Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Oct, 2017 | 10:00

Highlights

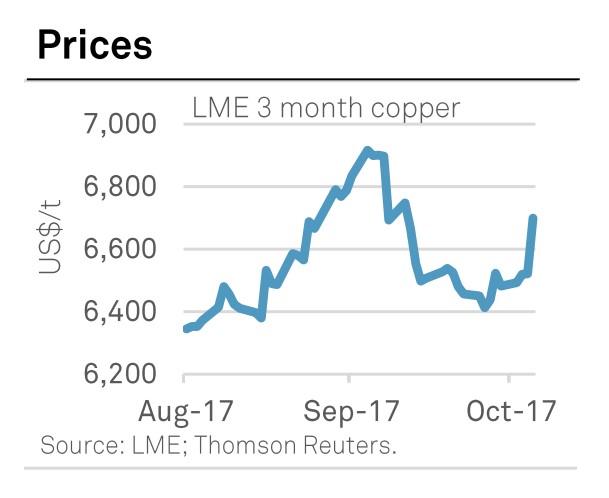

Despite a recent pickup in the LME three-month copper price and a push above US$6,700/t, our assessment of the broader copper market outlook has not altered.

Given current copper price levels, we have raised our Q4-2017 average forecast to US$6,098/t from US$5,574/t previously, still markedly below where prices are trading.

Despite a recent pickup in the three-month copper price on the London Metal Exchange and a push above US$6,700/t, our assessment of the broader copper market outlook has not altered. We still see copper prices as above fundamentally justified levels and the need to tackle Chinese debt as a significant risk to forward demand prospects, and we expect prices to trade lower in the fourth quarter and into 2018.

Some price impetus was provided by a strong, deep earthquake with a magnitude of 5.4 in the Calama region of northern Chile on October 5. However, the earthquake did not cause any injuries or major damages to property, and top copper producers such as Codelco and Antofagasta Plc reported no impact to their operations. The market is operating with reduced liquidity due to the absence of Chinese traders during the National Golden Week holiday, so any price moves are more likely to be amplified.

Precautionary short covering may also be playing a role in current market activity, with the impending release of U.S. nonfarm payroll data causing uncertainty among investors, as well as the potential reaction of Chinese market participants when they return. After hitting a three-year intraday traded high of US$6,970/t on September 5, up 26.7% since the start of the year, the LME three-month copper price fell 8.7% to a one-month traded low of US$6,366/t on September 22. Prices have since consolidated, closing at US$6,700/t on October 5. Given current copper price levels, we have raised our fourth-quarter 2017 average forecast to US$6,098/t from US$5,574/t previously, still markedly below where copper prices are trading.

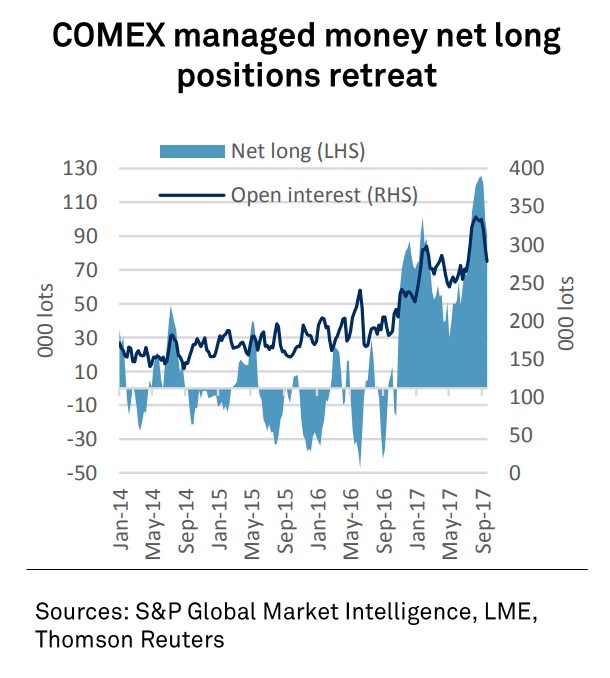

We had indicated that the earlier copper price rally was largely driven by speculator interest, which inflated prices and detached them from the underlying fundamentals, leaving copper overbought and vulnerable to the long liquidation that ensued. COMEX data show that managed money net long positions hit a record high of 125,372 lots September 5. LME money manager net long positions reached a recent peak of 78,527 lots on August 29, but had fallen 28.0%, or 21,976 lots, by the end of September. Over the same period, LME three-month copper prices retreated 4.6%.

On the macro front, China's purchasing managers' index, or PMI, sent mixed signals in September. The official NBS measure rose to 52.4, representing the 14th consecutive month of expansion and the fastest pace of growth since April 2012. However, the Caixin/Markit manufacturing PMI indicated that manufacturing activity for small and medium-sized companies grew at its weakest pace for three months in September; the index fell to 51.0 from 51.6 in August.

In Europe, industrial activity appears robust. IHS Markit's manufacturing PMI climbed to 58.1 in September from August's reading of 57.4, its highest since February 2011. There are also signs of broadening recovery in the Japanese manufacturing sector. According to the Bank of Japan's quarterly "tankan" survey, large manufacturers have more confidence in business conditions now than at any time over the past decade. The headline index for big manufacturers' sentiment was recorded at 22 in September, higher than the last survey in June, which showed a reading of 17.

Latest reports on Grasberg indicate that Freeport-McMoRan Inc. and the Indonesian government are still negotiating the terms of the former's 51% divestment of its stake in the mine. There are growing fears that a lack of resolution could cause concentrate supply to cease for the second time this year. We are assuming that exports are likely to be allowed to continue along with any extension to negotiations.

We bring transparency to the commodity markets. Visit our Resource Hub to read more reports on the commodity markets.