Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Nov, 2016 | 10:15

Highlights

A review of the Chinese Insurance Market.

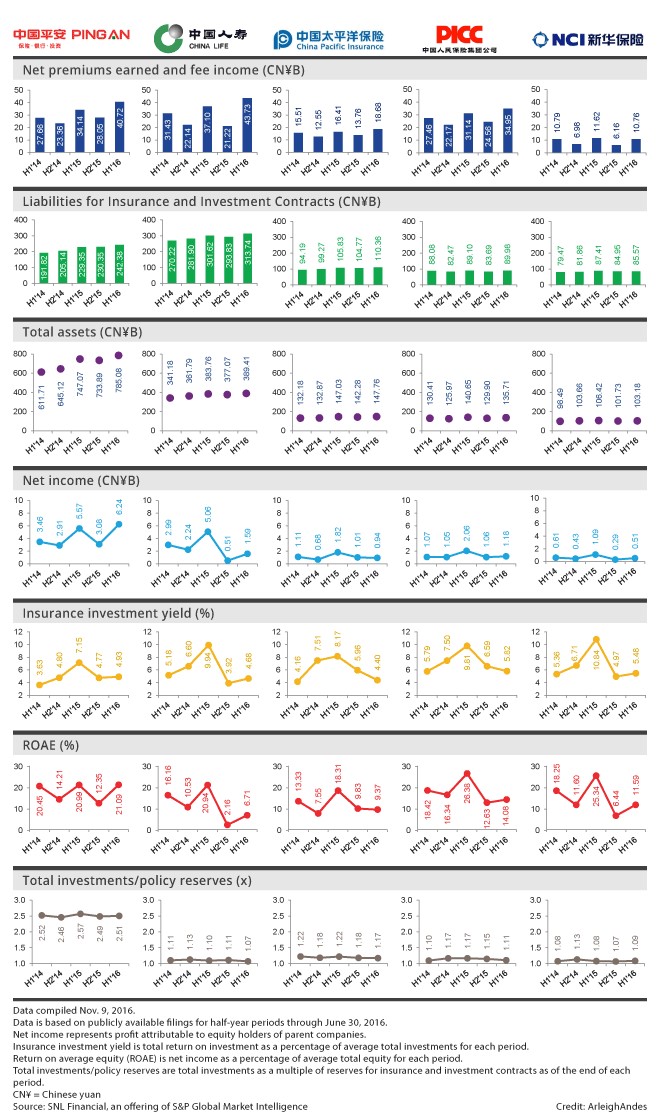

China's life insurance market, the world's fourth-largest, is growing at the fastest pace in eight years, but for the industry in the country, bigger does not mean more profit.

Gross written premiums for life insurance policies in China jumped 43.56% year-to-date through September from the same period of 2015, the biggest increase for the first nine months of any year since 2008, according to data from the China Insurance Regulatory Commission. On an annualized basis, the sector has expanded 54.22% this year, the strongest pace since 2010.

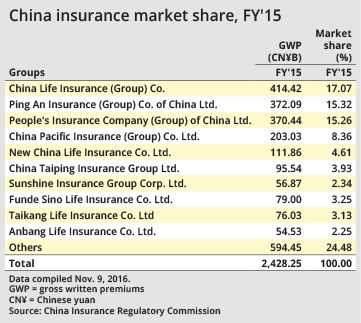

Industrywide net profit more than halved year-over-year during the first six months of 2016, and the outlook for the rest of the year is just as grim. Annual net profit will likely fall at four of the five biggest listed insurers by assets in 2016 from the previous year, which would be their first earnings decline in at least four years, according to mean analyst estimates compiled by S&P Capital IQ. Insurance demand is increasing fast in the country, as economic development translates into more income for consumers. Yet the sector's profit is set to drop in 2016, under pressure from monetary easing that has pushed bond yields down and tighter capital rules that are forcing companies to boost reserves.

"There won't be a significant improvement in profitability in the second half," Luo Xiang, an analyst at Shanghai-based Hwabao Securities, said in an interview.

Major player China Life Insurance Co. Ltd., for one, reported a 60% year-over-year drop in nine-month net profit on October 27.

Amid woes of an economic slowdown, Chinese stock prices are far below their mid-2015 highs, so any gains from equity investments for insurers have been limited as well.

Low rates are doubly troublesome for Chinese insurers under rules that came into effect at the start of 2016. They are required to discount liabilities based on 750-day moving averages of government bond rates. As a consequence, companies now need to ramp up reserves when rates slide, resulting in estimated values of liabilities declining less. Previously, capital requirements for the industry did not take into account market risks.

Exacerbating the challenges are obligations arising from a product type in vogue. In recent years, Chinese insurers have been aggressively selling short-term investment schemes that guarantee returns as high as 8% to lure yield-hungry investors.

The downside for insurers is that, to meet such appealing terms, they need to invest in high-yield assets, exposing themselves to greater investment risks. Also, the use of income from short-term products to make longer-term investments creates an asset-liability mismatch. Industrywide revenue from investment policies grew faster than income from insurance contracts in the two years to 2015.

"Companies have to continuously sell new policies to cover payments for previous ones, putting their cash flow at risk," Jerry Li, a Hong Kong-based analyst at China Merchants Securities, said in an interview.

The unhealthy frenzy did not go unnoticed by the CIRC. The regulator in March began banning sales of policies with maturities of less than a year. It gave insurers until 2018 to reduce contracts with terms of one to three years to less than 50% of their overall product portfolios and until 2021 to cut the share to less than 30%. In addition, firms are required to gain regulatory approval to sell any schemes that guarantee a minimum return of 3%.

Fees from investment schemes are still up 80.71% year-to-date, but sales slowed markedly after the first quarter, likely in response to the new regulatory restrictions.

"Concerns have been somewhat eased," said Wang Guojun, professor at the School of Insurance and Economics at Beijing-based University of International Business and Economics.

China is still a promising market for life insurers, with plenty of untapped demand. The country's insurance penetration rate was 3.57% in 2015, as measured by gross written premiums relative to GDP, lower than regional emerging-market peers Malaysia and Thailand, according to Swiss Re data. Although China in 2015 overtook the U.K. as the world's third-largest insurance market, in terms of gross written premiums, its life sector is still smaller than the European country's life sector.

But for now, it is not getting any easier for the industry to cash in on its expansion. "With rising insurance awareness and a growing middle class, the demand for protection insurance from Chinese will be strong," Eunice Tan, director of Greater China insurance at S&P Global Ratings, said in an interview.

"The low interest rate environment makes it harder for insurers to profit from traditional bond investment," Luo said. "Reserve discounts have been adjusted lower. These factors will continue to have an impact on insurers' profit.”