Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 3 Nov, 2022

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Financial regulators across the globe are increasingly looking to identify, assess and understand how to mitigate climate risks in the financial system. As of October 2021, at least 31 central banks and supervisors are conducting or planning climate scenario analysis exercises, with the U.S. Federal Reserve recently announcing it will join this group early in 2023.[1][2] In addition, climate-related financial disclosures have been, or will be, mandatory in many countries (e.g., New Zealand, Switzerland, China and the G7 nations). [3]

Scenario analysis is employed as a well-established tool to address uncertainties over the future. There are challenges, however, including: the availability and standardization of data; the unconventionally long time-horizons involved with climate-related scenarios; the quantification of the financial and credit risk impact of risks and opportunities at an entity level; and, the interplay between physical risk events and energy-related transition plans.

In our view at S&P Global Market Intelligence (“Market Intelligence”), there is a subtler source of uncertainty that can have profound effects on the understanding and management of climate risks and opportunities — that is, model risk and how a chosen analytical approach influences the final modelled results for a given scenario. For energy transition scenarios, in particular, model risk stems from the inability to backtest these new financial and credit risk implications as corporations progressively invest in, and adopt, greener technology.

We have developed two analytical tools to quantify the financial and credit risk impact of climate change risks and opportunities: Climate Credit Analytics (CCA) and Climate RiskGauge (CRG). Both models employ a bottom-up approach, linking climate scenario variables to key drivers that impact firms’ financial performance and credit risk profiles. These two tools differ in the level of granularity needed for inputs, assumptions made and outputs generated.

Both models incorporate the Network for Greening the Financial System (NGFS) energy transition scenarios that can be used to benchmark results obtained on the same set of companies, when possible, and explore the uncertainty introduced by model risk.

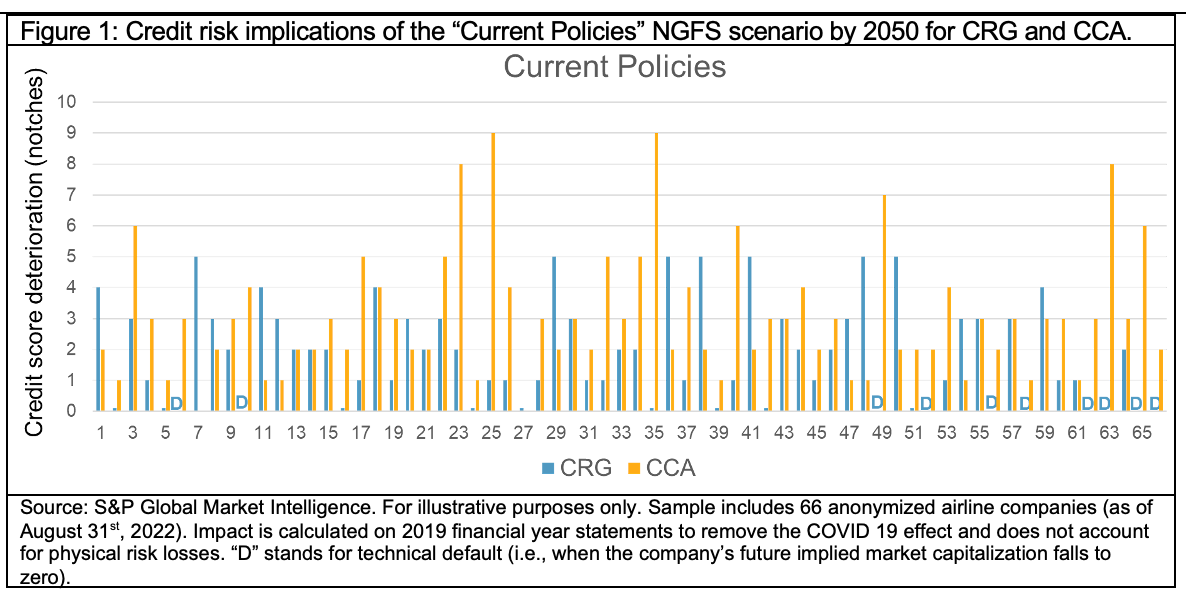

Figure 1: Credit risk implications of the “Current Policies NGFS scenario by 2050 for CRG and CCA.

Figure 1 shows the credit risk impact modelled via CCA and CRG to 2050 for an anonymized set of airline companies and a select NGFS scenario (“Current Policies”). While both models outputs align directionally across this portfolio, the credit score changes differ significantly for individual companies (e.g., company 35 or 63).

Model risk plays a critical role and is driven by: the underlying bottom-up approach selected to translate the energy transition scenarios into a full or essential financial impact; the number of assumptions made in simulating a company’s financial strategy to 2050; and, the robustness of the underlying data needed to run either model.

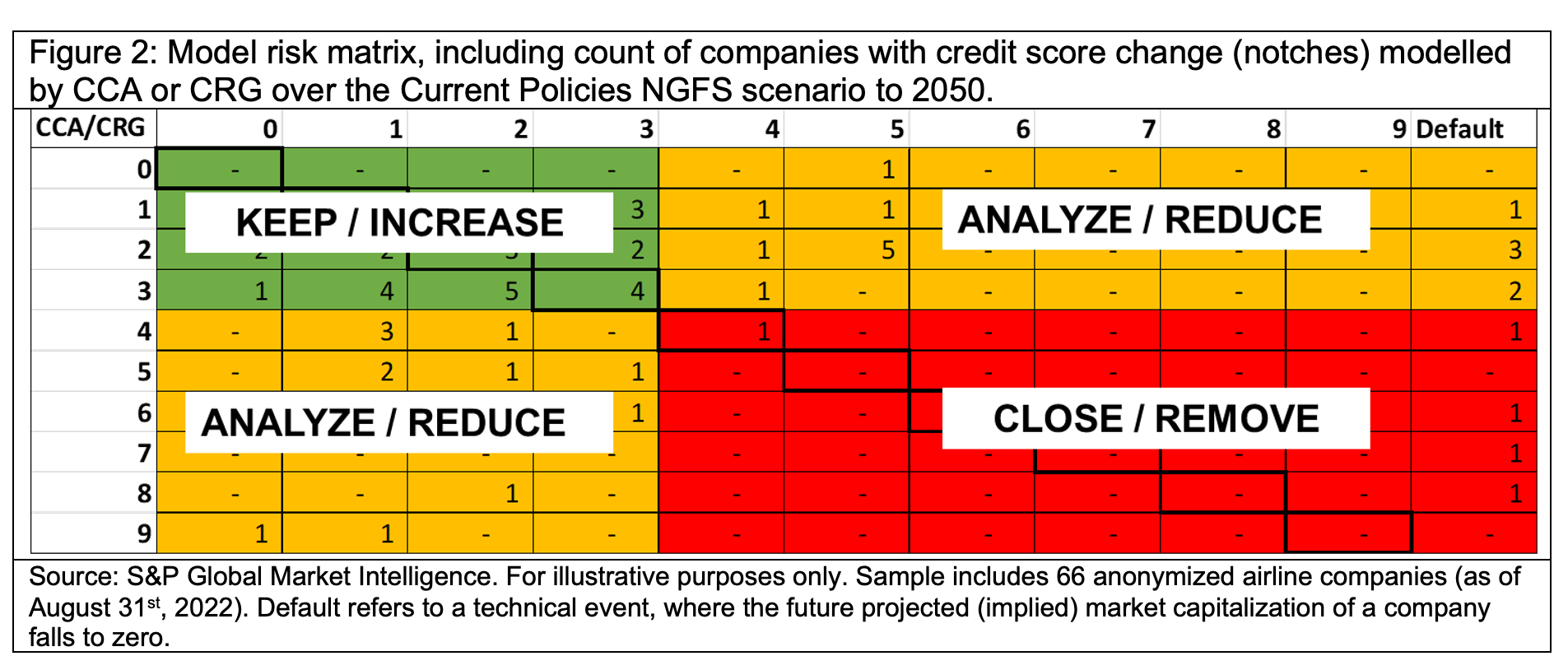

In this instance, it would be erroneous to take the average of the two outputs. A more solid analytical approach would consist in building a two-dimensional matrix, as shown in Figure 2, and partitioning it into four quadrants based on a user’s risk appetite.

Figure 2: Model risk matrix, including count of companies with credit score change (notches) modelled by CCA or CRG over the Current Policies NGFS scenario to 2050.

For the companies falling into the amber quadrants, an in-depth review could be warranted. Things worth considering could include:

An additional step to address these issues would help refine the structure of the matrix.

Please click here to learn more about these capabilities.

[1] Scenarios in Action: A progress report on global supervisory and central bank climate scenario exercises, Network for Greening the Financial System (October 19, 2021).

[2] Press Release, Federal Reserve (September 29, 2022).

[3] G7 Nations agree on mandatory climate-related disclosure”, Green Central Banking (June 8, 2021).

[4] Oliver Wyman is an independent third-party firm and is not affiliated with S&P Global or any of its divisions.