Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 21, 2024

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

Access the databook.

See Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel and zinc.

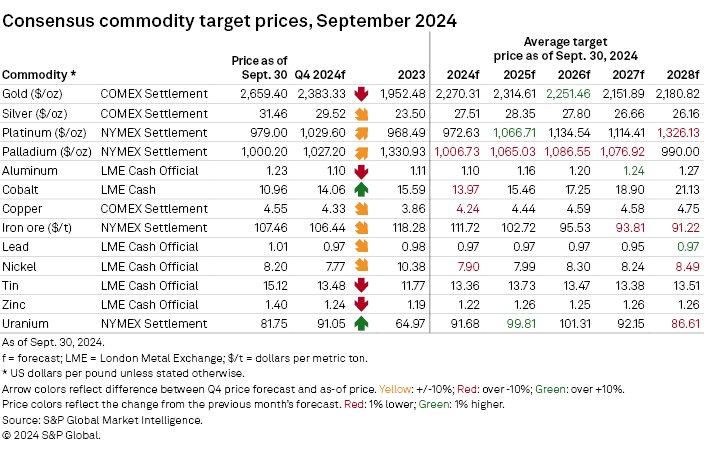

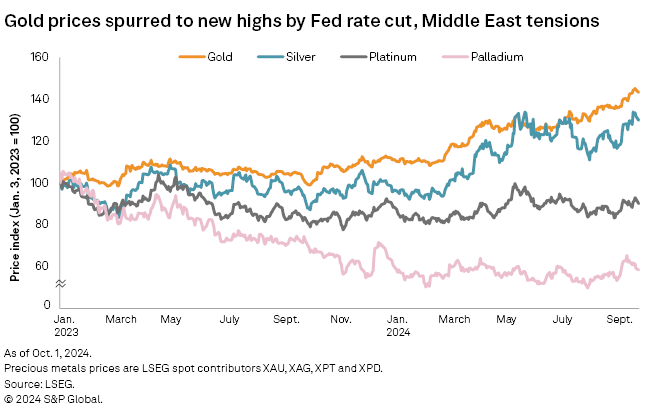

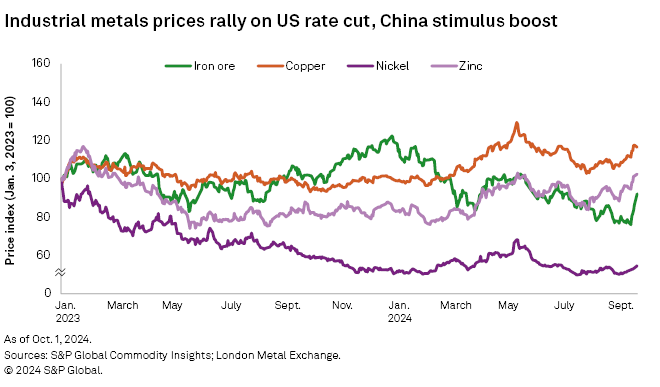

The highly awaited US interest rate cut finally materialized in September and China announced its largest stimulus package since the COVID-19 pandemic, driving price gains across metals markets. Bullish macroeconomics and robust demand driven by investors' flight to safety bolstered the consensus price outlook for gold, albeit tempered by anticipation of profit taking. However, a downside bias prevailed in price expectations for industrial metals in 2024–25, dampened by a sluggish demand recovery and lingering oversupply.

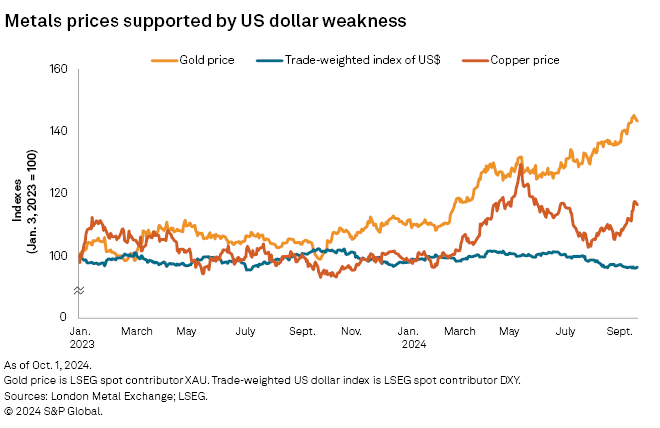

The US Federal Reserve implemented a much-awaited interest rate cut Sept. 18, its first since March 2020, trimming rates by half a percentage point. On the same day, the US dollar trade-weighted index fell to a 12-month low. The weakening dollar provided a tailwind to precious and industrial metals prices, which were buoyed further later in the month when the People's Bank of China unveiled a large stimulus package that included a half-a-percentage point interest rate reduction on existing mortgages and relaxed borrowing restrictions. Gold prices found sustained upside momentum as bullish macroeconomics combined with safe-haven demand amid an escalation of geopolitical tensions in the Middle East, while industrial metals prices rallied on expectations for an improved demand outlook.

The London Bullion Market Association gold price was on an upward trajectory throughout much of September, peaking at $2,663.75 per ounce Sept. 26, as speculation leading up to the US interest rate cut and its aftermath added to support from continued safe-haven buying. The Fed's rate cut was announced against a backdrop of slowing inflation and a cooling labor market. The US Consumer Price Index eased to a three-year low of 2.5% in August, while new jobs were below expectations and the unemployment rate was near unchanged. The 50-basis-point rate cut raised concerns about the health of the US economy and increased demand for safe-haven assets. Uncertainty over the US presidential elections and escalating tensions around the Russia-Ukraine war and the Middle East conflict spurred momentum for investors' flight to safety, although sporadic rounds of profit taking could cap the upside. Gold consensus price forecasts have been adjusted 0.2% lower for 2024 and 0.5% higher on average in the 2025–28 period.

The silver price rose from an average of $28.54/oz in the Sept. 2–12 period to above $30/oz throughout the remainder of the month. Consensus price targets have been downgraded by a modest 0.2% on average over the five-year forecast horizon. Tepid manufacturing indicators fueled gloomy demand sentiment, with August purchasing managers' indexes (PMIs) across major economies largely remaining in contraction. The downside is limited, however, by silver's green-economy applications, such as solar panels and electric vehicles, and expectations that gold prices will remain strong in 2025.

Platinum and palladium prices continued to trade on either side of $1,000/oz in September, with palladium holding a premium almost throughout the entire month. Consensus price outlooks diverge, with a 0.4% downgrade for 2024 followed by an average 1.2% upgrade in 2025–26 for platinum and a 2.2% downgrade on average over the same three-year period for palladium. Platinum-for-palladium substitution in autocatalysts underpins demand support for platinum, with the automotive sector being the largest contributor to demand for both metals. Resilient and diversified demand for platinum — including its industrial application in the emerging green hydrogen technology — is expected to exacerbate current supply deficits, while palladium is seen tipping into surplus due to rising palladium recycling.

The London Metal Exchange three-month (LME 3M) copper price slipped to $8,980 per metric ton Sept. 3 on soft manufacturing data but rallied to $9,995/t Sept. 26 on supportive macroeconomics and improving Chinese demand. Shanghai Futures Exchange (SHFE) inventories experienced their largest drawdown to date in August as reduced cathode imports due to shipment delays from Africa coincided with heavy restocking encouraged by deflated copper prices in the same month. The Platts-assessed China cathode import premium rose from $55/t on Aug. 29 to $80/t on Sept. 18, reflecting healthy demand from consumers in China. Platts is part of S&P Global Commodity Insights. Narrowing SHFE stockpiles notwithstanding, strong domestic production is keeping the Chinese cathode market well supplied. New smelter projects that are nearing startup are poised to further boost cathode supply. While there remains a lingering concentrate squeeze, it does not necessarily spill over to the refined copper market, given smelter capacity additions and expansions. The refined copper supply overhang has weighed on the consensus price outlook, which has been downgraded an average of 0.6% over the five-year forecast horizon.

The LME 3M nickel price climbed to $16,136/t on Sept. 12 following the news of Russia's possible export restrictions but pulled back to $16,000/t the next day amid lingering fundamental weakness. In a Sept. 11 statement to government ministers, Russian President Vladimir Putin suggested limiting exports of uranium, titanium and nickel; the comments initially sent prices higher, but the upside was short-lived. Russia is the world's second-largest producer of refined class 1 nickel, but its trade flows have already been impacted by previous rounds of sanctions in response to its invasion of Ukraine, and European consumers have since shifted away from Russia-origin nickel imports. Investment funds' net short positions on nickel were on the rise Sept. 13, just as LME nickel stocks climbed following increased inflows of refined class 1 nickel from China and Indonesia since August. Prolonged oversupply continues to pressure prices, but reduced borrowing costs in the US and China drive demand optimism. Nickel consensus price expectations were lowered an average of 0.8% in the 2024–28 period.

The LME 3M zinc price rose from $2,712/t on Sept. 10 to roughly $3,100/t at the end of September as the US dollar slumped alongside a tightening refined market and news of Chinese stimulus. Chinese smelters have announced unplanned production cuts as high feedstock costs persist due to limited concentrate availability. A chronic squeeze in the concentrate market has led to Chinese domestic treatment charges (TCs) plunging 70% in September compared to December 2023, while imported TCs have fallen for the 19th consecutive month. China's largest smelters — accounting for almost 70% of production — have recently agreed to slash output and reduce concentrate usage by up to 1 million metric tons of contained metal in 2024. New sources coming online, such as the Ozernoye zinc-lead mining complex in Russia, could boost concentrate supplies, but refined production in China could remain subdued amid reduced smelter profitability. Consensus price forecasts for zinc have been downgraded 0.3% on average in the 2024–26 period but upgraded by a similar magnitude for 2027–28.

Downbeat Chinese demand prospects pulled the Platts IODEX 62% Fe iron ore price to a 22-month low at $90.50 per dry metric ton Sept. 5 before restocking activity and China's stimulus boost drove the price up to $108.30/dmt on Sept. 30. Chinese steel mills have begun to aggressively curtail production in response to surplus supplies, which has resulted in inventory drawdowns. Nevertheless, the Chinese steel market continues to grapple with oversupply as the slow domestic property sector stifles steel demand. Although Chinese iron ore imports eased in August, iron ore stocks at Chinese ports remain abundant. A further slowdown in imports is anticipated through year-end on Chinese steel production curtailments, which will coincide with a seasonal uptick in global seaborne iron ore exports. Consensus price forecasts for iron ore are almost unchanged in the 2024–25 period but are lowered by an average of 1.3% over the 2026–28 period, when the seaborne trade balance is expected to move into surpluses.

The Platts-assessed European cobalt metal price fell to its lowest level since July 2016 at $11.30 per pound Sept. 24, pressured by cobalt thrifting by EV battery-makers and growing supplies. Passenger plug-in electric vehicle demand is losing momentum, especially in Europe, where sales in the January–August period slumped due in part to low affordability. With automakers opting for the less costly lithium-iron phosphate chemistry for the launch of more affordable vehicle models, the popularity of cobalt-containing batteries is diminishing. Battery manufacturers are also postponing planned capacity additions. An improvement in consumer electronic demand since the June quarter thus far has not been sufficient to offset weakness in plug-in electric vehicle demand. Meanwhile, the market surplus could widen, with elevated copper prices increasing the profitability of copper-cobalt operations and fueling rising supply. Major copper-cobalt producer CMOC Group Ltd. achieved 83% of its target annual cobalt output in the first half of 2024 alone, up 178% year over year. Cobalt consensus price targets have been downgraded 2.5% for 2024 amid persistent oversupply but upgraded 0.5% for 2025 and unchanged thereafter as prospects of green-economy demand remain intact.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.