Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Aug, 2017 | 12:00

Highlights

The price of the red metal surged despite quiet trading activity.

During 2017's traditional "summer slowdown," prices have not just held up, they have surged higher. After intraday trading at about US$6,000/tonne in mid-July, the London Metal Exchange three-month copper price finally closed above that level on July 18. Since then, in just over three weeks, prices traded at a recent high August 9 of US$6,515/tonne, a level last seen in December 2014.

There has been no noticeable pickup in demand that could have triggered the dramatic price rise. Rather, market sources report quiet trading activity in both the concentrates and refined metal markets, which is very much expected at this time of year. This is also reflected in steady-to-lower Chinese premiums.

In the latest Commodity Briefing Service on copper, or CuCBS, S&P Global Market Intelligence noted that without an increase in physical demand to drive prices higher, other factors have been more prominent. A generally weaker U.S. dollar has continued to be price-supportive, and the higher-than-expected Chinese GDP data for the June quarter has been supplemented by further positive signals concerning the country's economic health.

The positive sentiment over China includes an unexpectedly good boost to the country's foreign exchange reserves in July, indicating the government has some control over capital outflows, which had been of concern to the wider market. Furthermore, the Chinese proposal to ban "category seven" scrap imports provided a fillip to prices, although any potential impact would not be seen until later in 2018. We believe that there is plenty of time for the market to adjust to the implementation of any ban.

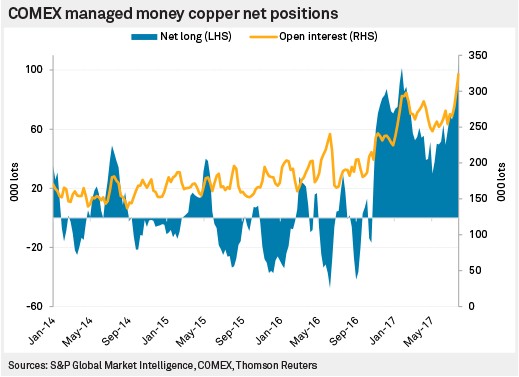

Market sentiment also found technical support in late July, with the copper price overcoming long-term resistance convincingly and the 50-day moving average crossed above the 100-day trend. These would have provided strong signals for algorithmic-trading funds to buy copper. LME Commitment of Trader reports show that money managers had raised their net long positioning by August 4 to the highest level since February. Also, the Commodity Futures Trading Commission reported that net long managed money positions on COMEX hit a new record high August 1, beating the previous peak seen at the end of January.

CuCBS concludes that such speculator and investor interest in copper has undoubtedly been a driving force behind the recent price rise, but does leave the market at risk of long liquidation if sentiment turns. After hitting its previous peak in January, COMEX net long managed money positions rapidly retreated, as prices fell to below US$5,500/tonne in early May. However, what had previously been a line of resistance should now provide some price support, at least initially, in the event of any selloff.

Request a demo to gain vital insights into the commodity markets.