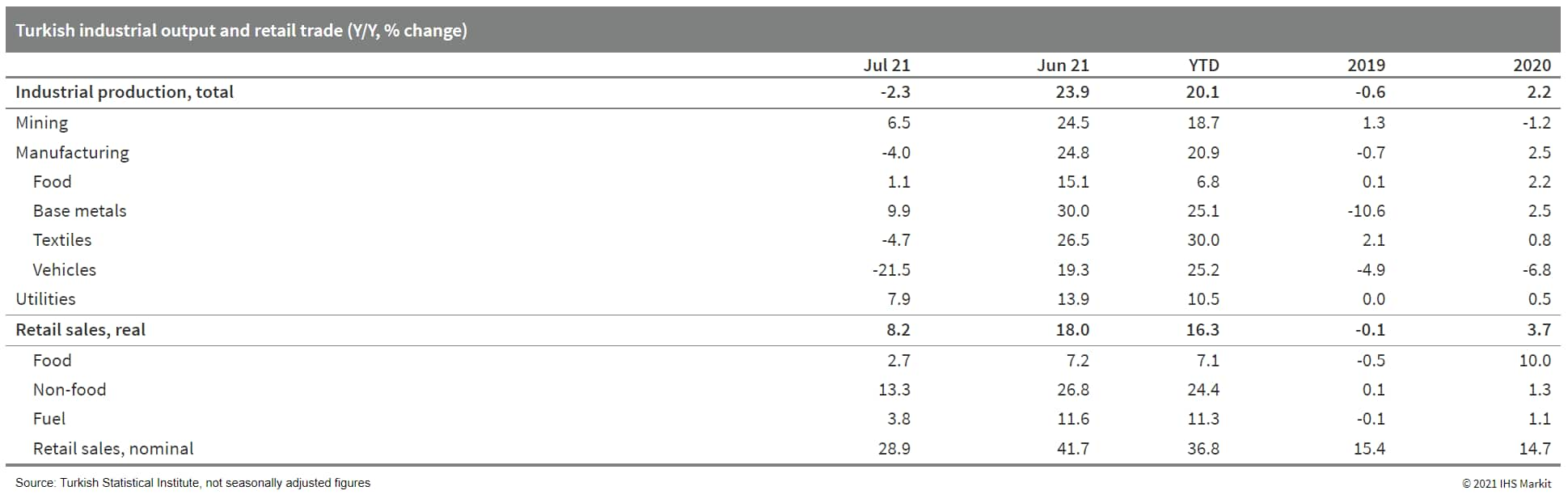

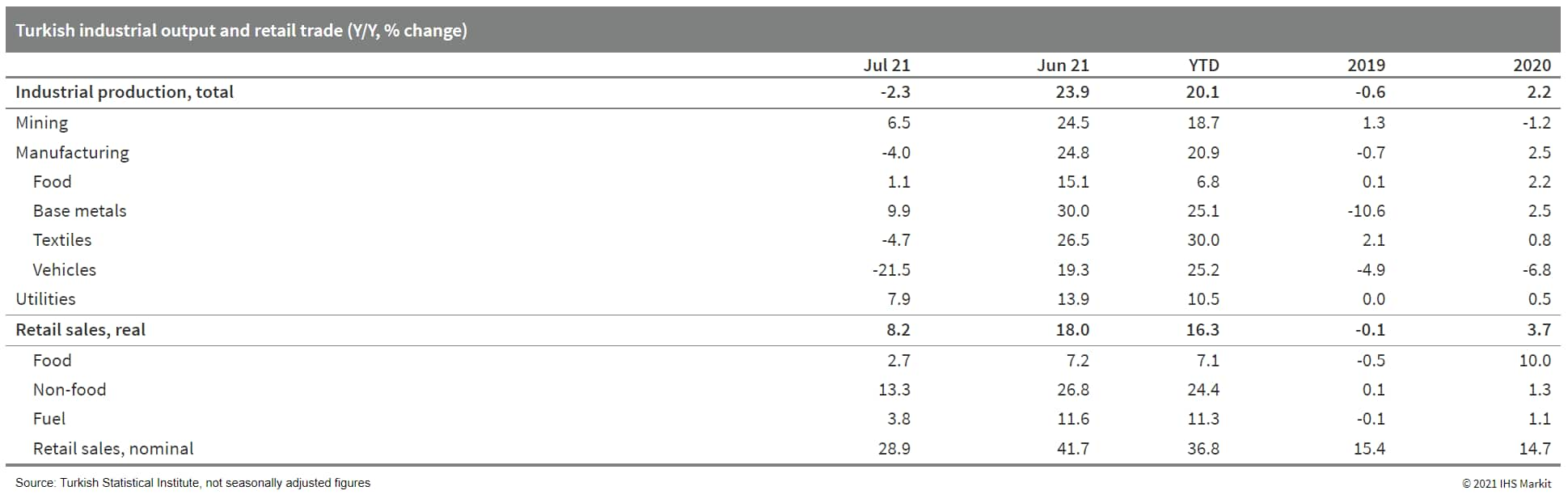

- In July 2021, Turkish industrial production dropped by 4.2% month on month (m/m) according to seasonally and calendar-adjusted data reported by the Turkish Statistical Institute (TurkStat). The m/m drop was the sharpest recorded since the sector began to recover in May 2020 following the first global COVID-19-related lockdown. (IHS Markit Economist Andrew Birch)

- While the July downturn of industrial production was widespread, the manufacture of high and medium-high technological products fell particularly sharply - down 22.4% m/m and 7.1% m/m, respectively. The global shortages contributed to the sharp downturn of output, particularly in the Turkish automotive sector, which had been a focus of development before the pandemic.

- TurkStat also reported that retail trade activity was sluggish in July. Retail sales volume expanded by only 0.7% m/m that month, retreating from a temporary surge the previous month. Despite expansionary economic policies, the recovery of retail sales has been uneven since the pandemic began.

- The narrowing of Turkey's current-account deficit continued in July. Through the first seven months of the year, the gap narrowed by nearly USD9.5 billion year on year (y/y) according to data from the Central Bank of the Republic of Turkey (TCMB). In July 2021 alone, the current-account deficit was more than USD1.3 billion smaller than it had been a year earlier. (IHS Markit Economist Andrew Birch)

- As indicated previously by leading customs-based data, Turkey's merchandise trade deficit has paced the reduction of the overall current-account gap.

- Further augmenting the narrowing of the trade deficit, the revival of tourism service exports sent the service surplus soaring by nearly USD6.3 billion y/y in January-July 2021. Although tourism-related service exports remain far below pre-pandemic levels, they are nonetheless soaring y/y as travel restrictions fall - in January-July 2021, transport service exports were up by nearly USD4.1 billion y/y and travel service exports jumped by over USD2.9 billion y/y, respectively.

- In July, the net inflow of portfolio investments continued, although it retreated from the resurgence the previous month. Fresh capital inflows in recent months has fuelled a recovery of Turkey's foreign currency reserves. By end-July, total foreign currency reserves once again covered more than three months of imports, with the negative net position - after calculating out short-term obligations and commercial bank holdings - easing to the equivalent of around 1.5 months of imports.

- Saudi Arabia's real GDP edged up by just 0.6% in the second quarter compared to the first, according to revised data from the GAStat. That is lower than the rate of 1.1% that was published in the first provisional release in August. Year-on-year, the growth rate accelerated from 1.5% published in August to 1.8%, but that was due to data revisions for previous quarters. However, at least it affirms that the Saudi economy eventually surpassed the pre-crisis level of GDP. (IHS Markit Economist Ralf Wiegert)

- As expected, the oil sector caught up as production levels have been ramped up during the second quarter. The oil sector, as a result, grew by 2.4% compared to the first quarter, but still sagged 6.9% on the year as Saudi oil production still remained below the previous year's level. This gap is expected to close in the second half of the year as oil output rises further.

- The non-oil sector of the economy, however, went down by 0.5% in the second quarter compared to the first, with private consumption being the main culprit as the segment edged down by 0.4%. Fixed investment, though, not least being driven by the large-scale projects connected with the Vision 2030 strategy, rose 7.2% at the same time. Net exports were clearly positive, with second-quarter exports of goods and services remaining at the first quarter's level and imports declining by 10.4% quarter on quarter (q/q).

Asia-Pacific

- Major APAC equity markets closed mixed; Japan/South Korea +0.7%, Australia +0.2%, India +0.1%, Hong Kong -1.2%, and Mainland China -1.4%.

- China's foodservice sector saw sales increase about 14% y/y to CNY375 billion ($58.2 billion) in July 2021. The most important growth driver is digital ordering and delivery, according to a recent report by Rabobank. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Foodservice operators have accelerated delivery channel expansion, with contribution from delivery channels ranging from 29% to over 45%.

- Third-party food delivery platforms have largely outpaced the foodservice industry growth, reflecting in Meituan's transaction value increase of nearly 60% y/y in Q2.

- In tier 1 and tier 2 cities, population density can offer the opportunity to scale up the delivery businesses. Given the high rental costs of commercial properties in these cities, it makes sense to expand delivery sales. Ele.me and Meituan (operators like Just Eat) have the monopoly status in the delivery service sector. However, delivery costs are increasingly high partly due to the improved social security benefits and wages in the "geek economy".

- China's recent regulatory measures on subsidies have led to a slowdown in the community group buying sector. Some players such as Shixianghui and Tongcheng Life discontinued their operations or filed for bankruptcy. This could temporarily ease the competition for those offline food retailers whose traffic has been negatively hit for several years by those community group buying players, Rabobank added.

- Overall, hyper-and-supermarket chain's online channel sales share improved from low single-digits in 2017 to 23% in 2020.

- Autonomous vehicle (AV) startup DeepRoute.ai has raised USD300 million in a Series B funding round, according to a company statement. The funding round was led by Alibaba in participation with Jeneration Capital, Geely, Fosun RZ Capital, Yunqi Partners, and Glory Ventures, among others. The company plans to use the capital for further research and development (R&D), scaling automaker collaboration and fleet operation, and expanding team. DeepRoute.ai offers solutions that focus on Level 4 autonomous operations and has research centers in Shenzhen and Beijing (China) and Silicon Valley (US). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu has announced that it will begin public testing of its Apollo Go robotaxi service in Shanghai (China), according to a company statement. The company will open 150 stations in phases throughout the city to provide passengers with access to residential, commercial, offices, and major transportation hubs through its robotaxi service from 9:30 am to 11:00 pm every day. Shanghai is the fifth Chinese city to operate Baidu's Apollo Go robotaxi service, joining Beijing, Cangzhou, Changsha, and Guangzhou. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's Ministry of Industry and Information Technology (MIIT) is encouraging mergers and reorganizations in the new energy vehicle (NEV) segment especially for smaller players amid the increasing number of such companies in the country, reports China Daily. Xiao Yaqing, Minister of Industry and Information Technology, said that the sector is very technology-heavy, and resources should be market-oriented as much as possible to avoid dispersion. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The first 10 locally assembled wind turbines for wpd's 640 MW Yunlin offshore wind farm (OWF) in Taiwan are expected to be grid-connected by the end of September. Fred. Olsen Windcarrier's heavy lift crane vessel Brave Tern installed the wind project's first turbine with local content on 23 April. The remaining turbines will be grid-connected in batches by the end of 2021. The Yunlin OWF comprises of 80 units of SGRE 8.0-167 DD 8 MW wind turbines installed on monopile foundations. Sapura Offshore's heavy lift pipelay vessel Sapura 3500 is installing the offshore wind turbine foundations, while Fred. Olsen Windcarrier is undertaking the wind turbine installation scope under a contract from Siemens Gamesa Renewable Energy. The transition piece (TP) and tower of the wind turbine were manufactured by Taiwan-based CTCI Machinery Corporation (CTCI MAC) and Formosa Heavy Industries (FHI) respectively. CTCI MAC and Smulders each delivered 40 TPs for Yunlin OWF. Steelwind Nordenham delivered 40 complete monopiles and supplied 120 monopile segments for the 40 monopiles constructed by FHI. Jumbo is contracted to transport 40 TPs from the Netherlands to Taiwan and install 80 TPs for the offshore wind project under a contract from wpd's subsidiary Yunneng Windpower. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- Ride-hailing firm Grab reported a wider net loss of USD815 million in the second quarter of 2021, compared with USD718 million in the same period of 2020. The company's adjusted net sales rose to USD550 million in the second quarter, an increase of 92% year on year (y/y). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The growth was mainly driven by Grab's mobility business, which registered adjusted net sales of USD146 million, up 122% y/y.

- The revenue for Grab's mobility business was USD118 million in the second quarter, increase of 129% y/y. The company expects improvement in the demand for mobility services in the coming quarters as vaccination rates increase across the Southeast Asia region.

- Grab's delivery business, which includes food, groceries and parcel delivery, reported adjusted net sales of USD345 million in the second quarter, a 68% increase y/y. For the same period, revenue for deliveries was USD45 million, up 92% y/y.

- In the second quarter of 2021, the number of monthly transacting users (MTUs) increased 28% to 24.7 million users, while the gross merchandise value (GMV) per MTU, which is an operating measure representing average spend per user, increased 27% to USD157 million compared to the same period last year.

Posted 14 September 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.