Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Apr, 2016 | 17:00

Highlights

The upper end of the New York City market has been flooded in recent years by a wave of luxury condominium and apartment construction, even as prices continue to soar for more affordable dwellings

Few will cry for Gary Barnett, founder and president of New York's Extell Development, who disclosed in an Israeli regulatory filing in March that his firm had sought mezzanine financing to help it complete three Manhattan projects, amid growing buzz that the city's high-end condominium market had peaked.

Tears are probably not in order anyway: The priciest condos in the city are still very pricey — albeit less so than they were a year ago — and supply tightness, for condos and rental apartments, persists in New York outside the market's upper tiers. Yet the prospect of tighter financing for Barnett, who famously had the resources to keep building through the last decade's financial crisis even as many competitors' projects ground to a halt, came as a warning of tougher times for the city's ultra-high-end residential market.

Observers say the problems at the high end of the market have not trickled down to affect more affordable properties, and they may not ever. Rather, a supply glut among the city's most expensive properties is evidence of New York City's housing predicament: Land is so expensive that developers could only get the returns they sought in recent years by building luxury units. So build them they did, leaving most of the city's residents underserved and as desperate as ever for affordable places to live while flooding the top of the market.

"The problem with that is that they're introducing all of this new inventory at basically the same time," Alan Lightfeldt, a data scientist at StreetEasy, said in an interview. "These developers, I think, have a much higher expectation of what they can get for these properties than what buyers can actually pay for it."

Too much of a good thing

The exact peak of the luxury segment, which StreetEasy defines as the top 20% of the city's residential market, came in March 2015, Lightfeldt said. In February, the median resale price of Manhattan luxury homes fell 0.1% year over year to $3.2 million, according to StreetEasy data. Luxury was the only market segment to post a year-over-year decline, and midpriced Manhattan homes, which the firm defines as those that sold for between $595,000 and $1.5 million, posted the borough's greatest annual price growth. The median resale price for middle-tier Manhattan homes grew by 7.0%.

The land under the three properties for which Extell sought financing help was acquired cheaply enough that the company can sell units at relatively low prices — in the $1 million to $3 million range — and target a segment of the market where supply is still tight, Bloomberg reported. Yet many developers' plans and balance sheets are not so flexible, even as a confluence of factors challenges the high-end market, Jonathan Miller, CEO of the appraisal firm Miller Samuel Inc., said in an interview.

Even as the strong U.S. dollar has hurt foreign investors' buying power, land prices in the city have stayed high while other costs have escalated, Miller said.

"We just came off the biggest housing boom in the modern era, and the low-hanging fruit has been picked over, so development sites are expensive," he added. "This global luxury housing boom basically has mandated view as a key amenity, so we're building buildings that are twice as tall as the last cycle on a much smaller footprint, so the materials and engineering costs are much higher. Everybody's building at the same time, so labor costs are at a high, so the only thing you can sell is super luxury condos, and the only rentals you can build are luxury rentals."

Moreover, the new landscape is unfamiliar for many players. Partly as a result of new regulations, the commercial banks that financed previous real estate booms have been relatively absent from the city's latest construction binge, while hedge funds, sovereign wealth funds and private capital have backed a greater share of the city's developments in recent years, Miller said.

"They've all been smarter than everybody else until now," he said. "It was 'game on' in 2011. Everybody at the same time, and everybody's in a silo. And then apparently at some point, in the last month or two, people are opening their windows and looking outside their silo, and all of a sudden they see all these towers around them, and they're panicking. It's a strange but logical conclusion."

Once bitten

In response to price weakness in the New York luxury market, builders have appeared to back off. Manhattan development site sale volume fell sharply in the fourth quarter of 2015 and continued to slip in January and February, according to Real Capital Analytics data.

Jim Costello, a Real Capital Analytics spokesman, said in an email that development deal activity is noisy, adding that the average recent trend is upward. Still, he said, continued weakness in development site sale volume could signal a real change in the market.

StreetEasy's Lightfeldt, for his part, said persistently high land costs, coupled with the expiration and nonrenewal of the city's 421-a tax abatement program for new residential buildings, will lead to a sharp decrease in construction in 2016. At the same time, he predicted, condominium price growth could begin to flatten — and not just in the luxury segment.

"Time on the market is increasing significantly across Manhattan and Brooklyn, so I think buyers are kind of taking a step back, evaluating the situation, perhaps waiting for prices to moderate even more, and we're forecasting that they're going to do just that over the next 12 months," Lightfeldt added.

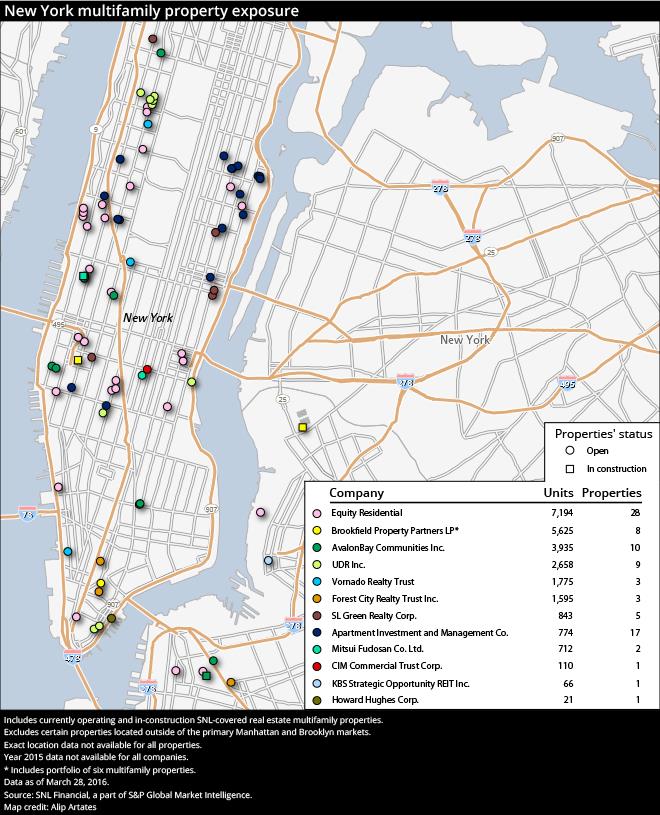

For apartment landlords in the city, including REITs, the condo market's bumpy ride — aside from offering a "circus sideshow" spectacle, in Miller's words — brings good news and bad news. On one hand, as in the sales market, fundamentals in most of the rental market remain landlord-friendly, with new supply lagging population and employment growth. Yet, similar to sales, the high end of the rental market is where new construction has been concentrated.

Besides that, Lightfeldt said, many buyers of luxury condominiums in recent years treated their properties as investments and rented them out. That strategy, employed en masse, has pushed luxury apartment supply even higher and sapped landlords' pricing power. In both Manhattan and Brooklyn luxury rentals, Lightfeldt said, asking rents have been flat over the last year.

That flatness, coupled with continued escalation in rents and sales prices for New Yorkers seeking anything other than luxury apartments, points to an unhealthy residential market in the city, Miller said.

"In order for a city to remain vibrant, the demographic profile has to be broad, it can't be skewed only to the high end," he said. "I'm much more concerned about affordability for the 82% of the market with slow inventory growth than I am about the super-luxury oversupply."