Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2017 | 08:30

Highlights

Streaming and off-take deals continue to be popular for lithium producers, and most see an immediate benefit in their share price.

It has been a few years since lithium became the mining industry's "hot" commodity, and the interest has not waned over the past 18 months. Activity surrounding the commodity remains high, especially in streaming and lithium off-take deals. Both transaction types involve doing deals with lithium producers, current or planned, for products delivered at an agreed price in the future.

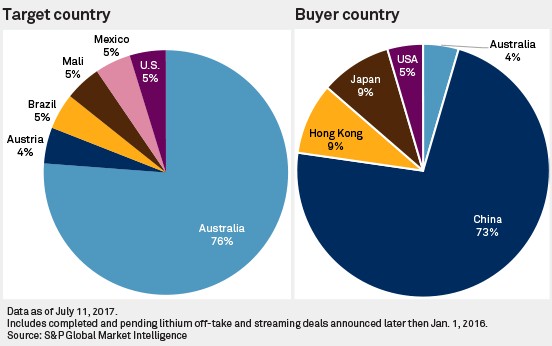

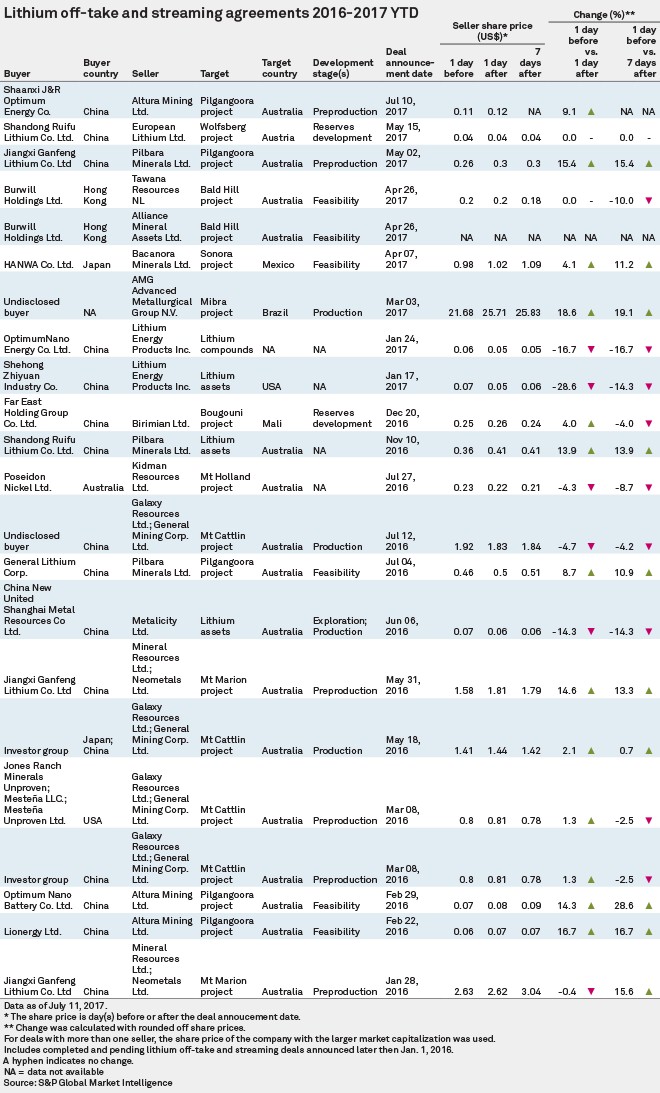

There were 13 lithium off-take and streaming deals announced in 2016, which represented a sharp increase from the 10 deals recorded in 2015. The first half of 2017 has already seen the announcement of nine deals. Almost all of the deals are for the supply of Australian lithium to China.

The popularity of lithium stems from the revolution of the green energy market, which has led to soaring demand for lithium batteries.

Tesla led the way in battery cell production in June 2014 with the start of construction at its Gigafactory in Nevada. Market growth has since accelerated, with China announcing the expansion of several large battery factories. This translates to a high Chinese demand for lithium, which is sourced either internally or from neighboring countries. Out of the 22 lithium off-take and streaming deals since the start of 2016, 17 were by buyers from China or Hong Kong.

Australian lithium miners dominate this supply, with all but six of the 22 deals involving Australian material, and all but one of the deals in 2016. The companies selling lithium forward in streaming or off-take deals have generally seen an improvement in their share price following the announcement.

Of the 22 sellers since the start of last year, 13 saw an immediate increase in their share price on the announcement, comparing the equity valuation one day after the deal was announced with one day before the transaction. The positive market valuation continued when recorded one week after the announcement, with nearly half of the sellers still seeing an increase in their share price.

For comparison with the general mining market at the time of the lithium transactions, we have compared the change in the S&P Global Market Intelligence Index, measured by the SNL Metals & Mining database over the same period.

For example, at the beginning of May, Pilbara Minerals Ltd. announced a deal with Jiangxi Ganfeng Lithium Co. Ltd. for the latter to secure 100% of lithium products from stage one of Pilbara Minerals' Pilgangoora project. Pilbara Minerals' share price increased by 15.4% following the off-take agreement, despite a slight decline in the S&P Global Market Intelligence Index.

The previous month, Bacanora Minerals Ltd. announced a deal with HANWA Co. The transaction entails the 100% acquisition by HANWA of lithium from Bacanora's flagship Sonora project.

Bacanora's share price had risen 4.1% one day after the announcement and 11.2% after seven days.

Most of the assets targeted in these off-take and metal streaming agreements are developing mines. As such, they represent important financing for mines that have yet to reach full production.

Based on transactions for the future supply of lithium, this market shows no sign of slowing. And at the moment, it is a market dominated by the supply of Australian material to China.

Turn our mining data into strategic insights for your investment decisions in the mining sector. Learn more about our solutions.