Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 24, 2021

By Arlene Kish

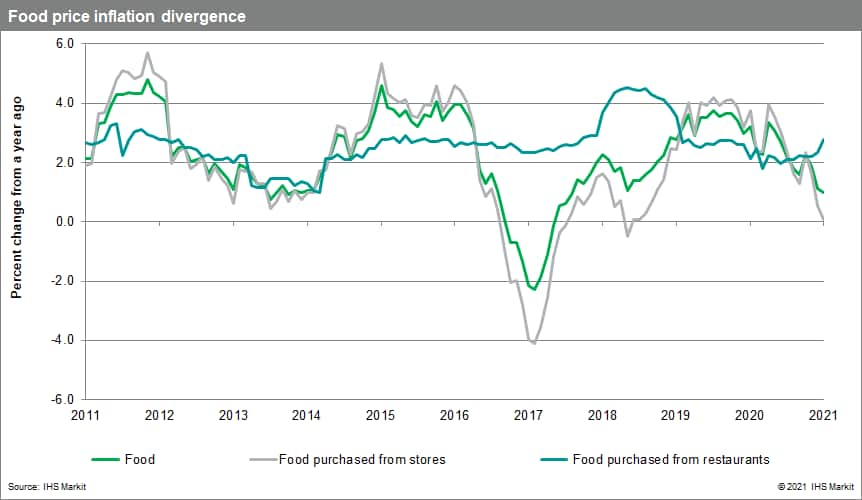

Although food price inflation has decelerated for the past three months, the slowdown was weaker than expected. This was in part due to a boost in food prices purchased at restaurants, hitting a 22-month high of 2.8% y/y. The price increase in the food purchased from stores was significantly slower at 0.1% y/y.

Inflation was driven higher by the 1.9% y/y lift in services. The 31.1% y/y leap in travel tours contributed to the overall annual price increase despite recommendations against non-essential travel. This boosted the recreation, education, and reading price index. Elsewhere, the upward swings in home prices are putting more upward strain on homeowners' replacement costs, advancing 5.8% y/y. Plus, purchases of passenger vehicle prices climbed 2.9% y/y with the release of new motor vehicle models. The low 3.3% y/y decline in gasoline prices and higher costs for vehicle parts and repairs lifted the cost of operating passenger vehicles for the first time since February 2020. While demand remains soft, consumers are getting a break on spending with a 4.1% y/y decline for clothing and footwear.

With the economy reopening, there is a greater chance that businesses will pass on higher prices to consumers, as many business operators face challenges with slow business activity and higher input costs, thanks to rising producer price inflation. However, as of now, total and core inflation remain low, which means the Bank will focus mostly on the economic recovery and on lagging industries and sectors. The anticipated quick rise in annual gasoline price inflation will pull total prices higher, but as usual, the Bank will view this as a temporary price pressure. There is still plenty of economic slack that needs to be absorbed. The stronger-than-expected takeoff in January inflation will lift the 2021 inflation outlook, closer to the 1.5% y/y range. The Bank of Canada is expected to remain on the sidelines for a while longer until the first rate hike in mid-2023.

Posted 24 February 2021 by Arlene Kish, Director, Economics, S&P Global Market Intelligence