Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 16, 2022

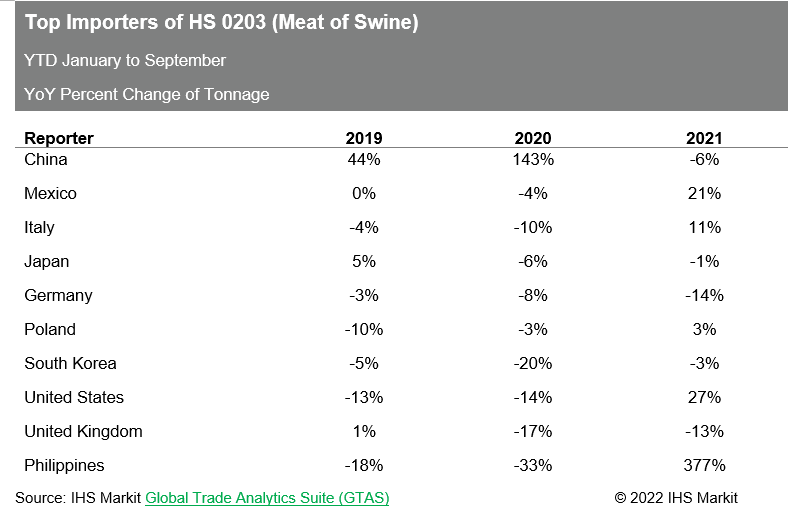

Supply chain disruptions caused by viruses are not limited to coronavirus in 2022. On January 26th, 2022, the China Ministry of Agriculture announced a suspension of pork from Italy after the African swine fever virus was detected in a wild boar in that country. Mainland China's moratorium is the latest in a series of challenges to Italy's global pork markets, with Japan, Taiwan, Kuwait and Switzerland also refusing Italian pork imports with similar restrictions according to IHS Markit Agriculture analysts. The suspension of imports from mainland China will likely have a significant impact on pork exporters in Italy and potentially create additional opportunities for other suppliers into the mainland China market.

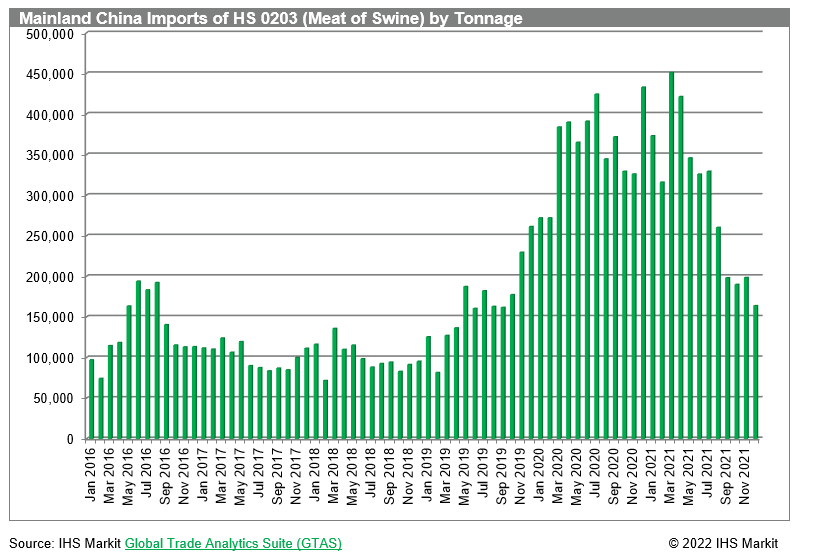

African swine fever virus causes a hemorrhagic fever within domesticated pigs and in 2019 infected around half of the herds in mainland China. This crisis caused mainland China to look outside its borders to supply its pork needs with imports increasing from 1.2 million tons in 2018 to 4.3 million tons in 2020.

As the herds in mainland China have begun to recover from the 2019 outbreak, the return to domestic supplies is apparent as the volume of imports had begun to reduce. But in the case of Italy, the suspension of imports by mainland China may have dramatic consequences.

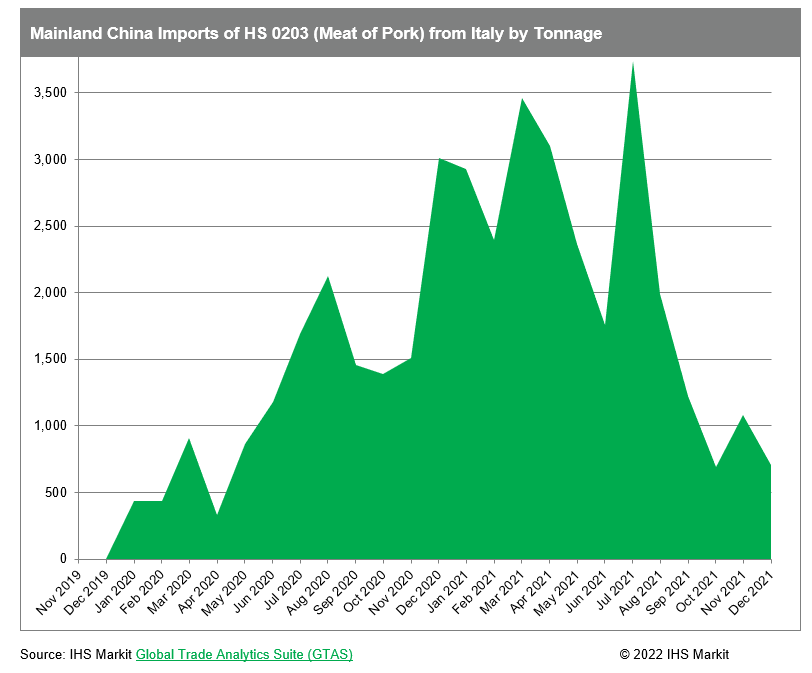

As a supplier into the mainland China market for pork, Italy was not a player until its entry into the market in January 2020. As local supplies have began to become more available, the imports from Italy into mainland China have reduced in recent months, but still have been enough to make Italy the 13th largest import market representing around .71% of the total market share for mainland China.

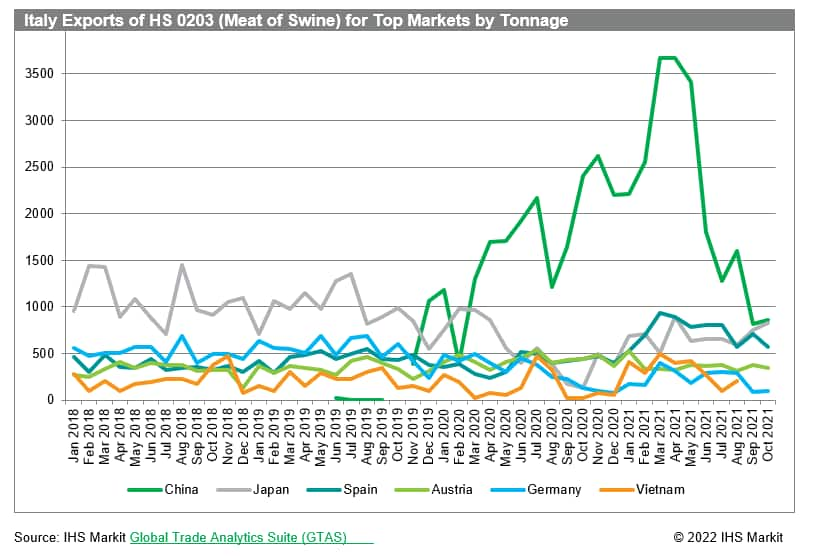

From an Italian export perspective, the recent suspension of imports could have massive impacts to its pork industry. Since 2018, mainland China has moved from the 60th largest export market for Italian pork to the largest, now representing 22.5% of the total export market share.

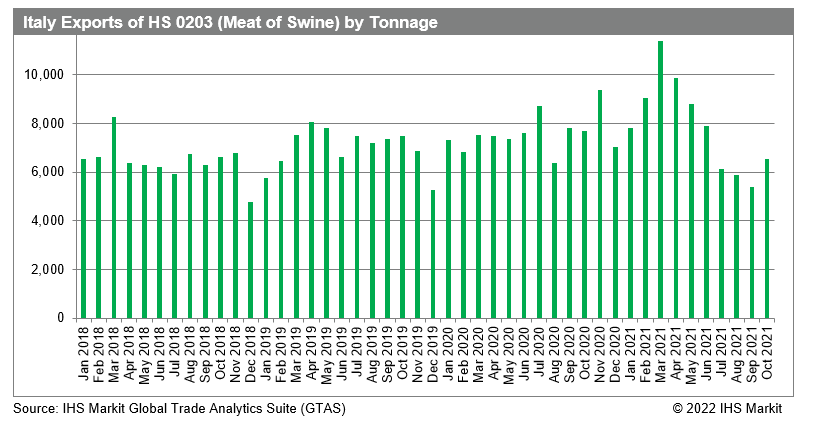

While mainland China's fluctuating demand has changed a good deal of the market landscape for Italian pork exporters, the change in overall exports has not been as large. Italian pork destined for Japan has dropped from around nearly 13,000 metric tons in 2018 to just over 6,500 metric tons in 2020, with mainland China picking up much of that slack.

The suspension of Italian pork imports by mainland China will likely serve as a minor opportunity for suppliers in other countries, although mainland China's overall import market is shrinking as consumers return to domestically-produced goods. Meanwhile, a challenge awaits pork exporters in Italy as they look for new markets to offset the loss of mainland China as a viable market.

The IHS Markit Global Trade Analytics Suite (GTAS) allows clients to explore bilateral trade in goods across any merchandise type to see where new markets are emerging. For Italian pork producers, new markets of interest may include Mexico, the Philippines, and Chile, as all have seen significant import increases during the first three quarters of 2021.

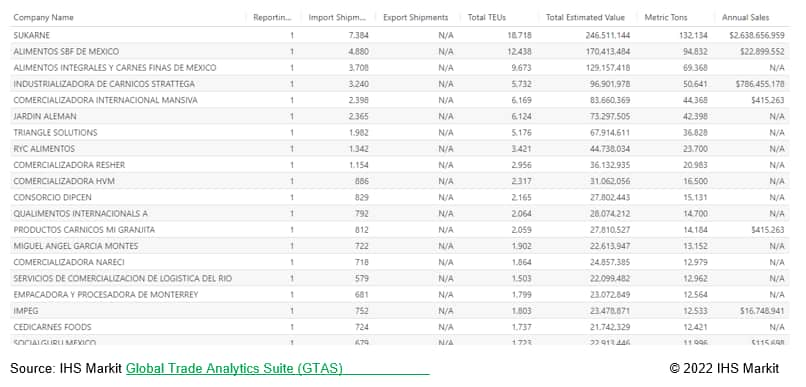

The GTAS also allows users to leverage bills of lading from 13 available countries to view the companies involved in the imports of particular products, giving them insight into the players in the marketplace. Below is a view into those companies who have imported HS 0203 (meat of swine) into the Mexico market over the last 15 months, derived from Mexico bill of lading data.

Italian producers of pork are faced with challenges over the short term with the new suspension order from mainland China and a shrinking market overall in mainland China, but tools exist to help them and others who are seeking to expand or adjust their trade strategies going forward.

The volatile and dynamic supply chain environment demands more transparency than ever before to continue to achieve sustainable outcomes. IHS Markit Maritime & Trade offers end-to-end coverage of the intelligence used by the world's leading organizations to effectively understand and respond to the threats and opportunities that continue to impact all organizations. Contact us today for a personalized introduction to a more informed, agile supply chain strategy.

Join us February 27-March 2 for the return to an in-person TPM 2022 in Long Beach, California, USA, the premier conference for the trans-Pacific and global container shipping and logistics community. This year's theme is Relationships Matter, hosted by the Journal of Commerce (JOC) of IHS Markit. View the agenda, speakers and venue at events.joc.com/tpm and register today. We look forward to seeing you there!

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 16 February 2022 by Russell Patterson, Subject Matter Expert, Maritime, Trade & Supply Chain, S&P Global Market Intelligence

How can our products help you?