Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Dec, 2016 | 09:00

By Tom Manzella

Highlights

Planned capital spending by mining companies reached US$97.85 billion between January 2015 and November 21, 2016.

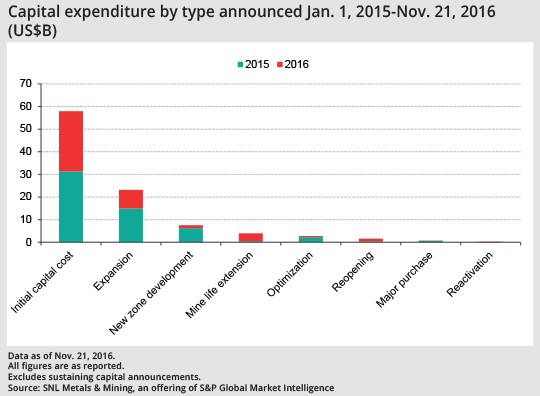

Planned capital spending by mining companies has reached a total of US$97.85 billion between January 2015 and November 21, 2016, a 32% increase compared with the end of March 2016. The current figures, based on 381 announcements and excluding sustaining capital spending, provide a snapshot of which commodities and geographies are receiving attention from miners.

It is important to note that only US$1.72 billion of actual non-sustaining expenditure has been reported since January 2015, while the remaining bulk of the planned project spending is targeted for the future. Companies that report multiple capital expenditure scenarios were only tabulated once in the aggregation to avoid double (and in some cases triple) counting.

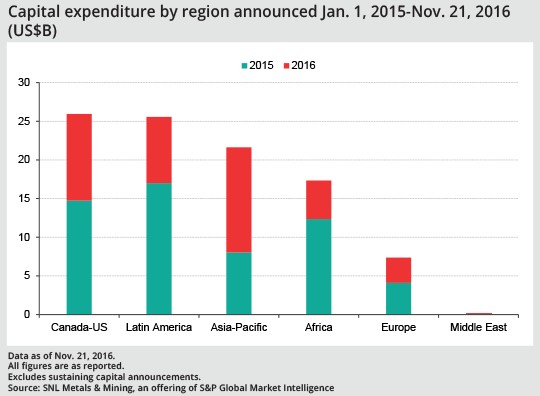

As was the case in the previous iteration of this article, which included sustaining capital expenditure, the Canada-U.S. and Latin America regions are the targets for most of the announced capital expenditure, with Canada-U.S. narrowly overtaking Latin America by US$383 million as of November 21. Both regions contain projects with some of the largest announced capital spending, including Seabridge Gold Inc., which recently announced a US$5.49 billion capital cost estimate for development of its late-stage KSM gold project in British Columbia.

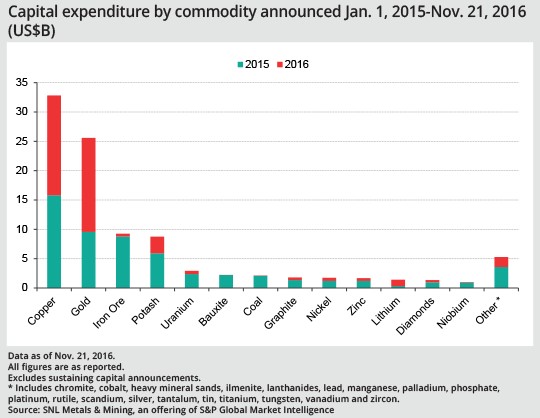

Copper accounted for the largest share of global capital cost spending in Latin America, where the NuevaUnion joint venture in Chile between Goldcorp Inc. and Teck Resources Ltd. currently has the largest capital expenditure announcement in the region at US$3.5 billion. The copper project's PEA estimates this amount will be necessary to bring Project Corridor into production, while project cash flows will fund future expansions. Two more Chilean copper assets, Constellation and Centinela Sulfide, have capital cost estimates of US$3.08 billion and US$2.7 billion, respectively.

Gold projects had the second-largest allocation of capital expenditure, comprising US$25.57 billion, or 26%, of the global total. Gold also accounted for 26% of the total in the April 2016 capital expenditure report (source: SNL Metals & Mining database), but gold has slipped slightly further behind copper in the following months, as the red metal comprised only 27% of announcements in April and now makes up 34%.

In June, Lundin Gold Inc. announced US$668.7 million in initial CapEx for its Fruta del Norte gold project in Ecuador, which will be used to develop the underground mine, processing plant and onsite/offsite infrastructure, and for contingency spending. Other significant spending on gold projects includes the Damang mine in Ghana, where Gold Fields Ltd. projected US$1.4 billion in spending to extend the mine's life by eight years.

Iron ore and potash projects hold third and fourth places, respectively, for potential CapEx spending, which is unchanged from April. The largest announcements were US$5.75 billion for the Sunny Lake iron ore project in Quebec, and US$2.58 billion for the Danakil potash project in Ethiopia.

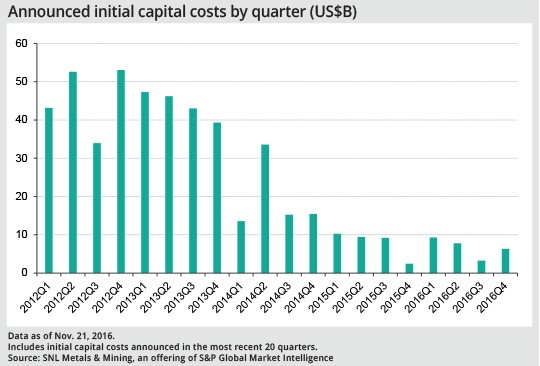

Analysis of initial CapEx announcements over a longer period can provide insight into market sentiment. Larger capital allocations to development-stage assets is an encouraging sign, as it suggests that companies are not only interested in maintaining current operations, but also in bringing new projects to production. There is a clear downward trend in initial CapEx announcements over the period, with allocations to date in 2016 down by US$4.66 billion from the 2015 total, with less than a month and a half left in the year. The jump in initial CapEx from the third to the fourth quarters of the year can largely be attributed to the aforementioned KSM gold project’s US$5.49 billion estimate.

A wild card in projecting capital expenditure in the months ahead is how the policies of U.S. President-elect Donald Trump will affect commodity markets. Trump's promise to increase infrastructure spending came as good news for steel producers, since it could boost demand for commodities such as iron ore and coal. Copper, another industrial metal, benefited in the days immediately following Trump's victory, hitting US$6,000/t on November 11. While commodity prices are likely to continue to fluctuate in a period of speculation about the new administration's intentions, the long-term implications of Trump's actual policies could potentially affect where companies choose to spend on new projects and expansions.