Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Oct, 2021

By Min Jiang

Highlights

A Credit Scoring Model Specializing in the Analysis of Unrated Firms and Low-Default Sectors for the China Domestic Market

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global (China) Ratings. The opinions herein are not reflective of those of S&P Global (China) Ratings. S&P Global (China) Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global (China) Ratings.

Overview

The Chinese credit market has experienced exponential growth in recent years and is progressively opening to external investors. Thus, it is essential for both local and foreign market participants to gauge the default risk of counterparties in this relatively nascent market using a quantitative tool that incorporates unique local market features and produces a differentiated credit risk assessment.

CreditModelTM China Corporates 1.0 (CM China 1.0), developed by S&P Global Market Intelligence, is a statistical model that offers an automated and scalable solution to assess the credit risk of corporate counterparties in the China domestic market. It aims to generate credit scores that are largely aligned with S&P Global (China) Ratings’ rating criteria and to provide credit risk assessments on a scale that is tailored to the China domestic market. The tool can be used by risk managers at financial institutions, corporations, and asset management firms to:

Model Features

The model applies to companies in the China corporate sector, including both publicly- traded and privately-owned corporates in the China domestic market. The model considers multiple risk dimensions through a holistic approach and outputs a lowercase credit score that is calculated on a stand-alone basis, prior to any group or government support consideration.[1]

Stress Testing and Peer Comparison

Clients can score any corporate company using their own financials, change financial data and other input factors for a ‘what-if’ analysis, and stress test input factors. The model enables simultaneous scoring of many companies for a single financial period, or one entity over multiple financial periods. Surveillance dashboards enable users to quickly compare the creditworthiness and distribution of a portfolio of entities covered by the model.

Sensitivity Analysis

For each input, the model reports a sensitivity measure that indicates the change in the model output (i.e., its sensitivity) when an input is changed by a small proportion (typically 10% of the initial value for financial ratios and one notch for non-financials).

Contribution Analysis

In addition to the sensitivity measures, clients can assess the weight or importance of the contribution of a risk factor to the current credit score through two contribution measures: the Absolute Contribution and the Relative Contribution.

Imputation

The model can still generate the outputs when only partial information for a company is available by utilizing a sophisticated imputation methodology to estimate missing inputs.

A Tailored Framework for the China Domestic Market

CM China is trained on the S&P Global (China) Ratings data that are customized for the China domestic credit market. The model produces a widely dispersed credit score distribution with granularity and offers a differentiated credit risk assessment for Chinese companies. The score grades are based on the China local scale that is in line with the underlying ratings data. The model incorporates unique local market features, e.g., industry risk scores for the China domestic market that reflect heterogeneity in risk dynamics across different industries.

Rigorous Variable Selection Process

To select the final set of inputs and variables, we used both statistical analysis and business judgment and weighed the following considerations.

Sophisticated Methodology

The underlying modeling framework belongs to the family of exponential density models. It uses the prior distribution of all S&P Global (China) Ratings’ ratings data in the training sample as an “anchor distribution” and modifies it in proportion to how much the financials of a specific company deviate from those of companies used in the anchor distribution. The statistical analysis of variable selection is based on the K-fold Greedy Forward Approach, a widely used statistical method that results in a good fit out of sample.

The model maximizes the maximum likelihood function within a Maximum Expected Utility, adapted to the case of multi-state scores, and uses the Akaike Information Criterion (AIC) to limit the maximum number of variables that are included (model parsimony). This optimization process helps the model exhibit greater stability and out-of-time performance. Moreover, monotonicity constraints are applied to have the model produce outputs that follow economic intuition.

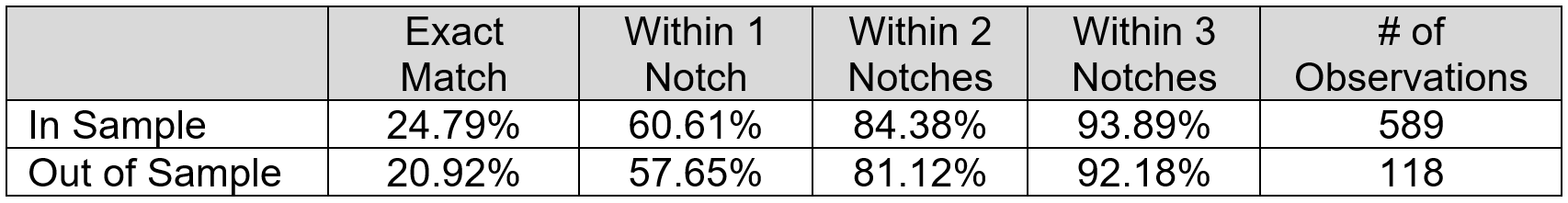

Model Performance

CM China was trained on S&P Global (China) Ratings’ stand-alone credit profile (SACP) data, aiming to generate a credit score that statistically matches the SACP. Thus, the model’s performance can be best measured by looking at the agreement of model scores with S&P Global (China) Ratings’ SACPs, as shown in Table 1. The overall model performance is good, as suggested by the high matching ratios.

Table 1: CM China Corporates 1.0 Ratings Agreement[2]

Source: S&P Global Market Intelligence. Data as of March 31, 2021. For illustrative purposes only.

Case Study

Company X is a firm that provides water treatment services in China and had been actively expanding its business throughout the country. As of October 2020, the company had failed to pay debt that was due.

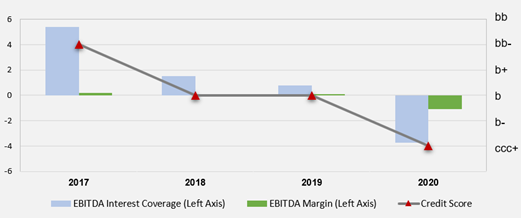

Figure 1: Case Study - CM China Corporates 1.0

Source: S&P Global Market Intelligence. Data as of August 10, 2021. For illustrative purposes only.

Figure 1 illustrates the evolution of credit score estimates generated by CM China 1.0 for the period 2017-2020. The company’s model score had been continuously worsening and dropped from ‘bb-’ to ‘b’ in 2018 and then to ‘ccc+’ in 2020, flashing strong warnings at least two years before the credit event. To understand the driving forces for the significant drop in credit scores, we also show the time series of two key model inputs, i.e., EBITDA interest coverage and EBITDA margin. The company’s revenue generation ability had been deteriorating with EBITDA, entering the negative zone in 2020 due to the large shock of the COVID-19 pandemic. Its weakened profitability, coupled with the mounting debt overload, resulted in a sharp drop in debt service capability, as measured by the large decrease of the EBITDA interest coverage ratio (from 542% to -373% between 2017 and 2020). This was consistent with the fast deterioration of the company’s creditworthiness.

Conclusion

Credit risk assessments of large corporate counterparties in China are challenging due to the low-default characteristics and unique local market features. Risk managers often rely on the limited universe of ratings by main rating agencies, or use scorecard approaches that can be time consuming and not scalable. CM China, trained on S&P Global (China) Ratings data, offers an automated and scalable solution for gauging the credit risk of corporate companies in China. The model is specifically tailored to the China domestic market and calibrated to produce differentiated credit scores that are statistically aligned with S&P Global (China) Ratings’ rating criteria and scale. It can be applied to assess the credit risk of rated and unrated corporate entities in China.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. Accurate, deep, and insightful. We integrate financial and industry data, research, and news into tools that help track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations, and assess credit risk. Investment professionals, government agencies, corporations, and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spglobal.com/marketintelligence.

[1] Parental and government support is modelled separately, considering the link between the subsidiary and its parent, or the importance of the company to the underlying supporting government.

[2] The out-of-sample performance is calculated based on the five-fold cross validation method.