Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 13 May, 2021

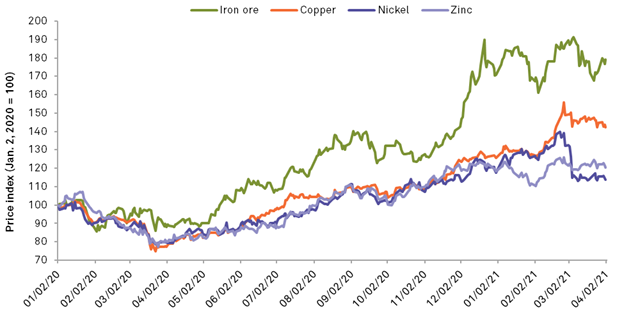

The last 12 months have been a dynamic time for the metals and mining industry, with the sector facing sharply lower prices early in the COVID-19 pandemic only to see many commodities hit multiyear highs in recent months. Here are three big trends to watch for the rest of 2021 and beyond.

1: The demand for commodities

As vaccination campaigns ramp up, rebounding economic activity is driving demand for many commodities, which will leave miners challenged to meet supply needs. Iron ore and copper prices have particularly benefitted from the improving outlooks, buoyed by government stimulus efforts around the world. In addition, a surge in electric vehicle interest is also pressuring supply chains for the three big battery metals: nickel, lithium and cobalt.

2: The rise of Environment, Social, and Governance (ESG) minded companies

How will the energy transition, and investor appetite for more ESG-minded companies, mix with the mining industry? S&P Global Market Intelligence found that electric vehicle sales across Germany, France, the U.K. and Norway doubled month over month in March, while in China, the world’s biggest EV market, plug-in electric vehicle sales are forecast to hit 2.2 million units this year, climbing to over 5 million by 2025. While the EV revolution is driving demand for battery metals, the push for renewable energy sources will also benefit copper and iron ore producers. At the same time, miners are under pressure from investors and governments to reduce emissions, be environmentally responsible and more culturally aware. Addressing these ESG concerns while meeting rising demand will require significant transparency and flexibility going forward.

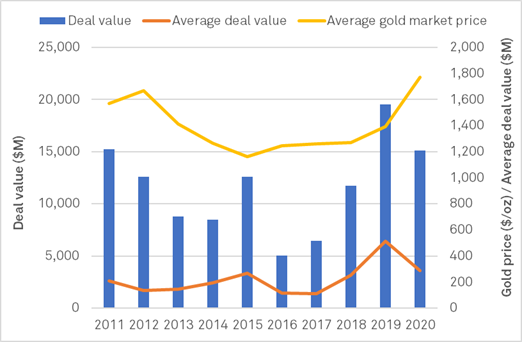

3: The stronger gold price

Finally, what’s next in the gold market? The pandemic-driven recession pushed gold to new highs, with prices crossing $2,000 per ounce in August 2020, but recovery has since settled the market. Buoyed by the higher prices, investment in junior and intermediate companies has been very strong since the middle of 2020, with the amount raised in this year's first quarter marking a nine-year high. M&A activity also picked up in the second half of 2020, a trend we foresee continuing through 2021 as many leading companies are saying consolidation seems imminent.

In summary, the near-term outlook for the mining industry remains strong as pent-up demand emerges post-pandemic while gold prices are expected to remain elevated. In the longer term, the sector will capitalize on raw material needs critical to the global energy transition efforts.

We will be watching these trends for the rest of 2021 and providing insights that can help you make decisions with conviction.