Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Apr, 2017 | 09:30

Rapidly evolving in-vehicle technology has the auto industry cautious about the ramifications of automobiles turning into computer-controlled devices. Adding to concerns, the product development process for in-dash technology can span four to five years from concept to production, raising the risks if automakers get something wrong. In some cases it takes the involvement of more than 10,000 people to bring an auto product to market, which can delay the adoption of wireless technology that can seem ubiquitous among consumers accustomed to the update/upgrade process of smartphones.

Kagan, a media research group within S&P Global Market Intelligence, expects the total installed base for new vehicles with in-vehicle cellular to grow by 24.3% in 2017, partly due to improvements in technology for automatic parking, maintenance and infotainment systems. However, we have lowered our projections slightly due to slow original equipment manufacturer (OEM) production cycles and consumers' reluctance to pay extra for in-car connectivity.

Despite the slow adoption by some OEMs, on-board 4G LTE connectivity from wireless carriers like AT&T Inc., Sprint Corp. and Verizon Communications Inc. is increasingly important for consumers, with almost all carriers supporting aftermarket connectivity solutions. Demand for Apple Inc.'s CarPlay and Alphabet Inc.'s Android Auto is also growing as new car buyers seek to integrate smartphones and in-vehicle dashboards.

For both automakers and wireless carriers, the longer-term goal of self-driving cars is still years away. While automakers are focused on the refinement of autonomous vehicles, the infrastructure to make them seamless continues to evolve, along with supporting technology and services focused on mobility, safety, convenience and performance.

Features such as artificial intelligence-powered personal assistants, advanced driver assistance systems, vehicle-to-everything (V2X) communication, and ride-sharing are being looked at as key developments for the future of the autonomous vehicle and are likely to improve drastically over the next few years. Yet these improvements take time to test and develop.

Car manufacturers do not want to lose control over the dashboard of their cars, nor do they want to support three or more different standards for interacting with smartphone apps. At the same time, they do not want to support only a single technology and lose potential customers because of smartphone compatibility issues.

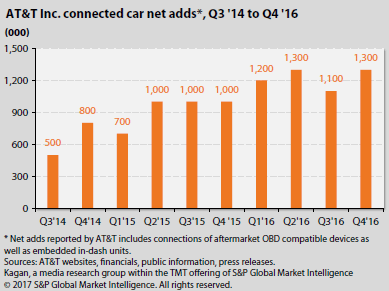

AT&T's AT&T Mobility LLC has paid particular attention to connected cars as a major opportunity. The company has agreements with at least 15 different automakers, according to our analysis, or 10 more than runner-up Verizon. The company has added one million or more connected car wireless plans each quarter since the second quarter of 2015, and as of February 28, connected more than 11.0 million cars in the U.S. and in selected international markets.

Verizon has 3G/4G LTE-connected car platform agreements with Hyundai (KIA), Mercedes-Benz, Toyota and Volkswagen and after-market on-board diagnostics (OBD-II) device maker Delphi, for the Verizon Hum hardware system. The Hum device, which plugs into the OBD-II port, turns older cars (1996 or newer) into 4G LTE-connected cars with OnStar-like capabilities.

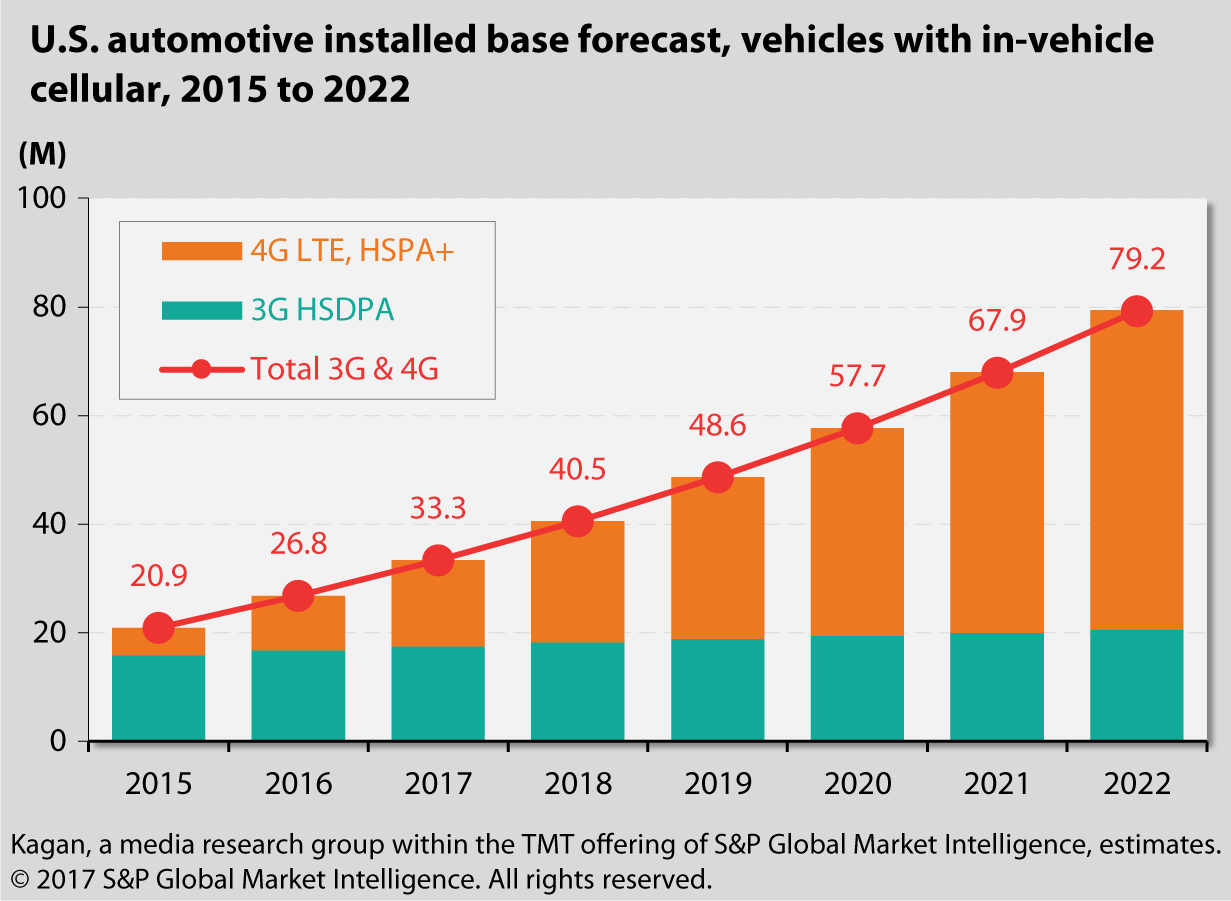

According to Kagan estimates, the installed base of U.S. vehicles with embedded in-vehicle cellular (3G/4G LTE) systems reached approximately 26.8 million by year-end 2016, with the majority comprising 3G basic telematics systems for monitoring service schedules, mapping/GPS and roadside assistance, at an estimated 16.8 million. However, the 4G LTE installed base estimate roughly doubled from 5.0 million in 2015 to 10.0 million by year-end 2016.

Our 4G LTE in-vehicle cellular installed base forecast shows the segment surpassing the 3G installed base in 2018 and far overshadowing 3G in the long term. The addition of 5G connections is likely to creep into our next set of projections, which may diminish 3G connections further as auto manufacturers and wireless carriers compete to bring the faster speeds into the connected car.

With the rise of 4G LTE-installed antennas and on-board Wi-Fi routers built into new vehicles, and with nearly every auto manufacturer offering a connectable platform on one or more models, we estimate the number of in-vehicle cellular systems will reach 33.3 million in 2017 (15.8 million 4G LTE), rising to 79.2 million by year-end 2022 (58.8 million 4G LTE).

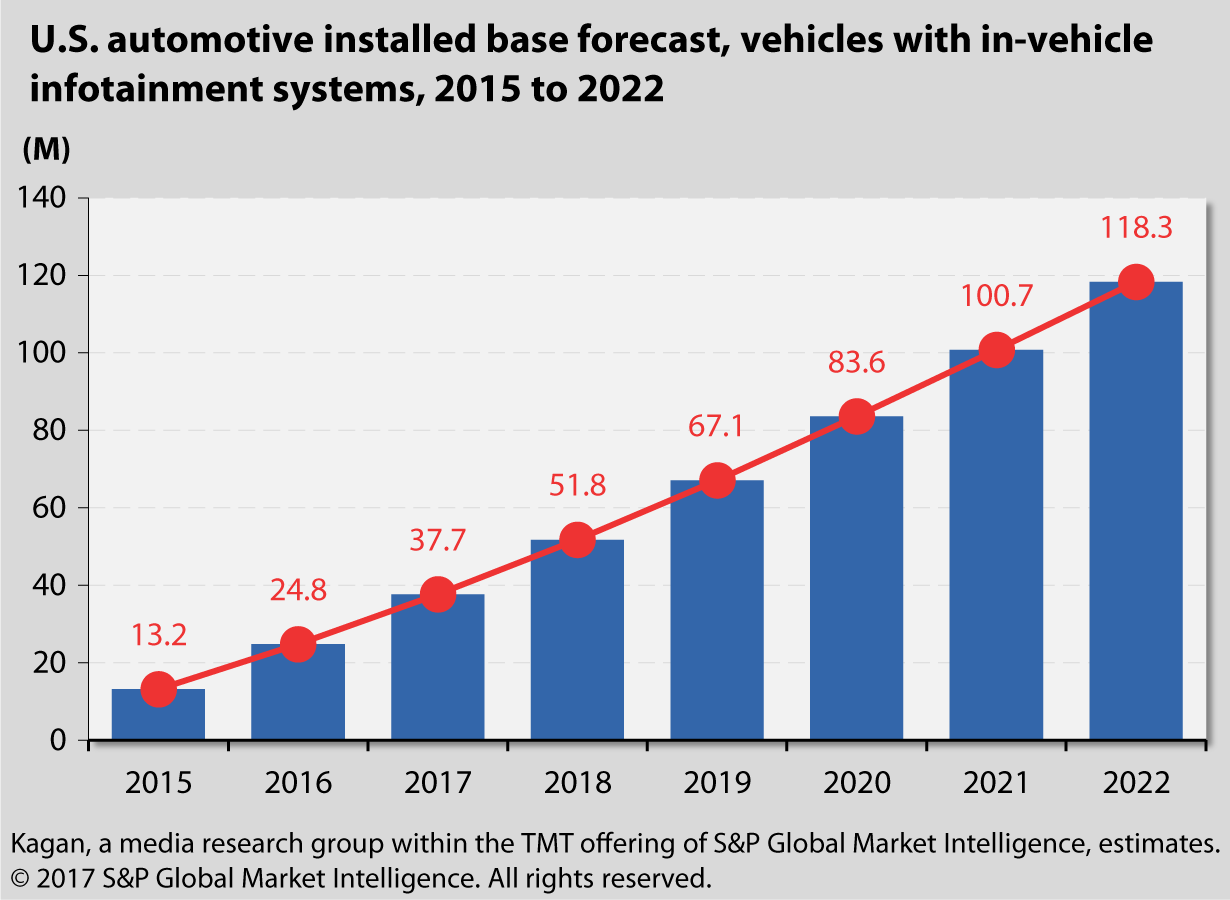

According to Kagan projections, the installed base of U.S. vehicles with embedded in-vehicle infotainment reached approximately 24.8 million by year-end 2016 and should grow 51.9% year-over-year to 37.7 million by year-end 2017. We estimate the number of embedded systems may reach 118.3 million by 2022.

One of the biggest opportunities for automakers and tech suppliers is the ability to deliver highly personalized location-based targeting of advertisements to connected cars. In-car advertising has been limited to radio and small-scale infotainment activations, but the connected car holds the potential to present marketers with a range of opportunities for placing the medium on par with TV and mobile in terms of time spent by the consumer.

Location data from connected cars can help marketers effectively understand driver habits, but who owns the data, how to secure it, and how to use it are issues that need resolution. With connected cars representing one of the first large-scale Internet of Things platforms, there is still a lot to learn in this emerging space. As marketers better understand the evolution of the connected car and the data, the opportunities to monetize will become more apparent.